Geico Car Insurance Review

Geico Car Insurance Review: Unveiling the Coverages, Costs, and Customer Experience

In the realm of auto insurance, Geico has established itself as a prominent player, offering a wide range of coverages and competitive pricing. This comprehensive review aims to delve into the world of Geico car insurance, exploring its offerings, costs, and the overall customer experience. With a focus on providing valuable insights, we will navigate through the key aspects of Geico's services, ensuring you make an informed decision for your automotive insurance needs.

Understanding Geico’s Coverage Options

Geico, an acronym for Government Employees Insurance Company, has evolved to cater to a diverse range of drivers. Their coverage options are designed to provide comprehensive protection, ensuring peace of mind for policyholders. Here’s an in-depth look at the coverages offered by Geico:

Liability Coverage

Liability insurance is a fundamental aspect of any car insurance policy. Geico provides both bodily injury liability and property damage liability coverage. This ensures that if you’re at fault in an accident, your policy covers the costs of injuries sustained by others and any damage to their property. Geico’s liability limits are customizable, allowing you to choose the level of coverage that suits your needs and budget.

| Liability Coverage Type | Coverage Limits |

|---|---|

| Bodily Injury Liability | Customizable up to $500,000 per person and $1,000,000 per accident |

| Property Damage Liability | Customizable up to $100,000 per accident |

Collision and Comprehensive Coverage

Collision coverage comes into play when your vehicle sustains damage due to a collision with another vehicle or object. It covers repairs or replacements, subject to your policy’s deductible. Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, natural disasters, and damage caused by animals. Both collision and comprehensive coverage are optional but highly recommended to ensure comprehensive protection.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, provides coverage for medical expenses and lost wages resulting from an accident, regardless of fault. This coverage is mandatory in some states and highly beneficial in ensuring that your medical needs are met after an accident. Geico’s PIP coverage limits vary depending on your state’s regulations and your chosen policy.

Medical Payments Coverage (MedPay)

MedPay coverage complements PIP by providing additional coverage for medical expenses, including co-pays and deductibles. It offers a faster and more flexible reimbursement process, ensuring you can focus on your recovery without worrying about immediate out-of-pocket costs.

Uninsured/Underinsured Motorist Coverage

With a significant number of uninsured or underinsured drivers on the road, this coverage becomes crucial. Geico’s uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who lacks sufficient insurance to cover the damages. It provides compensation for medical expenses, property damage, and, in some cases, pain and suffering.

Additional Coverages

Geico offers a range of optional coverages to enhance your policy. These include rental car coverage, emergency roadside assistance, gap coverage, and customized equipment coverage for unique vehicles or modifications. These additional coverages can be tailored to your specific needs, providing extra protection and peace of mind.

Analyzing Geico’s Costs and Discounts

When it comes to car insurance, cost is a critical factor in decision-making. Geico is known for its competitive pricing, but the actual cost of your policy will depend on various factors, including your driving history, location, vehicle type, and chosen coverages. Here’s an overview of Geico’s pricing structure and the discounts they offer:

Pricing Structure

Geico employs a comprehensive rating system that takes into account multiple factors to determine your insurance premium. These factors include your age, gender, driving record, marital status, and the make and model of your vehicle. Additionally, your location and the coverage limits you select play a significant role in the final cost of your policy.

Geico provides free online quotes, allowing you to get a personalized estimate based on your specific circumstances. Their transparent pricing and online quoting process make it convenient to compare rates and make an informed decision.

Discounts and Savings

Geico offers a wide range of discounts to help reduce the cost of your car insurance. These discounts can significantly impact your premium and are worth exploring to maximize your savings. Here are some of the key discounts available:

- Multi-Policy Discount: Combining your auto insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

- Military Discount: Geico's military discount program offers reduced rates for active-duty military personnel, veterans, and their families.

- Good Driver Discount: Maintaining a clean driving record can lead to significant discounts. Geico rewards safe drivers with lower premiums.

- Safe Vehicle Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes or electronic stability control, may qualify for discounts.

- Emergency Deployment Discount: Geico provides special discounts for military personnel who are deployed, ensuring they don't face financial burdens during their service.

- Early Shopping Discount: Shopping for insurance early and maintaining continuous coverage can lead to reduced rates.

- Pay-in-Full Discount: Paying your premium in full upfront rather than in installments can result in savings.

- Good Student Discount: Students who maintain a certain GPA or rank in their class may be eligible for discounts.

The Geico Customer Experience: A Comprehensive Overview

Geico’s commitment to customer satisfaction extends beyond its coverage options and competitive pricing. The company strives to provide a seamless and efficient customer experience, ensuring that policyholders receive prompt assistance and support throughout their journey.

Claim Process and Handling

In the unfortunate event of an accident or incident, Geico’s claim process is designed to be straightforward and efficient. Policyholders can report claims online, over the phone, or through the Geico mobile app. Geico’s claims adjusters are known for their expertise and dedication to resolving claims promptly and fairly.

Geico offers multiple claim options, including direct repair through their network of preferred shops, which ensures quality repairs and timely turnaround. They also provide rental car coverage and assist with temporary housing if necessary. The company's focus on customer convenience and satisfaction is evident in their claim handling process.

