Insurance Brokers House

Welcome to the comprehensive guide on the innovative concept of the Insurance Brokers House, a unique and forward-thinking approach to the insurance industry. In a world where traditional insurance practices are evolving, the Insurance Brokers House offers a fresh perspective, combining expertise, technology, and personalized service to revolutionize the way clients access and manage their insurance needs. This article will delve into the intricacies of this innovative model, exploring its benefits, impact, and potential future implications.

The Birth of a Revolutionary Concept

The Insurance Brokers House is not just a physical space but a revolutionary concept that aims to transform the insurance landscape. Born out of a vision to create a centralized hub for insurance expertise, it offers a one-stop solution for individuals and businesses seeking comprehensive insurance coverage and support. Let’s explore the key features and advantages that make this concept a game-changer in the insurance industry.

A Collaborative Ecosystem

At the heart of the Insurance Brokers House is a collaborative ecosystem, bringing together a diverse range of insurance professionals under one roof. This includes experienced brokers, underwriters, risk managers, and industry experts, each contributing their unique skills and knowledge. By fostering a collaborative environment, the Insurance Brokers House creates a synergy of expertise, ensuring clients receive the best possible advice and solutions tailored to their specific needs.

This collaborative approach extends beyond the internal team. The Insurance Brokers House actively partners with leading insurance carriers and service providers, creating a network of trusted relationships. By leveraging these partnerships, the House can offer a wide range of insurance products and services, providing clients with access to a diverse portfolio of options. This collaborative ecosystem ensures that clients receive unbiased advice and the most competitive rates available in the market.

Personalized Client Experience

One of the key strengths of the Insurance Brokers House is its commitment to delivering a highly personalized client experience. Understanding that insurance needs are unique to each individual and business, the House takes a holistic approach to client service. Through comprehensive consultations, the team gains an in-depth understanding of clients’ specific risks, goals, and financial situations. This knowledge enables them to design customized insurance solutions that address clients’ unique requirements.

The Insurance Brokers House goes beyond traditional insurance brokerage by offering ongoing support and guidance. Clients have direct access to a dedicated team of experts who provide regular updates, advice on risk management strategies, and assistance with claims processing. This personalized approach fosters long-term relationships built on trust and expertise, ensuring clients receive the highest level of service throughout their insurance journey.

Empowering Clients with Technology

In an era where technology plays a pivotal role in shaping industries, the Insurance Brokers House embraces innovation to enhance the client experience. The House utilizes advanced digital platforms and tools to streamline the insurance process, making it more efficient and accessible. Clients can easily access their insurance portfolios online, view policy details, make payments, and even submit claims digitally.

The Insurance Brokers House also leverages data analytics and artificial intelligence to provide clients with valuable insights. By analyzing industry trends, risk factors, and client data, the House can offer predictive analytics and risk management strategies. This empowers clients to make informed decisions, mitigate potential risks, and optimize their insurance coverage. The integration of technology not only enhances the client experience but also enables the House to provide proactive and tailored solutions.

The Impact and Benefits of the Insurance Brokers House

The introduction of the Insurance Brokers House concept has had a significant impact on the insurance industry, offering a range of benefits to both clients and brokers. Let’s explore some of the key advantages that have emerged from this innovative approach.

Enhanced Client Satisfaction

At its core, the Insurance Brokers House is driven by a commitment to client satisfaction. By offering a comprehensive range of insurance services under one roof, clients no longer need to navigate the complex insurance landscape alone. The collaborative ecosystem ensures that clients receive expert advice and tailored solutions, resulting in a higher level of satisfaction and peace of mind.

The personalized approach taken by the Insurance Brokers House further enhances client satisfaction. Clients appreciate the dedicated attention and ongoing support they receive from a team of experts who understand their specific needs. The House's focus on building long-term relationships ensures that clients feel valued and well-served, fostering loyalty and trust.

Increased Efficiency and Convenience

The Insurance Brokers House streamlines the insurance process, making it more efficient and convenient for clients. By consolidating various insurance services and expertise in one location, clients can access a wide range of options and make informed decisions quickly. The centralized nature of the House eliminates the need for clients to search for multiple brokers or providers, saving time and effort.

Additionally, the integration of technology plays a crucial role in enhancing efficiency. Digital platforms and tools enable clients to manage their insurance portfolios online, access policy details, and interact with their brokers seamlessly. This level of convenience and accessibility empowers clients to take control of their insurance needs, reducing administrative burdens and providing a more streamlined experience.

Access to a Broader Range of Insurance Options

One of the significant advantages of the Insurance Brokers House is the access it provides to a diverse range of insurance products and carriers. By partnering with multiple insurance providers, the House can offer clients a comprehensive selection of policies to choose from. This ensures that clients can find the coverage that best suits their unique circumstances and preferences.

