What Is Liability Coverage Car Insurance

Liability coverage is a fundamental component of car insurance, playing a crucial role in protecting policyholders from financial risks associated with vehicle ownership. It is designed to provide coverage for bodily injury and property damage claims made against the insured driver when they are at fault in an accident. In essence, liability coverage acts as a safeguard, ensuring that the insured can meet their legal obligations arising from an at-fault accident. This type of insurance is mandatory in most states, underscoring its importance in the realm of automotive insurance.

This article aims to provide an in-depth exploration of liability coverage in car insurance, delving into its various facets, its importance, and how it functions in real-world scenarios. By understanding liability coverage, drivers can make more informed decisions about their insurance policies and effectively protect themselves and their assets.

Understanding Liability Coverage

Liability coverage, often referred to as third-party insurance, is a cornerstone of car insurance policies. It is designed to protect policyholders from the financial consequences of accidents for which they are legally responsible. This coverage is typically divided into two main categories: bodily injury liability and property damage liability.

Bodily Injury Liability

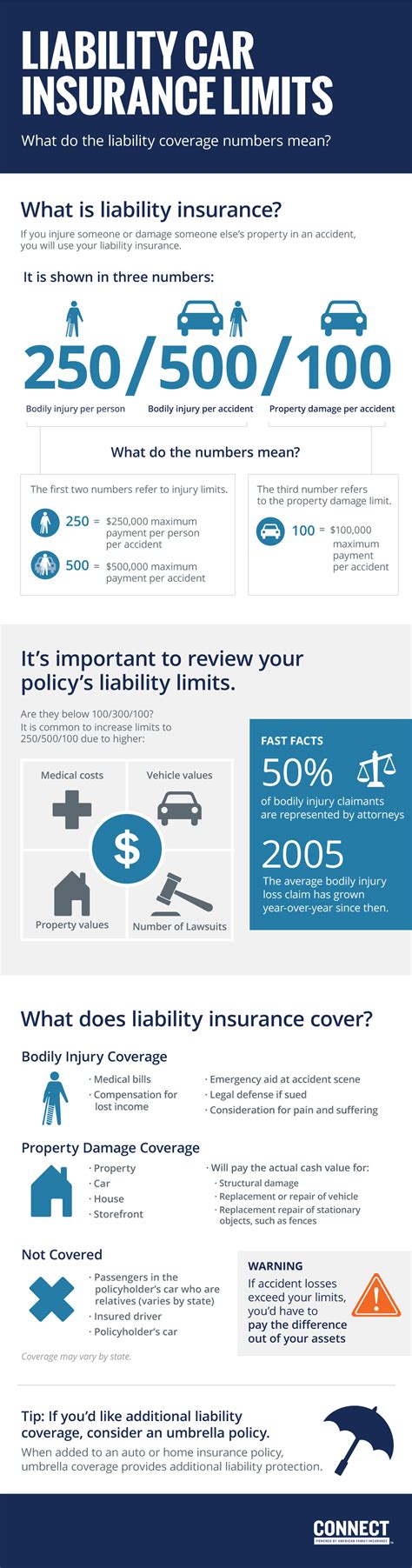

Bodily injury liability coverage is a vital component of car insurance, providing financial protection to the policyholder in the event that they are deemed legally responsible for causing bodily harm to others in an accident. This coverage is essential, as it can help cover the cost of medical expenses, lost wages, and even pain and suffering for those injured in an accident caused by the insured driver. The limits of bodily injury liability coverage are usually expressed as two numbers, representing the maximum payout per person and the total per accident.

| Bodily Injury Liability Limits | Description |

|---|---|

| Per Person Limit | Maximum coverage amount for each person injured in an accident. |

| Per Accident Limit | Overall coverage limit for all injuries and damages resulting from one accident. |

For example, if a policy has bodily injury liability limits of $100,000 per person and $300,000 per accident, it means the insurer will pay up to $100,000 for each person injured, but the total payout for all injuries and damages cannot exceed $300,000.

Property Damage Liability

Property damage liability coverage is another critical aspect of car insurance, offering financial protection to policyholders when they are at fault for damage to another person’s property, such as their vehicle, home, or other possessions. This coverage is essential, as it can help cover the cost of repairs or replacements for the other party’s property, ensuring the insured meets their legal obligations.

