Get A Quote For Car Insurance Online

Getting a quote for car insurance online has become an increasingly popular and convenient way for drivers to explore their insurance options. With just a few clicks, individuals can access multiple quotes from various insurance providers, compare rates, and make informed decisions about their coverage. This article will delve into the process of obtaining car insurance quotes online, highlighting the benefits, considerations, and steps involved in finding the best coverage for your vehicle.

The Benefits of Online Car Insurance Quotes

The online insurance quote process offers several advantages over traditional methods. Firstly, it provides drivers with a quick and efficient way to gather multiple quotes from different insurers. This allows for a comprehensive comparison of prices and coverage options, ensuring that individuals can make well-informed choices. Additionally, online quotes often provide instant feedback, eliminating the need for lengthy phone calls or in-person meetings. Drivers can obtain quotes at their convenience, whether during their lunch break or late at night.

Furthermore, online insurance platforms often offer a more personalized experience. Many websites allow users to input their specific preferences and requirements, tailoring the quotes to their unique needs. This level of customization ensures that drivers receive quotes that align with their desired coverage limits, deductibles, and additional features, such as roadside assistance or rental car reimbursement.

Efficiency and Convenience

The efficiency of online car insurance quotes cannot be overstated. Traditional methods often involve visiting multiple insurance agencies or making numerous phone calls, which can be time-consuming and cumbersome. In contrast, online platforms streamline the process, allowing drivers to compare quotes from the comfort of their homes or offices. This convenience is particularly beneficial for busy individuals or those with limited mobility.

Another significant advantage of online quotes is the ability to save and revisit quotes at any time. Unlike verbal quotes, which may be forgotten or misremembered, online quotes are stored and accessible, enabling drivers to carefully review and analyze the options before making a decision. This feature is especially helpful when comparing complex policies or when seeking input from other household members.

| Benefit | Description |

|---|---|

| Multiple Quotes | Online platforms provide access to quotes from various insurers, enabling comprehensive comparisons. |

| Instant Feedback | Drivers receive immediate feedback on their quotes, eliminating the wait for callbacks or appointments. |

| Personalization | Many online quote tools allow for customization based on individual preferences and coverage needs. |

| Efficiency | The process is quick and convenient, saving time and effort compared to traditional methods. |

| Accessibility | Online quotes can be accessed from anywhere with an internet connection, accommodating diverse lifestyles. |

Understanding the Online Quote Process

The process of obtaining an online car insurance quote typically involves a series of straightforward steps. Firstly, drivers need to identify reputable insurance providers or comparison websites. These platforms often have user-friendly interfaces, making it easy to navigate and input the necessary information.

During the quote process, drivers will be asked to provide details about themselves, their vehicle(s), and their driving history. This information is crucial for insurers to assess the level of risk and determine an accurate quote. Some common details required include the make and model of the vehicle, the primary driver's age and gender, driving record, and the desired coverage limits.

Personal Information and Vehicle Details

When filling out the online quote form, it’s important to provide accurate and detailed information. Insurers rely on this data to assess the level of risk associated with the driver and vehicle. Misrepresenting or omitting information can lead to inaccurate quotes and potential issues down the line.

For instance, failing to disclose a recent traffic violation or an accident on your record could result in an unfairly low quote. Additionally, providing the wrong vehicle information, such as the incorrect make or model, can impact the accuracy of the quote. It's always best to have your vehicle's registration and other relevant documents handy when obtaining quotes to ensure precision.

Furthermore, drivers should consider the additional coverage options available. Online quote platforms often present a range of add-ons, such as rental car reimbursement, roadside assistance, or gap insurance. While these features may come at an extra cost, they can provide valuable protection in specific situations. It's worth exploring these options and understanding their benefits to make an informed decision.

Comparing Quotes and Making a Decision

Once drivers have obtained multiple quotes from different insurers, it’s time to compare and evaluate the options. This step is crucial to finding the best value and coverage for your needs. Online comparison tools often present quotes in a side-by-side format, making it easier to see the differences in prices and coverage.

