Renters Insurance Average Cost Per Month

Renters insurance is a crucial aspect of financial planning for individuals who rent their living spaces. It provides coverage for personal belongings and liability protection, offering peace of mind to tenants. The cost of renters insurance is a significant factor in deciding whether to obtain a policy, and understanding the average monthly expenses can help renters make informed decisions about their insurance needs.

Understanding Renters Insurance Costs

The average cost of renters insurance per month can vary significantly based on several factors. While the national average provides a baseline, individual circumstances and regional differences can lead to substantial variations. It’s essential to consider these factors when estimating the cost of renters insurance to ensure an accurate assessment of your potential expenses.

National Average Monthly Cost

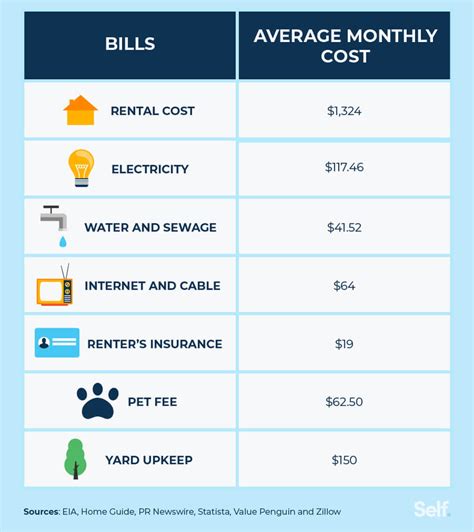

According to industry reports, the average monthly cost of renters insurance in the United States is approximately 15 to 30. This range represents a relatively affordable option for renters, providing essential coverage for personal property and liability. However, it’s important to note that this average cost can be influenced by various factors, and individual policies may differ significantly.

| Insurance Type | Average Monthly Cost |

|---|---|

| Basic Renters Insurance | $15 to $25 |

| Enhanced Coverage | $25 to $30 |

Basic renters insurance policies typically cover personal belongings and provide liability protection up to a certain limit. Enhanced coverage options may include additional benefits such as higher liability limits, coverage for specific high-value items, or rental reimbursement in case of a covered loss.

Factors Influencing Renters Insurance Costs

Several key factors contribute to the variation in renters insurance costs. Understanding these factors can help renters make more informed decisions about their insurance coverage and potentially reduce their monthly premiums.

- Location: The cost of renters insurance can vary significantly based on the geographic region. Urban areas with higher populations and increased risk of theft or natural disasters may have higher insurance premiums. Additionally, the cost of living and local property values can influence insurance rates.

- Coverage Amount: The amount of coverage an individual chooses will impact the cost of their renters insurance. Higher coverage limits for personal belongings and liability will generally result in higher monthly premiums.

- Deductible: Renters insurance policies often have a deductible, which is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the monthly premium, as the policyholder assumes more financial responsibility in the event of a claim.

- Discounts and Bundles: Insurance companies often offer discounts for various reasons. Bundle discounts, where renters insurance is purchased alongside other policies like auto insurance, can lead to significant savings. Additionally, discounts may be available for factors such as loyalty, safety features, or even payment methods.

- Policy Features: The specific features and benefits included in a renters insurance policy can impact its cost. Policies with additional coverage options, such as coverage for high-value items or identity theft protection, may have higher premiums.

Estimating Your Renters Insurance Costs

To estimate the cost of renters insurance for your specific situation, it’s essential to consider your location, the value of your personal belongings, and any additional coverage requirements. Here’s a step-by-step guide to help you calculate your estimated monthly premium.

Step 1: Assess Your Coverage Needs

Begin by evaluating the value of your personal belongings. Consider the cost of replacing all your furniture, electronics, clothing, and other items if they were damaged or stolen. This assessment will help determine the appropriate coverage amount for your renters insurance policy.

Step 2: Research Local Rates

Research the average renters insurance rates in your area. Contact local insurance agents or use online comparison tools to gather quotes from multiple providers. This step will give you a better understanding of the cost range in your region and help you identify potential discounts or promotions.

Step 3: Compare Deductibles and Coverage Limits

Review the deductibles and coverage limits offered by different insurance providers. Consider the trade-off between a higher deductible and a lower monthly premium. Ensure that the coverage limits align with your assessed needs, especially for high-value items or specific coverage requirements.

Step 4: Explore Discounts and Bundles

Inquire about available discounts and bundle options. Many insurance companies offer discounts for factors such as loyalty, safety features (like smoke detectors or security systems), or even for certain professions or affiliations. Bundling renters insurance with other policies, such as auto insurance, can often lead to significant savings.

Step 5: Obtain Quotes and Make an Informed Decision

Once you’ve gathered the necessary information, obtain quotes from multiple insurance providers. Compare the coverage, deductibles, and monthly premiums to make an informed decision. Consider not only the cost but also the reputation and reliability of the insurance company. Choose a policy that provides adequate coverage at a competitive price.

