Optical Insurance Plans

Optical insurance plans, also known as vision insurance, are a crucial component of comprehensive healthcare coverage. They provide individuals with access to affordable and essential eye care services, including regular eye examinations, prescription eyeglasses, contact lenses, and sometimes even specialized treatments. In today's fast-paced world, where visual health is often overlooked, these plans play a vital role in ensuring that people maintain good eye health and vision.

This comprehensive guide aims to delve deep into the world of optical insurance plans, exploring their intricacies, benefits, and how they can be tailored to meet the unique needs of individuals and families. By understanding the features and advantages of these plans, readers can make informed decisions about their visual healthcare and ensure they have the coverage they need.

Understanding Optical Insurance Plans

Optical insurance plans are specialized health insurance policies designed to cover eye-related medical expenses. These plans typically offer a range of benefits, from annual eye exams and lens prescriptions to discounts on eye surgeries and treatments. The primary goal of these plans is to promote preventive eye care, ensuring that potential issues are detected early and treated effectively.

One of the key advantages of optical insurance is the emphasis on regular eye examinations. These exams are crucial for detecting conditions such as glaucoma, cataracts, and diabetic retinopathy, which can lead to vision loss if left untreated. By encouraging individuals to have their eyes examined annually, these plans contribute significantly to the early diagnosis and management of eye diseases.

Types of Optical Insurance Plans

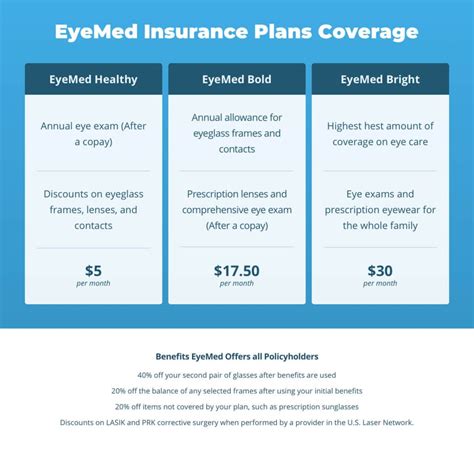

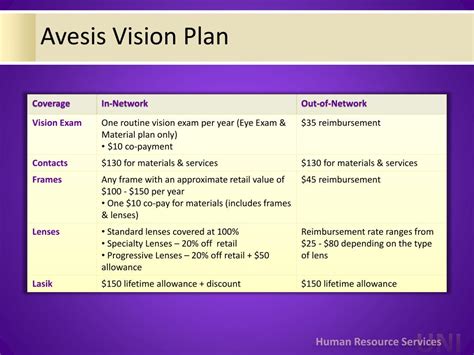

There are several types of optical insurance plans available, each with its own set of features and coverage options. Understanding the different types can help individuals choose the plan that best suits their needs and preferences.

- Indemnity Plans: These plans offer the most flexibility, allowing individuals to choose their own eye care providers and services. The insurance company typically reimburses a certain percentage of the costs, up to a maximum annual benefit.

- Managed Vision Care Plans: These plans are more structured and often include a network of preferred providers. Members usually pay a set copayment for services, and the plan covers the remainder. The network of providers ensures that costs are kept under control, making eye care more affordable.

- Discount Vision Plans: Unlike traditional insurance, discount plans provide members with access to reduced rates on eye care services. Members pay an annual fee to join the plan and then receive discounts on exams, glasses, and other services. While these plans don't offer direct reimbursement, they can still save individuals a significant amount of money.

The choice between these plan types depends on various factors, including an individual's preferred eye care provider, the level of coverage needed, and their budget. It's essential to carefully review the plan's details, including the covered services, provider network, and any limitations or exclusions, to ensure it aligns with one's specific eye care needs.

Key Benefits of Optical Insurance Plans

Optical insurance plans offer a wide range of benefits that extend beyond just covering the cost of eye exams and glasses. These plans are designed to provide comprehensive eye care coverage, ensuring individuals receive the necessary services to maintain good visual health.

Annual Eye Examinations

One of the primary benefits of optical insurance is the coverage for annual eye examinations. These exams are crucial for monitoring eye health and detecting any potential issues early on. During these comprehensive evaluations, eye care professionals check for refractive errors (such as nearsightedness or farsightedness), assess the overall health of the eyes, and screen for common eye diseases like glaucoma and macular degeneration.

| Eye Examination Components | Description |

|---|---|

| Visual Acuity Test | Measures the sharpness of vision, often done with an eye chart. |

| Refraction Test | Determines the need for corrective lenses and prescribes the correct lens power. |

| Eye Health Evaluation | Inspects the eye's exterior and interior structures for signs of disease or abnormalities. |

| Pupil Function and Eye Muscle Testing | Assesses the pupils' response to light and the eye muscles' alignment and movement. |

| Glaucoma Screening | Measures the pressure inside the eye to detect the risk of glaucoma. |

By covering the cost of these examinations, optical insurance plans encourage individuals to prioritize their eye health and detect any issues early when they are often more treatable. Regular eye exams are especially crucial for children, as they can help identify vision problems that may impact learning and development.

