Good Life Insurance Policies

Securing a good life insurance policy is a crucial step in protecting your loved ones' financial well-being and ensuring peace of mind. Life insurance serves as a safety net, providing a financial cushion during life's unforeseen events. In this comprehensive guide, we will delve into the intricacies of life insurance, offering expert insights to help you make informed decisions. From understanding the different types of policies to navigating the application process, we'll cover it all. So, let's embark on this journey to discover the key aspects of selecting and securing a solid life insurance plan.

The Importance of Life Insurance

Life insurance is a vital financial tool that safeguards your family’s future. It offers a range of benefits, including:

- Financial Security: Life insurance provides a lump-sum payment, known as the death benefit, to your beneficiaries in the event of your passing. This ensures they have the necessary funds to cover immediate expenses, pay off debts, and maintain their standard of living.

- Mortgage and Debt Protection: A life insurance policy can help your loved ones pay off any outstanding loans or mortgages, preventing financial strain and potential foreclosure.

- Education Funding: With life insurance, you can set aside funds to cover your children’s education expenses, ensuring they have access to quality education without burdening your family financially.

- Business Continuity: For business owners, life insurance can be a crucial tool to ensure the continuity of their business. It provides funds to cover business expenses, pay off debts, and even buy out a partner’s share in the event of their untimely demise.

- Legacy Building: Life insurance allows you to leave a lasting legacy by providing a financial gift to your loved ones, charities, or causes close to your heart.

Types of Life Insurance Policies

Understanding the different types of life insurance policies is essential to choosing the right coverage for your needs. Here’s a breakdown of the primary types:

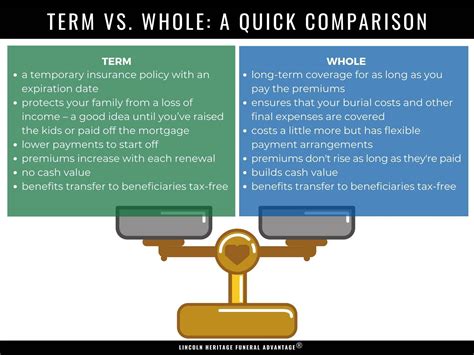

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance and is ideal for those seeking coverage during their working years to protect their family’s financial needs. Term policies provide a death benefit if the insured passes away during the policy term. However, it’s important to note that term life insurance does not build cash value and may require periodic renewals.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the insured’s entire life. It includes whole life, universal life, and variable life insurance. These policies offer a death benefit and also build cash value over time, which can be borrowed against or withdrawn during the insured’s lifetime. Permanent life insurance is generally more expensive than term insurance but offers long-term financial protection and potential investment opportunities.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that offers guaranteed premiums and a fixed death benefit. The policy builds cash value at a guaranteed rate, and the insured can access this cash value through loans or withdrawals. Whole life insurance provides a stable and predictable financial plan, making it suitable for those seeking long-term security.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance. It allows the insured to adjust their premiums and death benefit within certain limits. The policy builds cash value based on the investment performance of the separate account, which can fluctuate. Universal life insurance provides a balance between term and whole life insurance, offering flexibility and potential growth.

Variable Life Insurance

Variable life insurance, like universal life insurance, provides flexibility in premiums and death benefit amounts. However, the cash value in a variable life policy is tied to the performance of underlying investments, which can be more risky. While variable life insurance offers potential for higher returns, it also carries the risk of lower returns or even negative returns.

Factors to Consider When Choosing a Policy

Selecting the right life insurance policy involves careful consideration of various factors. Here are some key aspects to keep in mind:

Coverage Amount

Determining the appropriate coverage amount is crucial. Consider your financial obligations, such as outstanding debts, mortgage payments, and future expenses like your children’s education. Calculate the amount needed to cover these expenses and provide your loved ones with a comfortable lifestyle.

Term Length

If you opt for term life insurance, choose a term length that aligns with your financial goals. Consider when you anticipate your financial obligations will decrease, such as when your children become independent or when your mortgage is paid off. Select a term that provides coverage until those milestones are reached.

Policy Features

Explore the features offered by different policies. Some policies may include riders or add-ons that provide additional benefits, such as waiver of premium in case of disability or accelerated death benefit for terminal illness. These features can enhance your policy’s value and cater to specific needs.

Cost

The cost of life insurance varies based on factors like age, health, and lifestyle. Compare quotes from multiple insurers to find a policy that offers the coverage you need at a competitive price. Keep in mind that the cost of permanent life insurance tends to be higher than term insurance due to its long-term coverage and cash value buildup.

