New York City Health Insurance

New York City, the bustling metropolis known for its vibrant culture, diverse population, and bustling financial district, is a hub of activity and opportunity. However, amidst the excitement and hustle, ensuring access to quality healthcare and comprehensive health insurance coverage becomes paramount. The healthcare landscape in New York City is intricate, with a myriad of options available to residents. Understanding the intricacies of health insurance plans and navigating the system to find the best coverage can be challenging. This comprehensive guide aims to shed light on the world of New York City Health Insurance, offering an in-depth analysis to assist residents in making informed decisions about their healthcare.

Understanding the Importance of Health Insurance in New York City

Health insurance is a crucial aspect of life in New York City, a city renowned for its diverse population and dynamic healthcare system. With a multitude of healthcare providers and specialized services, the city offers a range of options to cater to the varying needs of its residents. However, navigating this complex landscape can be daunting, especially when it comes to understanding health insurance policies and selecting the most suitable plan.

The importance of health insurance in New York City cannot be overstated. It provides individuals and families with access to essential medical services, ensuring they receive the care they need without facing financial strain. With the cost of healthcare being a significant concern, having adequate health insurance coverage is a necessity. It not only provides peace of mind but also safeguards individuals from the potentially devastating financial impact of unexpected medical emergencies.

In this city, where the cost of living is notoriously high, health insurance becomes an essential tool for managing healthcare expenses. It allows residents to access a wide range of medical services, from routine check-ups and preventative care to specialized treatments and emergency care. By understanding the different types of health insurance plans available and the benefits they offer, New Yorkers can make informed decisions about their healthcare coverage, ensuring they receive the best possible care while managing their financial obligations.

Types of Health Insurance Plans in NYC

New York City boasts a diverse range of health insurance plans, each designed to cater to the unique needs of its residents. Understanding the different types of plans available is crucial in making an informed decision about your healthcare coverage. Here’s a breakdown of the most common types of health insurance plans in NYC:

Employer-Sponsored Plans

Many New Yorkers enjoy the benefit of employer-sponsored health insurance plans. These plans are offered by employers as part of their benefits package and often provide comprehensive coverage. The specific details of these plans can vary greatly, depending on the employer and the type of coverage offered. Some common features of employer-sponsored plans include coverage for doctor visits, hospital stays, prescription medications, and sometimes even dental and vision care.

Individual and Family Plans

For those who are self-employed, unemployed, or do not have access to employer-sponsored plans, individual and family health insurance plans are a viable option. These plans can be purchased directly from insurance companies or through the New York State of Health Marketplace. The marketplace offers a range of plans from various insurance providers, allowing individuals to compare and choose the plan that best suits their needs and budget. Individual and family plans typically cover a wide range of medical services, including doctor visits, hospital stays, and prescription medications.

Medicaid and Child Health Plus

Medicaid is a state-run health insurance program that provides coverage for low-income individuals and families. In New York City, Medicaid plays a vital role in ensuring access to healthcare for those who may not be able to afford private insurance. The program covers a wide range of services, including doctor visits, hospital stays, prescription medications, and even some long-term care services. Child Health Plus is a similar program designed specifically for children, offering comprehensive healthcare coverage to ensure their well-being.

Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, although people under 65 with certain disabilities or medical conditions may also be eligible. In New York City, Medicare plays a crucial role in providing healthcare coverage for seniors and those with specific medical needs. The program offers various coverage options, including Original Medicare (Parts A and B), Medicare Advantage plans (Part C), and Medicare Prescription Drug Coverage (Part D). These plans provide coverage for hospital stays, doctor visits, prescription medications, and sometimes even vision and dental care.

Key Considerations When Choosing a Health Insurance Plan

Selecting the right health insurance plan in New York City requires careful consideration of various factors. Here are some key aspects to keep in mind when making your choice:

