Different Types Of Life Insurance

Unveiling the Essentials: Navigating the Diverse Landscape of Life Insurance

In the intricate world of financial planning, life insurance stands as a cornerstone, offering a safety net for both the policyholder and their loved ones. With a myriad of options available, understanding the nuances of different life insurance types is crucial. This comprehensive guide aims to demystify the landscape, providing you with the insights needed to make informed decisions tailored to your unique circumstances.

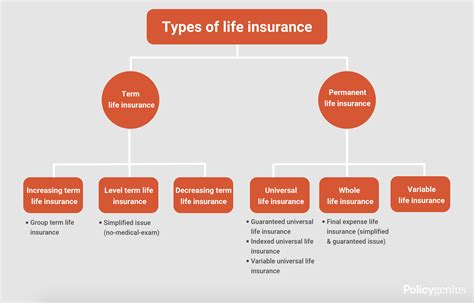

The Fundamentals: Term Life Insurance

Term life insurance, often considered the simplest form, provides coverage for a specified period, known as the term. Typically, this term ranges from 10 to 30 years, offering a cost-effective solution for those seeking protection during key life stages, such as raising a family or paying off a mortgage.

Key Features of Term Life Insurance

- Coverage Duration: Policies can be customized to align with specific life goals, offering protection for a defined term.

- Affordability: Known for its budget-friendly premiums, term life insurance is an attractive option for those on a tight financial leash.

- Renewal Options: Many policies allow for renewal, providing flexibility as life circumstances evolve.

While term life insurance is a straightforward choice, it's essential to recognize its limitations. Coverage expires at the end of the term, and policyholders may face higher premiums upon renewal, especially if their health status has changed.

Permanent Life Insurance: A Lifetime Commitment

Unlike term insurance, permanent life insurance is designed to offer coverage for the policyholder's entire life, providing a more comprehensive solution. This category includes various subtypes, each catering to distinct financial needs and goals.

Whole Life Insurance: The Classic Choice

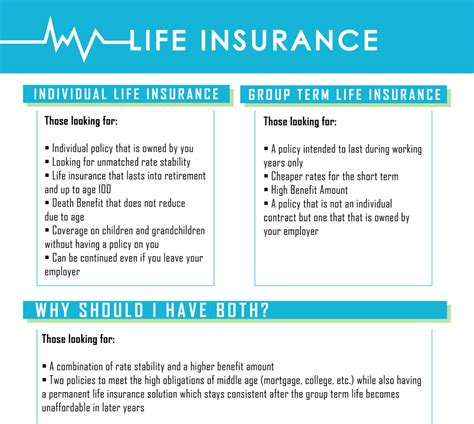

Whole life insurance, a traditional form of permanent insurance, boasts a straightforward structure. It provides coverage for the policyholder's lifetime, with premiums remaining consistent throughout.

- Guaranteed Protection: Policyholders can rest assured knowing their coverage is secure for life.

- Cash Value Accumulation: Whole life policies accrue a cash value, which can be borrowed against or withdrawn.

- Fixed Premiums: Premiums remain unchanged, making budgeting easier.

However, whole life insurance often comes with a higher price tag compared to term insurance, making it less accessible for those on a budget.

Universal Life Insurance: Flexibility at its Finest

Universal life insurance offers a more flexible approach, allowing policyholders to adjust their premiums and coverage amounts as their financial situation changes. This adaptability makes it an attractive option for those seeking customization.

- Premium Flexibility: Policyholders can increase or decrease premiums based on their needs.

- Coverage Adjustments: The amount of coverage can be altered to align with changing circumstances.

- Cash Value: Similar to whole life, universal policies accrue cash value, providing financial flexibility.

Despite its advantages, universal life insurance may be more complex to understand and manage, requiring regular adjustments to maintain optimal coverage.

Variable Life Insurance: Investing with Protection

Variable life insurance combines the traditional benefits of life insurance with the potential for investment growth. Policyholders can allocate their premiums to various investment options, allowing for the possibility of higher returns.

- Investment Opportunities: Premiums can be invested in stocks, bonds, and other financial instruments.

- Variable Premiums: The cost of coverage may fluctuate based on investment performance.

- Lifetime Coverage: Like other permanent policies, variable life insurance provides protection for the policyholder's entire life.

While offering the potential for significant gains, variable life insurance also carries higher risks, as investment performance can lead to either substantial rewards or losses.

Group Life Insurance: A Common Benefit

Group life insurance is often provided as an employment benefit, offering coverage to a group of individuals, typically employees of a company. This type of insurance is known for its affordability and simplicity, as it requires minimal underwriting.

Key Advantages of Group Life Insurance

- Cost-Effectiveness: Group policies are generally more budget-friendly compared to individual plans.

- Convenience: Employees can easily enroll in the plan, often without extensive medical examinations.

- Additional Benefits: Some group policies offer extra perks, such as accelerated benefit options or critical illness coverage.

However, group life insurance often comes with limited coverage amounts, and individuals may face challenges in porting the policy if they leave their employment.

Final Thoughts: Choosing the Right Fit

Navigating the diverse world of life insurance requires a thoughtful approach, considering both immediate and long-term financial goals. Whether it's the simplicity of term insurance, the security of permanent coverage, or the investment potential of variable policies, each type serves a unique purpose.

By understanding the nuances of these insurance types and their respective advantages and limitations, individuals can make informed decisions, ensuring they secure the protection they need to navigate life's unpredictable journey.

What is the main difference between term and permanent life insurance?

+

The primary distinction lies in the duration of coverage. Term life insurance offers protection for a specified period, while permanent life insurance, including whole life, universal life, and variable life, provides coverage for the policyholder’s entire life.

Are there any tax benefits associated with life insurance policies?

+

Yes, certain life insurance policies, particularly whole life and universal life, offer tax advantages. The cash value within these policies can grow tax-deferred, and withdrawals or loans against the cash value may be tax-free if certain conditions are met.

Can I convert my term life insurance policy into a permanent one?

+

Absolutely! Many term life insurance policies come with a conversion privilege, allowing policyholders to convert their term policy into a permanent one without undergoing a new medical exam. This provides a seamless transition for those seeking long-term coverage.