General Liabillity Insurance

In the complex landscape of risk management and financial security, General Liability Insurance stands as a cornerstone for businesses and professionals across various industries. This comprehensive policy is designed to safeguard entities from a wide range of potential liabilities, offering protection against unforeseen circumstances that could lead to costly legal battles and financial setbacks.

Understanding the nuances of General Liability Insurance is essential for anyone seeking to mitigate risks and secure the future of their ventures. From the fundamental principles that underpin this insurance type to the practical implications it holds for different businesses, delving into this topic provides a robust framework for informed decision-making.

Understanding General Liability Insurance

General Liability Insurance, often referred to as GL Insurance, is a broad commercial insurance policy that provides protection against a variety of liability claims, including bodily injury, property damage, personal and advertising injury, and medical payments. It is a cornerstone of risk management for businesses, helping to shield them from the financial repercussions of unexpected events.

The primary purpose of General Liability Insurance is to protect the insured party (typically a business or professional) from lawsuits and claims arising from everyday operations. This can include a wide range of incidents, from a customer slipping and falling on a wet floor to a product malfunction causing property damage. By providing coverage for these types of claims, GL Insurance acts as a safety net, helping businesses to navigate the complex and often costly world of legal disputes.

One of the key advantages of General Liability Insurance is its versatility. It covers a broad spectrum of potential risks, making it an essential component of a comprehensive risk management strategy. Whether it's a small local business or a large multinational corporation, GL Insurance offers a level of protection that is tailored to the specific needs and exposures of the insured party.

Key Components of General Liability Insurance

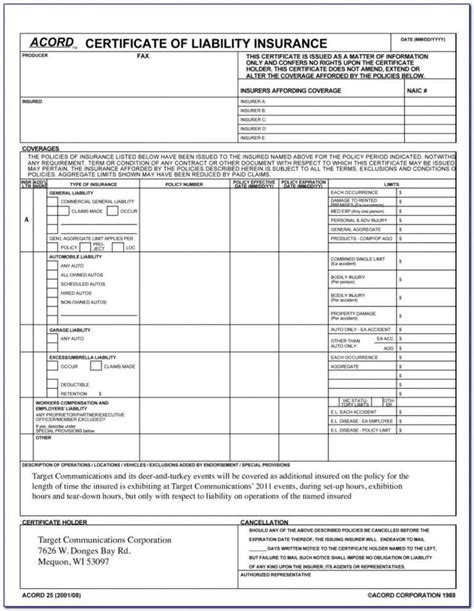

General Liability Insurance is typically composed of several key components, each addressing a different type of liability risk. These components include:

- Bodily Injury and Property Damage Liability: This covers claims arising from accidents or incidents that result in physical harm to individuals or damage to property. It includes both the cost of defending against such claims and any damages that may be awarded.

- Personal and Advertising Injury Liability: This provides coverage for claims of defamation, copyright infringement, false advertising, and other similar issues related to the insured's products, services, or advertising materials.

- Medical Payments: This component covers the cost of medical treatment for individuals injured on the insured's property, regardless of fault. It provides a quick response to medical expenses, helping to alleviate the financial burden on the injured party.

- Products and Completed Operations Liability: This coverage is particularly relevant for businesses that manufacture, sell, or install products. It protects against claims arising from defective products or workmanship, even after the product has been delivered or the work completed.

Each of these components plays a vital role in providing a robust layer of protection for businesses, ensuring that they are equipped to handle a wide range of liability risks.

The Importance of General Liability Insurance for Businesses

General Liability Insurance is of paramount importance for businesses, as it provides a critical layer of protection against the myriad of risks they face in their day-to-day operations. In an increasingly litigious world, businesses can find themselves vulnerable to a wide range of liability claims, from slip and fall accidents on their premises to allegations of defective products or services.

One of the key advantages of General Liability Insurance is its ability to provide financial security in the face of such claims. The cost of defending against a lawsuit or paying damages can be astronomical, often far exceeding the resources of even well-established businesses. GL Insurance steps in to cover these costs, helping to ensure that a single liability claim does not cripple the financial stability of the insured party.

Beyond the financial protection it offers, General Liability Insurance also plays a crucial role in maintaining the reputation and trustworthiness of a business. In an era where consumer awareness and advocacy are at an all-time high, a single liability claim, if not handled properly, can have devastating effects on a business's reputation. GL Insurance allows businesses to address such claims promptly and effectively, minimizing the potential damage to their brand and public image.

Industry-Specific Considerations

While General Liability Insurance provides a broad level of protection, the specific needs and exposures of different industries can vary significantly. For instance, a manufacturing business may face unique risks associated with their products, while a service-based business may have different liability concerns related to their operations.

Consider the case of a construction company. The nature of their work, which often involves heavy machinery, complex structures, and public spaces, exposes them to a wide range of potential liability risks. From a worker being injured on the job site to a passing pedestrian being hurt by falling debris, the potential for liability claims is high. General Liability Insurance helps to mitigate these risks, providing coverage for bodily injury, property damage, and other related claims.

In contrast, a software development firm may have different liability concerns. While they may not face the same physical risks as a construction company, they could be vulnerable to claims of copyright infringement, data breaches, or other technology-related issues. General Liability Insurance tailored to their industry can provide coverage for these types of claims, offering protection against the unique risks of the digital age.

Choosing the Right General Liability Insurance

Selecting the appropriate General Liability Insurance policy is a critical decision for any business. It involves a careful assessment of the unique risks and exposures associated with the business, as well as a thorough understanding of the coverage options and limitations offered by different insurance providers.

