How Much Homeowners Insurance Do I Need

Homeowners insurance is an essential financial protection for homeowners, providing coverage for a wide range of risks and damages that can occur to a property and its contents. It is crucial to have adequate coverage to ensure you are protected in the event of unforeseen circumstances. In this comprehensive guide, we will delve into the factors that influence the amount of homeowners insurance you need, explore the coverage options available, and provide you with the knowledge to make an informed decision about your insurance coverage.

Understanding Your Homeowners Insurance Needs

The amount of homeowners insurance you require depends on several key factors, including the value of your home, the cost of rebuilding or repairing it, and the specific coverage options you choose. Here’s a detailed breakdown of these considerations:

Assessing Your Home’s Value

The first step in determining your insurance needs is to accurately assess the value of your home. This includes not just the market value but also the replacement cost, which is the amount it would cost to rebuild your home from the ground up using similar materials and construction techniques. The replacement cost is typically higher than the market value and is a critical factor in determining your insurance coverage.

To estimate the replacement cost, you can use online calculators or consult with a professional appraiser. Factors that influence this cost include the size of your home, the materials used in its construction, and the cost of labor in your area. It's important to review and update this estimate periodically, especially after significant renovations or improvements.

Understanding Coverage Options

Homeowners insurance policies typically offer a range of coverage options, and it’s essential to understand each to tailor your policy to your specific needs. Here are some common coverage types and their implications:

- Dwelling Coverage: This is the core coverage of your policy, providing protection for the physical structure of your home. It covers damages caused by perils such as fire, windstorms, hail, and vandalism. It's important to ensure that your dwelling coverage matches the replacement cost of your home to avoid being underinsured.

- Personal Property Coverage: This coverage protects the contents of your home, including furniture, appliances, clothing, and personal belongings. It's typically covered up to a certain percentage of your dwelling coverage (e.g., 50%). However, high-value items like jewelry, artwork, or collectibles may require additional coverage through endorsements or separate policies.

- Liability Coverage: This coverage provides protection if you are held legally responsible for bodily injury or property damage to others. It covers legal fees and settlements, up to the policy limits. It's crucial to have adequate liability coverage to protect your assets in case of a lawsuit.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this coverage reimburses you for additional living expenses, such as hotel stays or temporary rental costs, until your home is repaired or rebuilt.

- Other Structures Coverage: This coverage extends to structures on your property that are separate from your home, such as a detached garage, shed, or guest house. It typically covers a percentage of your dwelling coverage (e.g., 10%).

- Medical Payments Coverage: This coverage provides payments for medical expenses incurred by visitors who are injured on your property, regardless of fault. It typically has a low limit (e.g., $1,000 to $5,000) and is designed to cover minor injuries without the need for a liability claim.

Considerations for Special Situations

Certain situations may require additional coverage or unique considerations. Here are some factors to keep in mind:

- If you have a home-based business, you may need additional coverage to protect your business assets and liability.

- If you own a high-value home or have valuable possessions, consider purchasing a homeowners insurance policy with higher limits or a personal articles policy to ensure full coverage.

- For older homes, it's essential to review the policy's coverage for outdated systems or appliances. Some policies may exclude coverage for older systems, so it's crucial to understand these limitations.

- If you live in an area prone to natural disasters like hurricanes, floods, or earthquakes, you may need to purchase separate policies or endorsements to cover these specific risks.

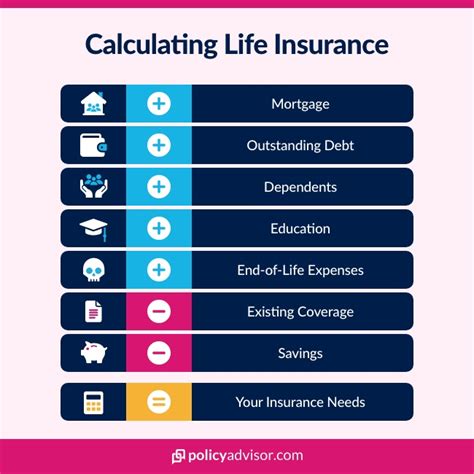

Determining the Right Amount of Coverage

To determine the appropriate amount of homeowners insurance coverage, consider the following guidelines:

- Replacement Cost: Ensure that your dwelling coverage matches the estimated replacement cost of your home. This is the most critical aspect of your policy, as it protects the value of your home in the event of a total loss.

- Personal Property: Assess the value of your belongings and choose a coverage limit that adequately protects them. Consider creating an inventory of your possessions to help with this process.

- Liability: Experts recommend carrying liability coverage of at least $1 million. This provides a robust layer of protection against potential lawsuits.

