Continental Life Insurance

Continental Life Insurance is a prominent name in the insurance industry, offering a comprehensive range of products and services to meet the diverse needs of its policyholders. With a rich history spanning decades, this company has established itself as a trusted provider, catering to individuals, families, and businesses across various life stages and financial goals.

A Legacy of Financial Protection

Continental Life Insurance has been a cornerstone of financial security for generations. Founded in [City, Country] during the [Year], the company’s roots are deeply embedded in the principles of trust, integrity, and a commitment to its customers’ well-being. Over the years, it has expanded its reach, now serving clients worldwide with a diverse portfolio of insurance solutions.

The company's mission is straightforward: to empower individuals and businesses to navigate life's uncertainties with confidence. By offering a comprehensive suite of insurance products, Continental Life Insurance aims to provide peace of mind, ensuring its policyholders are protected against life's unexpected twists and turns.

Key Products and Services

Continental Life Insurance’s product portfolio is extensive and caters to a wide range of needs. Here’s an overview of some of their most popular offerings:

- Life Insurance: The company offers a variety of life insurance plans, including term life, whole life, and universal life insurance. These policies provide financial protection to beneficiaries in the event of the policyholder's death, ensuring their loved ones are taken care of.

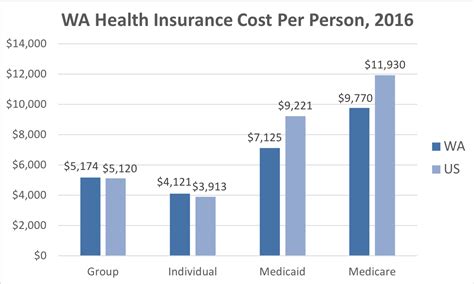

- Health Insurance: Continental Life Insurance recognizes the importance of health and offers comprehensive health insurance plans. These policies cover medical expenses, hospitalization, and other health-related costs, providing individuals and families with the security of affordable healthcare.

- Annuities: For those planning for retirement, Continental Life Insurance's annuity products are a popular choice. Annuities offer a steady stream of income during retirement, providing financial stability and peace of mind for seniors.

- Long-Term Care Insurance: This specialized insurance covers the costs associated with long-term care, such as assisted living facilities and nursing home care. It ensures individuals can receive the care they need without burdening their families financially.

- Disability Insurance: In the event of a disability that prevents an individual from working, Continental Life Insurance's disability insurance provides a monthly income to cover living expenses, helping policyholders maintain their standard of living.

The company's products are tailored to meet the unique needs of each policyholder, offering customizable options to ensure the best fit. Whether it's protecting a family's future, securing retirement income, or covering healthcare expenses, Continental Life Insurance has a solution.

Industry Recognition and Awards

Continental Life Insurance’s commitment to excellence has been recognized by various industry bodies and organizations. The company has received numerous accolades and awards over the years, solidifying its position as a leader in the insurance sector.

Some of the notable awards include:

- The Gold Standard Award for Excellence in Customer Service, presented by the International Insurance Association.

- The Innovation in Insurance Award for developing cutting-edge insurance products, awarded by the Insurance Industry Innovation Council.

- The Best Health Insurance Provider award, recognizing the company's comprehensive and affordable health insurance plans.

- The Industry Leader Award, honoring Continental Life Insurance's significant contributions to the insurance industry and its positive impact on policyholders.

These awards are a testament to the company's dedication to providing top-notch insurance solutions and exceptional customer service. Continental Life Insurance continues to set the bar high, inspiring confidence in its policyholders and industry peers alike.

Technological Innovations and Digital Presence

In an era where digital transformation is paramount, Continental Life Insurance has embraced technology to enhance its services and improve the customer experience. The company has invested significantly in developing a robust digital platform, making insurance more accessible and convenient for its clients.

Here's a glimpse of their technological advancements:

- Online Policy Management: Policyholders can now manage their insurance policies online, from anywhere in the world. The user-friendly portal allows them to view policy details, make payments, and even update personal information.

- Mobile Apps: Continental Life Insurance has launched mobile applications for both iOS and Android devices. These apps provide real-time policy updates, claim status tracking, and easy access to important documents, ensuring policyholders stay connected.

