Insurance Get Quote

Insurance is an essential aspect of modern life, providing financial protection and peace of mind to individuals, families, and businesses. Obtaining an insurance quote is a crucial step towards securing the right coverage for your specific needs. In this comprehensive guide, we will delve into the world of insurance, explore the factors influencing quotes, and provide valuable insights to help you navigate the process effectively.

Understanding the Insurance Landscape

Insurance is a multifaceted industry, offering a wide range of coverage options to protect against various risks. From health and life insurance to property and casualty insurance, each type serves a unique purpose. Health insurance, for instance, safeguards individuals against unexpected medical expenses, while life insurance provides financial security to loved ones in the event of the policyholder’s demise. Property insurance protects assets such as homes and vehicles, and casualty insurance covers liabilities arising from accidents or injuries.

The insurance market is diverse, with numerous insurance carriers competing for business. Each carrier has its own set of underwriting guidelines, risk assessment methodologies, and premium calculation formulas. This diversity ensures that individuals and businesses have a choice of providers, allowing them to find the coverage that best suits their needs and budget.

Factors Influencing Insurance Quotes

Insurance quotes are highly personalized and depend on a multitude of factors. Understanding these factors is crucial to obtaining accurate and affordable coverage.

Risk Assessment

Insurance carriers carefully assess the risk associated with insuring a particular individual or entity. This risk assessment process takes into account various elements, including:

- Age: Age plays a significant role in determining insurance rates. Younger individuals are generally considered higher risk due to their propensity for more frequent accidents or health issues.

- Health Status: For health and life insurance, your current and past health conditions are evaluated. Pre-existing conditions or a history of serious illnesses can impact your quote.

- Lifestyle and Occupation: Your lifestyle choices and occupation can influence your insurance quote. For example, hazardous occupations or high-risk hobbies may result in higher premiums.

- Location: The area where you live or work can affect your insurance rates. Areas with higher crime rates or natural disaster risks may command higher premiums.

Coverage Requirements

The extent of coverage you require is a critical factor in determining your insurance quote. Different types of insurance have varying coverage options, and the level of protection you choose will impact your premium.

- Deductibles and Limits: Higher deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) can lead to lower premiums. Conversely, lower deductibles may result in higher premiums.

- Coverage Add-ons: Additional coverage options, such as rental car coverage or emergency roadside assistance, can increase your premium.

- Policy Duration: Longer-term policies often provide cost savings over multiple shorter-term policies.

Claims History

Your claims history is an essential factor in insurance quotes. Insurance carriers analyze your past claims to assess your risk profile. A history of frequent or costly claims may result in higher premiums or even denial of coverage.

Credit Score

In many cases, insurance carriers consider your credit score when determining your insurance quote. A good credit score may result in lower premiums, as it indicates a lower risk of default.

Obtaining an Insurance Quote

The process of obtaining an insurance quote has evolved significantly with the advent of technology. While traditional methods, such as meeting with an insurance agent, are still prevalent, online platforms and comparison websites have made the process more accessible and efficient.

Working with an Insurance Agent

Insurance agents are professionals who represent one or more insurance carriers. They can provide personalized advice and guide you through the process of selecting the right coverage. Working with an agent offers several advantages:

- Expertise: Insurance agents have in-depth knowledge of the industry and can explain complex concepts in simple terms.

- Personalized Service: Agents can tailor coverage to your specific needs and provide ongoing support throughout the policy term.

- Multiple Carrier Options: Agents often represent multiple carriers, allowing them to shop around for the best rates and coverage.

Online Insurance Quotes

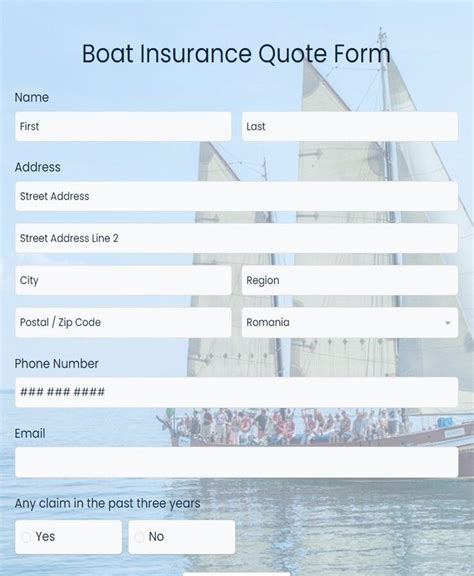

Online insurance quote platforms have gained popularity due to their convenience and efficiency. These platforms allow you to compare quotes from multiple carriers in a matter of minutes. Here’s how to navigate the process:

- Choose a Reputable Platform: Select a well-known and trusted online insurance marketplace. Ensure the platform offers quotes from reputable carriers.

