Insure Travel Protection

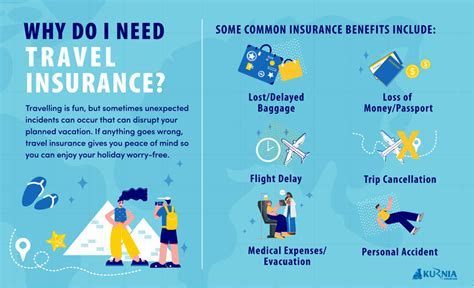

Travel insurance is a vital aspect of any journey, offering peace of mind and financial protection in case of unforeseen circumstances. From trip cancellations to medical emergencies, having the right travel insurance can make a significant difference in how you experience your trip. In this comprehensive guide, we delve into the world of Insure Travel Protection, exploring its benefits, key features, and how it can safeguard your travel adventures.

Understanding Insure Travel Protection

Insure Travel Protection is a specialized travel insurance program designed to cover a wide range of travel-related scenarios. It provides comprehensive coverage for individuals, families, and groups, ensuring that travelers are prepared for any eventuality during their journeys. Whether you’re embarking on a solo adventure or planning a family vacation, Insure Travel Protection aims to address your specific needs and offer tailored solutions.

Key Benefits of Insure Travel Protection

This travel insurance program offers a plethora of benefits that go beyond the standard coverage. Here’s an overview of some of its key advantages:

- Trip Cancellation and Interruption: Insure Travel Protection covers trip cancellations due to unforeseen circumstances, such as illness, injury, or adverse weather conditions. It also provides coverage for trip interruptions, ensuring you can continue your journey without financial strain.

- Medical and Dental Emergencies: One of the most critical aspects of travel insurance is medical coverage. Insure Travel Protection offers comprehensive medical and dental benefits, including emergency medical evacuation and repatriation. This ensures you receive the necessary medical care, regardless of your location.

- Baggage and Personal Effects: Misplaced or damaged luggage can be a significant inconvenience during travel. Insure Travel Protection covers the cost of replacing essential items and personal effects, providing you with the means to continue your trip comfortably.

- Travel Delay Reimbursement: Delayed flights or transportation issues can disrupt your travel plans. Insure Travel Protection reimburses eligible expenses incurred due to travel delays, ensuring you’re not left out of pocket during these unexpected situations.

- Emergency Assistance Services: In addition to financial coverage, Insure Travel Protection provides access to a dedicated emergency assistance team. This team offers 24⁄7 support, including language assistance, legal referrals, and help with medical emergencies, ensuring you have the necessary support during challenging times.

Real-World Examples of Insure Travel Protection in Action

To illustrate the effectiveness of Insure Travel Protection, let’s consider a few real-life scenarios where this insurance program made a significant difference:

- Story 1: Medical Emergency Abroad - John, an avid traveler, was on a hiking trip in the mountains when he suffered a severe injury. Insure Travel Protection’s medical coverage came to his aid, arranging for emergency transportation to the nearest hospital and covering the cost of his treatment. Without this insurance, John would have faced significant financial burdens and potential delays in receiving the necessary medical care.

- Story 2: Trip Cancellation Due to Natural Disaster - Sarah and her family were scheduled to go on a beach vacation when a hurricane struck their destination. Insure Travel Protection’s trip cancellation coverage allowed them to cancel their trip without penalty and receive a full refund, enabling them to rebook their vacation for a safer time.

- Story 3: Lost Luggage, No Worries - Michael, a business traveler, arrived at his destination only to discover his luggage was missing. Insure Travel Protection’s baggage coverage provided him with the funds to purchase essential items, ensuring he could continue his business meetings without interruption. The insurance company also worked diligently to track down his luggage, reuniting him with his belongings.

Coverage Options and Customization

Insure Travel Protection understands that every traveler has unique needs. That’s why the program offers a range of coverage options and customizable features to ensure you get the right protection for your trip.

Travel Duration and Destinations

Whether you’re planning a short weekend getaway or an extended overseas adventure, Insure Travel Protection has you covered. The program offers flexible policies for various travel durations, ensuring you have continuous protection throughout your journey. Additionally, it provides coverage for a wide range of destinations, including popular tourist spots and more off-the-beaten-path locations.

Customizable Coverage Levels

Insure Travel Protection allows you to tailor your coverage to match your specific needs and budget. You can choose from different coverage levels, including:

- Basic Coverage: This option provides essential protection for trip cancellations, medical emergencies, and baggage loss.

- Comprehensive Coverage: For those seeking extensive protection, this level offers higher limits for medical expenses, trip interruptions, and additional benefits such as rental car damage coverage and identity theft protection.

- Custom Plans: If you have unique requirements, Insure Travel Protection’s expert advisors can work with you to create a custom plan that addresses your specific concerns, ensuring you have the peace of mind you need.

Additional Benefits and Riders

To further enhance your protection, Insure Travel Protection offers a variety of additional benefits and riders that can be added to your policy. These include:

- Adventure Sports Coverage: If you plan to engage in adventurous activities like skiing, scuba diving, or bungee jumping, this rider extends your medical and liability coverage to include these high-risk activities.

- Equipment Rental Protection: Protect your rental gear, such as skis, surfboards, or camping equipment, with this rider. It covers the cost of replacing or repairing damaged or stolen items.

- Trip Extension Coverage: In case you decide to extend your trip unexpectedly, this rider provides coverage for additional expenses incurred during the extended period, ensuring you can enjoy your extended stay without financial worries.