Similar to bodily injury liability, property damage liability coverage also has specific limits. These limits dictate the maximum amount the insurer will pay for property damage in a single accident.

| Property Damage Liability Limits | Description |

|---|---|

| Per Accident Limit | Maximum coverage amount for property damage resulting from one accident. |

It's important to note that liability coverage only covers damages for which the insured driver is at fault. If the insured driver is not deemed at fault, their liability coverage will not be utilized, and they may need to rely on other types of insurance, such as collision or comprehensive coverage, or their own personal assets to cover any damages.

The Importance of Liability Coverage

Liability coverage is a critical component of car insurance for several reasons. Firstly, it is often mandatory by law in many jurisdictions, ensuring that drivers are financially responsible for their actions on the road. Secondly, it provides essential financial protection against the potentially devastating costs of bodily injury and property damage claims, which can be particularly significant in severe accidents.

Furthermore, liability coverage can also help protect the insured driver's assets. In the event of a serious accident, the injured party may seek compensation beyond the policy limits. If the insured driver does not have sufficient liability coverage, they may be personally liable for the remaining damages, which could include their savings, investments, or even their home.

In addition to protecting the insured, liability coverage also contributes to the overall safety and responsibility of the driving community. By requiring drivers to carry liability insurance, states encourage a culture of financial responsibility, ensuring that drivers are prepared to handle the potential financial consequences of an accident they cause.

Potential Legal Consequences

Driving without adequate liability coverage can lead to serious legal repercussions. In many states, it is a criminal offense to operate a vehicle without the minimum required liability insurance. Drivers caught without the necessary coverage may face fines, license suspension, or even jail time, depending on the severity of the offense and local laws.

Moreover, if an uninsured driver causes an accident and is unable to cover the damages, the injured party may pursue legal action. This can result in substantial financial judgments against the uninsured driver, leading to wage garnishments, asset seizures, or even bankruptcy.

How Liability Coverage Works

When an insured driver is involved in an accident and found to be at fault, the process of liability coverage comes into play. Here’s a step-by-step breakdown of how liability coverage typically works:

- Accident Occurrence: The insured driver is involved in an accident where they are deemed at fault.

- Reporting the Accident: The insured driver reports the accident to their insurance company as soon as possible. This is a crucial step, as it initiates the claims process.

- Claims Investigation: The insurance company investigates the accident to determine the extent of the damages and the insured's liability. This may involve reviewing police reports, speaking with witnesses, and assessing the insured's policy coverage.

- Determining Fault: Based on the investigation, the insurance company determines the level of fault attributed to the insured driver. This determination is crucial, as it affects the amount of liability coverage that will be utilized.

- Payout Process: Once fault is established, the insurance company pays out the claims up to the policy limits. This includes compensating the injured party for their bodily injuries and property damage.

- Policy Renewal or Adjustment: After an at-fault accident, the insured's policy may be subject to renewal or adjustment. This could include changes to their premium rates or the addition of surcharges.

It's important to note that the claims process can vary depending on the insurance company and the specific circumstances of the accident. Some insurers may offer additional services, such as legal advice or assistance with rental car arrangements during the claims process.

Limit Considerations

While liability coverage provides essential protection, it’s crucial to consider the policy limits. In severe accidents with multiple injured parties or extensive property damage, the policy limits may be quickly exhausted. This could leave the insured driver personally liable for the remaining damages.

To mitigate this risk, many insurance experts recommend purchasing higher liability limits, especially for bodily injury coverage. This ensures that the insured has more comprehensive protection in the event of a serious accident. However, it's important to balance the desire for higher limits with the cost of insurance, as increased coverage often comes with a higher premium.

Tips for Choosing Liability Coverage

When selecting liability coverage, it’s important to consider various factors to ensure you have adequate protection. Here are some tips to guide your decision-making process:

- Understand State Minimums: Research the liability insurance minimums required by your state. While these minimums are a legal requirement, they may not provide sufficient coverage in the event of a serious accident. It's generally advisable to exceed these minimums to ensure adequate protection.

