Driving Liability Insurance

Driving liability insurance is a crucial aspect of vehicle ownership and operation, offering financial protection to drivers and safeguarding them from potentially devastating financial consequences. This type of insurance provides coverage for various scenarios, including property damage, bodily injury, and legal expenses that may arise from accidents or incidents involving the insured vehicle. With a comprehensive understanding of driving liability insurance, drivers can make informed decisions to protect themselves and their assets.

Understanding Driving Liability Insurance

Driving liability insurance, often referred to as auto liability insurance, is a mandatory coverage type for vehicle owners in many regions. It serves as a vital safeguard, ensuring that drivers are financially prepared to handle the aftermath of accidents, thereby reducing the risk of financial ruin. This insurance type is designed to cover a range of potential liabilities, providing a safety net for drivers in the face of unforeseen circumstances.

Coverage Details

Driving liability insurance typically includes two main components: bodily injury liability and property damage liability. Bodily injury liability coverage protects the insured driver from financial claims resulting from injuries sustained by others in an accident caused by the insured vehicle. Property damage liability, on the other hand, covers damages to other people’s property, such as vehicles, structures, or personal belongings, caused by the insured vehicle.

In addition to these fundamental coverages, some driving liability insurance policies may also include personal injury protection (PIP) or medical payments coverage. PIP provides coverage for medical expenses, loss of income, and other related costs for the insured driver and passengers, regardless of fault. Medical payments coverage, as the name suggests, specifically covers medical expenses for the insured and their passengers.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers injuries sustained by others in an accident caused by the insured vehicle. |

| Property Damage Liability | Covers damage to other people's property caused by the insured vehicle. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses, loss of income, and other costs for the insured and passengers. |

| Medical Payments Coverage | Specifically covers medical expenses for the insured and their passengers. |

Benefits and Importance of Driving Liability Insurance

Driving liability insurance is not just a legal requirement; it is an essential tool for managing financial risks associated with vehicle ownership. The benefits and importance of this type of insurance are multifaceted and far-reaching.

Financial Protection

The primary benefit of driving liability insurance is the financial protection it provides. In the event of an accident, the costs associated with property damage, bodily injuries, and legal proceedings can be astronomical. Driving liability insurance ensures that these expenses are covered, up to the policy limits, providing peace of mind and financial security.

For instance, if an insured driver causes an accident resulting in severe injuries to another person, the medical expenses, loss of income, and other related costs can quickly accumulate. Without liability insurance, the insured driver would be personally responsible for these expenses, which could easily exceed their financial capabilities. With adequate liability coverage, however, the insurance company steps in to handle these costs, shielding the driver from potential financial ruin.

Legal Compliance and Peace of Mind

In many jurisdictions, driving liability insurance is a legal requirement. By complying with these regulations, drivers not only avoid legal penalties but also ensure they are prepared for the unexpected. This legal compliance provides peace of mind, knowing that they are protected in the event of an accident.

Moreover, driving liability insurance can also protect against lawsuits. In the unfortunate event of an accident, injured parties may seek legal recourse to recover damages. With liability insurance, the insured driver has the backing of their insurance provider to handle these legal matters, including legal defense and settlement costs.

Comparative Analysis

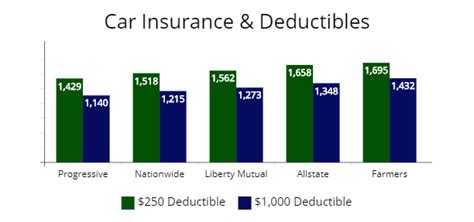

When comparing driving liability insurance policies, it’s crucial to consider the coverage limits, deductibles, and additional benefits offered. Higher coverage limits provide more protection but may result in higher premiums. Deductibles, on the other hand, are the amount the insured pays out-of-pocket before the insurance coverage kicks in. Choosing the right deductible involves a balance between affordability and adequate protection.

