Quotes For Home Insurance

Finding the right home insurance is crucial to protect your biggest investment and ensure peace of mind. With a myriad of options available, it's essential to compare quotes to make an informed decision. This article aims to guide you through the process, providing expert insights and a comprehensive analysis of the home insurance landscape. By the end, you'll be equipped with the knowledge to secure the best coverage for your home.

Understanding Home Insurance Quotes

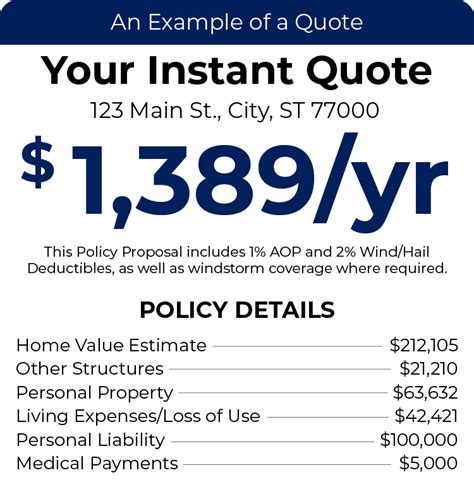

A home insurance quote is an estimate of the cost of insuring your home and its contents. It's a vital step in the insurance process, allowing you to compare providers, coverage options, and prices. Quotes are typically based on various factors, including the location, size, and age of your home, as well as any additional coverage needs you may have.

When seeking quotes, it's important to provide accurate and detailed information about your home. This ensures that the quote accurately reflects your needs and circumstances. Here are some key considerations when obtaining home insurance quotes:

- Location: Your home's location plays a significant role in determining the quote. Areas prone to natural disasters or with higher crime rates may result in higher premiums.

- Construction Type: The type of construction and materials used in your home can affect the quote. For instance, brick homes may be considered more durable and less prone to damage, leading to lower premiums.

- Coverage Amount: Determine the coverage amount you require. This should consider the replacement cost of your home and its contents, ensuring you're adequately insured.

- Deductibles: Higher deductibles can lower your premium, but it's essential to choose an amount you're comfortable paying out of pocket in the event of a claim.

- Additional Coverage: Consider any additional coverage you may need, such as flood, earthquake, or personal liability insurance. These can be added to your policy to enhance protection.

The Benefits of Comparing Quotes

Comparing multiple home insurance quotes offers several advantages. It allows you to:

- Identify the most competitive prices and coverage options.

- Negotiate better terms with your current insurer by providing competing quotes.

- Ensure you're not overpaying for coverage.

- Discover additional coverage options you may have overlooked.

By taking the time to compare quotes, you can make an informed decision and secure the best value for your home insurance needs.

Factors Influencing Home Insurance Quotes

Several factors influence the quotes you receive for home insurance. Understanding these factors can help you navigate the insurance landscape and make more informed choices. Here are some key considerations:

Location and Risk Factors

The location of your home is a significant factor in determining insurance quotes. Areas prone to natural disasters, such as hurricanes, floods, or wildfires, may result in higher premiums. Similarly, regions with higher crime rates or a history of severe weather events can impact your quote. Insurance companies assess these risks and adjust premiums accordingly.

Home Age and Condition

The age and condition of your home also play a role in insurance quotes. Older homes may require more maintenance and be at a higher risk of structural damage, leading to increased premiums. Additionally, homes in need of significant repairs or with outdated electrical or plumbing systems may be considered higher risk.

Claim History

Your personal claim history is a critical factor in determining insurance quotes. If you've made multiple claims in the past, it may reflect negatively on your record and result in higher premiums. Insurance companies use claim history to assess the risk of insuring you and set premiums accordingly.

| Factor | Impact on Premium |

|---|---|

| Location | High-risk areas lead to higher premiums |

| Home Age and Condition | Older or poorly maintained homes may result in increased premiums |

| Claim History | Multiple claims can lead to higher premiums |

Obtaining Accurate Quotes

To obtain accurate home insurance quotes, it's crucial to provide detailed and honest information about your home and circumstances. Here's a step-by-step guide to help you get started:

Step 1: Gather Essential Information

Before requesting quotes, gather the following information:

- Your home's address and location details.

- The year your home was built and its current condition.

- The replacement cost of your home and its contents.

- Any recent home improvements or renovations.

- Your personal claim history.

Step 2: Compare Multiple Quotes

Use online comparison tools or contact multiple insurance providers to obtain quotes. Compare the coverage options, premiums, and any additional benefits offered. Ensure you're comparing apples to apples by considering the same coverage limits and deductibles.

Step 3: Verify Coverage and Exclusions

Carefully review the policy details to understand the coverage and exclusions. Ensure the policy covers your specific needs, such as flood or earthquake insurance if required. Pay attention to any exclusions or limitations that may impact your coverage.

Step 4: Consider Additional Coverage

Evaluate your needs and consider any additional coverage options. For example, you may require personal liability insurance or coverage for high-value items. Discuss these options with your insurance provider to tailor your policy to your needs.

Step 5: Negotiate and Choose the Right Policy

If you're satisfied with a particular quote, negotiate the terms and premium with the insurance provider. Don't be afraid to ask for discounts or additional coverage. Once you've finalized the details, choose the policy that best suits your needs and budget.

Frequently Asked Questions

How often should I review my home insurance policy and quotes?

+It's recommended to review your home insurance policy and quotes annually. This allows you to stay up-to-date with any changes in your home's value, coverage needs, or market rates. Regular reviews ensure you maintain adequate coverage and aren't overpaying for insurance.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I provide inaccurate information when obtaining quotes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Providing inaccurate information when obtaining home insurance quotes can have serious consequences. If your claim is based on false or misleading information, the insurance company may deny your claim or even cancel your policy. It's crucial to be honest and transparent when seeking quotes to avoid issues in the future.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I bundle my home and auto insurance to save money?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Bundling your home and auto insurance policies with the same provider is a great way to save money. Many insurance companies offer discounts when you combine multiple policies. By doing so, you can often receive a significant discount on your premiums, making it a cost-effective option.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What additional coverage options should I consider for my home insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When considering additional coverage for your home insurance policy, it's important to assess your specific needs. Some common additional coverage options include flood insurance, earthquake insurance, personal liability insurance, and coverage for high-value items like jewelry or artwork. Discuss these options with your insurance provider to determine what's best for your situation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I reduce my home insurance premiums?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There are several ways to reduce your home insurance premiums. First, consider increasing your deductible. While this means you'll pay more out of pocket in the event of a claim, it can significantly lower your premiums. Additionally, maintaining a good credit score and installing security systems or fire protection devices can lead to discounts. Finally, regularly review and update your coverage to ensure you're not overinsured, as this can result in unnecessary expenses.</p>

</div>

</div>