How Much Is Insurance For Car

Understanding car insurance costs is crucial for any vehicle owner. The price of insurance for a car is a significant consideration when purchasing a vehicle, as it can vary widely depending on numerous factors. In this article, we will delve into the world of car insurance, exploring the key aspects that influence its cost and providing a comprehensive guide to help you estimate and manage your insurance expenses effectively.

The Factors Influencing Car Insurance Costs

The cost of car insurance is determined by a complex interplay of various factors. These factors are unique to each individual and can significantly impact the final insurance premium. Here’s a breakdown of the primary considerations:

Vehicle Type and Usage

The type of car you drive plays a pivotal role in insurance pricing. Generally, sports cars, high-performance vehicles, and luxury cars are more expensive to insure due to their higher repair costs and the increased risk of accidents. Additionally, the purpose for which you use your vehicle matters. If you primarily drive for work or business purposes, your insurance rates may be higher compared to those who use their cars solely for personal travel.

Driver’s Profile and History

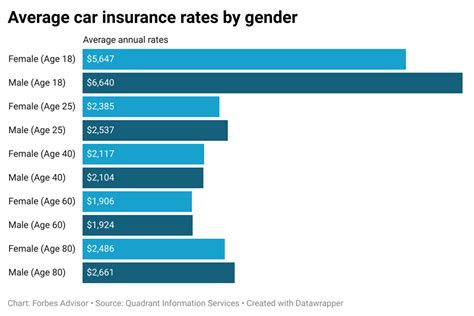

Your driving history is a critical factor in determining insurance costs. Insurers consider your age, gender, and driving record. Younger drivers, particularly those under 25, often face higher premiums due to their perceived lack of experience and higher risk of accidents. Conversely, mature drivers with a clean driving record may enjoy lower rates. Past accidents, traffic violations, and claims can also impact your insurance premiums, with a history of claims potentially leading to increased costs.

Location and Coverage

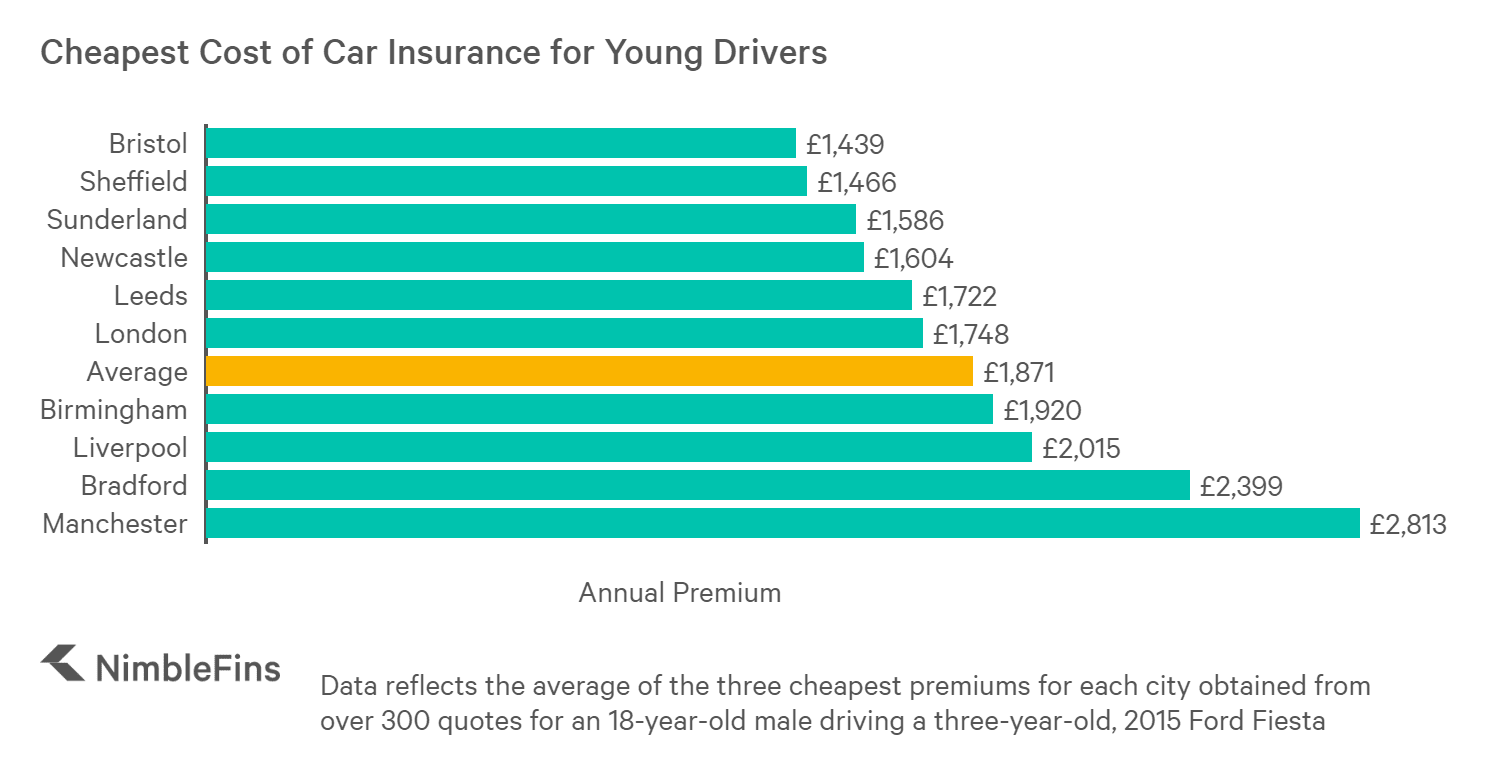

Where you live and drive your vehicle is another significant factor. Insurance rates can vary based on the state, city, or even the specific neighborhood you reside in. Areas with higher accident rates or a history of insurance claims may have elevated insurance costs. Furthermore, the level of coverage you choose affects the price. Comprehensive and collision coverage, which provide protection for a wider range of incidents, typically come at a higher cost compared to basic liability coverage.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you from claims arising from accidents you cause. |

