Auto Insurence Quotes

Welcome to a comprehensive guide on auto insurance quotes, where we delve into the intricacies of obtaining accurate and competitive rates for your vehicle coverage. The process of securing auto insurance can be complex, but with the right knowledge and strategies, you can navigate it with ease. This article aims to provide you with expert insights, real-world examples, and practical tips to ensure you get the best quotes tailored to your specific needs.

Understanding Auto Insurance Quotes

Auto insurance quotes are estimates of the cost of insuring your vehicle. These quotes are based on various factors, including your personal information, vehicle details, driving history, and the coverage options you choose. Obtaining multiple quotes is essential to compare different insurance providers and find the most suitable and affordable coverage.

Factors Influencing Auto Insurance Quotes

Several key factors come into play when insurance companies calculate your quote. Understanding these factors can help you anticipate the costs and make informed decisions.

- Demographics and Location: Your age, gender, and the area where you live significantly impact your insurance rates. Urban areas with higher population densities and traffic volumes often result in increased premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a role in determining your quote. Additionally, the purpose of your vehicle's usage, whether for personal or commercial use, can affect the price.

- Driving Record: A clean driving record is crucial for obtaining favorable insurance quotes. Traffic violations, accidents, and claims history can lead to higher premiums.

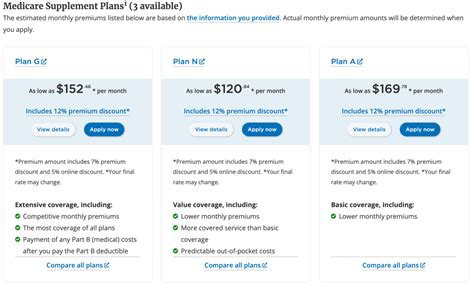

- Coverage and Deductibles: The level of coverage you choose, such as liability, collision, comprehensive, and personal injury protection, influences your quote. Additionally, opting for higher deductibles can reduce your premium.

- Discounts and Bundles: Insurance companies offer various discounts to incentivize customers. These may include safe driver discounts, multi-policy discounts, and loyalty rewards. Bundling your auto insurance with other policies, such as home or renters' insurance, can also result in savings.

Obtaining Competitive Auto Insurance Quotes

Now that we’ve covered the fundamentals, let’s explore strategies to obtain the most competitive auto insurance quotes.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Take the time to compare quotes from different insurance providers. Online quote comparison tools can be valuable resources to quickly assess various options.

- Research Insurance Companies: Before selecting an insurance provider, research their reputation, financial stability, and customer satisfaction ratings. Online reviews and ratings can provide valuable insights into their reliability and service quality.

- Understand Coverage Options: Familiarize yourself with the different types of coverage available and their respective costs. This knowledge will empower you to make informed decisions about the level of protection you require.

- Explore Discount Opportunities: Take advantage of any discounts you may qualify for. Common discounts include safe driver discounts, good student discounts, and loyalty rewards. Additionally, consider bundling your auto insurance with other policies to maximize savings.

- Maintain a Clean Driving Record: A spotless driving record is essential for obtaining favorable insurance quotes. Avoid traffic violations and prioritize safe driving practices to keep your premiums low.

Analyzing Auto Insurance Quote Results

Once you’ve obtained a range of auto insurance quotes, it’s time to analyze and evaluate them. This step is crucial to ensure you make the right choice for your specific circumstances.

Comparing Quote Details

When comparing quotes, pay close attention to the following aspects:

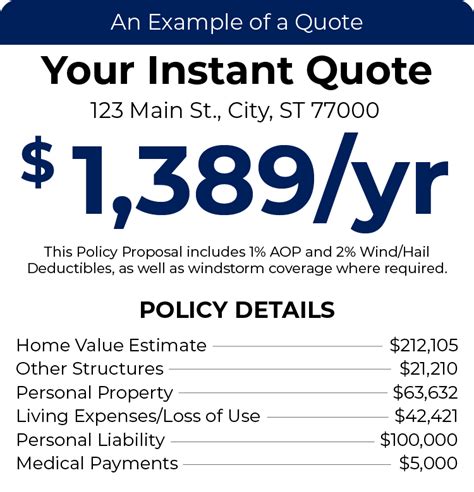

- Coverage Limits: Compare the coverage limits offered by different insurance providers. Ensure that the limits align with your needs and provide adequate protection.

