Get Quote For Auto Insurance

Securing an auto insurance quote is an essential step in ensuring your vehicle and yourself are adequately protected on the road. This process involves understanding your options, evaluating different providers, and making informed decisions based on your specific needs. In this comprehensive guide, we will delve into the world of auto insurance quotes, providing you with expert insights and practical tips to navigate the process with confidence.

Understanding Auto Insurance Quotes

An auto insurance quote is an estimate of the cost you’ll pay for insurance coverage. It takes into account various factors, including your personal details, vehicle information, driving history, and the level of coverage you require. Obtaining multiple quotes allows you to compare providers and find the best value for your money.

Key Factors Influencing Quotes

When requesting quotes, insurance companies consider several key factors to assess your risk profile and determine the premium. These factors include:

- Age and Gender: Younger drivers and those under 25 are often considered higher risk, resulting in higher premiums. Gender can also impact rates, with some providers offering more favorable rates to women.

- Location: The area where you live and drive plays a significant role. Urban areas with higher traffic and crime rates often lead to increased premiums.

- Driving Record: A clean driving history is advantageous. Tickets, accidents, and DUIs can raise your insurance costs significantly.

- Vehicle Type: The make, model, and year of your vehicle influence the quote. Sports cars and luxury vehicles typically require higher coverage, impacting the premium.

- Coverage Limits: The level of coverage you choose affects the quote. Higher liability limits and comprehensive coverage options can increase the cost.

Comparing Quotes: A Comprehensive Approach

To make an informed decision, it’s crucial to compare quotes from multiple providers. Here’s a step-by-step guide to help you navigate the process effectively:

- Identify Your Needs: Determine the type of coverage you require. Consider liability, collision, comprehensive, and additional coverage options like rental car reimbursement or roadside assistance.

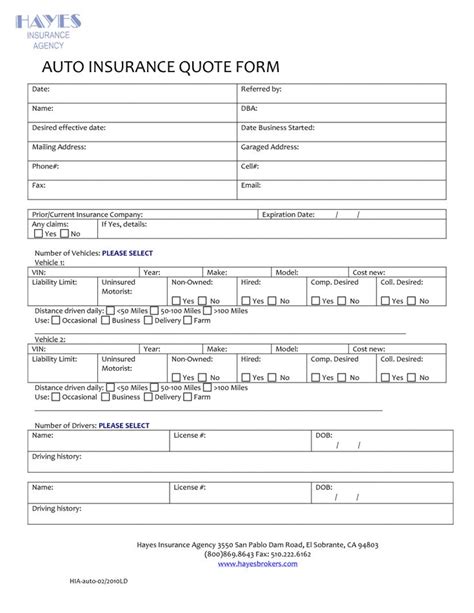

- Gather Information: Have your vehicle’s make, model, and VIN handy. Provide accurate details about your driving history and any additional drivers.

- Use Online Quote Tools: Many insurance companies offer online quote generators. These tools provide a quick and convenient way to get initial estimates.

- Contact Providers: Reach out to reputable insurance companies or brokers. Discuss your needs and request personalized quotes. Ensure you understand the coverage details and any exclusions.

- Compare Apples to Apples: When comparing quotes, ensure you’re comparing similar coverage levels. Pay attention to deductibles, coverage limits, and any additional benefits or discounts offered.

- Review Discounts: Insurance companies often provide discounts for various reasons, such as good driving records, safety features in your vehicle, or multi-policy bundles. Inquire about available discounts to lower your premium.

- Consider Reputation and Service: While cost is important, don’t forget to assess the provider’s reputation and customer service. Look for reviews and ratings to ensure you’re choosing a reliable insurer.

Tailoring Your Auto Insurance Coverage

Auto insurance is not a one-size-fits-all solution. It’s essential to customize your coverage to match your specific needs and circumstances. Here are some considerations to help you tailor your policy:

Assessing Your Risk Profile

Evaluate your risk factors and adjust your coverage accordingly. If you have a clean driving record and live in a low-risk area, you may opt for higher deductibles and lower coverage limits to save on premiums.

Balancing Cost and Coverage

Strike a balance between the cost of your insurance and the level of protection it provides. While it’s tempting to choose the cheapest option, ensure you have adequate coverage for your vehicle and liability risks.

Additional Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages you cause to others’ property or injuries you cause to others in an accident. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault. |

| Comprehensive Coverage | Covers non-collision-related incidents like theft, vandalism, natural disasters, or damage from animals. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who has no or insufficient insurance. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

The Future of Auto Insurance Quotes

The auto insurance industry is evolving, and technology is playing a significant role in shaping the future of quotes. Here’s a glimpse into the potential advancements:

Telematics and Usage-Based Insurance

Telematics devices and smartphone apps are being used to monitor driving behavior and provide personalized insurance rates. This pay-as-you-drive or pay-how-you-drive model offers incentives for safe driving and can lead to lower premiums for responsible drivers.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are enhancing the accuracy of risk assessment. These technologies can analyze vast amounts of data, including driving patterns, weather conditions, and accident trends, to provide more precise quotes and tailored coverage options.

Digital Transformation

The shift towards digital insurance platforms and online quote tools is streamlining the process. Insurers are investing in user-friendly interfaces and chatbots to provide instant quotes and personalized recommendations, making it easier for consumers to compare options and make informed decisions.

Frequently Asked Questions

How often should I review my auto insurance policy and quotes?

+

It’s recommended to review your policy and quotes annually, especially when your policy renews. This allows you to stay updated with any changes in your personal circumstances, vehicle, or coverage needs. Additionally, reviewing quotes regularly can help you identify potential savings or better coverage options.

Can I negotiate auto insurance quotes?

+

While insurance quotes are typically based on standardized rates, you can negotiate certain aspects of your policy. Discuss any discounts you may be eligible for, such as multi-policy discounts or loyalty rewards. Additionally, if you have a long-standing relationship with an insurer, you can inquire about potential rate adjustments.

What happens if I switch auto insurance providers mid-policy term?

+

Switching providers mid-term is possible, but it may result in a refund or additional charges. If you’ve paid your premium in full, you may receive a partial refund for the unused portion of your policy. However, if you’ve paid monthly, you may incur cancellation fees or be required to pay the remaining balance.

Are there any hidden costs associated with auto insurance quotes?

+

While insurance quotes provide a good estimate of your premium, there may be additional costs or fees. These can include policy fees, administrative charges, or surcharges for specific coverage options. It’s important to review the policy details and ask your insurer about any potential hidden costs.

Obtaining an auto insurance quote is the first step towards ensuring your peace of mind and financial protection on the road. By understanding the factors that influence quotes, comparing providers, and tailoring your coverage, you can make informed decisions to secure the best value for your insurance needs. Stay informed, stay safe, and drive with confidence.