Performance Analysis and Future Implications

The performance of renters insurance policies can vary based on the claims experience and the financial stability of the insurance provider. It’s essential to choose a reputable insurer with a solid financial rating to ensure that your claims will be honored. Additionally, understanding the claims process and the average settlement amounts can provide valuable insights into the effectiveness of renters insurance policies.

Claims Experience and Settlement Amounts

The frequency and severity of claims can impact the overall performance of renters insurance policies. While renters insurance claims are generally less frequent and less severe than other types of insurance claims, it’s important to consider the potential risks associated with your specific situation. For example, if you live in an area prone to natural disasters or have high-value items, the likelihood of making a claim may increase.

When a renters insurance claim is made, the settlement amount is typically based on the actual cash value of the lost or damaged items. This means that the insurer will consider the age and condition of the items when determining the compensation amount. It's crucial to maintain accurate records and receipts for your personal belongings to support any potential claims.

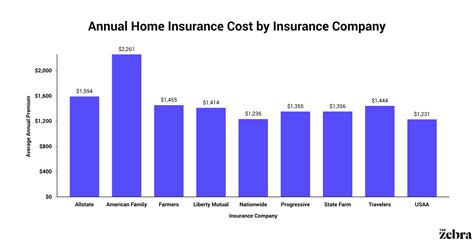

Financial Stability of Insurance Providers

Choosing a financially stable insurance provider is essential to ensure that your renters insurance policy remains viable and that claims will be honored. Reputable insurance companies regularly undergo financial assessments and receive ratings from independent agencies, such as A.M. Best or Standard & Poor’s. These ratings provide an indication of the insurer’s financial strength and ability to meet its obligations.

When researching insurance providers, consider their financial ratings and reviews from industry experts and consumer advocacy groups. A strong financial rating indicates that the insurer is well-positioned to handle claims and provide long-term stability. Additionally, consider the insurer's track record for prompt claim settlements and customer satisfaction.

Future Implications and Trends

The renters insurance market is evolving, and several trends and developments are shaping the industry. These factors can influence the cost and availability of renters insurance policies in the future.

- Increasing Natural Disasters: With the growing impact of climate change, the frequency and severity of natural disasters are expected to rise. This trend may lead to higher insurance premiums, especially in regions prone to such events. Renters in these areas should consider the potential risks and ensure they have adequate coverage.

- Technological Advancements: The insurance industry is embracing technology to improve efficiency and enhance the customer experience. Online quote comparisons, digital policy management, and claim reporting are becoming more prevalent. These advancements can lead to increased competition and potentially lower insurance costs for renters.

- Changing Demographics: The demographics of renters are evolving, with a growing number of millennials and Gen Z individuals entering the rental market. These younger generations often have different insurance needs and preferences. Insurance providers may adapt their policies and pricing strategies to cater to these changing demographics.

- Data Analytics and Risk Assessment

Advancements in data analytics allow insurance companies to more accurately assess risks and set premiums. By analyzing large datasets, insurers can identify patterns and trends that influence the likelihood of claims. This precision in risk assessment may lead to more tailored insurance policies and potentially lower costs for low-risk renters.

Conclusion

Renters insurance is an essential component of financial planning for individuals who rent their living spaces. Understanding the average cost per month and the factors that influence these costs is crucial for making informed decisions about insurance coverage. By assessing your individual needs, researching local rates, and exploring discounts and bundles, you can obtain a renters insurance policy that provides adequate protection at a competitive price.

Additionally, considering the performance and financial stability of insurance providers, as well as staying abreast of industry trends, can further enhance your insurance experience. Renters insurance not only provides peace of mind but also ensures that your personal belongings and liability are protected in the event of unforeseen circumstances.

What is the average monthly cost of renters insurance in the United States?

+The average monthly cost of renters insurance in the United States is approximately 15 to 30. However, this can vary based on factors such as location, coverage amount, deductible, and policy features.

How can I estimate the cost of renters insurance for my specific situation?

+To estimate the cost of renters insurance, assess your coverage needs, research local rates, compare deductibles and coverage limits, explore discounts and bundles, and obtain quotes from multiple providers. This process will help you make an informed decision about your renters insurance policy.

What factors influence the cost of renters insurance?

+The cost of renters insurance can be influenced by various factors, including location, coverage amount, deductible, discounts, and policy features. Urban areas with higher populations and increased risk may have higher premiums, while choosing a higher deductible can lower the monthly premium.

How can I ensure I choose a reputable insurance provider?

+When choosing an insurance provider, consider their financial stability and reputation. Look for companies with strong financial ratings from independent agencies like A.M. Best or Standard & Poor’s. Additionally, research their track record for prompt claim settlements and customer satisfaction.