Pet Insurance California

Pet insurance has become an increasingly popular topic of discussion among pet owners in California, as it offers a valuable safety net for unforeseen veterinary expenses. With the state's diverse pet population and the rising costs of veterinary care, understanding the benefits and intricacies of pet insurance is essential for responsible pet ownership. This comprehensive guide aims to delve into the world of pet insurance in California, providing an in-depth analysis of the coverage options, key providers, and the unique considerations for residents of the Golden State.

Understanding Pet Insurance in California

Pet insurance in California, as in many other states, operates on a reimbursement basis. Policyholders pay a monthly premium, and in return, the insurance provider covers a portion of the veterinary costs for illnesses, injuries, and sometimes even routine care. The specific coverage and reimbursement rates vary greatly depending on the chosen plan and the insurance company.

One of the key advantages of pet insurance is the peace of mind it offers. California is home to a wide array of pets, from dogs and cats to exotic species, and veterinary care can be costly, especially for emergency procedures or specialized treatments. Pet insurance helps mitigate the financial burden, ensuring that pet owners can focus on their pet's health rather than the associated expenses.

Key Coverage Types

There are several types of pet insurance coverage available in California, each with its own set of benefits and limitations. The most common coverage types include:

- Accident-Only Coverage: This is the most basic form of pet insurance, covering accidents such as car collisions, poisoning, or broken bones. It typically does not cover illnesses or routine care.

- Accident and Illness Coverage: A more comprehensive option, this coverage includes accidents as well as a wide range of illnesses, from chronic conditions like diabetes to sudden ailments like gastrointestinal issues.

- Wellness Plans: In addition to accident and illness coverage, some providers offer wellness plans that cover routine care, such as vaccinations, dental cleanings, and check-ups. These plans can be a cost-effective way to manage ongoing healthcare needs.

- Specific Condition Coverage: For pets with pre-existing conditions or those prone to certain ailments, some insurers offer coverage for specific conditions, such as hip dysplasia or heart disease. This can be a valuable option for managing long-term health issues.

It's important to note that coverage for pre-existing conditions is often excluded from standard pet insurance policies. However, some insurers in California offer unique plans or riders that can provide coverage for these conditions, though they may come with higher premiums or specific enrollment requirements.

Leading Pet Insurance Providers in California

California is served by a variety of reputable pet insurance providers, each with its own network of veterinary partners and unique coverage options. Here’s an overview of some of the leading insurers in the state:

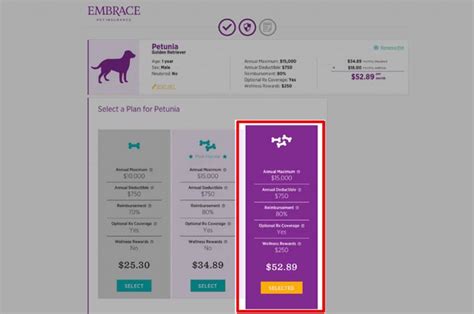

Embrace Pet Insurance

Embrace offers a comprehensive range of coverage options, including accident and illness plans, wellness plans, and even a unique “Healthy Pet Deductible” feature that rewards policyholders for their pet’s good health. They also provide a “Nosy Neighbor” feature, which covers costs associated with property damage caused by your pet.

Petplan

Petplan is known for its extensive coverage, including not just accidents and illnesses but also congenital conditions and hereditary disorders. They offer a “Customizable Coverage” option, allowing pet owners to tailor their plan to their specific needs. Petplan also provides a unique “Pet Parent Helpline” for round-the-clock veterinary advice.

Trupanion

Trupanion is a direct insurance provider, meaning they handle all aspects of the insurance process, from billing to claims. They offer unlimited payouts for the life of the policy, ensuring that pet owners never have to worry about reaching a coverage limit. Trupanion’s “Simple Deductible” feature allows for a straightforward reimbursement process.

Healthy Paws

Healthy Paws is another popular choice in California, known for its straightforward coverage and high reimbursement rates. They offer accident and illness coverage, and their plans include an annual deductible and a choice of reimbursement levels. Healthy Paws is particularly well-regarded for its customer service and easy claims process.

PetPartners

PetPartners provides a wide range of coverage options, including accident-only, accident and illness, and even cancer-specific plans. They also offer a unique “FlexCare” plan, which covers both routine care and accidents/illnesses. PetPartners is known for its customizable plans and competitive pricing.

| Insurance Provider | Coverage Highlights |

|---|---|

| Embrace | Healthy Pet Deductible, Nosy Neighbor feature |

| Petplan | Customizable Coverage, Pet Parent Helpline |

| Trupanion | Unlimited payouts, Simple Deductible |

| Healthy Paws | High reimbursement rates, easy claims process |

| PetPartners | FlexCare plan, cancer-specific coverage |

California-Specific Considerations

While pet insurance policies are generally consistent across the country, there are some California-specific factors that pet owners should be aware of when selecting a policy.

