How Much Flood Insurance

Floods are one of the most common and costly natural disasters, affecting countless homes and businesses each year. As a result, understanding the intricacies of flood insurance is essential for homeowners and property owners alike. This comprehensive guide aims to shed light on the crucial question: "How much flood insurance do I need?" By delving into the factors that influence flood insurance coverage, we will explore the key considerations that will help you make an informed decision.

Assessing Your Flood Risk

Before determining the amount of flood insurance you require, it's imperative to assess your specific flood risk. Flood risk varies greatly depending on your location, proximity to bodies of water, and the historical flood patterns in your area. To obtain an accurate assessment, you can refer to official flood maps provided by governmental agencies or consult with local experts who specialize in floodplain management.

These resources will provide valuable insights into the likelihood of flooding in your region. By understanding your flood risk, you can make informed decisions about the level of coverage you need to adequately protect your property.

Understanding Flood Zones

Flood zones are designated areas that reflect the level of flood risk in a particular region. These zones are categorized based on factors such as elevation, proximity to water sources, and historical flood data. The most commonly used flood zone classifications are:

- Zone V: This zone represents areas with the highest risk of flooding. Properties in Zone V are typically located near bodies of water, such as rivers, coasts, or lakes, and are prone to frequent and severe flooding.

- Zone A: Zone A indicates areas with a moderate to high risk of flooding. These zones often experience periodic flooding, especially during heavy rainfall or storm events.

- Zone X: Zone X is considered a lower-risk flood zone. Properties in this zone are still susceptible to flooding, but the risk is relatively lower compared to Zones V and A. However, it's important to note that even in Zone X, flood events can occur.

- Zone D: Zone D represents areas where flood hazard assessments have not been completed. While the risk in these zones is unknown, it doesn't necessarily mean there is no risk. Properties in Zone D should still consider obtaining flood insurance for added protection.

Understanding your property's flood zone classification is crucial as it directly influences the type and amount of flood insurance coverage you should consider.

| Flood Zone | Risk Level |

|---|---|

| Zone V | High Risk |

| Zone A | Moderate to High Risk |

| Zone X | Lower Risk |

| Zone D | Unknown Risk |

Determining the Value of Your Property

The value of your property plays a significant role in determining the amount of flood insurance you should obtain. Flood insurance coverage is typically calculated based on the replacement cost of your home and its contents. Here's how you can estimate the value of your property:

Replacement Cost

Replacement cost refers to the amount it would cost to rebuild your home and replace its contents if they were damaged or destroyed by a flood. This cost considers the current market value of similar properties in your area, the cost of construction materials, and the cost of labor.

To accurately estimate the replacement cost, you can consult with a professional appraiser or use online tools and resources that provide estimates based on your property's specifications and location. These estimates will give you a good starting point for determining the appropriate level of flood insurance coverage.

Building and Content Coverage

Flood insurance policies typically offer coverage for both the building structure and its contents. It's crucial to ensure that your policy provides adequate coverage for both aspects. Here's a breakdown of the coverage you should consider:

- Building Coverage: This covers the physical structure of your home, including the foundation, walls, roof, and permanent fixtures. It's essential to have sufficient coverage to rebuild your home in the event of a flood. Ensure that your policy covers the full replacement cost of your home.

- Content Coverage: This coverage protects your personal belongings, such as furniture, appliances, clothing, and electronics. It's important to assess the value of your possessions and ensure that your policy provides enough coverage to replace them. Consider creating an inventory of your belongings to help determine the appropriate coverage limit.

When determining the value of your property, it's advisable to consult with an insurance agent or broker who specializes in flood insurance. They can provide expert guidance and help you tailor your policy to meet your specific needs and ensure adequate coverage.

Factors Influencing Flood Insurance Costs

The cost of flood insurance is influenced by several factors, and understanding these factors can help you make informed decisions about your coverage and potential savings.

Flood Zone and Risk Level

As mentioned earlier, the flood zone your property is located in directly impacts the cost of flood insurance. Properties in high-risk zones (Zones V and A) typically require higher insurance premiums due to the increased likelihood of flooding. On the other hand, properties in lower-risk zones (Zones X and D) may enjoy more affordable insurance rates.

Policy Deductibles

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can result in lower insurance premiums. However, it's important to carefully consider your financial situation and ability to cover the deductible in the event of a flood. A higher deductible may save you money in the short term, but it could also mean a more significant financial burden if a flood occurs.

Building and Content Coverage Limits

The coverage limits you choose for your building and contents will directly impact your insurance premiums. Opting for higher coverage limits will provide greater protection but also result in higher insurance costs. It's essential to strike a balance between adequate coverage and affordability. Work with your insurance provider to determine the right coverage limits for your specific needs.