- Assess Your Assets: Consider your personal assets, such as your home, savings, and investments. If you have significant assets, you may want to opt for higher liability limits to protect them in the event of a severe accident. This ensures that your personal finances are not at risk if you are found at fault.

- Review Your Driving History: Evaluate your driving record. If you have a clean driving history, you may feel more comfortable with lower liability limits. However, if you have a history of accidents or traffic violations, higher limits can provide added peace of mind.

- Compare Insurance Providers: Shop around and compare liability coverage options from different insurance providers. Different insurers may offer varying coverage levels and premiums. It's essential to find a provider that offers the right balance of coverage and cost for your needs.

- Consider Bundling: If you own multiple vehicles or have other insurance needs, such as home or life insurance, consider bundling your policies with the same provider. Bundling can often result in significant discounts and simplified insurance management.

The Future of Liability Coverage

As technology advances and the automotive industry evolves, the landscape of liability coverage is likely to change. The rise of autonomous vehicles and advanced driver-assistance systems (ADAS) is already prompting discussions about the future of liability insurance.

In a world with highly automated vehicles, the traditional concept of driver fault may become less relevant. Accidents could be attributed to the vehicle's technology or even the manufacturer, rather than the driver. This shift could lead to a reimagining of liability coverage, with insurers potentially covering a broader range of scenarios, including product liability claims against vehicle manufacturers.

Additionally, the increasing popularity of ridesharing and car-sharing services is also influencing the future of liability coverage. These services often carry their own liability insurance, but there are gray areas, especially during periods when drivers are not actively transporting passengers. As these services become more prevalent, insurers will need to adapt their coverage to address these emerging risks.

Furthermore, the ongoing development of connected car technologies and data analytics is expected to play a significant role in shaping liability coverage. Insurers may leverage real-time vehicle data to assess risk and tailor coverage accordingly. This could lead to more dynamic and personalized liability insurance policies, offering greater flexibility to policyholders.

Emerging Trends

- Telematics-Based Insurance: Some insurers are already experimenting with telematics-based insurance, where policy premiums are adjusted based on the driver’s actual behavior and driving patterns. This could lead to more accurate risk assessments and potentially lower premiums for safe drivers.

- Usage-Based Insurance (UBI): UBI programs reward drivers for safe driving habits by offering discounts or reduced premiums. This trend is likely to continue, providing policyholders with an incentive to drive safely and potentially reducing the need for high liability limits.

- Product Liability Shifts: With the advent of autonomous vehicles and advanced safety features, there may be a shift towards product liability, where vehicle manufacturers bear more responsibility for accidents caused by their technology. This could impact the role and scope of liability coverage for drivers.

Conclusion

Liability coverage is a critical component of car insurance, providing essential financial protection for policyholders and the public. It ensures that drivers are held accountable for their actions on the road and helps prevent financial devastation in the event of an at-fault accident. As the automotive industry evolves, liability coverage is likely to adapt, becoming more dynamic and responsive to emerging technologies and driving trends.

By understanding the importance and intricacies of liability coverage, drivers can make informed decisions about their insurance policies, ensuring they have adequate protection without unnecessary costs. As the future of automotive technology unfolds, the role of liability coverage will continue to evolve, offering new opportunities for insurers and drivers alike.

What is the difference between liability coverage and other types of car insurance coverage?

+

Liability coverage is distinct from other types of car insurance coverage, such as collision and comprehensive coverage. While liability coverage protects the insured driver when they are at fault in an accident, collision coverage covers damage to the insured vehicle, regardless of fault. Comprehensive coverage, on the other hand, provides protection for non-accident-related incidents, like theft, vandalism, or natural disasters.

Is liability coverage mandatory in all states?

+

Yes, liability coverage is mandatory in most states, although the required minimum limits may vary. It’s essential to check your state’s specific requirements to ensure you are complying with the law and carrying adequate coverage.

How much liability coverage do I need?

+

The amount of liability coverage you need depends on several factors, including your personal assets, driving history, and the value of your vehicle. It’s generally recommended to exceed your state’s minimum requirements to ensure adequate protection. Consult with an insurance professional to determine the right coverage limits for your situation.