Prescription Eyeglasses and Contact Lenses

Optical insurance plans typically provide coverage for prescription eyeglasses and contact lenses. This coverage can include a reimbursement for the cost of frames, lenses, and even specialized coatings or treatments. For contact lens wearers, the plans often cover the cost of the lenses themselves and may also include a benefit for contact lens solutions and supplies.

The specific coverage for eyeglasses and contact lenses can vary depending on the plan. Some plans may offer a fixed allowance or reimbursement amount, while others may provide a more comprehensive benefit, covering a higher percentage of the costs. It's essential to review the plan's details to understand the exact coverage for these vision correction options.

Vision Correction Procedures

In addition to covering the cost of traditional vision correction methods like glasses and contacts, some optical insurance plans also offer benefits for vision correction procedures such as LASIK and PRK. These procedures, which use lasers to reshape the cornea, can provide a long-term solution for vision problems and reduce or eliminate the need for glasses or contacts.

The coverage for vision correction procedures can vary significantly between plans. Some plans may offer a fixed allowance or a limited number of procedures, while others may provide more comprehensive coverage. It's crucial to carefully review the plan's benefits to understand the extent of coverage for these procedures and any associated limitations or exclusions.

Other Covered Services

Optical insurance plans can also provide coverage for a range of other eye-related services and treatments. These may include:

- Eye emergencies and urgent care services

- Treatment for eye injuries or infections

- Specialized eye tests and diagnostics

- Low vision aids and devices

- Vision therapy and eye training

- Ocular disease management and treatment

The exact coverage for these additional services can vary depending on the plan and the individual's specific needs. It's essential to review the plan's benefits and limitations to understand the scope of coverage for these less common but potentially crucial eye care services.

Choosing the Right Optical Insurance Plan

Selecting the right optical insurance plan is a critical decision that can significantly impact one’s eye health and financial well-being. With a vast array of plan options available, it’s essential to consider various factors to ensure the chosen plan aligns with individual needs and preferences.

Assessing Personal Eye Care Needs

The first step in choosing an optical insurance plan is to assess one’s personal eye care needs. Consider the following questions:

- Do you require regular eye examinations due to a history of eye issues or family risk factors?

- Are you interested in vision correction procedures like LASIK or PRK in the future?

- Do you wear prescription eyeglasses or contact lenses, and do you need frequent replacements or upgrades?

- Are there any specific eye conditions or diseases that run in your family, requiring specialized care or treatments?

By evaluating your unique eye care needs, you can narrow down the types of plans that will provide the most comprehensive coverage and value.

Comparing Plan Features and Benefits

Once you have a clear understanding of your eye care needs, it’s time to compare the features and benefits of different optical insurance plans. Key considerations include:

- Coverage: Review the plan's coverage for eye examinations, prescription lenses, and any additional services or treatments you may require.

- Provider Network: Check if your preferred eye care providers are in-network, as this can significantly impact your out-of-pocket costs.

- Cost: Consider the plan's premium, copayments, deductibles, and any other out-of-pocket expenses. Balance the cost with the plan's benefits to ensure it fits within your budget.

- Limitations and Exclusions: Read the fine print to understand any limitations or exclusions, such as age restrictions, pre-existing condition clauses, or maximum benefit amounts.

- Flexibility: Assess if the plan allows for flexibility in choosing providers and services, or if it is more restrictive in its coverage options.

Taking the time to thoroughly compare plans and their features can help you make an informed decision and ensure you have the right coverage for your eye health needs.

Reading Plan Reviews and Ratings

Before finalizing your choice, it’s beneficial to read reviews and ratings from other plan members. Online forums, insurance review websites, and even social media platforms can provide valuable insights into the quality of service, customer satisfaction, and overall experience with the plan.

Pay attention to feedback on the plan's ease of use, customer service responsiveness, and claim processing efficiency. Positive reviews can indicate a plan's reliability and trustworthiness, while negative reviews may highlight potential issues or areas for improvement.

Optical Insurance Plans and Employer-Sponsored Coverage

Many individuals receive their optical insurance coverage through employer-sponsored plans. These plans are often more cost-effective and provide a higher level of coverage compared to individual plans purchased directly from insurance companies.

Advantages of Employer-Sponsored Plans

Employer-sponsored optical insurance plans offer several advantages, including:

- Cost Savings: These plans are typically more affordable than individual plans, as employers often subsidize a portion of the premium. Additionally, employees may have access to group rates, further reducing the cost.

- Comprehensive Coverage: Employer-sponsored plans often provide a higher level of coverage, including a broader range of services and benefits. This can include more generous allowances for eyeglasses and contact lenses, as well as coverage for vision correction procedures.

- Convenience: Employees can enroll in the plan directly through their employer, simplifying the process and reducing administrative burdens. The plan is often automatically renewed each year, providing continuity of coverage.

