What Does Subrogation Mean In Insurance

Understanding the Concept of Subrogation in Insurance

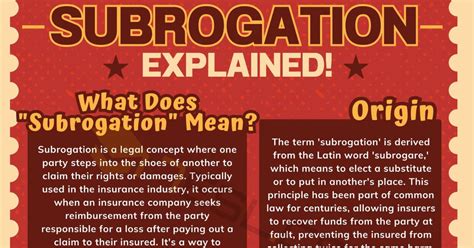

Subrogation is a fundamental principle in the insurance industry that plays a crucial role in managing claims and ensuring fair compensation. It is a legal process that allows an insurance company, known as the subrogee, to step into the shoes of its insured, the subrogor, to pursue a legal claim against a third party responsible for causing the insured's loss or damage.

This intricate process is designed to protect both the insured and the insurer's interests by recovering the compensation paid out by the insurer. By understanding the concept of subrogation, we can delve into the intricate world of insurance claims and explore its significance, practical applications, and potential implications.

The Legal Foundation of Subrogation

Subrogation finds its legal basis in the concept of equity and the principle of restitution. It is rooted in the idea that an individual should not benefit financially from the loss or damage caused by another party's negligence or wrongdoing. The insurance company, by paying the insured's claim, essentially steps into the insured's legal rights to pursue compensation from the liable party.

This legal foundation is crucial as it ensures that the burden of financial responsibility falls on the appropriate party. By allowing subrogation, the insurance industry promotes fairness and discourages individuals from taking advantage of the system.

How Subrogation Works: A Step-by-Step Guide

The subrogation process is a complex journey that involves several key steps. Let's break it down:

1. Identifying the Responsible Party

The first step in the subrogation process is to identify the party responsible for causing the insured's loss or damage. This can involve a thorough investigation, gathering evidence, and determining the liability of the involved parties.

For instance, in a car accident, the insurer would need to assess the circumstances, review police reports, and analyze the evidence to determine who was at fault.

2. Assessing the Loss

Once the responsible party is identified, the insurer must assess the extent of the loss or damage. This involves evaluating the insured's claim, calculating the financial impact, and determining the amount of compensation owed.

In a property damage claim, the insurer would inspect the damaged property, obtain repair estimates, and determine the fair value of the loss.

3. Paying the Claim

After assessing the loss, the insurer pays the insured the agreed-upon amount as per the insurance policy. This payment represents the insurer's fulfillment of its contractual obligation to provide financial protection to the insured.

However, by paying the claim, the insurer does not relinquish its rights to pursue subrogation.

4. Pursuing Subrogation

Once the claim is paid, the insurer initiates the subrogation process. This involves sending a notice of subrogation to the responsible party, informing them of the insurer's intention to seek compensation for the paid claim.

The insurer may also engage legal professionals to handle the subrogation claim, ensuring a thorough and robust pursuit of compensation.

5. Negotiation and Settlement

At this stage, the insurer and the responsible party engage in negotiations to reach a settlement. This can involve discussions, mediations, or even litigation to resolve the matter.

The goal of the insurer is to recover the full amount paid to the insured, ensuring that the responsible party assumes financial responsibility for the loss.

6. Recovery and Distribution

Upon reaching a settlement or obtaining a favorable judgment, the insurer recovers the funds from the responsible party. These funds are then distributed, with a portion going to the insurer to cover its expenses and the remaining amount reimbursed to the insured.

This distribution process ensures that the insured receives fair compensation and that the insurer's costs are covered.

Real-Life Scenarios: When Subrogation Comes into Play

Subrogation is applicable in a wide range of insurance claims, including but not limited to:

- Auto Insurance: In cases of car accidents, subrogation allows the insurer to pursue compensation from the at-fault driver's insurance company.

- Property Insurance: If a fire damages a home due to a neighbor's negligence, the insurer can subrogate against the neighbor to recover the costs paid for repairs.

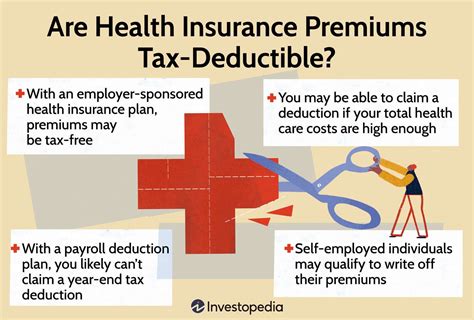

- Health Insurance: In situations where a third party causes an injury, the insurer can subrogate against the responsible party to recover medical expenses paid.

- Workers' Compensation: If an employee is injured due to a third party's negligence, the insurer can subrogate to recover the compensation paid to the employee.

The Impact of Subrogation on Insureds and Insurers

Subrogation has significant implications for both insureds and insurers. For insureds, it ensures that they receive the necessary financial support to recover from a loss while also protecting them from potential future liabilities.

Insurers, on the other hand, benefit from subrogation by recovering their costs and maintaining a sustainable business model. By pursuing subrogation, insurers can keep premiums affordable and ensure the long-term viability of the insurance industry.

Challenges and Considerations in Subrogation

While subrogation is a valuable tool, it is not without its challenges. Some of the key considerations include:

Statute of Limitations

Subrogation claims are subject to statute of limitations, which vary by jurisdiction. Insurers must be mindful of these time constraints to ensure that their subrogation rights are not waived due to delay.

Legal Complexity

Subrogation cases can be legally complex, involving intricate liability assessments, contractual interpretations, and potential disputes. Engaging experienced legal professionals is crucial to navigate these complexities successfully.

Resource Allocation

Pursuing subrogation claims requires significant resources, including time, personnel, and financial investments. Insurers must carefully assess the potential returns and allocate resources efficiently to maximize the success of their subrogation efforts.

The Future of Subrogation in the Insurance Industry

As the insurance industry evolves, so too does the practice of subrogation. With advancements in technology and data analytics, insurers are now better equipped to identify subrogation opportunities and streamline the process.

Furthermore, the increasing focus on fraud prevention and the growing complexity of insurance claims make subrogation an essential tool for insurers to protect their interests and maintain the integrity of the insurance system.

Conclusion

Subrogation is a vital component of the insurance industry, ensuring fairness, accountability, and financial recovery. By understanding the legal foundation, practical applications, and potential challenges of subrogation, we can appreciate its role in promoting a sustainable and equitable insurance ecosystem.

As the insurance landscape continues to evolve, subrogation will remain a critical tool for insurers to protect their policyholders and maintain the industry's stability.

What happens if the responsible party cannot be identified or located for subrogation purposes?

+In cases where the responsible party is unknown or cannot be located, the insurer may still pursue subrogation against the insured’s own insurance policy, often referred to as a first-party subrogation. This allows the insurer to recover its costs from the insured’s policy, provided certain conditions are met.

Can subrogation be applied to all types of insurance claims?

+Subrogation is commonly used in property, auto, health, and liability insurance claims. However, its applicability may vary based on the jurisdiction and the specific terms of the insurance policy. Some policies may exclude certain types of claims from subrogation, so it’s essential to review the policy documents carefully.

How long does the subrogation process typically take?

+The duration of the subrogation process can vary significantly depending on the complexity of the case, the cooperation of the responsible party, and the efficiency of the legal system. Simple cases may be resolved within a few months, while more complex ones can take several years.