Car Insurance For Rentals

Securing car insurance for rental vehicles is an essential aspect of travel planning, ensuring you're covered in the event of an accident or damage. This comprehensive guide will delve into the world of rental car insurance, offering expert insights, practical advice, and a deep dive into the options available to ensure a seamless and protected journey.

Understanding Rental Car Insurance

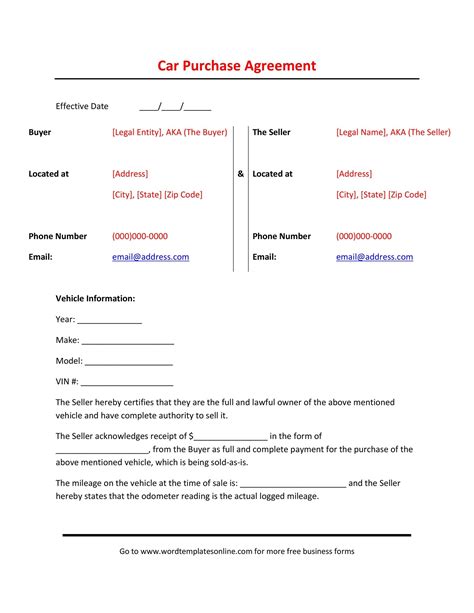

When renting a car, it’s crucial to consider the insurance options provided by the rental company. These policies can vary greatly, and understanding the coverage they offer is key to making an informed decision.

Standard Rental Car Insurance

Most rental companies offer basic liability insurance as a standard inclusion in their rental agreements. This insurance typically covers damage to third parties and their property in the event of an accident. However, it often excludes coverage for the rental vehicle itself, leaving the renter responsible for any repairs or replacement costs.

Here's a breakdown of what standard rental car insurance usually covers:

- Liability Coverage: Pays for damages and injuries caused to others involved in an accident.

- Collision Damage Waiver (CDW): Waives the renter's responsibility for damage to the rental car, except in cases of gross negligence or specified exclusions.

- Theft Protection: Covers the cost of the rental car if it is stolen during the rental period.

While these inclusions offer some peace of mind, it's important to note that CDW and theft protection often come with deductibles, which can be significant. Additionally, standard insurance may not cover personal belongings left in the vehicle or any personal injuries sustained by the renter or passengers.

Optional Insurance Upgrades

To enhance coverage, rental companies often provide optional insurance upgrades, which can be purchased at an additional cost. These upgrades aim to provide more comprehensive protection for the renter and the rental vehicle.

| Optional Coverage | Description |

|---|---|

| Personal Accident Insurance (PAI) | Covers medical expenses and death benefits for the renter and passengers in the event of an accident. |

| Personal Effects Coverage (PEC) | Protects personal belongings left in the rental car against theft or damage. |

| Supplemental Liability Insurance (SLI) | Provides additional liability coverage beyond what is offered in the standard insurance, protecting against higher damage claims. |

| Zero Excess/Deductible Waiver | Removes the deductible amount, ensuring the renter is not responsible for any costs related to vehicle damage. |

It's important to carefully consider these optional upgrades, weighing the potential risks and costs against the benefits they offer. Some upgrades may be more relevant depending on the nature of your trip and the level of protection you desire.

Alternative Insurance Options

Beyond the insurance offerings of rental companies, there are alternative sources of coverage to consider. These options can provide additional peace of mind and may offer more comprehensive protection at potentially lower costs.

Personal Auto Insurance

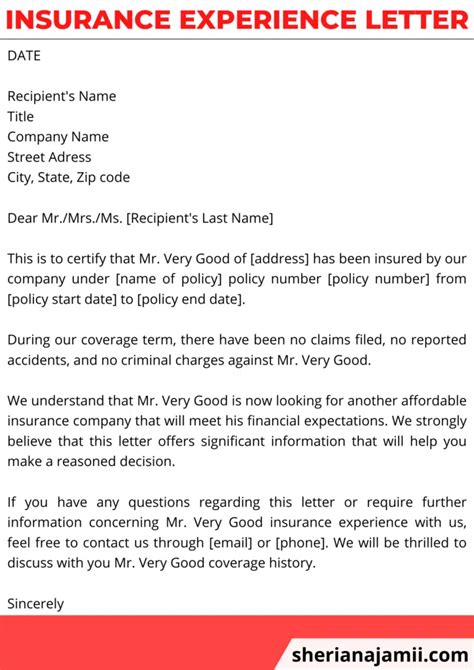

Many personal auto insurance policies extend coverage to rental vehicles. This means that your existing insurance may already provide some level of protection when you rent a car. However, it’s crucial to check the specifics of your policy, as coverage for rental cars often comes with limitations and exclusions.

