Are Health Insurance Premiums Taxdeductible In 2023

In the realm of personal finance and healthcare, one crucial aspect that often confuses individuals is the tax treatment of health insurance premiums. As we embark on the new year, 2023, it is imperative to clarify the deductibility of these premiums to ensure that individuals can make informed decisions regarding their tax obligations and healthcare coverage.

Understanding Health Insurance Premiums and Taxes

Health insurance premiums are the regular payments made by individuals or families to maintain their healthcare coverage. These premiums can be quite substantial, especially for comprehensive plans, and thus, their tax treatment is a matter of significant interest. The Internal Revenue Service (IRS) in the United States has specific guidelines regarding the deductibility of health insurance premiums, which have evolved over the years to adapt to changing healthcare landscapes and tax policies.

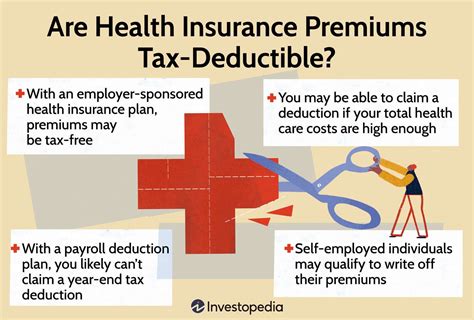

Health Insurance Premiums: A Tax-Deductible Expense

For the majority of taxpayers in the United States, health insurance premiums are considered a tax-deductible expense for the 2023 tax year. This means that individuals can reduce their taxable income by the amount they spend on their health insurance premiums, potentially leading to a lower tax liability.

The deductibility of health insurance premiums is particularly beneficial for individuals who are self-employed or have non-traditional employment arrangements. These individuals often do not have access to employer-sponsored health insurance plans and must purchase their own coverage. By deducting the premiums, they can effectively reduce the overall cost of their healthcare.

| Tax Year | Deductibility Status |

|---|---|

| 2023 | Premiums are deductible |

| 2022 | Premiums were deductible |

| 2021 | Premiums were deductible |

However, it is important to note that the deductibility of health insurance premiums is subject to certain conditions and limitations. The IRS has specific guidelines on who can claim this deduction and how it should be calculated. Understanding these rules is crucial to ensure compliance with tax regulations.

Eligibility and Limitations for Deduction

To be eligible to deduct health insurance premiums, individuals must meet specific criteria set by the IRS. Firstly, the health insurance policy must qualify as a high-deductible health plan (HDHP) or a qualified health plan (QHP) under the Affordable Care Act (ACA). This ensures that the plan meets certain standards for coverage and cost-sharing.

Additionally, individuals must not be eligible for employer-sponsored health insurance plans. If an employer offers a qualifying health plan and the individual declines coverage, they may not be able to deduct their premiums. This rule aims to prevent individuals from claiming deductions while also benefiting from employer-sponsored plans.

The deduction for health insurance premiums is also subject to income limitations. The IRS sets an income threshold, above which the deduction is phased out. For tax year 2023, this threshold is expected to remain at $64,000 for single filers and $128,000 for married couples filing jointly. As income exceeds these limits, the deduction gradually decreases until it is no longer available.

Calculating the Deduction

When calculating the deduction for health insurance premiums, individuals must consider the total amount paid for their healthcare coverage throughout the tax year. This includes premiums for medical, dental, and vision insurance, as well as any contributions made to a Health Savings Account (HSA) associated with a high-deductible health plan.

The IRS provides guidelines on how to calculate the deduction, taking into account the specific type of insurance plan and the individual's filing status. For instance, individuals with family coverage may deduct a higher amount compared to those with individual coverage. It is essential to refer to IRS publications and seek professional tax advice to ensure accurate calculations.

Implications and Strategies for Taxpayers

The deductibility of health insurance premiums can have significant implications for taxpayers, especially those with high medical expenses or self-employed individuals. By understanding the rules and limitations, taxpayers can strategically plan their healthcare coverage and tax obligations.

Maximizing Deductions

For individuals who are eligible to deduct their health insurance premiums, there are several strategies to maximize this deduction. Firstly, it is crucial to maintain detailed records of all premium payments and associated healthcare expenses. This includes keeping receipts, statements, and any other documentation that supports the deduction.

Additionally, taxpayers should explore the option of contributing to a Health Savings Account (HSA) if they are enrolled in a high-deductible health plan. HSAs allow individuals to save pre-tax dollars for qualified medical expenses, further reducing their taxable income. The funds in an HSA can be used to pay for various healthcare costs, including deductibles, copayments, and prescriptions.

Alternative Tax Benefits

While health insurance premiums are generally deductible, taxpayers should also be aware of other tax benefits related to healthcare. For instance, certain medical expenses, such as prescription drugs, doctor visits, and hospital stays, may be deductible if they exceed a certain percentage of the taxpayer’s Adjusted Gross Income (AGI). These expenses can be claimed as an Itemized Deduction on Schedule A of Form 1040.

Furthermore, taxpayers who are self-employed may qualify for the Self-Employed Health Insurance Deduction. This deduction allows them to deduct the cost of health insurance for themselves, their spouses, and their dependents, even if they do not itemize other deductions on their tax return. This provision provides a significant tax benefit for self-employed individuals who often bear the full cost of their healthcare coverage.

Planning for the Future

As we navigate the complexities of the healthcare and tax systems, it is essential to stay informed about any changes or updates to the deductibility of health insurance premiums. Tax laws and healthcare policies can evolve rapidly, and staying abreast of these changes can help individuals make informed decisions about their coverage and tax strategies.

For the upcoming tax year, 2023, taxpayers can expect continued deductibility for health insurance premiums. However, it is always advisable to consult with tax professionals or utilize reputable tax preparation software to ensure compliance with the latest regulations. Additionally, keeping an eye on legislative updates and IRS announcements can provide valuable insights into future tax treatments of healthcare expenses.

Conclusion

In conclusion, health insurance premiums are generally tax-deductible for the 2023 tax year, offering a valuable opportunity for taxpayers to reduce their taxable income. By understanding the eligibility criteria, income limitations, and calculation methods, individuals can maximize their deductions and optimize their financial well-being. As we continue to navigate the intersection of healthcare and taxes, staying informed and seeking professional advice is essential to making the most of these tax benefits.

Can I deduct health insurance premiums if I’m not self-employed?

+

Yes, even if you are not self-employed, you can still deduct health insurance premiums as long as you meet the eligibility criteria set by the IRS. This includes having a qualifying health plan and not being eligible for employer-sponsored coverage.

What if my income exceeds the threshold for the premium deduction?

+

If your income exceeds the threshold, the deduction for health insurance premiums will be phased out. The IRS provides specific guidelines on how the deduction is reduced based on your income level. It’s important to calculate this accurately to determine the maximum deduction available to you.

Are there any alternatives to deducting health insurance premiums if I don’t qualify?

+

If you don’t qualify for the premium deduction, you may still be able to claim other healthcare-related deductions. For instance, you can deduct qualified medical expenses that exceed a certain percentage of your AGI as an Itemized Deduction. Additionally, if you have a high-deductible health plan, you can contribute to a Health Savings Account (HSA) to reduce your taxable income.