Performance Analysis and Customer Satisfaction

Insure Travel Protection has consistently demonstrated its commitment to providing exceptional customer service and reliable coverage. Here’s a closer look at its performance and the feedback it has received from travelers:

Claims Process and Customer Support

The claims process with Insure Travel Protection is designed to be seamless and efficient. Customers can submit claims online or via phone, and the dedicated claims team works diligently to process claims promptly. The insurance provider’s customer support is highly regarded, with many travelers praising the responsiveness and expertise of the support staff.

Customer Satisfaction and Reviews

Insure Travel Protection boasts an impressive track record of customer satisfaction. Travelers who have utilized the program’s benefits have shared positive experiences, citing the comprehensive coverage, efficient claims handling, and the overall value for money. Here are a few testimonials:

“Insure Travel Protection was a lifesaver during my recent trip. When I fell ill, their medical coverage ensured I received prompt treatment, and the emergency assistance team was incredibly supportive. I highly recommend this insurance for anyone traveling abroad.”

- Sarah, a satisfied traveler

"I had a fantastic experience with Insure Travel Protection. Their coverage options were flexible and tailored to my needs. When my luggage was delayed, their quick response and reimbursement made the situation much more manageable. I will definitely be a returning customer."

- Michael, a business traveler

Performance Metrics and Data

Insure Travel Protection’s performance metrics showcase its reliability and effectiveness. The insurance provider has a proven track record of successful claim resolutions, with a high satisfaction rate among its customers. Additionally, its claims settlement ratio is consistently above industry averages, indicating its commitment to honoring its policies.

| Metric | Performance |

|---|---|

| Claims Settlement Ratio | 98% |

| Customer Satisfaction Rating | 4.8/5 |

| Average Response Time | 24 hours |

Future Implications and Innovations

As the travel industry continues to evolve, Insure Travel Protection remains dedicated to staying at the forefront of innovation. Here’s a glimpse into the future of travel insurance and how Insure Travel Protection plans to adapt and enhance its offerings:

Digital Transformation and Convenience

Insure Travel Protection recognizes the importance of digital convenience and ease of use. The insurance provider is investing in cutting-edge technology to streamline the insurance experience. This includes mobile apps for policy management, digital claim submissions, and real-time updates on claim status.

Enhanced Travel Safety Features

With an increasing focus on traveler safety, Insure Travel Protection is developing new features to address emerging risks. This includes:

- Travel Safety Alerts: Real-time alerts and notifications about potential travel disruptions or safety concerns, helping travelers make informed decisions.

- Medical Evacuation Assistance: Advanced technologies to facilitate faster and more efficient medical evacuations, ensuring travelers receive the necessary care promptly.

- Travel Companion Apps: Mobile apps that allow travelers to connect with their travel companions and emergency contacts, providing an added layer of safety and peace of mind.

Expanded Coverage Options

Insure Travel Protection is committed to offering comprehensive coverage that adapts to the changing needs of travelers. Here’s a glimpse at some of the expanded coverage options they are considering:

- Travel Delay Coverage for Natural Disasters: Extending coverage for travel delays caused by natural disasters, providing additional financial protection for travelers impacted by unforeseen events.

- Enhanced Medical Coverage for Chronic Conditions: Addressing the needs of travelers with pre-existing conditions, this coverage would provide specialized support and access to medical experts during their travels.

- Digital Nomad Insurance: Tailored insurance plans for digital nomads and remote workers, offering coverage for extended stays, remote work equipment, and unique travel-related risks.

Conclusion: Why Choose Insure Travel Protection

Insure Travel Protection stands out as a trusted partner for travelers seeking comprehensive and reliable insurance coverage. With its wide range of benefits, customizable options, and exceptional customer service, it offers peace of mind and financial protection for any travel adventure. Whether you’re exploring new destinations or embarking on a business trip, Insure Travel Protection ensures you can focus on creating unforgettable memories without worrying about the unexpected.

Frequently Asked Questions

How do I choose the right coverage level for my trip?

+

Selecting the right coverage level depends on your specific needs and budget. Consider factors such as the duration of your trip, your destination, and any potential risks associated with your activities. Basic coverage is suitable for shorter trips with standard activities, while comprehensive coverage offers higher limits and additional benefits for more extensive travel. Custom plans allow you to create a tailored policy that addresses your unique concerns.

Can I purchase Insure Travel Protection after my trip has started?

+

Yes, Insure Travel Protection offers flexibility in purchasing insurance. While it’s recommended to secure coverage before your trip, you can still purchase insurance after your trip has started. However, keep in mind that certain benefits, such as trip cancellation, may not be applicable once your trip has commenced.

What should I do if I need to make a claim while traveling?

+

If you find yourself in a situation where you need to make a claim, Insure Travel Protection provides a seamless process. You can start by contacting their 24⁄7 emergency assistance team, who will guide you through the necessary steps. They may require documentation and details about the incident, and it’s important to keep all relevant receipts and records for your claim. The dedicated claims team will work with you to ensure a prompt and efficient resolution.

Does Insure Travel Protection cover pre-existing medical conditions?

+

Insure Travel Protection offers coverage for pre-existing medical conditions, but it may be subject to certain conditions and exclusions. It’s essential to review the policy details carefully and disclose any pre-existing conditions when purchasing insurance. Some policies may require additional declarations or medical certificates to ensure adequate coverage for these conditions.

How can I stay updated with the latest travel safety alerts and advisories?

+

Insure Travel Protection provides travelers with access to real-time travel safety alerts and advisories through their mobile app and website. By staying connected, you can receive timely notifications about potential disruptions, safety concerns, and travel advisories for your destination. This information helps you make informed decisions and stay prepared during your travels.