Customer Service and Support

Geico’s customer service team is highly trained and readily available to assist policyholders with any inquiries or concerns. They offer 24⁄7 support, ensuring that you can reach a representative anytime, day or night. Whether you have questions about your policy, need assistance with a claim, or require general insurance advice, Geico’s customer service team is dedicated to providing prompt and helpful responses.

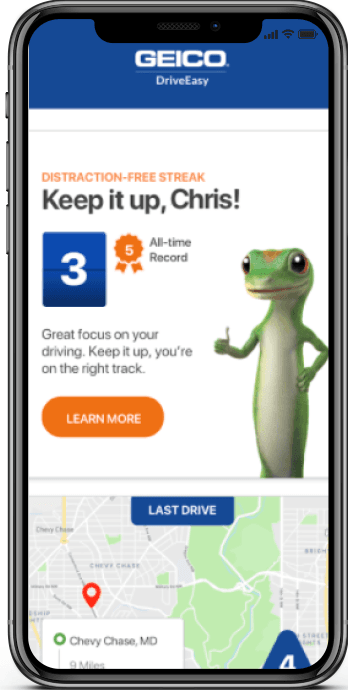

In addition to traditional support channels, Geico offers innovative digital tools and resources. Their mobile app allows policyholders to manage their policies, make payments, and access important documents on the go. The app also includes a digital ID card, making it convenient to provide proof of insurance whenever needed.

Online Tools and Resources

Geico understands the importance of empowering customers with knowledge and access to information. Their website is a comprehensive resource, providing detailed explanations of coverages, helpful articles, and interactive tools. Policyholders can easily navigate the site to learn more about their policies and make informed decisions.

Geico's online quote tool is particularly impressive, allowing users to compare rates and customize their coverage options. This transparency and ease of use have contributed to Geico's reputation as a trusted and customer-centric insurance provider.

Community Engagement and Social Responsibility

Beyond its insurance offerings, Geico actively engages with communities and promotes social responsibility. The company supports various charitable initiatives and partners with organizations dedicated to making a positive impact. This commitment to giving back further enhances Geico’s reputation as a responsible and caring business.

Conclusion: Why Choose Geico for Your Car Insurance Needs

Geico car insurance stands out for its comprehensive coverage options, competitive pricing, and exceptional customer experience. From their wide range of customizable policies to their efficient claim handling and dedicated customer service, Geico has established itself as a trusted and reliable insurance provider.

By offering transparent pricing, innovative digital tools, and a commitment to customer satisfaction, Geico ensures that policyholders receive the protection they need and the support they deserve. Whether you're a safe driver looking for affordable coverage or someone seeking comprehensive protection, Geico has the expertise and resources to meet your needs.

As you navigate the world of car insurance, Geico's reputation and track record speak for themselves. With a focus on providing value, convenience, and peace of mind, Geico is a top choice for drivers seeking a reliable and customer-centric insurance experience.

Can I customize my Geico car insurance policy to fit my specific needs?

+Absolutely! Geico offers a wide range of coverage options and customizable limits, allowing you to tailor your policy to your specific needs and budget. Whether you’re looking for basic liability coverage or want to add comprehensive and collision coverage, Geico provides the flexibility to create a policy that suits your driving habits and preferences.

How can I save money on my Geico car insurance policy?

+Geico offers various discounts to help you save on your car insurance. These include multi-policy discounts, military discounts, good driver discounts, and more. By combining your auto insurance with other policies or maintaining a clean driving record, you can significantly reduce your premium. Additionally, paying your premium in full upfront and exploring other eligible discounts can lead to additional savings.

What should I do if I need to file a claim with Geico?

+In the event of an accident or incident, you can file a claim with Geico by contacting their customer service team, either online or over the phone. Geico’s dedicated claims adjusters will guide you through the process, ensuring a smooth and efficient resolution. You can also report claims through their mobile app, making the process even more convenient.

How can I access my Geico policy information and make changes?

+Geico provides a user-friendly online platform and mobile app where you can access your policy information anytime. You can manage your policy, make payments, and update your personal details. Additionally, their website offers a wealth of resources and tools to help you understand your coverage and make informed decisions.

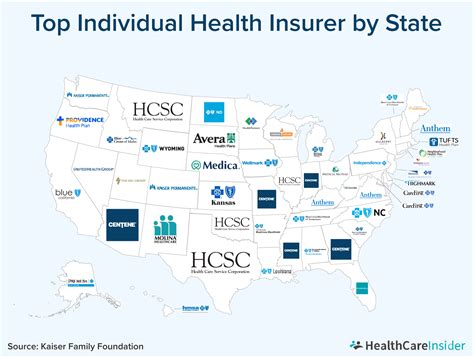

Is Geico insurance available in my state?

+Geico offers car insurance in all 50 states and Washington, D.C. However, coverage options and availability may vary depending on your specific location. It’s best to check with Geico’s website or contact their customer service team to confirm the availability of their services in your state and explore the coverages that meet your local requirements.