How To Register For Health Insurance

In today's world, having health insurance is not just a luxury but a necessity. It provides financial protection and peace of mind, ensuring that you and your loved ones receive the medical care you need without worrying about the associated costs. This comprehensive guide will walk you through the process of registering for health insurance, offering you a step-by-step approach to navigate the complex world of healthcare coverage.

Understanding the Basics of Health Insurance

Before delving into the registration process, it's essential to grasp the fundamentals of health insurance. Health insurance is a contract between you and an insurance provider, where you pay a premium in exchange for coverage of specified healthcare services. This coverage can include a wide range of medical expenses, from routine check-ups and prescriptions to more significant procedures and treatments.

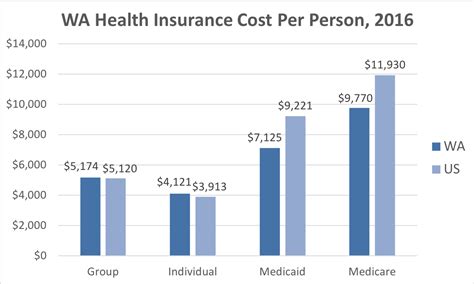

Health insurance plans come in various forms, each with its own set of benefits and limitations. Common types include employer-sponsored plans, individual market plans, Medicare, and Medicaid. The plan you choose should align with your specific healthcare needs and financial situation.

Key considerations when evaluating health insurance plans include:

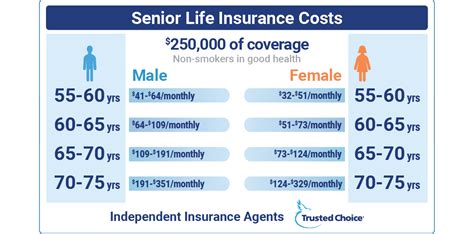

- Premiums: The amount you pay monthly to maintain your coverage.

- Deductibles: The portion of medical expenses you must pay out-of-pocket before your insurance coverage kicks in.

- Copayments: Fixed amounts you pay for specific services, such as doctor visits or prescriptions.

- Coinsurance: Your share of the costs of a covered health care service, calculated as a percent (for example, you pay 20%, and the insurance company pays 80%).

- Out-of-Pocket Maximum: The most you will pay during a year before your insurance plan starts to pay 100% of the allowed amount.

- Network of Providers: A list of healthcare providers and facilities that are part of your insurance plan's network, offering discounted rates.

- Covered Services: A comprehensive list of the medical services and treatments included in your plan.

It's crucial to carefully review and compare these aspects of different health insurance plans to ensure you select the one that best meets your needs.

Identifying Your Eligibility and Options

The first step in registering for health insurance is to determine your eligibility and explore your available options. Your eligibility will depend on factors such as your citizenship status, income, age, and whether you qualify for any government-sponsored programs.

Government-Sponsored Programs

Various government programs offer health insurance coverage to specific populations. For instance, Medicare is a federal program primarily for individuals aged 65 and older, as well as those with certain disabilities. Medicaid, on the other hand, is a joint federal and state program that provides coverage for low-income individuals and families. If you believe you may qualify for these programs, you can start by visiting their official websites to gather more information and initiate the application process.

Additionally, the Affordable Care Act (ACA), also known as Obamacare, has established Health Insurance Marketplaces or Exchanges in each state. These Marketplaces provide a platform for individuals and families to compare and purchase health insurance plans. You can visit Healthcare.gov to find your state's Marketplace and explore your options.

Employer-Sponsored Plans

If you are employed, your employer may offer health insurance as part of your benefits package. These plans often provide comprehensive coverage and can be more cost-effective due to the group rates negotiated by your employer. During your company's open enrollment period, you can review and select from the available plans. If you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage, you may also be eligible for a Special Enrollment Period outside of the open enrollment window.

Individual Market Plans

For those who are self-employed, do not qualify for government programs, or do not have access to employer-sponsored plans, the individual market offers a range of health insurance options. You can purchase these plans directly from insurance companies or through the Health Insurance Marketplace. When selecting an individual plan, consider factors such as your healthcare needs, budget, and the quality of the insurance provider.

