California Medical Insurance Plans

Welcome to an in-depth exploration of California's medical insurance landscape, a vital component of the state's healthcare system. California, known for its diverse population and innovative healthcare initiatives, offers a wide array of insurance plans to cater to its residents' unique needs. This article will delve into the various types of medical insurance available, providing a comprehensive guide for individuals and families seeking coverage in the Golden State.

Navigating California’s Insurance Market

California’s healthcare market is a dynamic environment, with a range of public and private insurance options. Understanding the landscape is crucial for making informed decisions about your healthcare coverage. Here’s an overview of the key players and plans available:

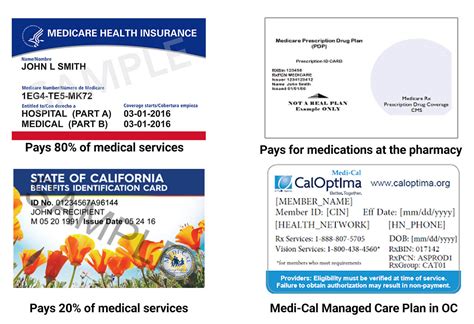

Medicare

Medicare is a federal program that provides health insurance for individuals aged 65 and older, as well as those with certain disabilities. In California, Medicare Advantage plans are a popular choice, offering comprehensive coverage and often including additional benefits such as dental, vision, and prescription drugs. These plans are administered by private insurance companies, providing a wide range of options for seniors and the disabled.

Medicare Supplement plans, also known as Medigap, are another option for those with original Medicare. These plans fill in the gaps left by Medicare, covering costs such as copayments, coinsurance, and deductibles. California residents can choose from a variety of Medigap plans, each with its own set of benefits and premiums.

Medi-Cal (California’s Medicaid Program)

Medi-Cal is California’s Medicaid program, offering low-cost or free healthcare coverage to eligible residents. This program is designed for individuals and families with limited income and resources. Medi-Cal provides comprehensive benefits, including doctor visits, hospital stays, prescription drugs, and more. The program also offers specialized services for pregnant women, children, and those with disabilities.

California has expanded its Medi-Cal program, making it more accessible to low-income adults. This expansion has helped reduce the state's uninsured rate, ensuring more residents have access to essential healthcare services.

Individual and Family Plans

California’s insurance market offers a variety of individual and family plans through both the Covered California marketplace and private insurers. These plans cater to a wide range of needs and budgets. Coverage options include:

- PPO (Preferred Provider Organization) Plans: These plans offer flexibility, allowing you to choose any healthcare provider, with or without a referral. PPO plans often have higher premiums but provide more freedom in choosing doctors and hospitals.

- HMO (Health Maintenance Organization) Plans: HMOs typically have lower premiums and provide coverage for a specific network of providers. You must choose a primary care physician, who will coordinate your care and provide referrals for specialists.

- EPO (Exclusive Provider Organization) Plans: Similar to HMOs, EPO plans have a network of providers, but unlike HMOs, EPO plans do not require a primary care physician. However, if you seek care outside the network, you may have to pay out-of-pocket costs.

- POS (Point of Service) Plans: POS plans combine features of both PPO and HMO plans. You can choose a primary care physician and receive care within the network at a lower cost, but you also have the option to seek care outside the network for an additional fee.

When selecting an individual or family plan, consider factors such as your healthcare needs, the providers you prefer, and your budget. It's essential to review the plan's network, coverage limits, and out-of-pocket costs to ensure it aligns with your requirements.

Group Health Insurance

Many Californians receive their medical insurance through group health plans offered by their employers. These plans are often more affordable and comprehensive, as the employer contributes to the cost of coverage. Group plans typically offer a range of options, including PPOs, HMOs, and other managed care plans.

Employers in California must adhere to certain regulations when offering group health insurance. These regulations ensure that plans provide a minimum level of coverage and that employees are protected from discrimination based on health status.

Short-Term Health Insurance

For those transitioning between jobs or seeking temporary coverage, short-term health insurance plans are an option. These plans offer more limited coverage and are generally less expensive than traditional plans. However, they may not cover pre-existing conditions and often have shorter durations, making them suitable for short-term needs.

Dental and Vision Insurance

California residents can also purchase dental and vision insurance separately or as part of a comprehensive health plan. These plans provide coverage for routine dental care, such as cleanings and check-ups, as well as more extensive procedures like root canals and braces. Vision insurance typically covers eye exams, contact lenses, and eyeglasses.

