Cost Of Insurance For A Car

The cost of insurance for a car is a multifaceted topic that can vary significantly based on numerous factors. Understanding these variables is crucial for anyone looking to insure their vehicle. In this comprehensive guide, we will delve into the intricate world of car insurance costs, providing you with a detailed analysis and expert insights to navigate this essential aspect of vehicle ownership.

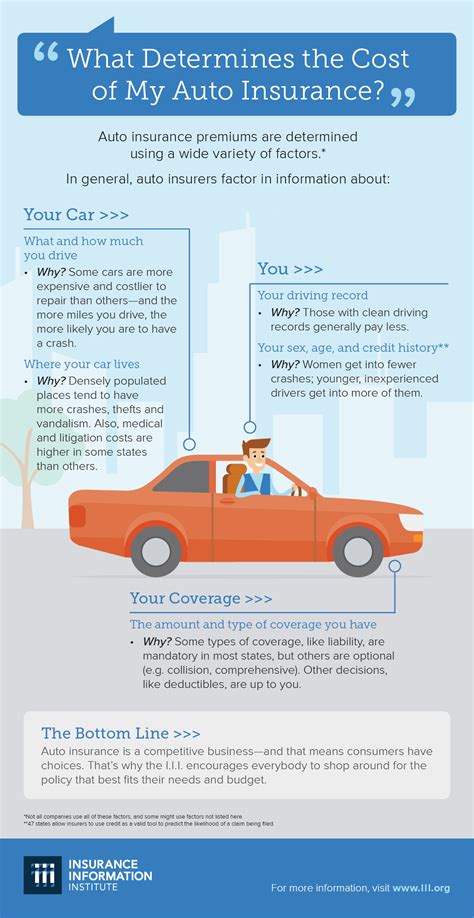

Factors Influencing Car Insurance Costs

Several key factors contribute to the overall cost of insuring a vehicle. These factors are often interconnected and can vary based on regional and personal circumstances. Here’s an in-depth look at each of these elements:

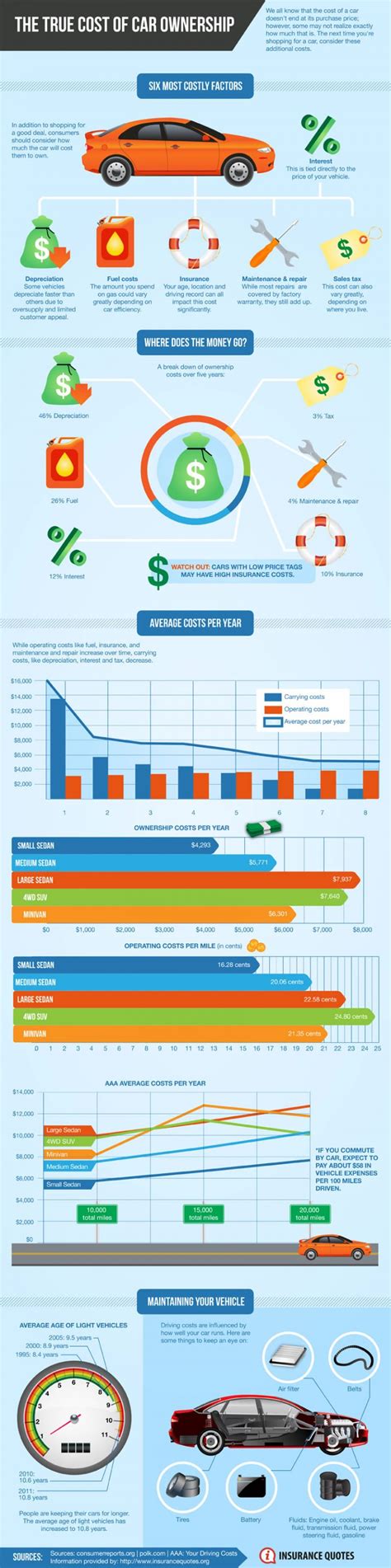

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining insurance costs. Generally, newer and more expensive cars tend to have higher insurance premiums. Additionally, the purpose for which you use your vehicle can impact insurance rates. For instance, if you use your car for business purposes or commute long distances, your insurance costs may be higher.

Driver’s Profile

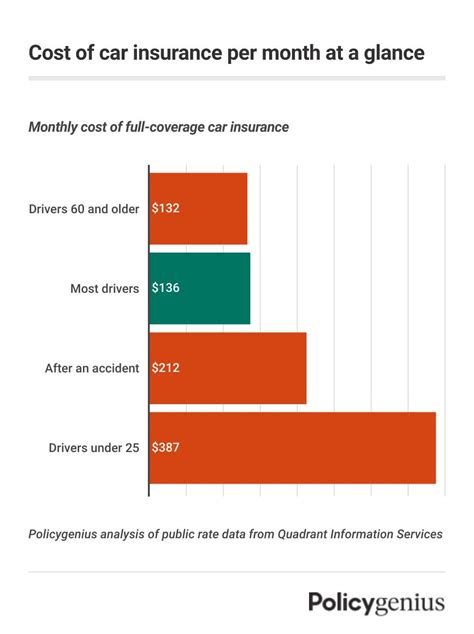

Your personal information and driving history are crucial in calculating insurance rates. Young drivers, especially males, often face higher premiums due to their perceived higher risk of accidents. Conversely, experienced drivers with a clean record may enjoy lower rates. Other personal factors, such as marital status and education level, can also influence insurance costs.

| Driver Profile Factor | Impact on Insurance Costs |

|---|---|

| Age | Younger drivers may pay more due to higher accident risk. |

| Gender | Males often face higher premiums than females. |

| Driving Experience | Experienced drivers with clean records often receive discounts. |

| Marital Status | Married individuals may enjoy lower rates. |

| Education Level | Higher education can sometimes lead to lower premiums. |

Location and Usage

The area where you reside and use your vehicle can significantly affect insurance costs. Urban areas often have higher insurance rates due to increased traffic and potential for accidents. Additionally, the number of miles you drive annually can impact your premium, with higher mileage often resulting in increased costs.