Gathering Necessary Documents and Information

Before initiating the registration process, ensure you have all the required documents and information ready. This will streamline the application and make the process more efficient.

- Personal Information: Your full name, date of birth, Social Security number, and contact details (phone number and email address) are essential.

- Income Verification: Depending on the plan and your eligibility, you may need to provide proof of income. This could include pay stubs, tax returns, or other relevant documents.

- Citizenship or Immigration Status: You will need to provide documentation proving your citizenship or legal immigration status.

- Dependent Information: If you are applying for coverage for your family members, you'll need their personal details and proof of their relationship to you.

- Existing Medical Conditions: Some insurance plans may require you to disclose any pre-existing medical conditions. Be prepared to provide details about your health history.

By gathering these documents in advance, you can ensure a smoother registration process and avoid any unnecessary delays.

Selecting the Right Plan

With a clear understanding of your eligibility and the available options, it's time to choose the health insurance plan that best suits your needs. Consider the following factors when making your selection:

Cost

The cost of health insurance can vary significantly between plans. Assess your budget and determine how much you can afford to pay in premiums, deductibles, and other out-of-pocket expenses. Remember, choosing a plan with a lower premium may result in higher out-of-pocket costs when you need medical services, so it's essential to strike a balance that works for your financial situation.

Coverage

Evaluate the scope of coverage provided by each plan. Consider the specific medical services you or your family may require, such as prescription drugs, mental health services, maternity care, or specialized treatments. Ensure that the plan covers these essential services adequately.

Network of Providers

Review the list of healthcare providers and facilities included in the plan's network. If you have a preferred doctor or hospital, verify that they are in-network to avoid higher out-of-pocket costs. Additionally, consider the accessibility and convenience of the network's providers in relation to your location.

Additional Benefits and Perks

Some health insurance plans offer extra benefits and perks that can enhance your overall experience. These may include wellness programs, discounted gym memberships, or access to telehealth services. While these additional benefits are not essential, they can provide added value to your coverage.

Initiating the Registration Process

Once you've selected the right health insurance plan, it's time to begin the registration process. Depending on your chosen plan and provider, the process may vary slightly, but generally, you can expect the following steps:

- Complete an Application: You will need to provide the necessary personal and health-related information to the insurance company. This can be done online, over the phone, or through a paper application.

- Verify Eligibility: The insurance company will review your application and verify your eligibility for the chosen plan. This process may involve additional documentation or clarification of certain details.

- Pay the Premium: After your eligibility is confirmed, you will need to pay the initial premium to activate your coverage. The payment method and due date will be specified in your application materials.

- Receive Your Insurance Card: Once your coverage is active, you will receive an insurance card in the mail. This card contains important information about your plan, including your policy number and the details of your coverage.

Understanding Your Coverage and Benefits

Once you've successfully registered for your health insurance plan, take the time to thoroughly understand your coverage and benefits. This knowledge will empower you to make the most of your insurance and navigate the healthcare system effectively.

Review Your Policy

Your insurance policy is a detailed document outlining the terms and conditions of your coverage. It specifies the covered services, any limitations or exclusions, and your responsibilities as a policyholder. Take the time to read and understand this document thoroughly. If you have any questions or concerns, don't hesitate to reach out to your insurance provider for clarification.

Explore Member Resources

Most insurance providers offer a range of member resources to help you navigate your coverage and access healthcare services. These resources may include online portals, mobile apps, or member handbooks. Explore these tools to familiarize yourself with features such as finding in-network providers, submitting claims, and accessing additional benefits offered by your plan.

Utilize Preventive Care

Many health insurance plans cover a range of preventive care services at no cost to you. These services, such as annual check-ups, screenings, and vaccinations, are designed to help you maintain good health and catch potential health issues early. Take advantage of these preventive care benefits to stay healthy and reduce the risk of more serious health conditions down the line.