When comparing quotes, consider not only the price but also the reputation and financial stability of the insurance provider. Researching customer reviews and ratings can provide valuable insights into the quality of service and claim handling processes. It's also essential to review the fine print of each policy, ensuring that the coverage limits and deductibles align with your requirements.

Additionally, drivers should consider the overall customer experience and ease of doing business with each insurer. Factors such as online account management, mobile app accessibility, and the availability of 24/7 customer support can significantly impact the convenience and satisfaction of the insurance experience.

Key Considerations When Getting Online Quotes

While online car insurance quotes offer numerous benefits, there are a few considerations to keep in mind. Firstly, it’s important to be aware of potential hidden costs or fees associated with certain policies. Some insurers may charge additional fees for online transactions or have specific conditions that can impact the overall cost of the policy.

Secondly, drivers should be cautious of overly low quotes that may seem too good to be true. These quotes may be based on minimal coverage or have hidden exclusions that could leave drivers vulnerable in the event of a claim. It's always advisable to carefully review the policy details and compare them with other quotes to ensure a comprehensive understanding of the coverage provided.

Bundle Discounts and Multi-Policy Benefits

Many insurance providers offer bundle discounts when drivers purchase multiple policies, such as car insurance and home insurance, from the same company. These discounts can significantly reduce the overall cost of insurance and provide added convenience by managing all policies under one provider. When obtaining online quotes, it’s worth exploring the potential savings from bundling policies.

Additionally, some insurers provide multi-policy benefits beyond simple discounts. These benefits may include additional coverage options, such as enhanced rental car coverage or extended warranty protection. By bundling policies, drivers can access these exclusive benefits and potentially enhance their overall insurance coverage.

Understanding Deductibles and Coverage Limits

When comparing online quotes, it’s crucial to pay close attention to the deductibles and coverage limits. Deductibles are the amount you pay out of pocket before your insurance coverage kicks in, while coverage limits define the maximum amount the insurer will pay for a covered claim. These two factors significantly impact the overall cost and effectiveness of your insurance policy.

Lower deductibles generally result in higher premiums, as the insurer assumes more financial responsibility. On the other hand, higher deductibles can lead to lower premiums, making insurance more affordable. It's essential to find a balance that aligns with your financial comfort and risk tolerance. Consider your ability to pay a higher deductible in the event of an accident or claim, as this can significantly impact your out-of-pocket expenses.

Coverage limits, on the other hand, define the maximum amount your insurance provider will pay for a covered claim. It's crucial to ensure that your coverage limits are adequate to protect your assets and financial well-being. For instance, if you have a valuable vehicle or significant assets, you may want to consider higher coverage limits to ensure comprehensive protection.

Future Trends and Innovations in Online Car Insurance Quotes

The landscape of online car insurance quotes is constantly evolving, driven by technological advancements and changing consumer preferences. Insurers are increasingly leveraging data analytics and artificial intelligence to enhance the quote process, offering more accurate and personalized quotes.

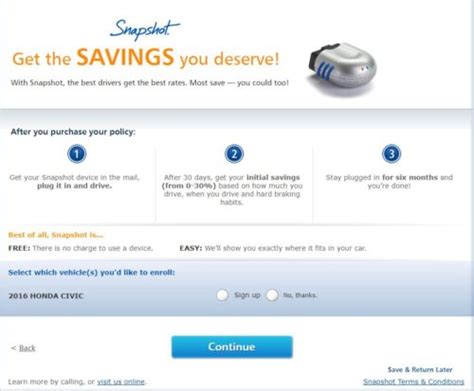

One emerging trend is the use of telematics, which involves installing a small device in the vehicle to track driving behavior. This technology provides insurers with real-time data on driving habits, allowing for more precise risk assessments and potentially lower premiums for safe drivers. While telematics is still in its early stages, it holds promise for revolutionizing the way insurance quotes are calculated and personalized.

