What Does Life Insurance Cover

Life insurance is an essential financial tool that provides a safety net for individuals and their loved ones. It offers protection and peace of mind by ensuring financial stability in the event of an unexpected demise. In this comprehensive guide, we will delve into the world of life insurance, exploring what it covers, how it works, and why it is crucial for your financial well-being.

Understanding Life Insurance Coverage

Life insurance policies are designed to offer a range of benefits and protections tailored to meet the specific needs of policyholders. While the exact coverage can vary depending on the type of policy and the provider, here are some common aspects that life insurance typically covers:

Death Benefits

The primary and most well-known coverage provided by life insurance is the death benefit. When the insured individual passes away, the life insurance policy pays out a predetermined sum, known as the death benefit, to the designated beneficiaries. This financial payout can help cover various expenses, including funeral costs, outstanding debts, and provide ongoing financial support for the family.

| Coverage Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specific term, typically 10, 20, or 30 years. It provides a death benefit only if the insured passes away during the term. |

| Whole Life Insurance | Provides lifetime coverage and accumulates cash value over time. It offers a death benefit and additional savings benefits. |

| Universal Life Insurance | Flexible policy with adjustable premiums and coverage amounts. It combines death benefit coverage with a cash value component. |

Financial Security for Beneficiaries

One of the key advantages of life insurance is the financial security it provides to beneficiaries. The death benefit can be used to ensure the surviving family members have the necessary funds to maintain their standard of living, pay off mortgages or loans, and cover everyday expenses. This financial cushion can be especially crucial during times of grief and adjustment.

Covering Outstanding Debts

Life insurance can also be a valuable tool for managing outstanding debts. The death benefit can be used to pay off credit card balances, personal loans, or even a portion of the mortgage, ensuring that the family is not burdened with excessive debt after the insured’s passing.

Protection for Business Owners

Life insurance plays a critical role in protecting business owners and their ventures. In the event of the owner’s demise, the death benefit can provide liquidity to the business, allowing it to continue operations, pay off debts, or even facilitate a smooth transition of ownership. This ensures the business’s longevity and financial stability.

Additional Benefits and Riders

Beyond the standard death benefit, many life insurance policies offer additional benefits and optional riders. These can include accelerated death benefits, which allow for early access to a portion of the death benefit in case of terminal illness, and waiver of premium riders, which waive premium payments if the insured becomes disabled.

How Life Insurance Works

The process of obtaining life insurance involves several key steps. First, individuals apply for coverage by providing personal and health-related information. The insurance company assesses the applicant’s risk profile and determines the premium, which is the cost of the policy. Premiums can be paid monthly, quarterly, or annually, and they are typically fixed for the duration of the policy.

Factors Influencing Premiums

The cost of life insurance premiums is influenced by various factors, including the applicant’s age, health status, lifestyle choices, and the type and amount of coverage desired. Generally, younger and healthier individuals can expect lower premiums, as they pose a lower risk to the insurer.

Claim Process

In the event of a claim, the beneficiaries must submit the necessary documentation, such as a death certificate and proof of their relationship to the insured. The insurance company then processes the claim and pays out the death benefit to the designated beneficiaries, typically within a few weeks of receiving the required paperwork.

Choosing the Right Life Insurance

Selecting the appropriate life insurance policy is a crucial decision that requires careful consideration. Here are some factors to keep in mind when choosing a life insurance plan:

- Your Age and Health: Younger individuals may opt for term life insurance, while those with long-term financial goals might consider whole life insurance.

- Financial Needs: Assess your family's financial needs and choose a policy that provides sufficient coverage to meet those needs.

- Budget: Evaluate your budget and choose a policy with premiums that align with your financial capabilities.

- Policy Duration: Consider the length of coverage you require and select a policy that aligns with your long-term goals.

- Rider Options: Evaluate the available riders and choose those that enhance the policy's benefits and meet your specific needs.

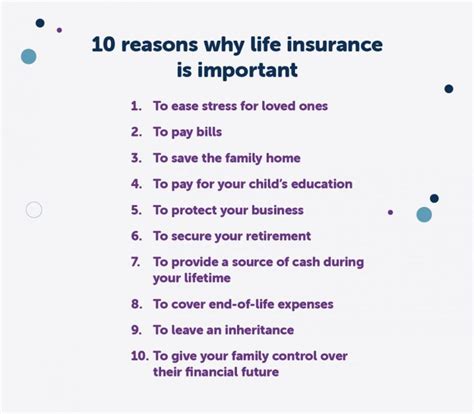

The Importance of Life Insurance

Life insurance is a critical component of any financial plan. It provides a safety net for your loved ones, ensuring they are financially secure in the event of your demise. By offering a death benefit, life insurance can help cover immediate expenses, pay off debts, and provide long-term financial stability. It is an essential tool for protecting your family’s future and ensuring their well-being.

Peace of Mind

One of the most significant benefits of life insurance is the peace of mind it brings. Knowing that your family is financially protected allows you to focus on living life to the fullest without worrying about their financial security in the face of uncertainty.

Estate Planning

Life insurance can also be a valuable asset in estate planning. The death benefit can be used to pay estate taxes, ensuring that your assets are distributed according to your wishes without incurring excessive tax burdens.

Frequently Asked Questions

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specified term, offering a death benefit only if the insured passes away during that term. It is generally more affordable but does not accumulate cash value. Whole life insurance, on the other hand, provides lifetime coverage and builds cash value over time. It offers both a death benefit and savings benefits.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your personal circumstances and financial goals. Factors to consider include your income, outstanding debts, mortgage, and the financial needs of your dependents. It’s recommended to consult with a financial advisor to determine the appropriate coverage amount.

Can I change my life insurance policy later on?

+Yes, you can often make changes to your life insurance policy, such as increasing or decreasing coverage, adding or removing beneficiaries, or adjusting premium payments. However, any changes may be subject to underwriting and could impact your premiums.

Are there any tax benefits associated with life insurance?

+Life insurance can offer certain tax advantages. The death benefit is generally tax-free, and the cash value of permanent life insurance policies can grow tax-deferred. Additionally, the premiums paid for life insurance may be tax-deductible in some cases, particularly for business owners.

Can I have multiple life insurance policies?

+Yes, it is possible to have multiple life insurance policies. Some individuals choose to have a combination of term and whole life insurance to meet their specific financial needs and goals. However, it’s important to carefully consider your budget and ensure you can afford the premiums for multiple policies.