Insurance Plan Comparison

Welcome to an in-depth exploration of the world of insurance plans, where we'll delve into the intricacies of various policies and compare them to help you make informed decisions. Insurance is an essential aspect of modern life, offering financial protection and peace of mind. With countless options available, it's crucial to understand the differences and choose the plan that best suits your needs.

Understanding the Basics of Insurance Plans

Insurance plans are contracts between individuals or entities and insurance companies, designed to provide financial coverage for specific risks and losses. These risks can range from health issues and accidents to property damage and liability claims. The type of insurance plan you choose depends on your unique circumstances and the level of protection you require.

Key Components of Insurance Policies

- Coverage: This refers to the specific risks or events the policy covers. For instance, a health insurance plan might cover medical expenses, prescription drugs, and hospital stays.

- Premiums: The amount you pay regularly (usually monthly or annually) to keep your insurance plan active. Premiums vary based on the type of insurance, coverage limits, and your personal factors.

- Deductibles and Co-payments: Deductibles are the amount you must pay out-of-pocket before the insurance coverage kicks in. Co-payments, on the other hand, are the fixed amounts you pay for certain services, like a doctor’s visit or prescription refill.

- Policy Limits: These are the maximum amounts the insurance company will pay for a covered loss. Understanding policy limits is crucial to ensure you have adequate coverage.

- Exclusions: Not all risks are covered by every insurance plan. Exclusions are specific events or circumstances that are not covered by the policy.

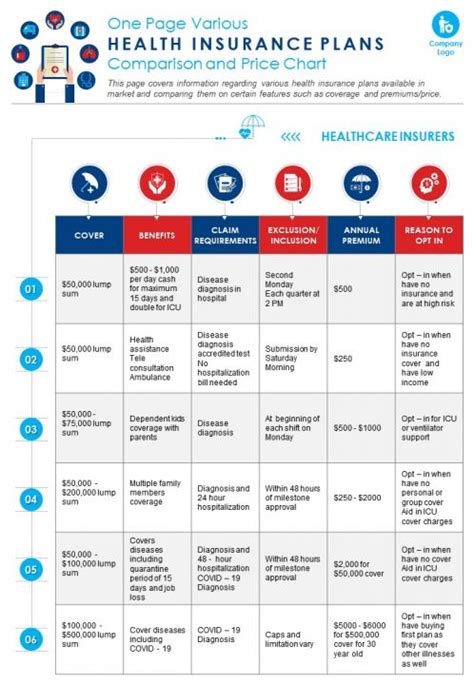

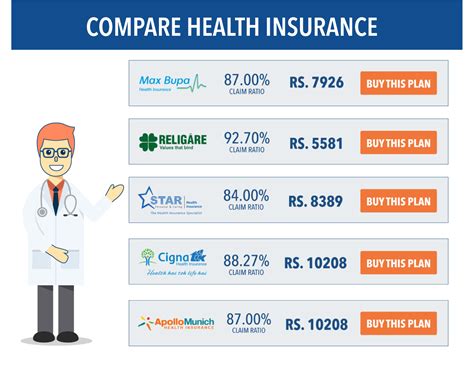

Comparing Health Insurance Plans

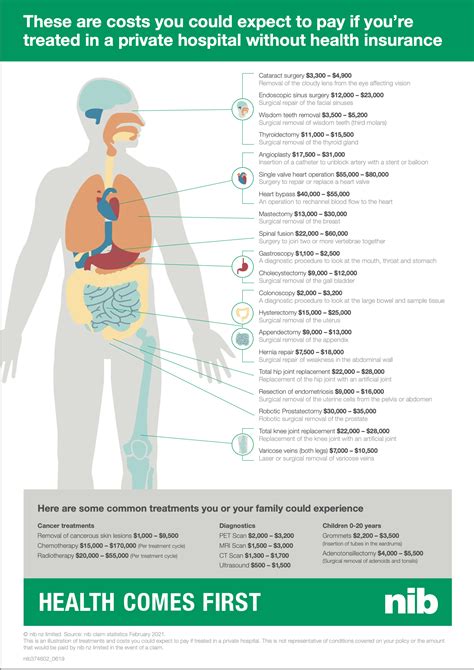

Health insurance is perhaps the most crucial type of insurance, ensuring you have access to medical care without incurring significant financial burdens. Let’s explore some key aspects of health insurance plans.

Types of Health Insurance

- Indemnity Plans: These traditional plans allow you to choose your own healthcare providers and cover a wide range of medical services. However, you may need to pay upfront and then submit claims for reimbursement.

- Managed Care Plans: Managed care plans, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), provide more structured care options. HMOs typically require you to choose a primary care physician and refer you to specialists within their network. PPOs offer more flexibility but may require higher out-of-pocket costs.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket expenses.