Coverage and Benefits

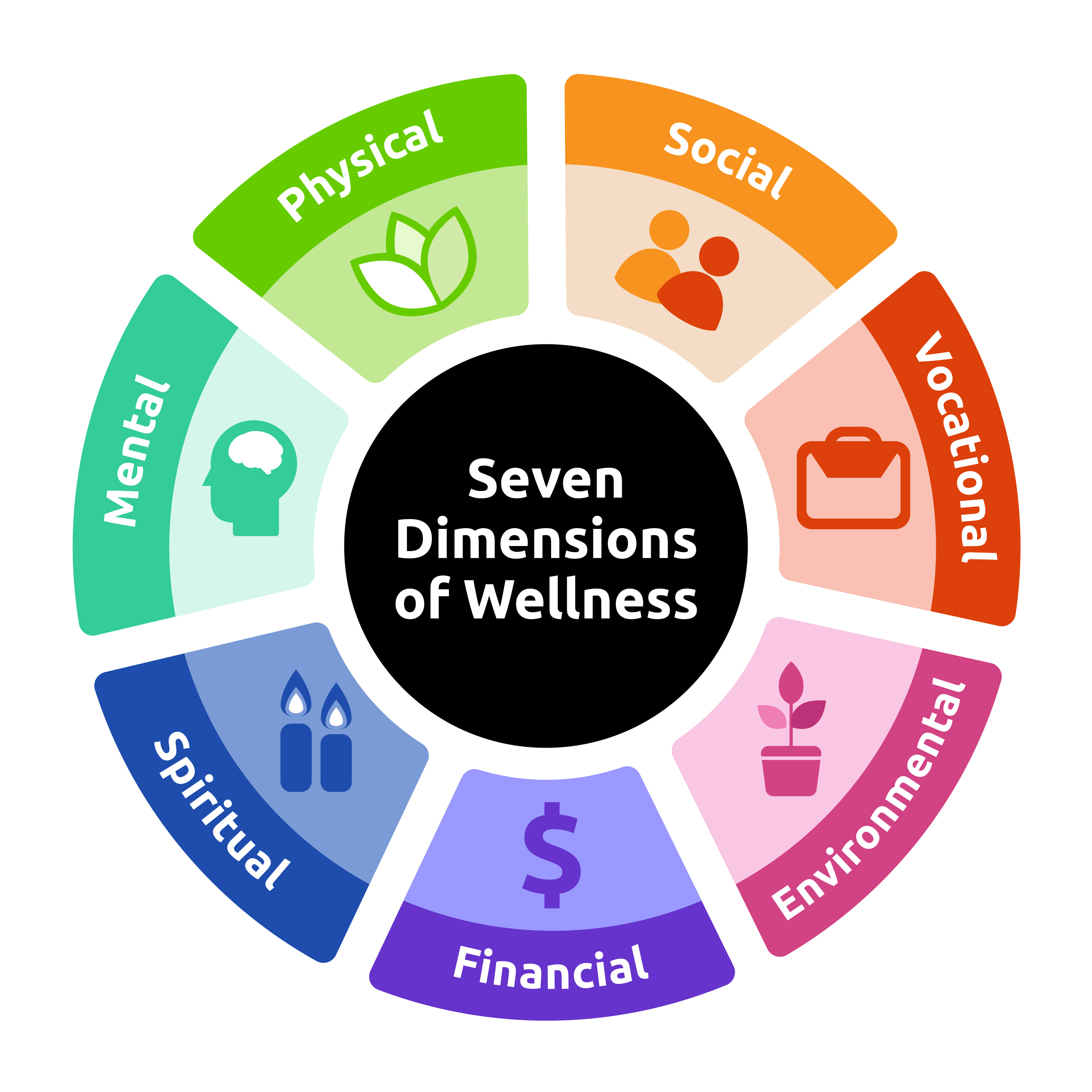

Understanding the coverage and benefits offered by different health insurance plans is essential. Consider the types of medical services you or your family are likely to need, such as doctor visits, hospital stays, prescription medications, dental care, and vision care. Ensure that the plan you choose covers these services adequately and provides the benefits you require. Some plans may offer additional benefits like wellness programs, mental health services, or alternative therapies, so explore these options to find a plan that aligns with your healthcare needs.

Cost and Financial Considerations

Health insurance plans come with varying costs, including monthly premiums, deductibles, copayments, and coinsurance. When choosing a plan, consider your budget and financial situation. Evaluate the overall cost of the plan, including not only the monthly premium but also the out-of-pocket expenses you may incur. Assess whether the plan’s cost aligns with your financial capabilities and whether it provides the level of coverage you require without putting a strain on your finances.

Network of Providers

Health insurance plans typically have networks of healthcare providers, including doctors, hospitals, and specialists, with whom they have negotiated rates. When selecting a plan, it’s crucial to ensure that your preferred healthcare providers are included in the plan’s network. Out-of-network care can result in higher out-of-pocket costs, so it’s important to choose a plan that offers a network of providers that meets your needs. Additionally, consider the plan’s coverage for out-of-network care, as some plans may provide partial coverage for these services.

Prescription Drug Coverage

Prescription medications can be a significant expense, so it’s essential to consider the prescription drug coverage offered by different health insurance plans. Evaluate the plan’s formulary, which is a list of prescription drugs covered by the insurance company. Ensure that the medications you or your family members take regularly are included in the plan’s formulary. Some plans may offer different tiers of coverage for prescription drugs, with varying copay amounts depending on the drug’s tier. Consider the cost and coverage of prescription medications when choosing a plan to ensure you have access to the medications you need at an affordable cost.

Navigating the Health Insurance Marketplace in NYC

The New York State of Health Marketplace is a valuable resource for New Yorkers seeking health insurance coverage. This online marketplace, established under the Affordable Care Act, provides a platform for individuals and families to compare and enroll in health insurance plans. Here’s a step-by-step guide to help you navigate the marketplace and find the right health insurance plan for your needs:

Step 1: Understand Your Eligibility

Before exploring the health insurance options available through the marketplace, it’s important to understand your eligibility. The marketplace is primarily for individuals and families who do not have access to affordable health insurance through their employer or another source. Eligibility is determined based on factors such as income, household size, and citizenship status. You can use the marketplace’s eligibility tool to determine whether you qualify for coverage through the marketplace.

