Renters Insurance Best

Renters insurance is a crucial aspect of financial protection for individuals who rent their living spaces. In today's dynamic world, where rental properties are often a preferred choice, understanding the significance of renters insurance and its benefits is essential. This comprehensive guide aims to explore the best practices, advantages, and key considerations when it comes to renters insurance, ensuring you make informed decisions to safeguard your belongings and peace of mind.

Understanding Renters Insurance: A Comprehensive Overview

Renters insurance, often overlooked, is a vital tool for anyone living in a rented accommodation. It provides financial coverage for a range of situations, offering protection against unexpected events that could lead to significant losses. From natural disasters to theft, renters insurance acts as a safety net, ensuring your personal belongings and liabilities are secured.

Coverage Offered by Renters Insurance

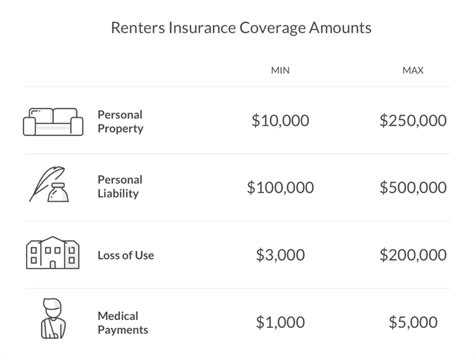

Renters insurance typically includes coverage for personal property, liability, and additional living expenses. In the event of a covered loss, such as a fire or burglary, your policy can reimburse you for the cost of replacing your belongings. Liability coverage protects you if someone is injured in your home or if you accidentally cause damage to someone else’s property. Additionally, it provides coverage for temporary living expenses if your rental becomes uninhabitable due to a covered event.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the cost of replacing or repairing your belongings if they are damaged or lost due to a covered event. |

| Liability | Protects you from legal and medical expenses if someone is injured on your rental property or if you cause damage to others. |

| Additional Living Expenses | Covers temporary living costs if your rental becomes unlivable due to a covered loss, such as a fire or storm damage. |

Why Renters Insurance is Essential

Renters often underestimate the value of their possessions, but the reality is that replacing everything from furniture to electronics can be a significant financial burden. Renters insurance provides a safety net, ensuring that you are not left with the sole responsibility of covering these costs. Furthermore, liability coverage is crucial, as it protects you from potential lawsuits if someone is injured on your property.

Key Considerations for Choosing the Best Renters Insurance

When it comes to selecting the best renters insurance policy, several factors come into play. It’s not just about finding the cheapest option; it’s about ensuring comprehensive coverage tailored to your specific needs. Here’s a breakdown of the key considerations:

Assessing Your Coverage Needs

The first step in choosing the right renters insurance is understanding your unique needs. Consider the value of your personal belongings and the potential risks associated with your rental location. Are you at a higher risk of natural disasters, such as floods or earthquakes? Do you have valuable items that may require additional coverage, like jewelry or electronics? Assessing these factors will help you determine the level of coverage you require.

Comparing Policy Options

Once you have a clear idea of your coverage needs, it’s time to compare different policy options. Research multiple insurance providers and analyze their offerings. Look for policies that provide flexible coverage limits, allowing you to tailor the policy to your specific situation. Compare the deductibles, as lower deductibles can provide more comprehensive coverage, but they may also result in higher premiums.

Evaluating Additional Coverages and Benefits

Beyond the standard coverage, many renters insurance policies offer additional benefits and coverages. These can include identity theft protection, coverage for high-value items, and even pet injury coverage. While these additional features may come at an extra cost, they can provide significant peace of mind and protection for specific situations.

| Additional Coverage | Description |

|---|---|

| Identity Theft Protection | Provides assistance and reimbursement for expenses related to identity theft, helping you recover and restore your identity. |

| High-Value Item Coverage | Covers expensive items like jewelry, artwork, or musical instruments that may exceed the standard policy limits. |

| Pet Injury Coverage | Offers coverage for veterinary costs if your pet is injured in a covered event, providing financial support during a difficult time. |

The Best Practices for Renters Insurance

To ensure you get the most out of your renters insurance policy, adopting best practices is essential. These practices not only help you make the most of your coverage but also streamline the claims process in the event of a loss.