Additionally, some insurance providers offer endorsements or add-ons to enhance driving liability insurance. These can include rental car coverage, emergency roadside assistance, or coverage for specific events like hail damage or natural disasters. While these add-ons may increase the policy cost, they can provide valuable additional protection.

Performance and Real-World Scenarios

The performance of driving liability insurance is best evaluated through real-world scenarios and case studies. Understanding how this insurance type has performed in various situations can provide valuable insights into its effectiveness and the level of protection it offers.

Case Study: Bodily Injury Liability

Consider a scenario where an insured driver, while navigating a busy intersection, collides with another vehicle, resulting in severe injuries to the other driver and their passenger. The medical expenses alone could exceed $100,000, not to mention potential loss of income, rehabilitation costs, and other related expenses.

In this case, bodily injury liability coverage would come into play. The insurance provider would step in to cover these expenses, ensuring the insured driver is not personally liable for these astronomical costs. This real-world example highlights the critical role of driving liability insurance in protecting drivers from devastating financial consequences.

Performance Analysis: Property Damage Liability

Property damage liability coverage is equally important. In a different scenario, an insured driver accidentally backs into a luxury car in a parking lot, causing extensive damage. The repair costs for this type of vehicle could easily exceed $20,000. With property damage liability coverage, the insurance company would cover these expenses, saving the insured driver from a significant financial burden.

Performance analysis of driving liability insurance often involves examining the policy's responsiveness, claim handling efficiency, and overall customer satisfaction. Positive feedback and high satisfaction rates indicate that the insurance provider is effectively managing claims and providing the promised protection.

Future Implications and Industry Insights

The landscape of driving liability insurance is constantly evolving, influenced by technological advancements, changing legal frameworks, and shifts in societal needs. Understanding these future implications is essential for drivers to make informed decisions about their insurance coverage.

Technological Advancements

With the rise of autonomous vehicles and advanced driver-assistance systems (ADAS), the role of driving liability insurance is likely to change significantly. As these technologies become more prevalent, insurance providers will need to adapt their policies to account for the reduced risk of human error. This could lead to more specialized coverage options and potentially lower premiums for drivers of autonomous or semi-autonomous vehicles.

Legal and Regulatory Changes

Changes in legal frameworks and regulations can also impact driving liability insurance. For instance, the introduction of stricter liability laws or changes in the definition of negligence could affect the scope and cost of insurance coverage. Staying informed about these legal changes is crucial for drivers to ensure they maintain adequate protection.

Industry Insights and Trends

The insurance industry is constantly evolving, with new trends and innovations shaping the market. One notable trend is the increasing focus on data-driven insurance. Insurance providers are leveraging advanced analytics and machine learning to better understand risk factors and personalize insurance coverage. This trend could lead to more accurate pricing and customized policies, benefiting drivers who exhibit safe driving behaviors.

FAQ

What is the difference between liability insurance and comprehensive insurance?

+

Liability insurance, as discussed in this article, covers damages caused to others, while comprehensive insurance provides broader coverage, including damages to your own vehicle from incidents like theft, vandalism, or natural disasters.

Is driving liability insurance mandatory in all states or regions?

+

Yes, most states or regions have mandatory liability insurance requirements. These requirements vary, but typically include a minimum level of bodily injury and property damage liability coverage. It’s important to check the specific regulations in your area.

How can I choose the right driving liability insurance policy for my needs?

+

Choosing the right policy involves considering your financial capabilities, the value of your vehicle, and your risk tolerance. It’s recommended to compare policies from different providers, considering coverage limits, deductibles, and additional benefits to find the best fit for your needs and budget.

In conclusion, driving liability insurance is a vital component of responsible vehicle ownership, offering financial protection and peace of mind. By understanding the coverage options, benefits, and real-world performance, drivers can make informed decisions to protect themselves and their assets. With the insurance industry’s constant evolution, staying informed about technological advancements, legal changes, and industry trends is essential for maintaining adequate and cost-effective coverage.