Carelon Insurance

In today's complex and ever-evolving world, insurance has become an indispensable tool for individuals and businesses alike, offering protection and peace of mind against various risks and uncertainties. Among the myriad of insurance providers, Carelon Insurance stands out as a trusted partner, offering a comprehensive range of insurance solutions tailored to meet the unique needs of its clients.

With a rich history spanning over several decades, Carelon Insurance has established itself as a leading insurance provider, consistently delivering innovative and reliable insurance products. The company's expertise lies in its ability to understand the diverse requirements of its clientele, from individuals and families to small businesses and large corporations.

Carelon Insurance's commitment to excellence is reflected in its extensive portfolio of insurance offerings, including but not limited to auto, home, life, health, and business insurance. Each product is meticulously designed, taking into account the specific risks and challenges associated with the respective domains.

The Carelon Advantage: Comprehensive Insurance Solutions

Carelon Insurance’s comprehensive approach to insurance sets it apart from its competitors. The company understands that every individual or business has unique circumstances and needs, and thus, offers a wide array of customizable insurance plans.

Auto Insurance

Carelon’s auto insurance policies are tailored to provide protection against a range of automotive risks. These policies offer coverage for vehicle damage, personal injury, and liability, ensuring that policyholders are protected in the event of an accident. Additionally, Carelon provides optional add-ons such as roadside assistance and rental car coverage, enhancing the overall insurance experience.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers damage to the insured vehicle due to a collision. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, or natural disasters. |

| Liability Coverage | Covers costs associated with injuries or damages caused to others in an accident. |

Home Insurance

Carelon’s home insurance policies provide protection for one of the most significant investments of an individual’s life - their home. These policies offer coverage for a wide range of perils, including fire, theft, vandalism, and natural disasters. Carelon also offers additional coverage options such as personal liability and medical payments, ensuring that homeowners are adequately protected.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers the physical structure of the home. |

| Personal Property Coverage | Protects the contents of the home, including furniture, electronics, and clothing. |

| Liability Coverage | Covers legal expenses and damages if someone is injured on the insured property. |

Life Insurance

Life insurance is a crucial aspect of financial planning, providing a safety net for one’s loved ones in the event of an untimely demise. Carelon offers a range of life insurance policies, including term life, whole life, and universal life insurance. These policies offer varying levels of coverage and flexibility, catering to the diverse needs of individuals and families.

| Policy Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specific term, typically 10, 20, or 30 years. It offers pure protection with no cash value. |

| Whole Life Insurance | Offers lifelong coverage with a fixed premium and a cash value component that grows over time. |

| Universal Life Insurance | Provides flexibility in premium payments and coverage amounts, allowing policyholders to adjust their policy based on changing needs. |

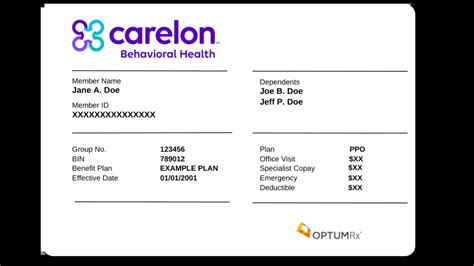

Health Insurance

Carelon’s health insurance plans are designed to provide individuals and families with access to quality healthcare services. These plans offer coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. Carelon also offers dental and vision insurance plans, ensuring comprehensive healthcare coverage.

| Coverage Type | Description |

|---|---|

| Medical Expense Coverage | Covers expenses related to medical treatments, surgeries, and hospitalization. |

| Prescription Drug Coverage | Provides coverage for the cost of prescription medications. |

| Preventive Care Coverage | Covers the cost of preventive services such as vaccinations, screenings, and check-ups. |

Business Insurance

Carelon understands the unique risks faced by businesses and offers a comprehensive range of business insurance solutions. These policies provide protection against property damage, liability claims, and business interruption, ensuring that businesses can recover from unforeseen events and continue operations seamlessly.

| Coverage Type | Description |

|---|---|

| Commercial Property Insurance | Covers physical damage to the business premises, equipment, and inventory. |

| General Liability Insurance | Protects against third-party claims arising from bodily injury, property damage, or personal injury. |

| Business Interruption Insurance | Provides coverage for lost income and expenses in the event of a covered loss that disrupts business operations. |

Customer Service Excellence: The Carelon Way

At Carelon Insurance, customer service is not just a priority, it’s a way of life. The company is dedicated to ensuring that its clients receive the best possible service and support throughout their insurance journey.

Carelon's customer service team is comprised of highly trained professionals who are passionate about providing exceptional service. They are available 24/7 to assist clients with any insurance-related queries, claims, or concerns. Whether it's helping policyholders understand their coverage or guiding them through the claims process, Carelon's team is always ready to assist.

Additionally, Carelon offers a user-friendly online platform that allows policyholders to manage their insurance policies conveniently. Policyholders can access their policy details, make payments, update personal information, and file claims online, making the insurance process seamless and efficient.

Carelon’s Commitment to Community and Sustainability

Beyond its insurance offerings, Carelon Insurance is deeply committed to making a positive impact on the communities it serves. The company actively engages in various community initiatives, partnering with local organizations to support education, healthcare, and environmental sustainability efforts.

Carelon believes in the power of collective action and encourages its employees to volunteer their time and skills to make a difference. The company's commitment to sustainability is evident in its environmental initiatives, including reducing paper usage, promoting energy efficiency, and supporting renewable energy projects.

Through its community engagement and sustainability efforts, Carelon strives to create a better world, ensuring that its positive impact extends beyond its insurance services.

Why Choose Carelon Insurance?

Carelon Insurance stands out as a leading insurance provider due to its comprehensive range of insurance solutions, dedication to customer service excellence, and commitment to community and sustainability. The company’s expertise, coupled with its personalized approach, ensures that policyholders receive insurance coverage tailored to their unique needs.

With Carelon Insurance, individuals and businesses can have the peace of mind that comes with knowing they are protected against life's uncertainties. Whether it's safeguarding one's home, vehicle, health, or business, Carelon Insurance is a trusted partner, offering reliable and innovative insurance solutions.

As a leading insurance provider, Carelon Insurance continues to innovate and adapt to the changing needs of its clients, ensuring that its insurance products remain relevant and effective in today's dynamic world.

How do I choose the right insurance coverage for my needs?

+Choosing the right insurance coverage depends on your unique circumstances and needs. Consider factors such as your age, health, financial situation, and the value of your assets. It’s beneficial to consult with an insurance professional who can guide you through the various options and help you select the coverage that provides the best protection for your situation.

What sets Carelon Insurance apart from other insurance providers?

+Carelon Insurance stands out for its comprehensive range of insurance solutions, dedicated customer service, and commitment to community and sustainability. The company’s expertise lies in understanding its clients’ unique needs and providing tailored insurance coverage. Additionally, Carelon’s 24⁄7 customer support and user-friendly online platform enhance the overall insurance experience.

How can I file a claim with Carelon Insurance?

+To file a claim with Carelon Insurance, you can either contact their customer service team via phone or email, or you can log in to your online account and follow the steps to file a claim online. The claims process is designed to be straightforward and efficient, ensuring that you receive the support you need during this time.