The Application Process

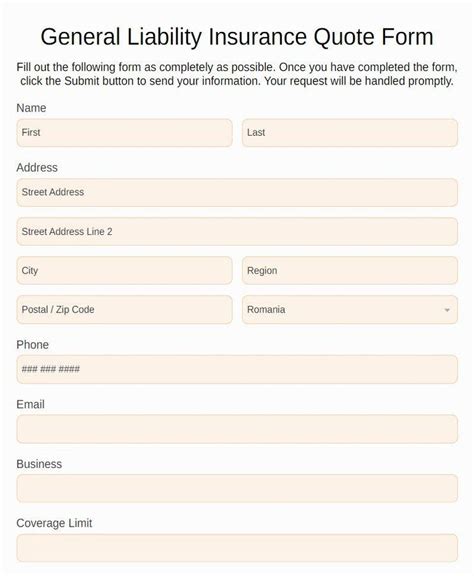

Applying for life insurance involves several steps to ensure the insurer assesses your eligibility and determines the appropriate premium. Here’s an overview of the typical application process:

Step 1: Choose an Insurer

Research and compare different life insurance companies to find one that aligns with your needs and offers competitive rates. Consider factors like financial stability, customer service, and policy features.

Step 2: Gather Information

Collect the necessary information, including personal details, medical history, and lifestyle factors. Be prepared to provide accurate and honest information to ensure a smooth application process.

Step 3: Complete the Application

Fill out the application form, providing all the required details. Ensure you understand the terms and conditions of the policy and ask any questions you may have before submitting the application.

Step 4: Medical Examination (if required)

Depending on the policy and your health status, you may need to undergo a medical examination. This examination helps the insurer assess your health and determine the appropriate premium. The examiner will typically collect a blood sample, urine sample, and perform basic health checks.

Step 5: Policy Offer

Once the insurer has reviewed your application and medical examination (if applicable), they will offer you a policy with specific terms and conditions, including the premium amount. Carefully review the policy to ensure it meets your expectations and needs.

Step 6: Acceptance and Payment

If you are satisfied with the policy offer, accept it and make the initial premium payment. This marks the beginning of your life insurance coverage.

Tips for Securing a Good Policy

Here are some additional tips to help you navigate the life insurance landscape and secure a policy that best suits your needs:

Shop Around

Don’t settle for the first policy you come across. Compare quotes from multiple insurers to find the best coverage at the most competitive price. Online comparison tools can be a great starting point to get an overview of the market.

Be Honest

Provide accurate and honest information on your application. Misrepresenting your health or lifestyle factors can lead to policy cancellation or reduced benefits in the future.

Understand the Policy

Take the time to thoroughly read and understand the policy documents. If you have any questions or concerns, don’t hesitate to reach out to the insurer’s customer support for clarification.

Consider Your Needs

Assess your specific needs and choose a policy that aligns with them. Whether it’s covering outstanding debts, providing for your family’s future, or protecting your business, ensure the policy addresses your unique circumstances.

Regularly Review and Update

Life insurance needs can change over time. Regularly review your policy to ensure it still meets your requirements. Update your coverage amount or policy type as your financial situation evolves.

| Policy Type | Coverage Period | Cash Value |

|---|---|---|

| Term Life Insurance | Specific Term (e.g., 10-30 years) | None |

| Permanent Life Insurance | Lifetime | Yes |

| Whole Life Insurance | Lifetime | Yes, with guaranteed rates |

| Universal Life Insurance | Lifetime | Yes, with flexible premiums and death benefits |

| Variable Life Insurance | Lifetime | Yes, tied to investment performance |

Frequently Asked Questions

How much life insurance do I need?

+The amount of life insurance you need depends on your financial obligations and goals. Calculate your outstanding debts, future expenses, and desired legacy to determine the coverage amount. Generally, experts recommend having 10 to 15 times your annual income as the death benefit.

Is term life insurance better than permanent life insurance?

+The choice between term and permanent life insurance depends on your needs and budget. Term life insurance is often more affordable and suitable for those seeking coverage during their working years. Permanent life insurance provides lifelong coverage and builds cash value, making it a good option for long-term financial planning.

Can I switch from term to permanent life insurance?

+Yes, you can switch from term to permanent life insurance. However, the conversion process and policy terms may vary depending on the insurer. It’s advisable to review your options and consider the financial implications before making the switch.

Do I need a medical examination for life insurance?

+The requirement for a medical examination depends on the policy and your health status. Younger, healthier individuals may not need a medical exam for certain term policies. However, for permanent life insurance or individuals with health concerns, a medical examination is typically required to assess risk and determine the premium.

Can I cancel my life insurance policy?

+Yes, you can cancel your life insurance policy at any time. However, it’s important to consider the financial implications, especially if you have a permanent life insurance policy with cash value. Canceling the policy may result in losing the accumulated cash value and having to pay surrender charges.