Understand Your Cost-Sharing Responsibilities

While your health insurance plan covers a significant portion of your medical expenses, you will likely have some cost-sharing responsibilities. This includes paying deductibles, copayments, and coinsurance for covered services. Understanding these cost-sharing responsibilities will help you budget effectively and make informed decisions about your healthcare.

Maintaining and Maximizing Your Coverage

Health insurance is an ongoing commitment, and to ensure you get the most out of your coverage, it's essential to maintain and manage your policy effectively.

Keep Your Information Up-to-Date

Life events such as a change in marital status, the birth of a child, or a move to a new address can impact your insurance coverage. It's crucial to notify your insurance provider of any significant changes to ensure your policy remains accurate and up-to-date. Failure to do so may result in gaps in coverage or unexpected out-of-pocket expenses.

Understand Your Renewal Process

Health insurance plans typically have a renewal period, often once a year. During this time, you'll have the opportunity to review and update your coverage, make any necessary changes, and select a new plan if desired. Stay informed about your renewal dates and take the time to assess whether your current plan still meets your needs or if you should consider alternative options.

Utilize Provider Networks

As mentioned earlier, health insurance plans typically have networks of preferred providers that offer discounted rates. To maximize your coverage, make sure to utilize these in-network providers whenever possible. This not only saves you money but also ensures a smoother claims process, as these providers are already familiar with your insurance plan.

Explore Additional Benefits and Programs

Many health insurance plans offer additional benefits and programs beyond basic coverage. These may include wellness programs, disease management resources, or discounts on fitness memberships. Take the time to explore these offerings and determine how you can leverage them to enhance your overall health and well-being.

Frequently Asked Questions (FAQ)

What happens if I miss the open enrollment period for employer-sponsored plans?

+If you miss the open enrollment period for your employer-sponsored health insurance plan, you may still be able to enroll if you experience a qualifying life event. These events include marriage, divorce, birth or adoption of a child, loss of other health coverage, or a change in your household income. When these events occur, you can initiate a Special Enrollment Period to enroll outside of the regular open enrollment window.

Can I have more than one health insurance plan at the same time?

+It is possible to have multiple health insurance plans simultaneously, but it's essential to understand how they interact. Typically, one plan will serve as the primary insurance, while the other(s) will act as secondary coverage. The secondary plan(s) will only cover expenses that the primary plan doesn't, and their benefits may be limited. It's crucial to coordinate benefits between the plans to avoid gaps in coverage and maximize your overall protection.

How can I lower my health insurance premiums?

+There are several strategies you can employ to lower your health insurance premiums. One approach is to opt for a higher deductible plan, which often comes with lower monthly premiums. Additionally, some insurance companies offer discounts for healthy lifestyles, such as non-smoking or regular exercise. You can also explore government programs like Medicaid or tax credits through the Health Insurance Marketplace to reduce your out-of-pocket costs.

What should I do if I'm denied coverage by a health insurance provider?

+If you're denied coverage by a health insurance provider, don't lose hope. First, review the denial letter carefully to understand the reasons for the denial. You may be able to provide additional information or documentation to support your application. If the denial is based on a pre-existing condition, you may still be eligible for coverage through a state-based high-risk pool or other programs. Alternatively, you can explore other insurance providers or government programs like Medicare or Medicaid.

How can I access mental health services through my health insurance plan?

+Mental health services are an essential part of overall healthcare, and many health insurance plans include coverage for these services. To access mental health services through your insurance, start by checking your plan's benefits summary or member handbook to understand the specific coverage and any limitations. Then, identify in-network providers who offer the services you need. Contact your insurance provider if you have any questions or concerns about accessing mental health services.

Registering for health insurance is a crucial step towards safeguarding your health and financial well-being. By understanding your eligibility, exploring your options, and selecting the right plan, you can ensure that you and your loved ones have the coverage you need. Remember, health insurance is an ongoing commitment, and staying informed and engaged with your plan will help you make the most of your coverage.