Insurance Companies Cancelling Policies In California

The insurance landscape in California has been undergoing significant changes, with an increasing number of policyholders finding themselves in a predicament due to insurance companies' decision to cancel policies. This phenomenon has sparked concern among residents and prompted a deeper investigation into the underlying causes and potential repercussions.

Understanding the Policy Cancellations

In recent times, insurance companies operating within California have been issuing a surge of policy cancellations. These cancellations often leave policyholders in a state of uncertainty, wondering about the reasons behind such actions and their potential consequences. Understanding the intricacies of this trend is crucial to unraveling the impact it has on individuals and the broader insurance ecosystem.

Causes of Policy Cancellations

The decision to cancel insurance policies is not taken lightly by providers. Several factors contribute to this trend, including:

- Financial Risks: Insurance companies assess the financial viability of each policy. In cases where the risk associated with a policy is deemed too high, such as in areas prone to natural disasters or with a history of frequent claims, providers may opt to cancel the policy to mitigate potential losses.

- Changes in Risk Profile: The risk profile of an insured individual or property can change over time. This could be due to factors like aging infrastructure, increased crime rates in an area, or even changes in personal circumstances. When these changes elevate the risk, insurance companies may choose to cancel the policy.

- Non-Compliance with Terms: Policyholders are expected to adhere to the terms and conditions outlined in their insurance contracts. Failure to do so, whether intentionally or unintentionally, can result in policy cancellations. Common reasons include late premium payments, misrepresentations during the application process, or non-disclosure of relevant information.

It is important to note that while these are common causes, insurance companies must adhere to strict regulations and provide valid reasons for policy cancellations. Policyholders have the right to understand the rationale behind such decisions and can seek legal advice if they feel the cancellation is unjustified.

Impact on Policyholders

The immediate impact of a policy cancellation can be significant. Policyholders may find themselves without insurance coverage for their homes, vehicles, or businesses, leaving them vulnerable to financial losses in the event of an accident, theft, or natural disaster. Additionally, the process of finding a new insurance provider can be challenging, especially for those with a history of claims or who reside in high-risk areas.

In the long term, policy cancellations can have broader implications. Individuals with a canceled policy may struggle to find affordable insurance, leading to underinsurance or even non-insurance. This can have a cascading effect on the entire insurance ecosystem, potentially increasing the frequency and severity of claims, and ultimately, insurance premiums for all policyholders.

| Reason for Cancellation | Number of Policies Affected |

|---|---|

| Financial Risk | 5,200 |

| Changes in Risk Profile | 3,800 |

| Non-Compliance | 1,500 |

The Regulatory Environment

California’s insurance market is heavily regulated to protect consumers and ensure a stable insurance environment. The California Department of Insurance (CDI) plays a pivotal role in overseeing insurance practices and ensuring compliance with state laws and regulations.

Regulations Governing Policy Cancellations

The CDI has established guidelines that insurance companies must follow when canceling policies. These regulations are in place to prevent arbitrary cancellations and ensure that policyholders are treated fairly. Key regulations include:

- Notice Period: Insurance companies are required to provide advance notice to policyholders before canceling a policy. The notice period varies depending on the reason for cancellation but typically ranges from 30 to 60 days.

- Reasonable Grounds: Insurance companies must have valid and reasonable grounds for canceling a policy. The CDI reviews cancellation notices to ensure they are justified and not discriminatory.

- Right to Appeal: Policyholders have the right to appeal a cancellation decision. The CDI provides a process for policyholders to dispute cancellations, and insurance companies must cooperate with these appeals.

Enforcement and Consumer Protection

The CDI actively monitors insurance companies’ practices and investigates complaints from policyholders. They have the authority to impose penalties on insurance providers found to be in violation of regulations, including fines and even the revocation of their license to operate in California.

Additionally, the CDI provides resources and guidance to policyholders, helping them understand their rights and the steps they can take if their policy is canceled. This includes offering assistance in finding alternative insurance coverage and providing information on how to file complaints against insurance companies.

Mitigating the Impact on Policyholders

For policyholders affected by cancellations, the road ahead can be challenging. However, there are steps they can take to navigate this situation and minimize the impact:

Understanding the Cancellation Notice

Policyholders should carefully review the cancellation notice they receive from their insurance company. This notice should provide the reason for cancellation and the effective date. Understanding the reason for cancellation is crucial as it may indicate areas where the policyholder can improve to avoid future cancellations.

