Average Homeowners Insurance Rates Florida

In the Sunshine State, where hurricanes and coastal storms are a reality, finding affordable homeowners insurance can be a challenge. Florida's unique climate and geographical factors contribute to some of the highest insurance rates in the nation. Understanding the factors that influence these rates and knowing how to navigate the market can help Floridians make informed decisions and potentially save money on their insurance premiums.

The Factors Shaping Homeowners Insurance Rates in Florida

Florida’s homeowners insurance landscape is complex, with various factors influencing the rates. Here’s a breakdown of the key elements that insurance companies consider when determining premiums for policies in the state.

1. Weather and Natural Disasters

Florida’s tropical climate makes it susceptible to a range of natural disasters, including hurricanes, tropical storms, tornadoes, and floods. The frequency and intensity of these events are major considerations for insurance providers. According to the Insurance Information Institute, Florida accounted for approximately 73% of all insurance-related hurricane losses in the United States from 1995 to 2019.

The Florida Hurricane Catastrophe Fund (FHCF), which provides reinsurance coverage to property insurers, plays a crucial role in the state’s insurance market. However, the fund’s capacity is limited, and insurance companies often need to purchase additional reinsurance to cover potential losses from major storms. This adds to the overall cost of insurance and can lead to higher premiums for homeowners.

| Year | Number of Named Storms | Major Hurricanes (Cat. 3+) |

|---|---|---|

| 2022 | 14 | 2 |

| 2021 | 21 | 4 |

| 2020 | 30 | 6 |

2. Coastal Location and Storm Surge Risks

Florida’s extensive coastline, spanning over 1,350 miles, exposes a large portion of the state’s population to the risks associated with coastal storms and storm surges. The National Oceanic and Atmospheric Administration (NOAA) estimates that approximately 3.5 million people in Florida live in areas vulnerable to coastal flooding.

Insurance companies carefully assess the proximity of a home to the coast and its susceptibility to storm surges. Homes located in high-risk areas often face higher insurance premiums to account for the increased likelihood of damage from these events. According to the Florida Office of Insurance Regulation, coastal counties like Miami-Dade, Broward, and Palm Beach typically have higher average premiums due to their exposure to storm surge risks.

3. Construction and Building Codes

The construction and age of a home are significant factors in determining insurance rates. In Florida, homes built before the implementation of stricter building codes (often referred to as the Florida Building Code or FBC) may be considered at higher risk for damage during storms. Insurance companies may offer discounts for homes that meet modern building standards, as these structures are generally more resilient to wind and water damage.

The Florida Building Code, first adopted in 2002, sets minimum standards for construction to enhance structural integrity and reduce the risk of damage from natural disasters. Homes built to these standards often benefit from lower insurance premiums.

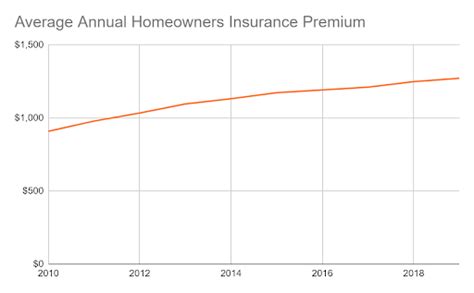

4. Home Value and Replacement Cost

The value of a home and its replacement cost are critical factors in insurance pricing. Homes with higher replacement values typically require more coverage, resulting in higher premiums. It’s important for homeowners to ensure their policy limits accurately reflect the cost of rebuilding their home, as underinsured properties can lead to significant financial losses in the event of a total loss.

Additionally, the location of the home within the state can influence its value and, consequently, the insurance premium. For instance, homes in urban areas or those with desirable amenities may have higher property values, affecting the overall cost of insurance.

5. Claims History and Credit Score

Insurance companies consider a homeowner’s claims history when determining rates. Frequent claims or a history of major losses can lead to higher premiums or even non-renewal of policies. It’s important for homeowners to carefully assess their coverage needs and file claims only when necessary to avoid adverse effects on their insurance rates.

Credit scores also play a role in insurance pricing. Insurance companies may use credit-based insurance scores to assess a homeowner’s risk level. These scores are calculated based on credit history and can impact the overall premium. Maintaining a good credit score can potentially lead to lower insurance rates.