| Collision Coverage | Covers repairs or replacement of your vehicle in the event of a collision. |

| Comprehensive Coverage | Provides protection for incidents like theft, vandalism, or natural disasters. |

Additional Factors

Other factors that can influence insurance costs include the deductible you choose, the insurer’s assessment of your credit score, and any additional features or endorsements you add to your policy. For instance, adding a rental car reimbursement or roadside assistance coverage can increase your premium.

Estimating Car Insurance Costs: A Comprehensive Guide

Now that we’ve covered the key factors, let’s explore a step-by-step guide to help you estimate and manage your car insurance costs effectively.

Step 1: Research and Compare Insurance Providers

Begin by researching and comparing insurance providers in your area. Different insurers offer varying rates and coverage options, so it’s essential to shop around. Online comparison tools and insurance brokerages can be valuable resources for this step.

Step 2: Understand Your Coverage Needs

Assess your specific coverage needs based on your vehicle type, driving habits, and personal circumstances. Consider the minimum liability coverage required by your state, but also evaluate whether you need additional coverage for your peace of mind. Remember, while higher coverage limits provide more protection, they also increase your premium.

Step 3: Explore Discounts and Savings

Many insurance companies offer discounts to help reduce your premium. These discounts can be based on factors like your driving history, vehicle safety features, and even your membership in certain organizations. Additionally, bundling your car insurance with other policies, such as home or renters’ insurance, can often lead to significant savings.

Step 4: Consider Pay-As-You-Drive Insurance

For those who drive infrequently or have low annual mileage, pay-as-you-drive insurance policies can be a cost-effective option. These policies use telematics devices to track your driving behavior and reward safe driving with lower premiums. However, they may not be suitable for everyone, so be sure to research and understand the terms and conditions before opting for such a policy.

Step 5: Review and Adjust Your Policy Regularly

Insurance needs can change over time, so it’s important to review your policy annually and make adjustments as necessary. Factors like a clean driving record, a change in vehicle, or a move to a new location can impact your insurance costs. Regularly reviewing your policy ensures you’re getting the best value and coverage for your needs.

The Future of Car Insurance: Emerging Trends

The car insurance industry is constantly evolving, and several emerging trends are shaping the future of automotive coverage. Here are some key developments to watch:

Usage-Based Insurance (UBI)

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining traction. This innovative approach uses telematics technology to monitor driving behavior, rewarding safe drivers with lower premiums. UBI policies provide a more personalized insurance experience, as premiums are based on actual driving data rather than estimates.

Connected Car Technology

The rise of connected car technology, including advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is set to revolutionize car insurance. These technologies enhance safety and provide valuable data for insurers, potentially leading to more accurate risk assessments and tailored insurance policies.

Artificial Intelligence and Data Analytics

Insurers are increasingly leveraging artificial intelligence (AI) and data analytics to streamline processes and improve risk assessment. AI-powered algorithms can analyze vast amounts of data, including driving behavior, weather conditions, and road infrastructure, to make more precise predictions about insurance risk. This technology has the potential to enhance underwriting accuracy and offer more tailored insurance products.

Electric and Autonomous Vehicles

The widespread adoption of electric and autonomous vehicles is expected to have a significant impact on car insurance. Electric vehicles, with their advanced safety features and lower maintenance costs, may lead to reduced insurance premiums. Autonomous vehicles, while still in the early stages of development, could potentially transform insurance models, as liability shifts from individual drivers to vehicle manufacturers and technology providers.

Conclusion: Taking Control of Your Car Insurance Costs

Understanding the factors that influence car insurance costs and staying informed about industry trends empowers you to make smart decisions about your coverage. By researching, comparing, and tailoring your insurance policy to your specific needs, you can find the right balance between protection and affordability. Remember, car insurance is a vital component of responsible vehicle ownership, providing financial security in the event of accidents or other unforeseen circumstances.

Frequently Asked Questions

How can I lower my car insurance premium?

+There are several strategies to reduce your car insurance premium. These include maintaining a clean driving record, increasing your deductible, exploring discounts for safe driving or vehicle safety features, and considering usage-based insurance policies if you drive infrequently.

What factors determine insurance rates for teenagers?

+Insurance rates for teenagers are typically higher due to their perceived lack of driving experience and higher risk of accidents. Factors that influence their rates include their age, gender, and the type of vehicle they drive. Some insurers offer discounts for teenagers with good grades or those enrolled in driver education programs.

How do insurance companies determine the value of my car?

+Insurance companies typically use various methods to determine the value of your car, including its make, model, year, mileage, and condition. They may refer to industry-standard valuation guides or consult with appraisers to assess the vehicle’s worth. This value is crucial in determining the appropriate coverage and premium for your vehicle.