Insurance For 1St Time Drivers

Navigating the world of insurance as a first-time driver can be a daunting task. Understanding the coverage options, choosing the right provider, and making sense of the policies can be overwhelming, especially when you're new to the road. This comprehensive guide aims to shed light on the process, offering expert insights and practical tips to ensure you get the best insurance coverage for your needs.

Understanding the Basics: Insurance for First-Time Drivers

When you’re new to driving, insurance companies often view you as a higher risk, which can result in higher premiums. However, understanding the types of insurance and the factors that influence your premiums can help you make informed decisions and potentially save money.

Types of Insurance

There are several types of insurance coverage to consider when insuring your vehicle. The most common types include:

- Liability Insurance: This is the most basic form of insurance, covering damages you cause to others and their property. It’s mandatory in most states and is essential to protect you from financial ruin in the event of an accident.

- Collision Insurance: This type of coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It’s an optional coverage, but it can be crucial if you have a lease or loan on your vehicle.

- Comprehensive Insurance: Comprehensive coverage protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. Like collision insurance, it’s optional but highly recommended.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault. It’s a no-fault insurance, meaning it pays out regardless of who caused the accident. PIP is mandatory in some states and optional in others.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Factors Influencing Premiums

Several factors can influence the cost of your insurance premiums as a first-time driver. These include:

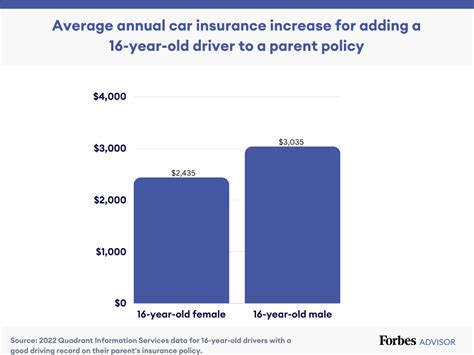

- Age and Driving Experience: Younger drivers, especially those under 25, are often considered higher risk due to their lack of experience. As a result, insurance premiums for younger drivers tend to be higher.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., daily commute, pleasure driving, business use), can impact your premiums. Sports cars and high-performance vehicles, for instance, often carry higher insurance costs.

- Location: Where you live and where you park your vehicle can affect your premiums. Urban areas with higher population densities and more traffic often result in higher insurance costs.

- Driving Record: A clean driving record is crucial for keeping insurance premiums low. Even minor infractions like speeding tickets or parking violations can increase your rates. Serious offenses like DUIs or reckless driving can significantly impact your insurance costs.

- Credit Score: Believe it or not, your credit score can also influence your insurance premiums. Many insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit score can potentially lower your insurance costs.

Choosing the Right Insurance Provider

With so many insurance companies in the market, choosing the right one can be challenging. Here are some tips to help you make an informed decision:

Research and Compare

Take the time to research and compare different insurance providers. Look at their reputation, customer service, and financial stability. You can find valuable information through online reviews, consumer reports, and ratings from organizations like J.D. Power and AM Best.

Consider Bundling

If you also need home or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who bundle multiple policies, which can result in significant savings.

Look for Discounts

Insurance companies often offer a variety of discounts to attract customers. These can include discounts for good students, safe driving records, loyalty discounts, and even discounts for belonging to certain organizations or groups.

Understand Coverage Limits

When comparing policies, pay close attention to the coverage limits. This refers to the maximum amount the insurance company will pay out in the event of a claim. Higher coverage limits typically result in higher premiums, but they can provide more financial protection in the event of a severe accident.

Tips for Lowering Premiums

As a first-time driver, your insurance premiums might be higher than you’d like. However, there are strategies you can employ to potentially lower your costs:

Take a Defensive Driving Course

Completing a defensive driving course can not only improve your driving skills but also potentially lower your insurance premiums. Many insurance companies offer discounts for drivers who have completed these courses.

Consider a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it’s essential to ensure you can afford the higher deductible in the event of an accident.

Maintain a Good Driving Record

A clean driving record is crucial for keeping insurance premiums low. Avoid speeding, obey traffic laws, and always drive defensively. Even minor infractions can increase your rates, so be mindful of your driving behavior.

Shop Around

Insurance rates can vary significantly between providers. Don’t be afraid to shop around and get quotes from multiple companies. You might be surprised at the differences in premiums and coverage.

Future Implications and Strategies

As a first-time driver, your insurance premiums will likely be higher, but there are strategies you can employ to improve your insurance situation over time:

Build a Good Driving Record

Over time, as you establish a good driving record with no accidents or violations, your insurance premiums will likely decrease. Insurance companies reward safe driving behavior, so the longer you maintain a clean record, the more your premiums should decrease.

Consider Switching Providers

As your driving record improves and you gain more experience, it might be beneficial to switch insurance providers. Some companies specialize in insuring younger or less experienced drivers, so shopping around every few years can help you find better rates.

Review Your Coverage Regularly

Your insurance needs might change over time. Review your coverage annually to ensure you’re still getting the best value. As your situation changes (e.g., getting married, buying a home, adding a teen driver to your policy), your insurance needs may also change.

Stay Informed

Keep yourself informed about changes in the insurance industry and new coverage options. Staying aware of industry trends and advancements can help you make better-informed decisions about your insurance coverage.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages to others and their property. |

| Collision Insurance | Pays for repairs to your vehicle after an accident. |

| Comprehensive Insurance | Protects against non-collision damage, such as theft or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with an uninsured or underinsured driver. |

What is the average cost of insurance for first-time drivers?

+

The average cost of insurance for first-time drivers can vary widely based on several factors, including age, location, vehicle type, and driving record. On average, young drivers aged 16-19 can expect to pay around 3,000 to 5,000 per year for insurance, while drivers aged 20-24 might pay closer to 2,000 to 3,500 per year. However, these are just averages, and actual costs can be significantly higher or lower depending on individual circumstances.

Are there any specific discounts available for first-time drivers?

+

Yes, several insurance companies offer discounts for first-time drivers. These can include good student discounts, driver training course discounts, and safe driving discounts. Additionally, some companies offer loyalty discounts, so if you’ve been with the same insurer for a while, you may be eligible for lower rates as you gain more driving experience.

How can I get the best insurance rates as a first-time driver?

+

To get the best insurance rates as a first-time driver, consider the following strategies: research and compare multiple insurance providers, take advantage of any available discounts, choose a higher deductible to lower premiums, maintain a clean driving record, and consider bundling your insurance policies (e.g., auto and home insurance) with the same provider.