Comparative Analysis of Health Insurance Plans

| Plan Type | Premium | Deductible | Co-payment | Network Flexibility |

|---|---|---|---|---|

| Indemnity | Moderate | Varies | Usually applies | High |

| HMO | Low to Moderate | Lower | Often included | Limited to network providers |

| PPO | Moderate to High | Varies | May apply | Flexibility within network |

| HDHP | Low | High | Varies | Varies based on network |

Auto Insurance: Protecting Your Ride

Auto insurance is mandatory in most places and offers financial protection in case of accidents, theft, or other vehicle-related incidents. Let’s examine the key components of auto insurance.

Coverage Options in Auto Insurance

- Liability Coverage: This covers the costs if you’re found at fault in an accident, including bodily injury and property damage to others.

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Factors Affecting Auto Insurance Premiums

- Vehicle Type: Sports cars and luxury vehicles often have higher premiums due to their cost and higher risk of theft.

- Driver’s Age and Experience: Younger drivers, especially those under 25, often pay higher premiums due to their higher risk profile.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Location: Insurance rates can vary based on the state and even the city you live in.

Homeowner’s Insurance: Safeguarding Your Haven

Homeowner’s insurance is essential for protecting your home and its contents against various risks, including fire, theft, and natural disasters. It’s a critical investment for any homeowner.

What Does Homeowner’s Insurance Cover?

- Dwelling Coverage: Protects the structure of your home against damage from covered perils.

- Personal Property Coverage: Covers the cost of replacing or repairing your belongings if they’re damaged or stolen.

- Liability Coverage: Provides protection if someone is injured on your property or if you’re found liable for property damage.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered loss.

Comparing Homeowner’s Insurance Plans

| Plan Type | Dwelling Coverage | Personal Property Coverage | Liability Limits | Additional Living Expenses |

|---|---|---|---|---|

| Standard Plan | Up to 250,000</td> <td>50% of dwelling coverage</td> <td>100,000 | Additional 20% of dwelling coverage | ||

| Enhanced Plan | Up to 500,000</td> <td>70% of dwelling coverage</td> <td>300,000 | Additional 30% of dwelling coverage | ||

| Deluxe Plan | Up to 1,000,000</td> <td>100% of dwelling coverage</td> <td>500,000 | Unlimited |

Life Insurance: Securing Your Legacy

Life insurance is a vital aspect of financial planning, providing financial security for your loved ones in the event of your death. It’s a thoughtful way to ensure your family’s future is protected.

Types of Life Insurance

- Term Life Insurance: Offers coverage for a specific term, typically 10, 20, or 30 years. It’s affordable and suitable for those who need coverage for a specific period, like during their working years.

- Whole Life Insurance: Provides lifetime coverage and builds cash value over time. It’s more expensive but offers permanent protection and potential investment benefits.

- Universal Life Insurance: Offers flexibility in coverage and premium payments. You can adjust the coverage amount and premiums based on your needs and financial situation.

Factors Influencing Life Insurance Premiums

- Age: Premiums are generally lower when you’re younger.

- Health: Your health status plays a significant role. Those with health issues may pay higher premiums or may not be eligible for certain types of life insurance.

- Lifestyle: Factors like smoking, hazardous hobbies, or high-risk occupations can impact your premiums.

- Coverage Amount: The higher the coverage amount, the higher the premiums.

The Future of Insurance: Emerging Trends

The insurance industry is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of insurance.

Digital Transformation

Insurance companies are increasingly leveraging technology to enhance the customer experience. From online policy management to mobile apps for filing claims, digital tools are making insurance more accessible and convenient.

Personalized Insurance

With the advent of big data and analytics, insurance companies are moving towards personalized insurance plans. These plans are tailored to individual needs and behaviors, offering more precise coverage and potentially lower premiums.

Parametric Insurance

Parametric insurance is a new concept where payouts are based on predefined parameters rather than individual claims. For example, if you have parametric flood insurance and your area experiences a certain level of flooding, you receive a payout regardless of whether your home was directly affected.

How often should I review my insurance plans?

+It's a good practice to review your insurance plans annually or whenever there's a significant life event, such as marriage, buying a home, or starting a family. These events can impact your insurance needs, and you may require adjustments to your coverage.

What's the difference between an agent and a broker in insurance?

+An insurance agent typically represents a specific insurance company and can help you choose from the policies offered by that company. A broker, on the other hand, works with multiple insurance companies and can provide a wider range of options, often at competitive rates.

How can I save money on insurance premiums?

+There are several ways to save on insurance premiums. Bundle multiple policies with the same insurer, maintain a good credit score, and consider higher deductibles for health and auto insurance. Additionally, shopping around and comparing quotes can help you find the best rates.

In the world of insurance, knowledge is power. By understanding the different types of insurance plans and their key components, you can make informed decisions to protect what matters most. Remember, insurance is a tool to manage risk, and choosing the right plan can provide you with the financial security and peace of mind you deserve.