Wildlife Encounters

California is home to a diverse array of wildlife, from bears and mountain lions to rattlesnakes and scorpions. Encounters with these creatures can result in serious injuries to pets, and the treatment can be costly. Ensure your pet insurance policy covers such emergencies, as they may not be included in standard accident and illness plans.

Natural Disasters

California is prone to natural disasters like earthquakes, wildfires, and mudslides. These events can lead to injuries or illnesses in pets, and the treatment costs can be significant. Check that your chosen policy covers these types of incidents, as some providers may have specific exclusions or limits for such events.

Vet Availability and Specialization

California boasts a large number of veterinary professionals, including specialists in various fields. If your pet has specific health needs or requires specialized care, ensure your insurance provider has a network of these specialists or offers coverage for out-of-network care.

Pet Care Costs

The cost of veterinary care in California can vary significantly, with urban areas like Los Angeles and San Francisco often having higher costs compared to more rural regions. Ensure your insurance plan offers adequate coverage limits to match these potential expenses.

Choosing the Right Pet Insurance Plan

Selecting the right pet insurance plan in California involves a careful consideration of your pet’s specific needs, your budget, and the potential risks they may face. Here are some steps to guide your decision-making process:

- Assess Your Pet's Health History: If your pet has pre-existing conditions or is prone to certain ailments, ensure you understand how these are covered by different insurance plans. Some insurers may offer specialized plans for pets with specific health needs.

- Determine Your Budget: Pet insurance premiums can vary widely, so establish a budget that works for you. Keep in mind that higher premiums often mean more comprehensive coverage.

- Research Coverage Options: Explore the different types of coverage available, from accident-only to comprehensive plans. Consider the potential risks your pet may face and choose a plan that provides adequate protection.

- Read the Fine Print: Understand the exclusions and limitations of each plan. Pay close attention to any waiting periods, coverage limits, and reimbursement rates.

- Compare Providers: Research multiple insurers and compare their offerings, customer reviews, and financial stability. Look for providers with a strong track record of paying claims and providing excellent customer service.

- Consider Additional Benefits: Some insurers offer unique features like coverage for travel or boarding, or discounts on pet supplies. These benefits can add value to your policy.

The Future of Pet Insurance in California

The pet insurance market in California is evolving, with new providers entering the scene and existing insurers enhancing their offerings. Here’s a glimpse into the future of pet insurance in the state:

Expanded Coverage Options

As the demand for pet insurance grows, insurers are likely to expand their coverage options. This may include more comprehensive plans that cover a wider range of conditions, including mental health issues and age-related ailments.

Improved Technology Integration

Technology is set to play a larger role in pet insurance, with the potential for apps and digital tools to streamline the claims process, provide better customer service, and even offer real-time health monitoring for pets.

More Customizable Plans

Pet owners in California can expect to see more flexible and customizable plans in the future, allowing them to tailor coverage to their pet’s specific needs and budget constraints.

Increased Education and Awareness

With the rising costs of veterinary care, there’s a growing need for education and awareness about pet insurance. Insurers and veterinary professionals are likely to collaborate more closely to provide information and resources to pet owners, helping them make informed decisions about their pet’s healthcare.

Potential Regulatory Changes

As the pet insurance industry continues to grow, there may be regulatory changes to ensure fair practices and consumer protection. This could include clearer guidelines on policy terms and conditions, and potentially more standardized coverage options.

How do I choose the right pet insurance provider in California?

+When selecting a pet insurance provider in California, consider factors such as coverage options (including any specific needs your pet may have), the provider's reputation and financial stability, the ease of the claims process, and any unique features or benefits offered. Research multiple providers and compare their plans to find the best fit for your pet and your budget.

What should I look for in a pet insurance plan?

+When choosing a pet insurance plan, consider the scope of coverage (accident-only, illness, or both), the reimbursement rate, any deductibles or co-pays, coverage limits, and any waiting periods. Also, look for plans that cover pre-existing conditions or offer specific riders for these, as well as any additional benefits like wellness coverage or travel insurance.

Are there any California-specific regulations or requirements for pet insurance?

+Currently, there are no state-specific regulations for pet insurance in California. However, it's important to review the terms and conditions of your chosen policy to understand any state-specific exclusions or limitations. It's also advisable to ensure your pet's specific needs are covered, especially if they may be at risk for wildlife encounters or natural disasters common in California.

What is the average cost of pet insurance in California?

+The average cost of pet insurance in California can vary widely depending on factors such as the age and breed of your pet, the coverage level you choose, and any optional riders or add-ons. Premiums can range from around $20 to over $100 per month. It's important to shop around and compare plans to find the best coverage at a price that fits your budget.

Can I get pet insurance for an older pet in California?

+Yes, you can typically get pet insurance for older pets in California, although it may be more expensive and may have certain limitations or exclusions. Some insurers may have age restrictions or offer specific plans for senior pets. It's always a good idea to compare multiple providers to find the best coverage and rates for your older pet.

Pet insurance in California offers a valuable layer of protection for pet owners, ensuring they can provide the best possible care for their furry companions without financial strain. By understanding the different coverage options, key providers, and unique considerations for the state, pet owners can make informed decisions to safeguard their pets’ health and well-being.