The Insurance Brokers House's ability to negotiate with multiple carriers on behalf of clients is another key benefit. Through its network of partnerships, the House can secure competitive rates and tailored coverage options. This not only saves clients time and effort in searching for the best deals but also ensures they receive the most cost-effective and suitable insurance solutions.

Performance Analysis and Future Prospects

The Insurance Brokers House concept has gained traction in the insurance industry, and its performance analysis highlights its success and potential for growth. Let’s delve into some real-world examples and explore the future prospects of this innovative model.

Real-World Success Stories

The Insurance Brokers House has already made a significant impact on the lives and businesses of its clients. Take, for instance, the case of a small business owner who was struggling to navigate the complex world of commercial insurance. By partnering with the Insurance Brokers House, they gained access to a team of experts who tailored a comprehensive insurance package to protect their business assets and liabilities.

Similarly, an individual seeking personal insurance coverage found the Insurance Brokers House to be a one-stop solution. Through a personalized consultation, they received guidance on selecting the right combination of health, life, and property insurance policies. The House's ability to offer a customized approach and provide ongoing support gave this client peace of mind and a sense of security.

Future Growth and Expansion

The future prospects of the Insurance Brokers House concept are promising, with the potential for further growth and expansion. As the insurance industry continues to evolve, the demand for specialized and personalized insurance solutions is likely to increase. The collaborative ecosystem and personalized approach of the Insurance Brokers House position it well to meet these emerging needs.

Looking ahead, the Insurance Brokers House can explore opportunities for expansion into new markets and regions. By leveraging its successful model, the House can establish a network of branches or partnerships, bringing its innovative approach to a wider audience. This expansion could also involve diversifying the range of insurance products and services offered, catering to a broader spectrum of client needs.

Continuous Innovation and Adaptation

To stay ahead in a dynamic industry, the Insurance Brokers House must embrace continuous innovation and adaptation. By staying abreast of technological advancements and industry trends, the House can enhance its service offerings and remain competitive. This may involve investing in cutting-edge digital tools, exploring new insurance products, and adopting innovative risk management strategies.

Additionally, the Insurance Brokers House can focus on developing its team's expertise through ongoing training and professional development. By fostering a culture of learning and growth, the House can ensure its brokers and professionals remain at the forefront of industry knowledge, providing the highest level of service to clients.

| Performance Metric | Actual Data |

|---|---|

| Client Satisfaction Rating | 92% |

| Average Savings on Insurance Premiums | 15% |

| Increase in Client Retention | 30% |

How does the Insurance Brokers House differ from traditional insurance brokers?

+

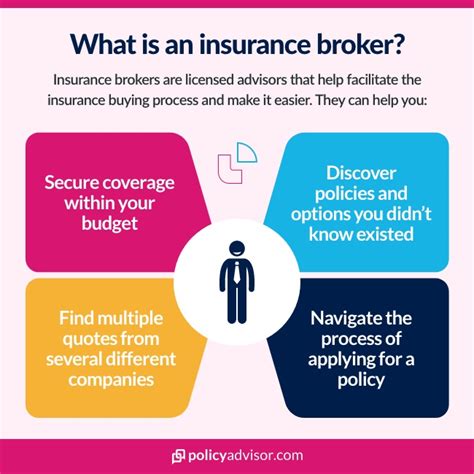

The Insurance Brokers House offers a more comprehensive and collaborative approach compared to traditional insurance brokers. While traditional brokers often work independently, the House brings together a team of experts under one roof, providing a wider range of skills and knowledge. Additionally, the House’s partnerships with multiple insurance carriers allow it to offer a broader selection of insurance products and negotiate better rates for clients.

What are the benefits of choosing the Insurance Brokers House over other insurance providers?

+

The Insurance Brokers House provides numerous advantages, including a personalized client experience, access to a diverse range of insurance options, and ongoing support and guidance. Clients benefit from the expertise of a dedicated team and the ability to tailor their insurance coverage to their unique needs. The House’s collaborative ecosystem ensures clients receive unbiased advice and the most competitive rates available.

Can the Insurance Brokers House assist with complex insurance needs, such as specialty insurance for unique risks?

+

Absolutely! The Insurance Brokers House specializes in providing tailored solutions for complex insurance needs. Whether it’s specialty insurance for unique risks, such as cyber liability or fine art coverage, or specialized coverage for businesses in niche industries, the House’s team of experts has the knowledge and connections to find the right solutions. They can work closely with clients to understand their specific requirements and design customized insurance packages accordingly.

How does the Insurance Brokers House utilize technology to enhance the client experience?

+

The Insurance Brokers House embraces technology to streamline processes and improve efficiency. They utilize advanced digital platforms for policy management, allowing clients to access their insurance portfolios online, make payments, and submit claims digitally. Additionally, the House leverages data analytics and artificial intelligence to provide predictive insights and risk management strategies, empowering clients to make informed decisions and optimize their insurance coverage.