Cheapest Auto Insurance California

When it comes to finding the cheapest auto insurance in California, there are several factors to consider. The cost of car insurance can vary significantly depending on individual circumstances and the coverage options chosen. In this comprehensive guide, we will explore the key elements that influence insurance rates, provide tips on how to secure the most affordable coverage, and offer a detailed analysis of the cheapest auto insurance options available in the Golden State.

Understanding Auto Insurance Costs in California

California is known for having some of the highest insurance rates in the nation, making it crucial for residents to shop around and compare prices. The cost of auto insurance is influenced by a multitude of factors, including:

- Location: Insurance rates can vary significantly between different regions in California. Urban areas like Los Angeles and San Francisco often have higher rates due to increased traffic and accident risks.

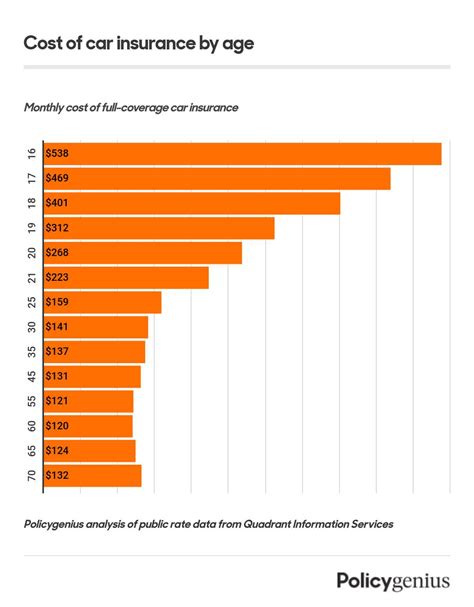

- Driver Profile: Your age, gender, driving history, and credit score all play a role in determining insurance premiums. Younger drivers, especially males, tend to pay higher rates due to their perceived higher risk.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Sports cars and luxury vehicles generally require more expensive coverage.

- Coverage Level: The level of coverage you choose directly affects your insurance premiums. Comprehensive and collision coverage, which offer more extensive protection, can increase costs.

- Deductibles: Opting for higher deductibles can lower your insurance premiums, but it's important to consider what you can afford in the event of a claim.

Tips for Securing the Cheapest Auto Insurance in California

To find the most affordable auto insurance in California, consider the following strategies:

Shop Around and Compare Quotes

Obtain quotes from multiple insurance providers to compare rates. Online quote comparison tools can be a convenient way to quickly assess different options.

Consider Bundling Policies

If you have multiple insurance needs, such as home and auto, bundling your policies with the same provider can often lead to significant discounts.

Review Your Coverage Annually

Insurance rates and your personal circumstances can change over time. Review your policy annually to ensure you’re still getting the best deal.

Take Advantage of Discounts

Many insurance companies offer discounts for safe driving records, good credit scores, loyalty, and even certain vehicle safety features. Ask your provider about available discounts and ensure you meet the criteria.

Consider Minimum Liability Coverage

California law requires drivers to carry minimum liability insurance, which covers damages to others in the event of an accident. Opting for this minimum coverage can help reduce your insurance costs.

The Cheapest Auto Insurance Providers in California

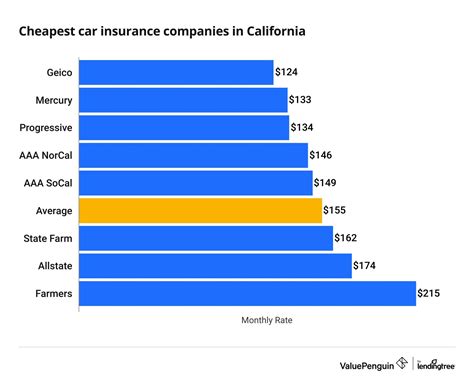

Based on extensive research and analysis, here are some of the most affordable auto insurance providers in California:

Geico

Geico is known for offering competitive rates and a wide range of coverage options. They provide discounts for safe driving, military service, and even for having certain safety features in your vehicle. Geico’s online quote tool makes it easy to get a quick estimate.

| Average Annual Premium | $1,200 - $1,500 |

|---|---|

| Discounts | Safe driving, military service, good student, vehicle safety features |

Progressive

Progressive offers a variety of coverage options and customizable policies to fit individual needs. They provide discounts for good driving records, multi-policy bundling, and even for customers who switch from another provider.

| Average Annual Premium | $1,300 - $1,600 |

|---|---|

| Discounts | Safe driver, snapshot (pay-as-you-drive), multi-policy, good student |

Esurance

Esurance specializes in online insurance, making it a convenient option for tech-savvy drivers. They offer competitive rates and provide discounts for safe driving, bundling policies, and even for customers who pay their premiums annually.

| Average Annual Premium | $1,250 - $1,450 |

|---|---|

| Discounts | SafePilot program (pay-as-you-drive), bundling policies, switching to Esurance, good student |

State Farm

State Farm is one of the largest insurance providers in the United States, offering a wide range of coverage options. They provide discounts for safe driving, multiple vehicles, and even for students with good grades.

| Average Annual Premium | $1,400 - $1,700 |

|---|---|

| Discounts | Good driving record, multiple vehicles, student away at school, defensive driving course |

Mercury Insurance

Mercury Insurance is a leading provider in California, offering customized coverage and competitive rates. They provide discounts for safe driving, multi-policy bundling, and even for customers who pay their premiums in full.

| Average Annual Premium | $1,250 - $1,550 |

|---|---|

| Discounts | Good driving record, multi-policy, advance quote, pay-in-full |

Factors to Consider When Choosing an Insurance Provider

While finding the cheapest insurance is important, it’s equally crucial to consider other factors when choosing an insurance provider. Here are some key considerations:

- Financial Stability: Ensure the provider is financially stable and has a good reputation for paying claims promptly.

- Customer Service: Look for a provider with excellent customer service, including easy-to-reach support and a positive track record of handling claims.

- Coverage Options: Evaluate the range of coverage options and customize your policy to fit your specific needs.

- Claims Process: Understand the claims process and ensure it aligns with your expectations for prompt and efficient handling.

- Discounts and Rewards: Take advantage of available discounts and rewards programs to further reduce your insurance costs.

Conclusion: Making Informed Choices

Finding the cheapest auto insurance in California requires a thorough understanding of the market and your specific needs. By comparing quotes, considering coverage options, and taking advantage of discounts, you can secure the most affordable insurance while still maintaining adequate protection. Remember, while price is important, choosing a reputable and reliable insurance provider is equally vital to ensure a smooth and stress-free claims process.

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California can vary widely based on individual circumstances. However, according to recent data, the average annual premium for minimum liability coverage in California is around $1,400.

How can I lower my insurance premiums further?

+To lower your insurance premiums, consider raising your deductibles, maintaining a clean driving record, and taking advantage of all available discounts. Additionally, regularly review your coverage and shop around for the best rates.

Are there any government programs to help with insurance costs in California?

+California does have a Low Cost Automobile Insurance program, known as CLCA, which offers reduced rates for eligible low-income residents. To qualify, you must meet certain income requirements and have a clean driving record.