Navigating the Florida Homeowners Insurance Market

Given the unique challenges of the Florida insurance market, it’s crucial for homeowners to take an active approach to managing their insurance coverage. Here are some strategies to consider:

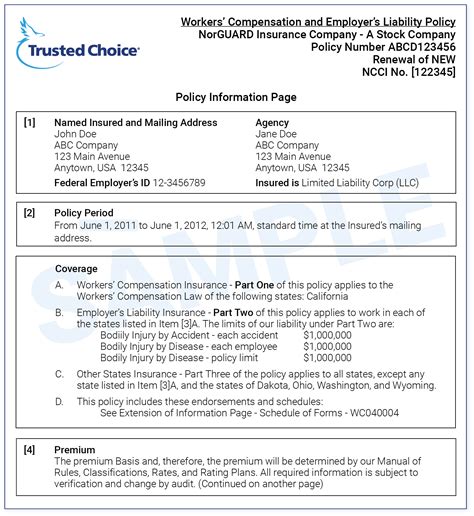

1. Understand Your Coverage

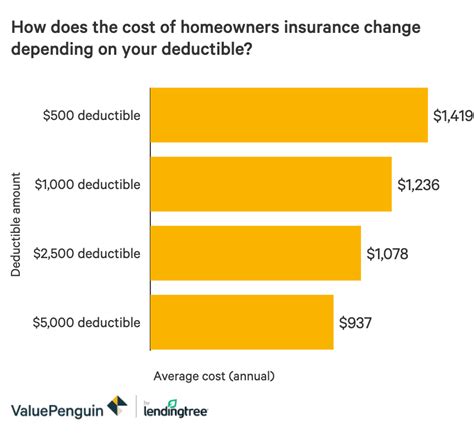

Review your insurance policy regularly to ensure you have the appropriate coverage for your home and belongings. Understand the types of perils covered (e.g., wind damage, flood, theft) and the deductibles and limits associated with each. Make sure your policy limits align with the current replacement cost of your home and its contents.

Consider purchasing additional coverage for specific risks, such as flood insurance through the National Flood Insurance Program (NFIP), if your standard homeowners policy does not provide sufficient protection.

2. Shop Around and Compare Rates

Florida’s insurance market is competitive, with numerous providers offering policies. Compare rates and coverage options from multiple insurers to find the best value for your needs. Online insurance marketplaces and comparison websites can be valuable tools for researching and obtaining quotes from various carriers.

When comparing policies, consider factors beyond just the premium. Look at the coverage limits, deductibles, and any exclusions or limitations. Ensure you’re comparing similar policies to get an accurate assessment of value.

3. Explore Discounts and Savings

Insurance companies often offer a variety of discounts to attract and retain customers. Common discounts include:

- Multi-Policy Discounts: Bundling your homeowners insurance with other policies, such as auto insurance, can lead to significant savings.

- Safety Features Discounts: Homes with certain safety features, such as storm shutters, reinforced roofs, or fire suppression systems, may qualify for discounts.

- Loyalty Discounts: Some insurers reward long-term customers with loyalty discounts.

- Credit-Based Insurance Discounts: Maintaining a good credit score can make you eligible for credit-based insurance discounts.

- Senior Citizen Discounts: Certain insurers offer discounts to homeowners over a specific age.

Ask your insurance agent or broker about available discounts and ensure you’re taking advantage of any applicable savings.

4. Consider Insurance Companies’ Financial Strength

When selecting an insurance company, it’s essential to consider their financial stability and strength. Look for companies with a strong financial rating from reputable agencies like AM Best, Moody’s, or Standard & Poor’s. A financially stable insurer is more likely to be able to pay out claims in the event of a major catastrophe.

5. Maintain Your Home and Mitigate Risks

Taking steps to reduce the risk of damage to your home can lead to lower insurance premiums. Regular maintenance, such as keeping your roof in good condition, trimming trees away from power lines, and ensuring proper drainage around your property, can help prevent damage and potential claims.

Consider investing in storm protection measures, such as impact-resistant windows and doors or hurricane shutters. These upgrades can lead to significant discounts on your insurance premiums and provide added protection for your home.

The Future of Homeowners Insurance in Florida

The homeowners insurance market in Florida is evolving, driven by technological advancements, changing consumer expectations, and the ongoing threat of natural disasters. Here’s a glimpse into the future of homeowners insurance in the Sunshine State:

1. Technological Innovations

Insurance companies are increasingly leveraging technology to enhance their operations and improve the customer experience. Here are some key technological trends shaping the future of homeowners insurance in Florida:

- Digital Insurance Platforms: Online and mobile platforms are becoming more prevalent, allowing homeowners to manage their policies, file claims, and communicate with insurers more efficiently.