- Tailored Benefits: Some employers work with insurance providers to customize the plan's benefits to better meet the needs of their workforce. This can include adding specific services or increasing coverage limits for certain eye care procedures.

Employer-sponsored optical insurance plans are an excellent option for individuals who are eligible for this coverage. By taking advantage of these plans, employees can access affordable and comprehensive eye care services, ensuring they maintain good visual health.

Understanding Enrollment and Coverage Periods

When enrolling in an employer-sponsored optical insurance plan, it’s important to understand the enrollment process and coverage periods. Most employers offer open enrollment periods once a year, during which employees can select or change their insurance coverage, including vision plans.

During open enrollment, employees can review the available plan options, compare benefits and costs, and make informed decisions about their coverage. It's crucial to take advantage of this period to ensure you have the right plan for your eye care needs.

If you miss the open enrollment period or experience a qualifying life event (such as marriage, birth of a child, or loss of other coverage), you may be eligible for a special enrollment period. During this time, you can enroll in or change your vision plan outside of the regular open enrollment window.

Maximizing Your Optical Insurance Benefits

Once you’ve selected the right optical insurance plan, it’s essential to make the most of your benefits to ensure you receive the best possible eye care. Here are some tips to maximize your coverage and get the most value from your plan:

Stay Informed about Your Plan’s Benefits

Take the time to thoroughly review your plan’s summary of benefits and coverage details. Understand what services are covered, any limitations or exclusions, and any specific requirements or procedures for obtaining benefits. This knowledge will help you make informed decisions about your eye care and ensure you receive the full value of your plan.

Choose In-Network Providers

If your plan includes a network of preferred providers, it’s generally more cost-effective to choose an in-network eye care professional. In-network providers have agreed to accept the plan’s negotiated rates, which can result in lower out-of-pocket costs for you. Check your plan’s directory to find in-network providers in your area, and consider asking your current eye doctor if they participate in your plan’s network.

Utilize Preventive Care Benefits

Optical insurance plans often cover a range of preventive care services, such as annual eye examinations, glaucoma screenings, and vision tests for children. Take advantage of these benefits to ensure your eyes are healthy and to detect any potential issues early on. Regular preventive care can help you avoid more serious and costly eye problems down the line.

Understand Your Plan’s Cost-Sharing Structure

Most optical insurance plans have a cost-sharing structure, which means you’ll be responsible for a portion of the costs. This may include copayments, deductibles, or coinsurance. Understanding these costs and how they work can help you budget for your eye care expenses and avoid any unexpected financial surprises.

Keep Track of Your Claims and Benefits

Stay organized by keeping track of your claims and the benefits you’ve utilized. This will help you understand how much of your annual benefit allowance you’ve used and how much is remaining. It will also allow you to identify any potential issues with claim processing and ensure you receive the full coverage you’re entitled to.

Consider Supplemental Coverage

If your optical insurance plan has limitations or doesn’t cover certain services or procedures you require, consider supplemental coverage. This can include adding a vision rider to your health insurance policy or purchasing a stand-alone vision plan to fill in any gaps in your primary coverage. Supplemental coverage can provide additional peace of mind and ensure you have the comprehensive eye care you need.

The Future of Optical Insurance

The field of optical insurance is constantly evolving to meet the changing needs of individuals and the advancements in eye care technology. As we move forward, several trends and developments are shaping the future of optical insurance plans.

Integration with Digital Health Technologies

The integration of digital health technologies is transforming the way eye care is delivered and accessed. Optical insurance plans are beginning to cover a wider range of digital health services, including telemedicine consultations, online vision tests, and digital eye tracking systems. These technologies enhance accessibility, especially for individuals in remote areas or with limited mobility, and can provide more efficient and cost-effective eye care solutions.

Focus on Preventive Care and Early Detection

Optical insurance plans are increasingly emphasizing the importance of preventive care and early detection of eye diseases. This shift is driven by the understanding that early intervention can significantly improve outcomes and reduce the long-term costs associated with managing chronic eye conditions. Plans are likely to continue expanding their coverage for preventive services and encouraging members to prioritize regular eye examinations.

Personalized Vision Care Plans

The future of optical insurance plans lies in personalization. Insurers are developing more sophisticated algorithms and risk assessment tools to tailor plans to individual needs. These plans will take into account an individual’s age, gender, family history, and lifestyle factors to offer personalized recommendations for eye care services and treatments. This level of customization will ensure that members receive the most appropriate and cost-effective care for their specific eye health needs.

Increased Coverage for Vision Correction Procedures

As vision correction procedures like LASIK and PRK become more accessible and effective, optical insurance plans are expected to increase their coverage for these procedures. While some plans already offer benefits for these procedures, future plans are likely to provide more comprehensive coverage, making these procedures more affordable and accessible to a wider range of individuals.

How do I know if I need optical insurance?

+Optical insurance can be beneficial for anyone, but it’s especially important for those who require regular eye examinations, wear prescription lenses, or have a family history of eye diseases. It provides peace of