- Review and Adjust: Regularly review your policy and make adjustments as needed. If you make significant improvements to your home or acquire new valuable possessions, update your coverage accordingly.

The Role of Deductibles and Premiums

When selecting a homeowners insurance policy, it’s essential to understand the relationship between deductibles and premiums. Deductibles are the amount you pay out of pocket before your insurance coverage kicks in, while premiums are the regular payments you make to maintain your policy.

A higher deductible typically results in a lower premium, and vice versa. It's a trade-off between affordability and risk. If you're comfortable paying a higher deductible in the event of a claim, you can save on your premiums. However, it's important to choose a deductible that you can afford to pay without financial strain.

Additionally, consider the potential impact of deductibles on your coverage. Some policies may have separate deductibles for specific perils, such as hurricanes or hail. These deductibles can be a percentage of the dwelling coverage or a set dollar amount. It's crucial to understand these details to ensure you're adequately protected.

Factors Influencing Homeowners Insurance Rates

The cost of homeowners insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Location and Risk Factors

Your location plays a significant role in determining your insurance rates. Areas prone to natural disasters, such as hurricanes, tornadoes, or wildfires, typically have higher insurance costs. This is because the risk of a covered loss is higher in these areas.

Additionally, crime rates and the proximity to fire stations can also influence your rates. Insurers consider the likelihood of theft, vandalism, and the response time of emergency services when calculating premiums.

Home Construction and Age

The construction and age of your home can impact your insurance rates. Older homes may have outdated systems and appliances, which can increase the risk of certain types of losses. For example, older electrical systems may be more prone to fire hazards.

The materials used in your home's construction can also affect rates. Homes built with brick or stone may have lower premiums than those constructed with wood, as they are generally more resistant to fire and wind damage.

Claim History and Credit Score

Your claim history is a significant factor in determining your insurance rates. Insurers consider the frequency and severity of your previous claims when calculating your premiums. Multiple claims within a short period can result in higher rates or even policy non-renewal.

Your credit score can also influence your insurance rates. Studies have shown a correlation between credit scores and the likelihood of filing an insurance claim. Insurers may use your credit score as a factor in assessing your risk profile.

Security and Safety Features

Installing security and safety features in your home can potentially lower your insurance premiums. These features include burglar alarms, smoke detectors, fire sprinklers, and reinforced doors and windows. By reducing the risk of theft, fire, and other losses, you may qualify for discounts on your policy.

Insurance Company and Policy Type

Different insurance companies offer various policy types and coverage options. It’s essential to compare policies and companies to find the best fit for your needs and budget. Factors to consider include the company’s financial stability, customer service reputation, and the range of coverage options available.

Shopping for Homeowners Insurance

When shopping for homeowners insurance, it’s crucial to compare policies and quotes from multiple insurers. Here are some tips to help you find the right coverage at the best price:

- Obtain quotes from at least three insurance companies. This allows you to compare coverage and premiums.

- Review the policy details carefully, including coverage limits, deductibles, and exclusions. Ensure that the policy meets your specific needs.

- Consider working with an independent insurance agent who can provide quotes from multiple companies. They can help you navigate the process and find the best policy for your situation.

- Look for discounts. Many insurers offer discounts for bundling homeowners and auto insurance policies, installing security systems, or being claim-free for a certain period.

- Read reviews and check the financial stability of the insurance companies you're considering. A financially stable company can provide peace of mind in the event of a claim.

Making an Informed Decision

Understanding your homeowners insurance needs and the factors that influence coverage and rates is essential to making an informed decision. Here are some key takeaways to keep in mind:

- Assess the replacement cost of your home and choose dwelling coverage that matches this amount.

- Evaluate your personal property and select a coverage limit that adequately protects your belongings.

- Carry sufficient liability coverage to protect your assets in the event of a lawsuit.

- Consider your risk tolerance and choose a deductible that aligns with your financial comfort level.

- Review your policy regularly and adjust coverage as needed to reflect changes in your home or possessions.

By following these guidelines and staying informed about your insurance options, you can ensure that you have the right amount of homeowners insurance to protect your investment and provide peace of mind.

What is the difference between replacement cost and actual cash value in homeowners insurance?

+Replacement cost coverage pays the full amount needed to rebuild your home, while actual cash value coverage deducts depreciation from the payout. Replacement cost coverage is typically recommended as it ensures you can fully rebuild your home.

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually or whenever you make significant changes to your home or possessions. This ensures that your coverage remains up-to-date and aligns with your needs.

Can I customize my homeowners insurance policy to cover specific risks?

+Yes, homeowners insurance policies can be customized with endorsements or riders to cover specific risks or valuable items. This allows you to tailor your coverage to your unique circumstances.