Insurance Coverage and Deductibles

The level of insurance coverage you choose and the associated deductibles can greatly influence your insurance costs. Comprehensive and collision coverage options, which provide broader protection, typically come with higher premiums. Conversely, higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lead to lower premiums.

Credit Score

Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, and a higher credit score can lead to lower insurance costs. Maintaining a good credit score is, therefore, an important factor in keeping insurance premiums down.

Insurance Company and Discounts

Different insurance companies offer varying rates and discounts. Shopping around and comparing quotes from multiple insurers can help you find the best deal. Additionally, many insurers offer discounts for safe driving, multiple policies, and loyalty, so it’s worth exploring these options to reduce your insurance costs.

Analyzing Real-World Insurance Costs

To provide a clearer picture, let’s examine some real-world insurance costs for different vehicles and scenarios. These examples will help illustrate how the factors mentioned above impact insurance premiums.

Example 1: New Driver with a Compact Car

Let’s consider a 19-year-old male driver living in an urban area who has just purchased a 2023 Toyota Corolla. With a clean driving record, he opts for basic liability coverage and chooses a deductible of 500. Based on his profile and vehicle choice, he can expect to pay an average of 1,200 to $1,500 annually for insurance.

Example 2: Experienced Driver with a Luxury Sedan

Now, let’s look at a 35-year-old female driver with an excellent driving record who owns a 2022 Mercedes-Benz E-Class. She opts for comprehensive coverage with a 1,000 deductible. Given her profile and vehicle choice, she can anticipate an annual insurance premium of approximately 1,800 to $2,200.

Example 3: High-Mileage Driver with a Pickup Truck

Consider a 40-year-old male driver who commutes long distances daily in a 2018 Ford F-150. With a few minor accidents on his record, he opts for liability and collision coverage with a 500 deductible. His annual insurance premium could range from 1,500 to $2,000, taking into account his vehicle type, usage, and driving history.

Strategies to Lower Insurance Costs

While insurance costs are influenced by numerous factors, there are strategies you can employ to potentially reduce your premiums. Here are some expert tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your specific circumstances.

- Increase Deductibles: Choosing higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense in the event of an accident.

- Maintain a Clean Record: A clean driving record is essential for keeping insurance costs down. Avoid accidents and moving violations to maintain a favorable insurance profile.

- Explore Discounts: Insurance companies often offer discounts for various reasons. Ask about safe driving, loyalty, and multi-policy discounts to see if you qualify.

- Consider Bundling: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can sometimes lead to significant savings.

- Improve Your Credit Score: As mentioned, a higher credit score can result in lower insurance costs. Focus on improving your credit to potentially reduce your insurance premiums.

Future Implications and Industry Trends

The world of car insurance is continually evolving, and several trends are shaping the industry’s future. Here’s a glimpse into what the future may hold for car insurance costs:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior, is gaining traction. Usage-based insurance policies that offer discounts based on safe driving habits are becoming more common. This trend may lead to more personalized insurance rates, rewarding safe drivers with lower premiums.

Autonomous Vehicles and Safety Features

The rise of autonomous vehicles and advanced safety features in traditional cars could potentially reduce accident rates, leading to lower insurance costs over time. However, the initial introduction of these technologies may temporarily increase insurance costs due to the novelty and potential unknown risks.

Digitalization and Customer Experience

The insurance industry is embracing digitalization, offering more convenient and efficient ways to manage policies and claims. This shift could lead to lower operational costs for insurers, which may eventually be passed on to customers in the form of reduced premiums.

Regulation and Policy Changes

Regulatory changes and policy updates can significantly impact insurance costs. While it’s challenging to predict specific changes, staying informed about industry developments and understanding how they may affect your insurance coverage is essential.

Conclusion

Understanding the factors that influence car insurance costs is the first step toward making informed decisions. By analyzing your personal circumstances, vehicle choice, and insurance needs, you can navigate the complex world of car insurance with confidence. Remember, shopping around, maintaining a clean driving record, and exploring discounts are key strategies to potentially lower your insurance premiums.

How do insurance companies determine rates for different vehicles?

+Insurance companies use a combination of factors, including vehicle type, make, and model, to assess the risk associated with insuring a particular vehicle. They consider factors such as repair costs, safety ratings, and theft rates to determine rates.

Can I negotiate my car insurance rates?

+While insurance rates are typically based on standardized calculations, you can still shop around and compare quotes from different insurers to find the best deal. Additionally, you can negotiate with your insurer to explore potential discounts or adjust your coverage to meet your needs and budget.

What are some common car insurance discounts I should be aware of?

+Common car insurance discounts include safe driver discounts, multi-policy discounts (for bundling auto insurance with other policies), loyalty discounts, good student discounts, and discounts for safety features in your vehicle. It’s worth inquiring with your insurer to see which discounts you may qualify for.