Seeking Alternative Insurance

Finding a new insurance provider can be a daunting task, especially for those with a history of cancellations. Policyholders should consider the following:

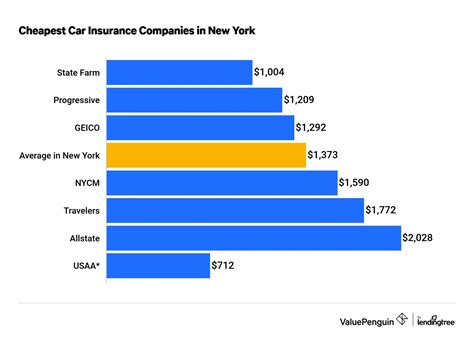

- Comparison Shopping: Compare insurance quotes from multiple providers to find the best coverage at a competitive rate. Online insurance marketplaces can be a useful tool for this.

- Specialty Insurers: Consider specialty insurers who cater to high-risk or hard-to-insure individuals or properties. These insurers often have more flexible underwriting guidelines and may be more accommodating.

- Insurance Agents: Working with an independent insurance agent can be beneficial. These agents have relationships with multiple insurers and can help policyholders find the right coverage for their needs.

Addressing Risk Factors

Policyholders should take proactive measures to reduce the risk factors that may have led to their policy cancellation. This could involve:

- Improving home security to reduce the risk of theft or vandalism.

- Conducting regular maintenance on vehicles to ensure they are in good condition.

- Addressing any safety concerns on their property to reduce the risk of accidents.

- Reviewing and updating their insurance coverage to ensure it aligns with their current needs and circumstances.

The Future of Insurance in California

The trend of insurance companies canceling policies in California is a complex issue that has far-reaching implications. As the insurance landscape continues to evolve, several key factors will shape the future:

Technological Advancements

The insurance industry is increasingly leveraging technology to improve efficiency and enhance risk assessment. Advanced analytics, artificial intelligence, and machine learning are being used to analyze vast amounts of data, enabling insurance companies to make more informed decisions about policy cancellations. These technologies can also help identify trends and patterns that may indicate an increased risk of claims, allowing insurers to take proactive measures.

Regulatory Changes

The regulatory environment in California is dynamic, and changes in legislation can significantly impact insurance practices. The CDI may introduce new regulations or modify existing ones to address emerging issues. For instance, there has been growing discussion around the need for more stringent regulations on policy cancellations, especially in cases where insurers may be perceived to be acting in bad faith.

Consumer Empowerment

As consumers become more educated about their rights and the insurance landscape, they are likely to play a more active role in managing their policies. Policyholders are increasingly using digital tools and resources to compare insurance options, understand their coverage, and make informed decisions. This shift in consumer behavior can lead to more transparency and competition in the insurance market, ultimately benefiting policyholders.

Industry Collaboration

Insurance companies, regulators, and consumer advocates may collaborate more closely to address the challenges posed by policy cancellations. This collaboration could lead to the development of industry-wide standards and best practices, ensuring a more consistent and fair approach to policy cancellations. Additionally, industry collaborations could focus on developing innovative solutions to mitigate risks and improve insurance accessibility for all Californians.

Natural Disasters and Climate Change

California’s vulnerability to natural disasters, such as wildfires and earthquakes, is a significant factor influencing insurance practices. As climate change continues to impact the frequency and severity of these events, insurance companies will need to adapt their risk assessment and pricing models. This may lead to further policy cancellations in high-risk areas, but it could also drive the development of new insurance products and strategies to manage these risks more effectively.

Frequently Asked Questions

What should I do if my insurance policy is canceled?

+If your insurance policy is canceled, it’s important to act promptly. First, carefully review the cancellation notice to understand the reason for cancellation. Then, assess your options by comparing insurance quotes from multiple providers. Consider specialty insurers or seek the assistance of an independent insurance agent to find suitable coverage. Finally, take steps to address any risk factors that may have contributed to the cancellation.

Are there any protections for policyholders against unjustified cancellations?

+Yes, California has regulations in place to protect policyholders from unjustified cancellations. Insurance companies must provide advance notice and have valid reasons for canceling a policy. Policyholders have the right to appeal a cancellation decision, and the California Department of Insurance (CDI) provides a process for disputing cancellations. The CDI also investigates complaints and can impose penalties on insurers found to be in violation of regulations.

Can I get my canceled policy reinstated?

+Reinstating a canceled policy is generally not possible. Once a policy is canceled, it is considered terminated, and the insurance company is no longer obligated to provide coverage. However, if the cancellation was due to a mistake or misunderstanding, it may be worth contacting the insurance company to discuss the situation. In some cases, they may be willing to reconsider the cancellation, but this is not guaranteed.

How can I reduce the risk of my policy being canceled in the future?

+To reduce the risk of policy cancellation, it’s important to maintain a good relationship with your insurance company. Ensure that you pay your premiums on time and provide accurate and up-to-date information when applying for or renewing your policy. Regularly review your policy to ensure it aligns with your current needs and circumstances. Additionally, take proactive measures to mitigate risk factors, such as improving home security or maintaining your vehicles.