Creating an Inventory of Your Belongings

Maintaining a detailed inventory of your possessions is a crucial step in renters insurance. This inventory should include a list of all your belongings, along with their estimated values and any relevant receipts or appraisals. By having an accurate inventory, you can ensure that you are adequately covered and provide evidence to support your claims in the event of a loss.

Understanding Policy Exclusions and Limitations

While renters insurance provides comprehensive coverage, it’s important to be aware of the exclusions and limitations. Most policies do not cover certain types of losses, such as damage caused by earthquakes, floods, or poor maintenance. Understanding these exclusions can help you make informed decisions about additional coverage options or alternative methods to protect your belongings.

Regularly Reviewing and Updating Your Policy

Renters insurance policies should be reviewed annually to ensure they still meet your needs. Life changes, such as acquiring new possessions or moving to a different rental property, can impact your coverage requirements. By regularly reviewing your policy, you can make necessary adjustments, ensuring you have the right coverage in place at all times.

Real-Life Examples of Renters Insurance Claims

Understanding the practical application of renters insurance can provide valuable insights into its benefits. Let’s explore a couple of real-life scenarios where renters insurance made a significant difference.

Case Study: Burglary Protection

Sarah, a young professional, rented an apartment in a busy city. One evening, while she was out with friends, her apartment was burglarized. The thieves made off with her laptop, camera equipment, and some valuable jewelry. Thanks to her renters insurance policy, Sarah was able to file a claim and receive reimbursement for the cost of replacing her stolen items. The policy also covered the cost of temporary accommodations while her apartment was being secured.

Case Study: Natural Disaster Coverage

John and his family rented a house in an area prone to hurricanes. Unfortunately, a powerful storm caused significant damage to their rental home, rendering it uninhabitable. John’s renters insurance policy covered the cost of temporary housing for his family while their home was being repaired. Additionally, the policy reimbursed them for the cost of replacing damaged furniture and electronics.

Future Trends and Innovations in Renters Insurance

The renters insurance industry is constantly evolving, with new trends and innovations shaping the future of coverage. As technology advances, insurers are adopting digital tools and data analytics to enhance the customer experience and improve risk assessment.

Digitalization and Online Services

Insurance providers are increasingly embracing digital platforms to streamline the policy purchasing and claims process. Online portals allow renters to easily manage their policies, file claims, and access support resources. This digitalization not only improves efficiency but also provides renters with greater control over their insurance journey.

Data-Driven Risk Assessment

Advanced data analytics and machine learning are transforming the way insurers assess risk. By analyzing vast amounts of data, insurers can identify patterns and make more accurate predictions about potential risks. This data-driven approach allows for more precise underwriting, resulting in fairer premiums and better coverage for renters.

Sustainability and Green Initiatives

With a growing focus on sustainability, insurers are also exploring ways to incorporate green initiatives into renters insurance. This may include offering discounts for renters who adopt energy-efficient practices or providing coverage for sustainable home improvements. By encouraging environmentally friendly practices, insurers can reduce risks and contribute to a more sustainable future.

Conclusion: Empowering Renters with Comprehensive Protection

Renters insurance is not just a financial safeguard; it’s a tool that empowers renters to live with confidence and peace of mind. By understanding the coverage options, assessing their unique needs, and adopting best practices, renters can ensure they are adequately protected against a range of unexpected events. As the industry continues to evolve, embracing digitalization, data-driven assessments, and sustainable practices, renters can look forward to an even more comprehensive and personalized insurance experience.

How much does renters insurance typically cost?

+

The cost of renters insurance can vary based on factors such as location, coverage limits, and the value of your possessions. On average, renters insurance policies range from 15 to 30 per month. However, it’s important to note that the cost can be significantly lower or higher depending on your specific circumstances.

Does renters insurance cover my personal liability if someone is injured on my rental property?

+

Yes, renters insurance typically includes personal liability coverage. This coverage protects you if someone is injured on your rental property or if you accidentally cause damage to someone else’s property. It can provide financial protection against potential lawsuits and medical expenses.

Can I customize my renters insurance policy to suit my specific needs?

+

Absolutely! Renters insurance policies offer flexibility to tailor coverage to your specific needs. You can adjust coverage limits, add additional coverages for high-value items or specific risks, and even choose different deductibles. This customization ensures that your policy provides the right level of protection for your situation.