Dental Insurance Comparison

Navigating the Complexities of Dental Insurance: A Comprehensive Guide

Dental insurance is a vital aspect of healthcare coverage, ensuring individuals can access essential dental care without incurring substantial financial burdens. With a myriad of options available, understanding the nuances of dental insurance plans is crucial for making informed decisions. This comprehensive guide aims to demystify the complexities, offering an in-depth analysis to assist you in selecting the most suitable plan for your needs.

In the following sections, we will delve into the specifics of various dental insurance plans, exploring their features, benefits, and potential drawbacks. By the end of this article, you should have a clear understanding of the landscape, enabling you to choose a plan that aligns with your oral health goals and financial capabilities.

Understanding the Basics of Dental Insurance

Dental insurance, akin to other forms of healthcare coverage, is designed to mitigate the financial impact of dental treatments and procedures. It operates on a similar premise, offering coverage for a range of services, from routine check-ups and cleanings to more complex procedures like root canals and implants.

However, the specifics of dental insurance plans can vary widely. Some plans focus primarily on preventive care, offering comprehensive coverage for regular check-ups and cleanings but limited coverage for more extensive treatments. Others may take a more comprehensive approach, providing coverage for a broader range of procedures but with higher premiums and potential out-of-pocket expenses.

Key Features of Dental Insurance Plans

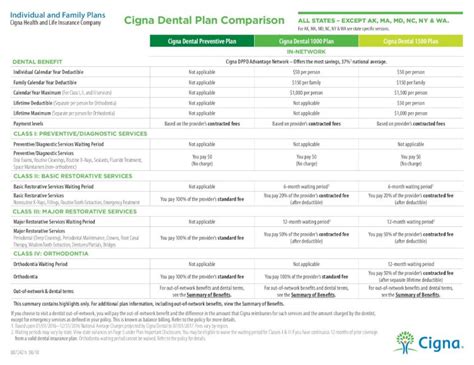

- Coverage Limits: Most dental insurance plans impose annual or lifetime coverage limits. These limits dictate the maximum amount the insurance provider will cover for dental services within a specified period. Exceeding these limits often requires individuals to pay out of pocket.

- Waiting Periods: Many plans implement waiting periods for certain procedures, particularly for more extensive treatments like implants or orthodontics. During these waiting periods, the insurance coverage may be limited or non-existent for these specific procedures.

- In-Network vs. Out-of-Network Providers: Dental insurance plans typically have networks of preferred providers. Visiting an in-network dentist often results in lower out-of-pocket costs, as the insurance company has negotiated discounted rates with these providers. Out-of-network care, on the other hand, may be more expensive and may not be fully covered by the insurance plan.

- Deductibles and Co-pays: Similar to other insurance types, dental plans may have deductibles and co-pays. A deductible is the amount you must pay out of pocket before the insurance coverage kicks in. Co-pays, on the other hand, are the fixed amounts you pay for covered services, typically after the deductible has been met.

Comparing Dental Insurance Plans

When comparing dental insurance plans, it's essential to consider your specific dental needs and financial situation. Here's a breakdown of some of the key factors to consider:

Cost

Premiums: The cost of dental insurance plans varies significantly. Factors like age, location, and the scope of coverage can influence the premium amounts. It's essential to compare premiums across different plans to find the most affordable option that still meets your needs.

Out-of-Pocket Costs: In addition to premiums, consider the potential out-of-pocket costs associated with each plan. This includes deductibles, co-pays, and any expenses not covered by the insurance. Plans with lower premiums may have higher out-of-pocket costs, so it's crucial to evaluate the overall financial impact.

| Plan | Premium | Deductible | Co-pay |

|---|---|---|---|

| Plan A | $30/month | $50 | 20% |

| Plan B | $45/month | $100 | 15% |

| Plan C | $55/month | $200 | 10% |

Coverage

Scope of Coverage: Different plans offer varying levels of coverage. Some may focus primarily on preventive care, covering regular check-ups and cleanings but providing limited or no coverage for more extensive treatments. Others may offer comprehensive coverage, including a wider range of procedures but with potentially higher costs.

Pre-existing Conditions: It's crucial to understand how each plan handles pre-existing dental conditions. Some plans may exclude coverage for certain pre-existing issues, while others may offer coverage after a waiting period.

Network of Providers

In-Network Advantages: Opting for an in-network dentist can result in significant cost savings. Insurance companies negotiate discounted rates with in-network providers, passing these savings on to policyholders. It's essential to check if your preferred dentist is in-network before committing to a plan.