The Rise of Insurtech and Digital Innovation

The insurance industry is experiencing a wave of digital transformation, with the emergence of insurtech companies and innovative digital solutions. These startups and established insurers are leveraging technology to enhance the customer experience, streamline processes, and offer more personalized insurance products.

Insurtech companies often focus on developing user-friendly platforms and apps, providing seamless online quote experiences and efficient claim management. They leverage data analytics and machine learning to offer more accurate and customized quotes, catering to the unique needs of individual drivers. Additionally, these companies often prioritize customer satisfaction and offer innovative features, such as real-time claim tracking and digital policy management.

Impact of Telematics and Data Analytics

Telematics and data analytics are transforming the way insurers assess risk and calculate quotes. By analyzing vast amounts of data, insurers can gain deeper insights into driving behavior, vehicle usage, and potential risks. This data-driven approach allows for more precise pricing and the development of innovative insurance products.

For instance, insurers can use telematics data to identify safe drivers who consistently follow traffic laws and maintain a low risk profile. These drivers may be rewarded with lower premiums or access to exclusive insurance programs. Additionally, data analytics can help insurers identify trends and patterns, enabling them to offer specialized coverage for specific demographics or driving behaviors.

The Role of Artificial Intelligence in Personalized Quotes

Artificial intelligence (AI) is playing an increasingly significant role in the online car insurance quote process. AI algorithms can analyze vast amounts of data, including driving behavior, weather conditions, and even social media activity, to provide highly personalized quotes. These algorithms can identify correlations and patterns that human analysts may miss, leading to more accurate and tailored insurance offerings.

AI-powered platforms can also offer real-time quotes, instantly adapting to changes in driving behavior or external factors. This dynamic pricing model ensures that drivers always have access to the most up-to-date and accurate quotes, allowing them to make informed decisions about their insurance coverage.

Conclusion: Empowering Drivers with Knowledge

Obtaining car insurance quotes online has revolutionized the way drivers explore their insurance options. The efficiency, convenience, and personalization of online quotes have empowered individuals to take control of their insurance decisions. By understanding the benefits, considerations, and steps involved in the online quote process, drivers can confidently navigate the insurance landscape and find the best coverage for their needs.

As the insurance industry continues to embrace digital innovation and data-driven approaches, the future of online car insurance quotes looks promising. With the rise of insurtech, telematics, and artificial intelligence, drivers can expect even more personalized and accurate quotes, tailored to their unique driving behaviors and preferences. Ultimately, the evolution of online insurance quotes is a testament to the power of technology in enhancing consumer experiences and empowering individuals to make informed choices about their financial protection.

How long does it typically take to receive an online car insurance quote?

+The time it takes to receive an online car insurance quote can vary depending on several factors. Generally, reputable insurance providers aim to provide instant feedback, and you can expect to receive a quote within a few minutes of completing the online form. However, more complex policies or situations may require additional time for the insurer to assess the risk and provide an accurate quote.

Can I save and revisit my online quotes later?

+Yes, many online insurance platforms allow you to save your quotes for future reference. This feature is particularly useful when you want to compare quotes over a longer period or discuss them with family members or financial advisors. Simply log back into your account or access the saved quote through the provided link or email.

What happens if I provide inaccurate information during the online quote process?

+It’s crucial to provide accurate and truthful information when obtaining an online car insurance quote. Misrepresenting or omitting important details can lead to an inaccurate quote and potential issues down the line. If you realize you’ve made a mistake, contact the insurance provider directly to update your information and obtain a revised quote.

Are there any additional fees associated with online car insurance quotes?

+Some insurance providers may charge additional fees for online transactions or have specific conditions that can impact the overall cost of the policy. It’s essential to carefully review the quote details and any associated fees before committing to a policy. Transparency in pricing is a key aspect of a reputable insurance provider.