Prescription Drug Coverage

Prescription drug coverage is an essential component of many health insurance plans in California. Depending on your plan, you may have access to a preferred drug list, which outlines the medications covered at a lower cost. It’s important to review your plan’s drug coverage to ensure your required medications are included.

| Insurance Type | Key Features |

|---|---|

| Medicare Advantage | Comprehensive coverage, often including dental, vision, and drug benefits |

| Medi-Cal | Low-cost or free healthcare for eligible residents, including specialized services |

| Individual and Family Plans | Flexible options with varying networks and costs, including PPOs, HMOs, EPOs, and POS plans |

| Group Health Insurance | Affordable, comprehensive coverage offered by employers, often with a range of plan options |

| Short-Term Health Insurance | Limited coverage for temporary needs, may not cover pre-existing conditions |

The Future of Medical Insurance in California

California’s healthcare landscape is continually evolving, with ongoing efforts to improve access and affordability. The state’s commitment to expanding coverage and protecting consumers is evident in its regulatory frameworks and initiatives. Here’s a glimpse into the potential future of medical insurance in California:

Healthcare Reform and Policy Changes

California has been at the forefront of healthcare reform, implementing policies to increase access to care and control costs. The state’s Covered California marketplace, established under the Affordable Care Act, has played a crucial role in providing affordable insurance options to residents. As policy changes occur at the federal and state levels, California is likely to continue adapting its insurance landscape to meet the evolving needs of its residents.

Technological Innovations

Technology is transforming the healthcare industry, and California is a hub for innovation. From digital health records to telemedicine, technological advancements are making healthcare more accessible and efficient. Insurance providers in the state are adopting these technologies to enhance customer service, streamline claims processes, and offer more personalized care.

Addressing Healthcare Disparities

California recognizes the importance of addressing healthcare disparities among its diverse population. Efforts are underway to improve access to care for underserved communities, including those with limited English proficiency and those in rural areas. The state’s insurance plans are working to ensure that all residents, regardless of background, have equal opportunities to receive quality healthcare.

The Rise of Value-Based Care

Value-based care models are gaining traction in California, focusing on the quality and outcomes of healthcare rather than the quantity of services provided. These models aim to improve patient health while controlling costs. Insurance plans in the state are increasingly adopting value-based strategies, such as rewarding providers for achieving positive health outcomes and reducing unnecessary treatments.

Consumer Empowerment

California is committed to empowering consumers to make informed decisions about their healthcare. This includes providing clear and accessible information about insurance plans, benefits, and costs. The state’s insurance marketplace, Covered California, offers resources and tools to help residents compare plans and understand their coverage options.

What is the difference between an HMO and a PPO plan?

+An HMO plan typically has a lower premium and provides coverage for a specific network of providers. You must choose a primary care physician and receive referrals for specialists. In contrast, a PPO plan offers more flexibility, allowing you to choose any healthcare provider, with or without a referral. PPO plans often have higher premiums but provide more freedom in choosing doctors and hospitals.

How do I know if I'm eligible for Medi-Cal?

+Eligibility for Medi-Cal depends on various factors, including income, age, disability status, and family size. You can visit the official Medi-Cal website or contact your local county social services office to determine your eligibility and apply for coverage.

What are the benefits of enrolling in a Medicare Advantage plan?

+Medicare Advantage plans offer comprehensive coverage, often including dental, vision, and prescription drug benefits. These plans are administered by private insurance companies, providing a wide range of options for seniors and the disabled. They can be a cost-effective choice, as they often have lower out-of-pocket costs compared to original Medicare.

Can I switch my health insurance plan during the year?

+In general, health insurance plans have a specific enrollment period, and changes outside of this period are limited. However, certain life events, such as losing your job or getting married, may qualify you for a Special Enrollment Period, allowing you to switch plans. It's best to consult with your insurance provider or a healthcare expert to understand your options.

How can I compare different insurance plans to find the best fit for my needs?

+Comparing insurance plans involves assessing factors such as coverage limits, network of providers, out-of-pocket costs, and additional benefits. Online tools and resources, like those provided by Covered California, can help you compare plans side by side. Additionally, consulting with an insurance broker or a healthcare professional can provide personalized guidance based on your specific needs.

In conclusion, California’s medical insurance market offers a diverse range of plans to meet the needs of its residents. From Medicare and Medi-Cal to individual, family, and group plans, Californians have access to a variety of coverage options. As the state continues to innovate and adapt its healthcare policies, the future of medical insurance in California looks promising, with a focus on accessibility, affordability, and consumer empowerment.