- Provide Accurate Information: When filling out the quote form, provide accurate and detailed information about yourself, your assets, and your coverage needs.

- Compare Quotes: Once you receive quotes from multiple carriers, compare the coverage, deductibles, and premiums. Look for policies that offer the best balance of coverage and cost.

- Consider Additional Benefits: Some carriers offer unique benefits or discounts. Explore these options to find additional value in your insurance coverage.

Direct Carrier Websites

Many insurance carriers offer the option to obtain quotes directly from their websites. This method provides a more personalized experience, as you are dealing directly with the carrier. However, it may limit your ability to compare quotes from multiple carriers simultaneously.

Tips for Securing the Best Insurance Quote

Obtaining an insurance quote is just the first step. To ensure you secure the best coverage at the most affordable price, consider the following tips:

Shop Around

Don’t settle for the first quote you receive. Compare quotes from multiple carriers to find the best deal. Online comparison platforms make this process efficient and convenient.

Bundle Your Policies

If you require multiple types of insurance, such as home and auto insurance, consider bundling your policies with the same carrier. Many carriers offer discounts for multiple policies, resulting in significant savings.

Review Your Coverage Regularly

Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. Update your policies as necessary to maintain adequate protection.

Consider Deductibles

Higher deductibles can lead to lower premiums. However, ensure you can afford the deductible in the event of a claim. Strike a balance between affordable premiums and manageable deductibles.

Maintain a Good Credit Score

A good credit score can impact your insurance rates. Maintain a healthy credit profile to potentially secure lower premiums.

Ask About Discounts

Insurance carriers offer various discounts, such as safe driver discounts, loyalty discounts, or discounts for certain professions. Inquire about available discounts and take advantage of those that apply to you.

The Future of Insurance Quotes

The insurance industry is continuously evolving, and the way we obtain quotes is no exception. With advancements in technology and data analytics, the insurance quote process is becoming increasingly streamlined and personalized.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry. These technologies enable carriers to analyze vast amounts of data quickly, resulting in more accurate risk assessments and personalized quotes. AI-powered chatbots and virtual assistants are also enhancing the customer experience, providing instant quotes and answering common queries.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. Usage-Based Insurance (UBI) utilizes telematics data to offer insurance coverage based on actual driving habits. This innovative approach rewards safe drivers with lower premiums, as their risk profile is accurately reflected in their quote.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Blockchain can streamline the claims process, improve data verification, and reduce fraud. As blockchain adoption grows, we may see more carriers utilizing this technology to enhance their quote and coverage processes.

Conclusion

Obtaining an insurance quote is a critical step towards securing the financial protection you need. By understanding the factors that influence quotes and exploring the various options available, you can make informed decisions and secure coverage that aligns with your unique circumstances. Remember, insurance is a long-term investment, and taking the time to research and compare quotes can result in significant savings and peace of mind.

How often should I review my insurance coverage and quotes?

+It’s recommended to review your insurance coverage annually or whenever your circumstances change significantly. Life events such as marriage, buying a home, or starting a family may impact your insurance needs. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I negotiate insurance quotes?

+While insurance quotes are based on standardized calculations, there may be room for negotiation, especially when working with an insurance agent. Agents can sometimes negotiate discounts or special rates, especially for loyal customers or those with a clean claims history.

What should I do if I receive a high insurance quote?

+If you receive a high insurance quote, don’t panic. Compare quotes from multiple carriers to find a more affordable option. Consider adjusting your coverage limits or deductibles to lower your premium. Additionally, review your risk factors and see if there are any improvements you can make to reduce your overall risk profile.