How Much For Renters Insurance

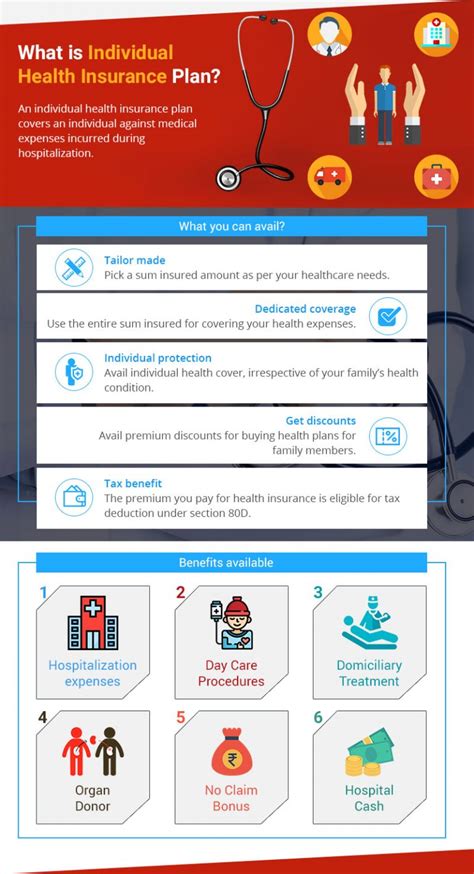

Renters insurance is an essential yet often overlooked aspect of financial planning for individuals living in rental properties. It provides coverage for personal belongings and liability protection, offering peace of mind and financial security in unforeseen circumstances. This article delves into the intricacies of renters insurance, exploring its costs, benefits, and the factors influencing premium rates.

Understanding Renters Insurance Costs

The cost of renters insurance varies significantly based on a multitude of factors. While it’s impossible to provide an exact figure without specific details, we can explore the key considerations that impact premium rates.

Coverage Amounts and Limits

The primary factor influencing the cost of renters insurance is the amount of coverage you choose. This refers to the value of your personal belongings and the level of liability protection you require. Generally, the higher the coverage limits, the higher the premium. It’s essential to assess the value of your possessions accurately to ensure adequate coverage without overpaying.

Consider the following example: If you have a modest collection of furniture, electronics, and clothing, you might opt for a lower coverage limit, resulting in a more affordable premium. On the other hand, if you have high-value items like fine art, jewelry, or expensive electronics, you'll need higher coverage limits, which will increase your premium.

| Coverage Limit | Estimated Annual Premium |

|---|---|

| $20,000 | $150 - $200 |

| $30,000 | $200 - $250 |

| $50,000 | $300 - $400 |

| $100,000 | $450 - $600 |

Note that these are rough estimates, and actual premiums can vary significantly based on other factors and the insurance provider.

Location and Property Type

The location of your rental property plays a crucial role in determining the cost of renters insurance. Areas with higher crime rates, frequent natural disasters, or a history of insurance claims tend to have higher premiums. Additionally, the type of property you rent can impact costs. For instance, a house may have higher premiums compared to an apartment due to potential differences in risk.

Deductibles and Policy Add-ons

Similar to other insurance policies, renters insurance offers various deductible options. A higher deductible typically results in a lower premium, as you’ll be responsible for a larger portion of any claims. Additionally, policy add-ons, such as coverage for specific high-value items or additional liability protection, can increase the cost of your premium.

Discounts and Bundling

Insurance companies often provide discounts to encourage policyholders to take out multiple policies. For instance, if you have a car insurance policy with a particular provider, you may be eligible for a discount on your renters insurance if you bundle the two. Additionally, some insurers offer discounts for factors like having a security system in your rental property or being a non-smoker.

Benefits of Renters Insurance

While the cost of renters insurance is an important consideration, it’s essential to understand the benefits it provides. Renters insurance offers protection for your personal belongings and liability coverage, ensuring you’re financially secure in various situations.

Protection for Personal Belongings

Renters insurance typically covers a wide range of personal belongings, including furniture, electronics, clothing, and other household items. In the event of a covered loss, such as a fire, theft, or natural disaster, renters insurance can help replace or repair these items. This coverage provides peace of mind, ensuring that you’re not left financially devastated in the wake of a disaster.

Liability Protection

Renters insurance also provides liability protection, which is crucial for protecting your financial well-being. This coverage protects you in the event that someone is injured on your rental property or if your actions result in property damage to others. It covers the cost of legal defense and any damages you may be required to pay.

For example, if a guest trips and falls in your rental property, sustaining an injury, your renters insurance's liability coverage can help cover the medical expenses and any potential legal fees if a lawsuit is filed.

Factors Influencing Premium Rates

In addition to the factors mentioned earlier, several other elements can influence the cost of renters insurance. These include:

- Credit Score: Many insurance providers use credit-based insurance scores to assess the risk associated with a policyholder. A higher credit score may result in a lower premium.

- Age and Occupation: Younger individuals or those with high-risk occupations may face higher premiums due to the perceived increased risk.

- Insurance Claims History: A history of frequent insurance claims can lead to higher premiums, as it indicates a higher risk profile.

- Insurance Provider and Policy Type: Different insurance companies offer various policy types and coverage options, which can impact the cost.

Getting the Best Deal on Renters Insurance

To ensure you’re getting the best deal on renters insurance, it’s essential to shop around and compare quotes from multiple providers. Additionally, consider the following tips:

- Review your coverage limits annually to ensure they're still adequate and make adjustments as necessary.

- Consider increasing your deductible to lower your premium, but ensure you can afford the deductible in the event of a claim.

- Explore policy add-ons to customize your coverage and protect high-value items.

- Bundle your renters insurance with other policies, such as auto insurance, to potentially save money.

Remember, the cost of renters insurance is a small price to pay for the peace of mind and financial security it provides. By understanding the factors that influence premium rates and taking steps to get the best deal, you can ensure you're adequately protected without breaking the bank.

How much does renters insurance typically cost per month?

+The average monthly cost of renters insurance ranges from 15 to 30, but it can vary significantly based on coverage limits, location, and other factors. It’s best to get personalized quotes to determine your specific cost.

What factors can increase my renters insurance premium?

+Several factors can increase your premium, including higher coverage limits, a history of insurance claims, living in an area with high crime rates or natural disasters, and having high-risk occupations or hobbies.

Are there any ways to lower my renters insurance premium?

+Yes, you can potentially lower your premium by increasing your deductible, bundling your insurance policies, exploring discounts, and maintaining a good credit score.