Additional Coverage Options

Some flood insurance policies offer additional coverage options that can provide extra protection for specific situations. These may include coverage for backup of sewers or drains, additional living expenses if you need to relocate during repairs, or coverage for valuable items that exceed the standard policy limits. While these options can increase your insurance costs, they may be worthwhile if you have specific concerns or valuable assets that require extra coverage.

Comparing Flood Insurance Providers

When it comes to flood insurance, it's crucial to compare different providers to find the best coverage and rates for your specific needs. Here's what you should consider when comparing flood insurance options:

Reputation and Financial Strength

Research the reputation and financial stability of the insurance providers you are considering. Look for companies that have a strong track record of paying claims promptly and efficiently. You can check ratings from reputable agencies such as AM Best or Standard & Poor's to assess the financial strength of the insurer.

Policy Features and Coverage Options

Compare the policy features and coverage options offered by different providers. Ensure that the policies provide adequate coverage for your building and contents, taking into account your specific flood risk and property value. Look for policies that offer flexible coverage limits and additional coverage options to meet your unique needs.

Customer Service and Claims Handling

The quality of customer service and claims handling can greatly impact your experience with an insurance provider. Consider factors such as the insurer's responsiveness, availability of customer support, and the ease of filing and managing claims. Online reviews and testimonials can provide valuable insights into the customer service experience of other policyholders.

Pricing and Discounts

Compare the premiums offered by different providers for similar coverage levels. Keep in mind that the cheapest option may not always be the best choice. Consider the overall value and quality of the policy, taking into account the coverage limits, deductibles, and additional features. Additionally, inquire about any available discounts, such as multi-policy discounts or loyalty discounts, which can help reduce your insurance costs.

Flexibility and Customization

Look for insurance providers that offer flexible policies that can be customized to your specific needs. Some insurers may allow you to tailor your coverage limits, choose different deductibles, or add optional coverage enhancements. Customization options can help you find the right balance between coverage and affordability.

FAQs

How do I know if I need flood insurance?

+Flood insurance is recommended for all homeowners, regardless of their flood zone classification. While properties in high-risk zones have a higher likelihood of flooding, even properties in lower-risk zones can experience flood events. It's important to assess your specific flood risk and the value of your property to determine the need for flood insurance.

Can I get flood insurance if I live in a high-risk flood zone?

+Yes, flood insurance is available for properties in high-risk flood zones. In fact, if your property is located in a high-risk zone, flood insurance is often mandatory. It's important to work with an insurance provider who specializes in flood insurance to ensure you obtain the necessary coverage.

What is the difference between flood insurance and homeowner's insurance?

+Flood insurance and homeowner's insurance are two distinct types of policies. Homeowner's insurance typically covers damage caused by fires, storms, theft, and other perils, but it usually does not cover flood damage. Flood insurance is specifically designed to provide coverage for damage caused by flooding, whether it's due to heavy rainfall, storm surges, or other water-related events.

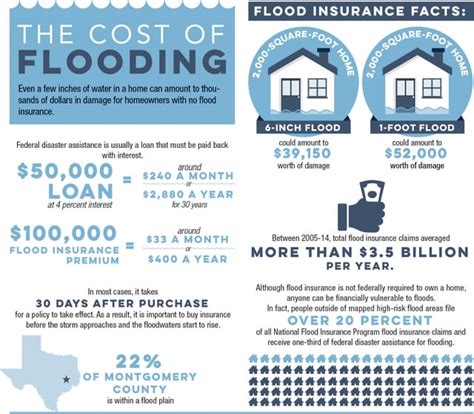

How long does it take for flood insurance to take effect?

+The waiting period for flood insurance to take effect varies. Standard flood insurance policies often have a 30-day waiting period from the date of purchase. This means that you need to plan ahead and purchase your policy well in advance of the flood season or any anticipated flood events. However, certain policies may have shorter waiting periods, so it's important to review the terms and conditions of your specific policy.

Can I get flood insurance if my property has previously experienced flooding?

+Yes, it is possible to obtain flood insurance for properties that have previously experienced flooding. However, the availability and cost of coverage may be affected by your property's flood history. Some insurance providers may require additional information or offer specialized policies for properties with a history of flooding. It's important to be transparent about your property's flood history when applying for insurance.

In conclusion, determining the right amount of flood insurance is a crucial step in protecting your property and financial well-being. By assessing your flood risk, understanding your property’s value, and considering the various factors that influence insurance costs, you can make an informed decision. Remember to compare multiple insurance providers, review policy features, and consult with experts to ensure you obtain the best coverage for your needs. Flood insurance provides peace of mind and financial security in the face of unexpected flood events, so it’s an investment worth considering.