- Telematics and IoT Devices

- Usage-Based Insurance (UBI): Some insurers are exploring UBI models, where premiums are based on real-time data collected from sensors and devices in the home. This could lead to more personalized and potentially lower premiums for homeowners who take proactive measures to mitigate risks.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being used to analyze vast amounts of data, including satellite imagery and weather patterns, to more accurately assess risk and price policies. This can result in more precise and fair insurance rates.

2. Changing Consumer Expectations

Consumers today have higher expectations for convenience, speed, and personalization in their insurance experiences. Insurance companies are adapting to meet these expectations, offering:

- Real-Time Claims Processing: Some insurers are utilizing technology to streamline the claims process, providing real-time updates and faster resolution of claims.

- Personalized Coverage Options: With the help of data analytics, insurers can offer more tailored coverage options to meet the unique needs of individual homeowners.

- Enhanced Customer Service: Insurance companies are investing in customer service technologies, such as chatbots and virtual assistants, to provide 24⁄7 support and assistance to policyholders.

3. Natural Disaster Preparedness and Resilience

As Florida continues to face the threat of hurricanes and other natural disasters, insurers are focusing on preparedness and resilience measures. Here’s how the industry is evolving to address these challenges:

- Catastrophe Modeling: Insurance companies are investing in advanced catastrophe modeling tools to more accurately assess the potential impact of natural disasters and price policies accordingly. This helps insurers maintain financial stability and ensure they have adequate reserves to pay out claims.

- Public-Private Partnerships: Insurers are collaborating with government agencies and organizations to enhance disaster preparedness and response efforts. These partnerships can lead to more effective mitigation and recovery strategies, ultimately reducing the financial burden on the insurance industry and policyholders.

- Resilience Initiatives: Insurance companies are encouraging and rewarding homeowners who take steps to increase the resilience of their homes against natural disasters. This can include providing discounts for homes that meet certain resilience standards or offering incentives for homeowners to invest in storm protection measures.

4. Regulatory and Industry Changes

The Florida insurance market is subject to ongoing regulatory changes and industry developments. Here are some key areas to watch:

- Insurance Rate Regulation: The Florida Office of Insurance Regulation (OIR) plays a critical role in overseeing insurance rates and ensuring they are fair and reasonable. OIR regularly reviews and approves insurance rates submitted by carriers, and they have the authority to reject rates that are deemed excessive or inadequate. Homeowners can stay informed about rate changes and regulatory developments by visiting the OIR website.

- Insurance Company Insolvency: In the event of an insurer becoming insolvent, the Florida Insurance Guaranty Association (FIGA) steps in to protect policyholders. FIGA is a non-profit organization funded by assessments on insurance companies doing business in Florida. In the event of an insurer’s insolvency, FIGA can provide coverage for certain types of claims, subject to specific limits and exclusions. Homeowners can find more information about FIGA and its role on their website.

5. Industry Consolidation and Innovation

The homeowners insurance market in Florida is highly competitive, with a mix of traditional insurers, regional carriers, and emerging insurtech companies. Here’s a look at some of the trends shaping the industry landscape:

- Insurtech Disruption: Insurtech startups are bringing innovation to the industry, leveraging technology to offer more efficient and personalized insurance products. These companies often have a digital-first approach, using data analytics and AI to provide tailored coverage and competitive pricing. Homeowners can explore these new options to find insurance that better meets their needs and preferences.

- Industry Consolidation: As the insurance market evolves, we may see consolidation among carriers, with larger insurers acquiring smaller ones. This consolidation can lead to increased market share for larger companies and potentially impact the range of coverage options available to homeowners.

- Partnerships and Collaborations: Insurers are increasingly forming partnerships with technology companies and other organizations to enhance their products and services. These collaborations can lead to the development of new insurance products, improved customer experiences, and more efficient claims handling.

FAQ

How often should I review my homeowners insurance policy in Florida?

+

It’s recommended to review your homeowners insurance policy annually or whenever there are significant changes to your home, such as renovations or additions. Regular reviews ensure your coverage remains adequate and that you’re taking advantage of any available discounts.

Can I bundle my homeowners and auto insurance to save money?

+

Yes, bundling your homeowners and auto insurance policies with the same insurer is a common way to save money. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option to potentially reduce your overall insurance costs.

What should I do if my insurance company increases my premiums significantly?

+

If your insurance company increases your premiums significantly, it’s a good idea to shop around for alternative quotes. Compare rates from multiple insurers to see if you can find a more competitive option. Additionally, consider reaching out to your current insurer to discuss the reasons for the increase and explore any available discounts.