Business Insurance Companies Near Me

When it comes to safeguarding your business, choosing the right insurance provider is crucial. With numerous options available, it can be challenging to navigate the market and find the best fit for your unique needs. This comprehensive guide aims to assist you in understanding the landscape of business insurance companies near you, highlighting key factors to consider, and offering valuable insights to make an informed decision.

Understanding Your Business Insurance Needs

Before embarking on your search for business insurance companies, it's essential to assess your specific needs. Every business is unique, and the coverage requirements vary depending on factors such as industry, size, location, and potential risks. Here's a breakdown of some critical aspects to consider:

Risk Assessment

Conduct a thorough risk assessment to identify the potential hazards your business faces. Consider factors like property damage, liability claims, data breaches, and industry-specific risks. By understanding these risks, you can tailor your insurance coverage accordingly.

Coverage Options

Business insurance offers a wide range of coverage options. Some common types include general liability insurance, property insurance, professional liability insurance (errors and omissions), workers' compensation, and cyber liability insurance. Depending on your industry and operations, you may require additional specialized coverages.

| Coverage Type | Description |

|---|---|

| General Liability | Protects against third-party claims, including bodily injury and property damage. |

| Property Insurance | Covers physical assets like buildings, equipment, and inventory against damage or loss. |

| Professional Liability | Provides coverage for errors, omissions, or negligence in professional services. |

| Workers' Compensation | Mandated by law in most states, it covers medical expenses and lost wages for employees injured on the job. |

| Cyber Liability | Protects against financial losses resulting from cyber attacks, data breaches, and identity theft. |

Tailored Solutions

Some businesses may benefit from customized insurance packages. For instance, construction companies may require specific coverage for equipment and projects, while tech startups might prioritize cyber liability insurance. Understanding your unique requirements will help you find the right insurer.

Researching Local Business Insurance Companies

Now that you have a clearer idea of your insurance needs, it's time to explore the options available near you. Here's a step-by-step guide to help you in your research:

Online Directories and Review Platforms

Start your search by utilizing online directories and review platforms. Websites like Yelp, Google My Business, and specialized insurance directories can provide valuable insights into local insurance companies. Read reviews, check ratings, and compare different providers to get an initial overview.

Industry-Specific Recommendations

Reach out to colleagues, industry peers, or business associations for recommendations. They may have firsthand experience with local insurance companies and can offer valuable insights based on their own interactions.

Insurance Brokers

Consider working with an insurance broker who specializes in commercial insurance. Brokers have access to a wide range of insurance companies and can help you compare policies and prices. They can also provide expert advice tailored to your business needs.

Company Websites and Online Presence

Visit the websites of local insurance companies to gather more information. Look for details about their offerings, experience in your industry, and any unique value propositions they provide. Pay attention to their online presence, including social media engagement and customer testimonials.

Compare Quotes and Policies

Obtain quotes from multiple insurance companies to compare coverage and prices. Ensure that you're comparing apples to apples by understanding the specific terms and conditions of each policy. Look for comprehensive coverage at a competitive price.

Evaluating Business Insurance Providers

Once you've narrowed down your options, it's time to evaluate the business insurance providers more thoroughly. Here are some key factors to consider during your evaluation process:

Financial Stability

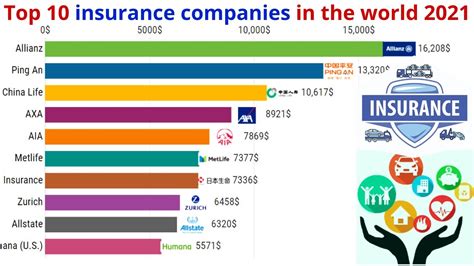

Choose an insurance company with a strong financial background. Check their financial ratings from reputable agencies like AM Best, Moody's, or Standard & Poor's. A stable financial position ensures that the company can meet its obligations and pay claims in the long run.

Claims Handling Process

Inquire about the company's claims handling process. Efficient and fair claims handling is crucial during times of need. Look for providers with a proven track record of prompt and fair claim settlements.