One of the key considerations when choosing GL Insurance is the policy limits. This refers to the maximum amount that the insurance company will pay for a covered claim. Policy limits can vary significantly between different providers and policies, and it's essential to choose limits that are adequate to cover the potential risks and liabilities of the business.

Another crucial factor is the policy exclusions. These are specific situations or claims that are not covered by the policy. Understanding the exclusions is vital to ensure that the business is not left vulnerable to unexpected gaps in coverage. It's essential to review the policy document carefully and discuss any concerns with an insurance professional to ensure a comprehensive understanding of the coverage provided.

Customizing Coverage for Your Business

While standard General Liability Insurance policies offer a broad level of protection, they may not be sufficient for businesses with unique or specialized risks. In such cases, it may be necessary to customize the coverage to ensure adequate protection.

For instance, a business that provides professional services, such as consulting or legal advice, may need to add Professional Liability Insurance (also known as Errors and Omissions Insurance) to their GL policy. This type of insurance provides coverage for claims arising from the provision of professional services, such as negligence, errors, or omissions in the advice or services provided.

Similarly, businesses that deal with sensitive customer data, such as healthcare providers or financial institutions, may need to consider adding Cyber Liability Insurance to their GL policy. This type of insurance provides coverage for claims arising from data breaches, cyber attacks, or other technology-related incidents that could result in financial loss or legal liability.

By customizing their General Liability Insurance coverage, businesses can ensure that they have the protection they need to address the unique risks associated with their industry, operations, and client base.

The Future of General Liability Insurance

As the business landscape continues to evolve, so too does the nature of risk and liability. This evolution is driving significant changes in the General Liability Insurance industry, with insurers increasingly focusing on providing tailored coverage solutions that meet the unique needs of different businesses.

One of the key trends in the future of General Liability Insurance is the rise of data-driven risk assessment. Insurers are leveraging advanced analytics and artificial intelligence to better understand the specific risks faced by different industries and businesses. This data-driven approach allows for more accurate risk assessment, enabling insurers to offer more precise and tailored coverage solutions.

Additionally, the increasing complexity of business operations, particularly in the digital age, is driving the need for more comprehensive and integrated insurance solutions. Businesses are no longer just concerned with traditional liability risks; they are also navigating the challenges of cyber security, data privacy, and emerging technologies. As a result, General Liability Insurance is evolving to provide more holistic coverage that addresses these modern risks.

Emerging Trends in General Liability Insurance

Here are some of the emerging trends that are shaping the future of General Liability Insurance:

- Cyber Liability Coverage: With the increasing reliance on technology and the growing threat of cyber attacks, many General Liability Insurance policies are now including cyber liability coverage as a standard or optional add-on. This coverage provides protection against data breaches, hacking, and other cyber incidents that could result in financial loss or legal liability.

- Product Recall Insurance: For businesses that manufacture or distribute products, the risk of a product recall due to defects or safety concerns is a significant liability. Product Recall Insurance provides coverage for the costs associated with recalling a product, including the cost of replacement or repair, public relations, and legal expenses.

- Environmental Liability Insurance: As environmental concerns continue to rise, businesses are increasingly facing liability risks related to environmental damage. Environmental Liability Insurance provides coverage for claims arising from pollution, contamination, or other environmental incidents that may occur on the insured's property or as a result of their operations.

These emerging trends highlight the evolving nature of General Liability Insurance and the increasing importance of staying informed about the latest developments in risk management.

Frequently Asked Questions

What is the difference between General Liability Insurance and Professional Liability Insurance?

+

General Liability Insurance provides broad coverage for a range of liability risks, including bodily injury, property damage, and personal and advertising injury. It is suitable for a wide variety of businesses. Professional Liability Insurance, on the other hand, is specifically designed for professionals and businesses that provide professional services. It covers claims arising from negligence, errors, or omissions in the services provided. While General Liability Insurance is a must-have for most businesses, Professional Liability Insurance is often an essential addition for professionals in fields like consulting, legal, or medical services.

How much does General Liability Insurance cost?

+

The cost of General Liability Insurance can vary significantly depending on several factors, including the type of business, the industry, the location, and the coverage limits. Typically, smaller businesses with lower revenue and fewer employees tend to have lower premiums, while larger businesses with more complex operations and higher revenue may pay more. It’s essential to shop around and get quotes from multiple insurance providers to find the best coverage at the most competitive price.

Can General Liability Insurance be customized for my business needs?

+

Yes, General Liability Insurance can often be customized to meet the unique needs of a business. Many insurance providers offer endorsements or additional coverages that can be added to the standard policy. These endorsements can provide coverage for specific risks or situations that are not typically covered under a standard GL policy. For example, a business that deals with customer data may add a Cyber Liability endorsement to their GL policy to protect against data breaches. It’s important to discuss your specific needs with an insurance professional to ensure you have the right coverage.

What are some common exclusions in General Liability Insurance policies?

+

General Liability Insurance policies typically exclude certain types of claims or situations. Common exclusions may include: intentional acts (e.g., intentional bodily injury or property damage), contract disputes, employee-related claims (e.g., wrongful termination or discrimination), pollution or environmental damage (unless specific environmental liability coverage is added), and professional services-related claims (which may require a separate Professional Liability policy). It’s crucial to carefully review the policy exclusions to ensure you understand the limitations of your coverage.

How can I choose the right policy limits for my General Liability Insurance?

+

Choosing the right policy limits for your General Liability Insurance is a critical decision. The limits you choose should be based on a careful assessment of your business’s potential risks and liabilities. Consider the maximum amount of financial loss your business could sustain in the event of a liability claim. Also, take into account any contractual requirements or industry standards for policy limits. It’s often recommended to consult with an insurance professional who can help you determine appropriate limits based on your specific business needs.