- Deductibles: Evaluate the deductibles associated with each quote. Higher deductibles can result in lower premiums, but consider whether you can afford the out-of-pocket expenses in the event of a claim.

- Policy Exclusions: Carefully review the policy exclusions to understand what is not covered. This ensures you're aware of any potential gaps in coverage.

- Additional Features: Some insurance providers offer unique features or add-ons. Evaluate these options to determine if they provide additional value or meet specific needs you may have.

Considering Long-Term Savings

While obtaining a competitive quote is essential, it’s equally important to consider the long-term savings potential of your insurance policy. Here’s how to assess this aspect:

- Annual Premium vs. Monthly Payments: Calculate the annual premium for each quote and compare it to your monthly budget. Some insurance providers offer flexible payment plans, so consider the impact of monthly payments on your finances.

- Discount Continuity: Review the eligibility criteria for discounts and assess whether you can maintain these discounts over time. This ensures that your savings remain consistent throughout your insurance term.

- Renewal Options: Inquire about renewal policies and any potential rate increases. Understanding the renewal process and associated costs can help you plan for the future and avoid unexpected expenses.

Maximizing Your Auto Insurance Savings

To truly optimize your auto insurance savings, consider the following strategies:

Utilize Online Resources

The internet offers a wealth of resources to help you navigate the auto insurance landscape. Take advantage of online tools and calculators to estimate your potential savings. These resources can provide valuable insights and comparisons to guide your decision-making process.

Negotiate with Insurance Providers

Don’t hesitate to negotiate with insurance providers. By presenting your research and highlighting the benefits you bring as a customer, you may be able to secure additional discounts or more favorable terms. Remember, insurance companies want your business, and a little negotiation can go a long way.

Explore Alternative Insurance Options

Consider exploring alternative insurance options, such as usage-based insurance or pay-per-mile insurance. These policies offer flexibility and can provide significant savings for low-mileage drivers. Research these options and assess their suitability for your driving habits.

Stay Informed and Proactive

Stay updated on changes in the auto insurance industry and keep an eye out for new policies or discounts that may benefit you. Regularly review your insurance policy and coverage limits to ensure they align with your current needs and circumstances. By staying proactive, you can make informed decisions and potentially save money.

Conclusion: Navigating the Auto Insurance Landscape

Obtaining auto insurance quotes requires careful consideration and strategic decision-making. By understanding the factors that influence quotes, comparing multiple options, and analyzing the details, you can secure the best coverage at the most competitive rates. Remember to utilize online resources, negotiate with providers, and stay informed to maximize your savings.

As you embark on your journey to find the perfect auto insurance policy, keep in mind that knowledge is power. With the insights provided in this guide, you are equipped to navigate the auto insurance landscape with confidence and make informed choices that protect your vehicle and your finances.

What is the average cost of auto insurance?

+The average cost of auto insurance can vary significantly based on numerous factors. According to recent studies, the national average for auto insurance premiums is approximately $1,674 per year. However, it’s essential to note that this average can fluctuate based on individual circumstances and regional differences.

How often should I review my auto insurance policy?

+It is recommended to review your auto insurance policy annually or whenever your circumstances change significantly. Life events such as moving to a new location, purchasing a new vehicle, or getting married can impact your insurance needs and rates. Regular reviews ensure that your coverage remains adequate and up-to-date.

What factors can lead to an increase in auto insurance premiums?

+Several factors can cause an increase in auto insurance premiums. These include traffic violations, accidents, and claims history. Additionally, changes in your personal circumstances, such as a move to a high-risk area or the addition of young drivers to your policy, can also result in higher premiums. Regularly monitoring your driving behavior and maintaining a clean record can help mitigate these increases.