Customer Service

Excellent customer service is a hallmark of a good insurance company. Assess their responsiveness, accessibility, and willingness to address your concerns. Consider factors like availability of online portals, dedicated account managers, and ease of communication.

Industry Expertise

Opt for an insurance company with experience in your industry. They are likely to have a better understanding of the unique risks and challenges your business faces. This expertise can lead to more tailored coverage options and better risk management strategies.

Policy Flexibility

Look for insurance companies that offer flexible policies. This allows you to customize your coverage as your business grows and evolves. Flexible policies can accommodate changes in your business operations, assets, and risk profile.

Additional Services

Some insurance companies provide additional services beyond insurance coverage. These may include risk management resources, loss prevention programs, or business continuity planning assistance. Such services can enhance your overall risk management strategy.

Building a Strong Relationship with Your Insurer

Choosing the right business insurance company is just the beginning. Building a strong relationship with your insurer can lead to better coverage, improved risk management, and potentially lower premiums over time. Here's how you can foster a positive partnership:

Regular Communication

Maintain open and regular communication with your insurer. Keep them informed about changes in your business, such as expansion, new products or services, or increased risk factors. This ensures that your coverage remains up-to-date and relevant.

Risk Management Collaboration

Work closely with your insurer to implement effective risk management strategies. They can provide valuable insights and resources to help you mitigate risks and prevent potential losses. By actively managing risks, you may also qualify for premium discounts.

Policy Reviews and Adjustments

Regularly review your insurance policies to ensure they align with your business needs. As your business grows and evolves, your coverage requirements may change. Schedule periodic policy reviews with your insurer to make necessary adjustments and maintain comprehensive coverage.

Feedback and Suggestions

Provide feedback to your insurer about their services. Share your experiences, both positive and constructive, to help them improve. Your insights can contribute to a better overall customer experience.

Future Implications and Industry Trends

The business insurance landscape is constantly evolving, influenced by technological advancements, regulatory changes, and shifting market dynamics. Staying informed about these trends can help you make more strategic decisions when it comes to insurance coverage.

Emerging Risks and Coverage

Keep an eye on emerging risks in your industry. For instance, with the rise of remote work and digital transformation, cyber risks have become increasingly prominent. Ensure that your insurance coverage addresses these evolving threats.

Technology in Insurance

The insurance industry is embracing technology to enhance efficiency and customer experience. Insurtech companies are introducing innovative solutions, such as digital claim processing, AI-powered risk assessment, and personalized coverage options. Stay updated on these developments to leverage the benefits of technological advancements.

Regulatory Changes

Stay informed about regulatory changes that may impact your insurance needs. For example, changes in workers' compensation laws or environmental regulations can affect your coverage requirements. Working with an insurance provider who stays abreast of these changes can help you stay compliant.

Collaborative Risk Management

The future of business insurance is likely to involve more collaborative risk management approaches. Insurers and businesses may work together to develop customized risk management plans, leveraging data analytics and shared expertise. This collaborative approach can lead to more effective risk mitigation and cost savings.

Frequently Asked Questions

What is the average cost of business insurance?

+

The cost of business insurance varies widely depending on factors such as the size of your business, industry, location, and coverage limits. On average, small businesses can expect to pay anywhere from 500 to 2,000 per year for a basic general liability policy. However, more specialized coverages and higher limits can significantly increase the cost.

How often should I review my business insurance policies?

+

It’s recommended to review your business insurance policies annually, or whenever there are significant changes to your business operations, assets, or risk profile. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I bundle different types of business insurance to save money?

+

Yes, bundling different types of business insurance, such as general liability, property, and professional liability, can often lead to significant savings. Many insurance companies offer discounts when you purchase multiple policies from them.

What should I do if I’m unsure about the coverage I need for my business?

+

If you’re unsure about the coverage you need, it’s best to consult with an insurance broker or agent who specializes in commercial insurance. They can assess your business risks and recommend appropriate coverage options tailored to your needs.

Are there any tax benefits associated with business insurance premiums?

+

Yes, business insurance premiums are generally tax-deductible expenses. This means you can reduce your taxable income by deducting the cost of your insurance premiums, providing a potential tax advantage for your business.