Step 2: Research and Compare Plans

Once you’ve established your eligibility, it’s time to research and compare the different health insurance plans offered through the marketplace. The marketplace provides a comprehensive platform where you can view and compare plans from various insurance providers. Consider the coverage, benefits, cost, and network of providers offered by each plan. Take note of the plan’s monthly premium, deductible, copayments, and coinsurance to understand the overall cost and financial implications of the plan.

Step 3: Choose a Plan That Fits Your Needs

With a better understanding of the available plans and their features, it’s time to choose the plan that best fits your needs and budget. Consider your healthcare requirements, such as the types of medical services you or your family are likely to need. Evaluate the plan’s coverage for these services and ensure it aligns with your priorities. Additionally, assess the plan’s financial implications, including the monthly premium and out-of-pocket expenses, to ensure it is affordable and sustainable for your situation.

Step 4: Enroll in Your Chosen Plan

Once you’ve selected the health insurance plan that meets your needs, it’s time to enroll. The enrollment process is typically straightforward and can be completed online through the marketplace’s website. You’ll need to provide personal and household information, including your income and household size, to determine your eligibility for any subsidies or tax credits. After submitting your application, you’ll receive confirmation of your enrollment and details about your chosen plan, including important dates and information about your coverage.

Understanding Your Health Insurance Coverage

Once you’ve selected and enrolled in a health insurance plan, it’s crucial to understand your coverage and how to maximize its benefits. Here are some key aspects to consider:

Understanding Your Plan’s Coverage

Familiarize yourself with the specifics of your health insurance plan’s coverage. Review the plan’s summary of benefits and coverage document, which outlines the services covered by the plan, any limitations or exclusions, and the associated costs. Understand the plan’s deductibles, copayments, and coinsurance amounts, as these will impact your out-of-pocket expenses. Additionally, be aware of any network restrictions and the process for obtaining referrals or prior authorizations for certain services or treatments.

Utilizing Your Plan’s Benefits

Make the most of the benefits offered by your health insurance plan. Take advantage of preventive care services, such as annual check-ups, screenings, and immunizations, which are often covered at no additional cost. Utilize the plan’s network of providers to access quality healthcare services without incurring high out-of-network expenses. Explore any additional benefits offered by your plan, such as wellness programs, mental health services, or discounts on fitness memberships, and consider how these can enhance your overall well-being.

Managing Your Healthcare Costs

Health insurance plans can help manage healthcare costs, but it’s important to be mindful of your out-of-pocket expenses. Keep track of your deductible and copayment amounts, as these will impact your financial obligations. Utilize cost-saving strategies, such as generic medications or in-network providers, to minimize your expenses. Consider setting aside funds in a health savings account (HSA) or flexible spending account (FSA) to help cover out-of-pocket costs. Additionally, review your Explanation of Benefits (EOB) statements from your insurance company to ensure the services you receive are properly billed and covered by your plan.

FAQ

What is the difference between an HMO and a PPO health insurance plan?

+

An HMO (Health Maintenance Organization) plan typically requires you to choose a primary care physician (PCP) and obtain referrals from your PCP for specialist care. HMO plans often have a more limited network of providers, but they may offer lower out-of-pocket costs. On the other hand, a PPO (Preferred Provider Organization) plan allows you more flexibility in choosing healthcare providers, both inside and outside the network, although out-of-network care may be more expensive.

How do I know if I’m eligible for Medicaid in New York City?

+

Eligibility for Medicaid in New York City depends on various factors, including income, household size, and citizenship status. Generally, individuals and families with low incomes are eligible for Medicaid. You can use the New York State of Health’s eligibility tool to determine your eligibility and apply for coverage.

Can I switch health insurance plans during the year?

+

In most cases, you can only switch health insurance plans during the annual Open Enrollment Period, which typically occurs from November to December each year. However, certain life events, such as marriage, divorce, or loss of employer-sponsored coverage, may qualify you for a Special Enrollment Period, allowing you to change plans outside of the Open Enrollment Period.

What happens if I don’t have health insurance in New York City?

+

Going without health insurance in New York City can be risky and may result in significant financial consequences if you require medical care. Without insurance, you’ll be responsible for paying for all medical services out of pocket, which can quickly become unaffordable. Additionally, you may face penalties for not having health insurance, as mandated by the Affordable Care Act.

How can I save money on my health insurance premiums in NYC?

+

There are several strategies to save money on health insurance premiums in NYC. Consider enrolling in a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars for medical expenses. Additionally, compare plans and shop around for the best rates, as premiums can vary significantly between insurance providers. Finally, explore any available subsidies or tax credits for which you may be eligible to reduce your premium costs.