Out-of-Network Options: If you have a preferred dentist who is not in-network, consider the out-of-network benefits of each plan. Some plans may cover out-of-network care at a reduced rate, while others may offer limited or no coverage.

Real-World Examples and Case Studies

To illustrate the practical implications of dental insurance plans, let's examine a few case studies:

Case Study 1: John's Experience with Plan A

John, a 35-year-old with a history of good oral health, opted for Plan A due to its low premium. He visited his in-network dentist for a routine check-up and cleaning, which were fully covered by the plan. However, during the check-up, the dentist identified a potential issue with one of John's molars, recommending a root canal. John was surprised to learn that Plan A had a $500 annual limit for major restorative procedures, which would not cover the entire cost of the root canal.

Case Study 2: Sarah's Choice of Plan B

Sarah, a 40-year-old with a family history of gum disease, chose Plan B for its comprehensive coverage. She had recently moved to a new city and was pleased to find that her preferred dentist was in-network. Sarah's insurance covered the cost of her initial check-up and cleaning, and when she was diagnosed with early-stage gum disease, the plan covered the necessary deep cleaning treatment.

Case Study 3: Michael's Struggle with Plan C

Michael, a 28-year-old with a history of dental anxiety, selected Plan C for its promise of covering a wide range of procedures. However, he soon discovered that the plan had a lengthy waiting period for orthodontic treatment, which he desperately needed. Michael had to wait an additional six months before his insurance coverage for braces kicked in, adding to his dental anxiety and discomfort.

Expert Insights and Recommendations

Navigating the world of dental insurance can be challenging, but with the right guidance, you can make an informed decision. Here are some expert tips to consider:

- Assess Your Dental Needs: Before selecting a plan, evaluate your current and potential future dental needs. Consider your oral health history, any ongoing treatments, and any procedures you may require in the near future.

- Research Provider Networks: Ensure that your preferred dentists and specialists are in-network for the plans you're considering. This can significantly impact your out-of-pocket costs and overall satisfaction with your insurance coverage.

- Read the Fine Print: Carefully review the policy documents for each plan. Pay attention to coverage limits, waiting periods, and any exclusions or limitations. Understanding these details can help you avoid unpleasant surprises down the line.

- Compare Multiple Plans: Don't settle for the first plan that seems attractive. Compare at least three to five plans to ensure you're getting the best value for your money.

The Future of Dental Insurance

As the healthcare landscape continues to evolve, so too will the world of dental insurance. Here are some potential trends and developments to watch for:

- Telehealth Integration: With the rise of telehealth services, dental insurance plans may begin to offer virtual consultation options. This could make it more convenient for individuals to access dental advice and potentially reduce the need for in-person visits for certain issues.

- Focus on Preventive Care: There is a growing recognition of the importance of preventive care in maintaining oral health. Dental insurance plans may increasingly emphasize preventive services, offering more comprehensive coverage for check-ups, cleanings, and early intervention treatments.

- Technology Advancements: Advances in dental technology, such as digital dentistry and 3D printing, may influence the way dental insurance plans are structured. These technologies could potentially reduce the cost of certain procedures, leading to more affordable coverage options.

Conclusion

Dental insurance is a crucial component of overall healthcare coverage, offering peace of mind and financial protection when it comes to oral health. By understanding the intricacies of different plans and considering your unique needs, you can make an informed decision that ensures access to quality dental care without breaking the bank.

Remember, the right dental insurance plan can make a significant difference in your oral health journey. Take the time to research, compare, and seek expert advice to find the plan that best aligns with your needs and goals.

What is the average cost of dental insurance plans?

+The cost of dental insurance plans can vary widely, ranging from around 30 to 55 per month. Factors such as age, location, and the scope of coverage can influence the premium amounts.

Are there any government-funded dental insurance options available?

+Yes, some government-funded programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), offer dental coverage for eligible individuals and families. These programs typically provide comprehensive dental benefits for children and limited benefits for adults.

Can I use my dental insurance plan outside of my network?

+Most dental insurance plans provide coverage for out-of-network care, but at a reduced rate. It’s important to check the specific terms of your plan to understand the out-of-network benefits and potential costs.

How often should I visit the dentist with dental insurance coverage?

+With dental insurance coverage, it’s generally recommended to visit the dentist at least once every six months for a check-up and cleaning. This helps maintain good oral health and allows for early detection of any potential issues.