How Do I Find Out What Health Insurance I Have

Understanding your health insurance coverage is crucial for ensuring access to necessary medical services and managing your healthcare costs effectively. In this comprehensive guide, we will explore the steps to uncover your health insurance details, whether you're navigating the complexities of private health insurance or delving into the specifics of government-provided coverage.

Unveiling Your Private Health Insurance Coverage

Private health insurance plans offer a range of options, and understanding your coverage is essential for making informed healthcare decisions. Here’s a step-by-step guide to help you discover the specifics of your private health insurance:

Step 1: Locate Your Insurance Card and Policy Documents

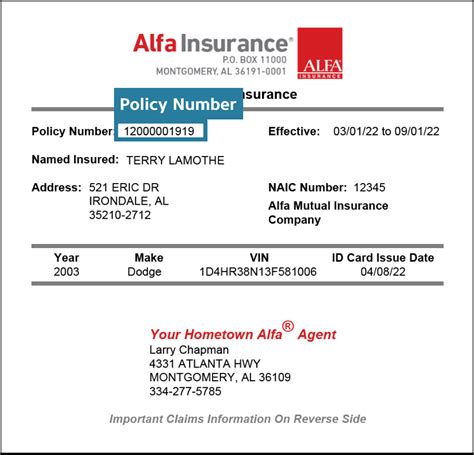

Start by gathering the essential documents related to your health insurance. These typically include your insurance card, which displays important information such as your policy number, member ID, and the name of your insurance provider. Additionally, search for any policy documents, brochures, or welcome kits you received when enrolling in the plan. These materials often contain detailed explanations of your coverage, including the types of services covered, deductibles, co-pays, and any exclusions.

Step 2: Contact Your Insurance Provider

If you’re unable to locate your insurance card or policy documents, the next step is to reach out to your insurance provider directly. Most insurance companies have dedicated customer service hotlines or online portals where you can access your account information. By contacting their support team, you can request a copy of your policy documents or obtain the necessary details over the phone. They can provide information on your plan type, coverage limits, and any recent changes to your policy.

Step 3: Utilize Online Member Portals

Many insurance companies offer online member portals or mobile apps that allow you to access your account information conveniently. These portals often provide a wealth of details about your coverage, including a summary of your plan, a list of covered services, and information on your current deductibles and out-of-pocket maximums. By logging into your account, you can review your benefits, check claims status, and even print temporary insurance cards if needed.

Step 4: Review Your Explanation of Benefits (EOB) Statements

Explanation of Benefits (EOB) statements are documents sent by your insurance company after they process a claim. These statements provide a detailed breakdown of the services rendered, the charges incurred, and the portion covered by your insurance. By reviewing your EOBs regularly, you can gain insights into your coverage, identify any discrepancies, and understand the costs associated with different procedures or treatments. EOBs can also help you track your progress towards meeting your deductible and out-of-pocket maximums.

Step 5: Consult Your Employer or Benefits Administrator

If your health insurance is provided through your employer, it’s essential to reach out to your company’s benefits administrator or human resources department. They can provide you with the necessary information about your specific plan, including any changes or updates to your coverage. They may also have access to online portals or tools that can help you navigate your benefits more effectively.

Exploring Government-Provided Health Insurance Coverage

Government-provided health insurance programs, such as Medicare and Medicaid, offer essential healthcare coverage to eligible individuals. Understanding your coverage under these programs is crucial for accessing the necessary medical services. Here’s how you can find out more about your government-provided health insurance:

Step 1: Check Your Eligibility and Enrollment Status

The first step is to determine your eligibility for government-provided health insurance programs. For Medicare, individuals typically become eligible at the age of 65 or if they have certain disabilities. Medicaid, on the other hand, has different eligibility criteria based on factors like income, family size, and other specific circumstances. Check the official websites of these programs or consult with your local social services agency to verify your eligibility and enrollment status.

Step 2: Review Your Medicare or Medicaid Card

Similar to private health insurance, government-provided health insurance programs issue cards that serve as proof of coverage. Your Medicare or Medicaid card contains important information, including your unique identification number, the program you’re enrolled in, and the specific plan or coverage type. By reviewing your card, you can gain insights into your coverage and any restrictions or limitations.

Step 3: Access Online Resources and Portals

Both Medicare and Medicaid offer online resources and member portals that provide valuable information about your coverage. These portals allow you to view your plan details, check the status of claims, and access educational materials and resources related to your healthcare. By logging into your account, you can explore your benefits, understand copayments and deductibles, and make informed decisions about your healthcare.

Step 4: Contact the Program’s Help Desk or Hotline

If you have specific questions or need further assistance, both Medicare and Medicaid provide dedicated help desks or hotlines. These support services are staffed by knowledgeable representatives who can answer your queries, provide clarification on coverage details, and guide you through any complexities related to your insurance.

Step 5: Consult with a Healthcare Provider or Social Worker

Healthcare professionals, such as doctors or social workers, can also be valuable resources for understanding your health insurance coverage. They often have experience working with different insurance plans and can provide insights into the specific benefits and limitations of your coverage. By consulting with them, you can gain a clearer understanding of what is covered and how to navigate any potential challenges.

| Private Health Insurance | Government-Provided Health Insurance |

|---|---|

| Policy Documents and Insurance Card | Medicare/Medicaid Card |

| Online Member Portals | Online Resources and Portals |

| Explanation of Benefits (EOB) Statements | Claim Status and Educational Materials |

How often should I review my health insurance coverage details?

+It’s a good practice to review your health insurance coverage details at least once a year, especially during open enrollment periods. This allows you to stay updated with any changes to your plan and ensure that your coverage aligns with your healthcare needs.

What if I find discrepancies in my coverage details?

+If you discover any discrepancies or inaccuracies in your coverage details, it’s important to contact your insurance provider immediately. They can help resolve any issues and provide you with the correct information.

Can I switch health insurance plans if I’m not satisfied with my current coverage?

+Yes, depending on your circumstances, you may have the option to switch health insurance plans during open enrollment periods or if you experience a qualifying life event. However, it’s important to carefully review the new plan’s coverage and compare it with your existing coverage to ensure a smooth transition.

Are there any resources available to help me understand my health insurance coverage better?

+Absolutely! Many insurance providers offer online resources, brochures, and educational materials specifically designed to help policyholders understand their coverage. Additionally, you can consult with healthcare professionals or seek assistance from consumer advocacy groups for further guidance.