Here are some key points to consider regarding personal auto insurance for rental cars:

- Collision and Comprehensive Coverage: These coverages may extend to rental vehicles, protecting against damage to the rental car.

- Liability Coverage: Your personal policy may provide additional liability protection beyond what is offered by the rental company.

- Policy Limitations: Check for any daily or trip limits, as well as any exclusions or conditions that may apply when using your policy for rental cars.

Credit Card Insurance

Many credit card companies offer rental car insurance as a benefit to their cardholders. This insurance typically covers collision damage and theft, providing a valuable layer of protection when renting a vehicle.

Consider the following when relying on credit card insurance:

- Eligibility: Check the eligibility requirements, as not all credit cards offer this benefit, and there may be specific conditions or exclusions.

- Coverage Limits: Understand the maximum coverage limits and any deductibles that may apply.

- Primary vs. Secondary Coverage: Determine whether the credit card insurance is primary (pays first) or secondary (pays after your personal insurance or the rental company's insurance has been exhausted).

Travel Insurance

Travel insurance policies often include rental car coverage as part of their comprehensive packages. This coverage can provide protection against a range of incidents, including accidents, theft, and damage.

When considering travel insurance for rental car coverage, keep the following in mind:

- Policy Terms: Review the policy terms carefully to understand the specific coverage, exclusions, and any limitations that may apply.

- Deductibles and Excess: Check for any deductibles or excess amounts that you may be responsible for in the event of a claim.

- Additional Benefits: Travel insurance policies often offer additional benefits, such as emergency medical assistance and trip cancellation coverage, which can further enhance your protection while traveling.

Evaluating Your Insurance Needs

Assessing your insurance needs is a critical step in ensuring you have adequate coverage for your rental car. Consider the following factors to help you make an informed decision:

Trip Duration and Frequency

The length and frequency of your rental car usage can impact the most cost-effective insurance option. For short-term rentals, relying on your personal auto insurance or credit card coverage may be sufficient. However, for longer trips or frequent rentals, purchasing optional insurance from the rental company might be a more practical choice.

Vehicle Value and Risk

The value and type of vehicle you rent can also influence your insurance decision. High-value vehicles or those with specialized features may require more comprehensive coverage to protect against potential losses. Additionally, consider the risk factors associated with the rental location and your driving experience.

Existing Insurance Coverage

Understanding your existing insurance coverage is vital. Review your personal auto insurance policy and any credit card benefits to determine the level of protection you already have for rental cars. This will help you identify any gaps in coverage and make informed decisions about additional insurance needs.

Travel Plans and Activities

Consider the nature of your trip and the activities you plan to engage in. If you’re participating in high-risk activities or traveling to remote locations, you may require more comprehensive insurance coverage to mitigate potential risks.

Making an Informed Decision

Securing the right insurance coverage for your rental car is a crucial aspect of responsible travel planning. By understanding the various insurance options, evaluating your specific needs, and comparing costs and coverage, you can make an informed decision that provides the protection you require.

Remember, while insurance can provide peace of mind, it's always important to drive safely and responsibly. By being a cautious driver, you can further reduce the risks associated with renting a car and ensure a stress-free journey.

FAQ

What happens if I decline insurance at the rental counter?

+Declining insurance at the rental counter means you’ll be financially responsible for any damage or loss to the rental car. This could result in significant out-of-pocket expenses if an accident occurs. It’s important to carefully consider your insurance options before declining coverage.

Can I use my personal auto insurance for rental cars?

+Yes, many personal auto insurance policies extend coverage to rental cars. However, it’s crucial to check the specifics of your policy, as coverage for rental cars often comes with limitations and exclusions. Review your policy carefully to understand the extent of your coverage.

Are there any drawbacks to relying on credit card insurance for rental cars?

+While credit card insurance can provide valuable coverage, there are a few potential drawbacks. Some credit cards offer this benefit only for rentals of a certain duration, and there may be limitations on the type of vehicles covered. Additionally, credit card insurance may not provide the same level of coverage as a dedicated rental car insurance policy.

What should I do if I’m involved in an accident with a rental car?

+If you’re involved in an accident with a rental car, it’s important to follow these steps: (1) Ensure the safety of yourself and others; (2) Call the police to report the accident; (3) Document the scene with photos and notes; (4) Contact the rental company and your insurance provider to notify them of the incident; (5) Cooperate with any investigations and provide accurate information.