- AI-Powered Chatbots: The company has integrated artificial intelligence into its customer service, deploying chatbots that provide instant support and assistance. These chatbots can answer common queries, guide users through the insurance process, and offer personalized recommendations.

- Blockchain Integration: Continental Life Insurance is exploring blockchain technology to enhance data security and streamline insurance processes. This innovative approach ensures data integrity and improves efficiency in claims processing.

By leveraging technology, Continental Life Insurance has created a seamless and efficient customer journey, making insurance more accessible and user-friendly. The company's digital initiatives have not only improved customer satisfaction but have also positioned it as a forward-thinking leader in the industry.

Community Engagement and Social Responsibility

Beyond its insurance offerings, Continental Life Insurance is deeply committed to giving back to the communities it serves. The company believes in making a positive impact beyond its core business, and this commitment is reflected in its various social responsibility initiatives.

Some of the notable community engagement programs include:

- Education Scholarships: Continental Life Insurance supports education by offering scholarships to deserving students. These scholarships aim to empower young minds and provide them with the means to pursue their academic goals.

- Environmental Initiatives: The company recognizes the importance of environmental sustainability and has launched several eco-friendly initiatives. From promoting renewable energy to supporting conservation projects, Continental Life Insurance strives to minimize its environmental footprint.

- Volunteer Programs: Employees of Continental Life Insurance actively participate in volunteer programs, contributing their time and skills to various community projects. These initiatives range from building homes for the less fortunate to organizing charity events, fostering a culture of giving back.

- Disaster Relief Efforts: In times of natural disasters, Continental Life Insurance steps up to provide support. The company has a dedicated disaster relief fund, offering financial assistance and resources to affected communities, helping them rebuild and recover.

Through these initiatives, Continental Life Insurance demonstrates its commitment to making a lasting positive impact on society. The company's social responsibility efforts not only strengthen its bond with the community but also inspire its policyholders and employees alike.

Looking Ahead: Future Prospects and Industry Trends

As the insurance industry continues to evolve, Continental Life Insurance remains at the forefront, adapting to changing market dynamics and customer needs. The company is committed to staying ahead of the curve, leveraging technology and innovation to enhance its services and remain a trusted partner for its policyholders.

Some of the key trends and future prospects for Continental Life Insurance include:

- Personalized Insurance: The company is exploring ways to offer even more personalized insurance solutions. By leveraging advanced analytics and data-driven insights, Continental Life Insurance aims to create tailored policies that meet the unique needs of each individual or business.

- Wellness Programs: With a focus on preventative care, Continental Life Insurance is investing in wellness programs that encourage healthy lifestyles. These programs aim to reduce healthcare costs and improve the overall well-being of policyholders, fostering a culture of health and wellness.

- Digital Transformation: The company will continue to invest in its digital infrastructure, enhancing its online and mobile platforms. By doing so, Continental Life Insurance aims to provide an even more seamless and user-friendly experience, making insurance accessible to a broader audience.

- Sustainable Practices: As environmental concerns become more prominent, Continental Life Insurance is committed to adopting sustainable practices. From reducing paper waste to promoting eco-friendly initiatives, the company aims to minimize its environmental impact and contribute to a greener future.

With its rich history, comprehensive product portfolio, and commitment to innovation and social responsibility, Continental Life Insurance is well-positioned to thrive in the dynamic insurance landscape. The company's focus on customer satisfaction, technological advancements, and positive community impact ensures it remains a trusted partner for individuals and businesses seeking financial protection and peace of mind.

What sets Continental Life Insurance apart from other insurance providers?

+Continental Life Insurance distinguishes itself through its comprehensive product portfolio, exceptional customer service, and commitment to innovation. The company’s diverse range of insurance solutions, coupled with its focus on technological advancements and social responsibility, sets it apart as a trusted and forward-thinking provider.

How does Continental Life Insurance ensure data security for its policyholders?

+Continental Life Insurance prioritizes data security by implementing robust cybersecurity measures and adopting emerging technologies like blockchain. These initiatives ensure the protection of sensitive information, giving policyholders peace of mind.

What community initiatives does Continental Life Insurance support?

+Continental Life Insurance actively supports various community initiatives, including education scholarships, environmental sustainability projects, volunteer programs, and disaster relief efforts. These initiatives reflect the company’s commitment to giving back and making a positive impact on society.