Opm Insurance

OPM Insurance, a prominent player in the insurance industry, has established itself as a trusted provider of comprehensive insurance solutions. With a rich history spanning decades, the company has evolved to meet the changing needs of its clients, offering a wide range of insurance products and services. In this article, we delve into the world of OPM Insurance, exploring its offerings, expertise, and impact on the market.

A Legacy of Excellence: OPM Insurance’s Journey

OPM Insurance, short for Original Progressive Mutual, has been a prominent fixture in the insurance landscape since its founding in 1923. Headquartered in the heart of the financial district in New York City, the company has grown from humble beginnings to become a leading provider of insurance solutions across the United States. Over the years, OPM Insurance has built a reputation for innovation, adaptability, and a deep commitment to its customers.

The company's journey began with a vision to offer accessible and reliable insurance coverage to individuals and businesses alike. Initially focusing on property and casualty insurance, OPM Insurance quickly gained recognition for its efficient claims handling and customer-centric approach. As the insurance landscape evolved, so did OPM, expanding its product portfolio to include life, health, and specialty insurance lines.

One of the key strengths of OPM Insurance lies in its ability to adapt to the ever-changing needs of its clients. With a dedicated team of experienced underwriters, actuaries, and risk management experts, the company has consistently developed innovative insurance solutions to address emerging risks and market trends. This proactive approach has positioned OPM Insurance as a trusted advisor to its customers, providing tailored coverage and risk management strategies.

Comprehensive Insurance Solutions: Unveiling the OPM Portfolio

OPM Insurance’s comprehensive insurance portfolio caters to a diverse range of clients, from individuals and families to small businesses and large corporations. The company’s product offerings are designed to address various insurance needs, providing peace of mind and financial protection.

Property Insurance

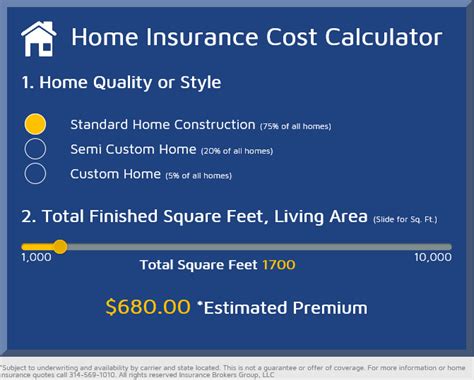

OPM Insurance’s property insurance division offers a wide array of coverage options, including homeowners’, renters’, and condominium insurance. The company understands that every property is unique, and its experienced underwriters work closely with clients to tailor policies that address specific risks and provide adequate protection. Additionally, OPM Insurance offers specialized coverage for high-value homes, historical properties, and unique dwelling structures.

| Coverage Options | Real-World Examples |

|---|---|

| Homeowners' Insurance | Protection for single-family homes, townhouses, and apartments. |

| Renters' Insurance | Covers personal belongings and liability for renters. |

| Condo Insurance | Tailored coverage for condominium owners, including unit and common area protection. |

Casualty Insurance

In the casualty insurance realm, OPM Insurance provides comprehensive coverage for various liabilities. The company’s general liability policies protect businesses and individuals from a range of risks, including bodily injury, property damage, and personal and advertising injury. OPM Insurance’s expertise extends to specialty liability coverage, such as professional liability (E&O), product liability, and cyber liability, addressing the unique risks faced by professionals and businesses in today’s digital age.

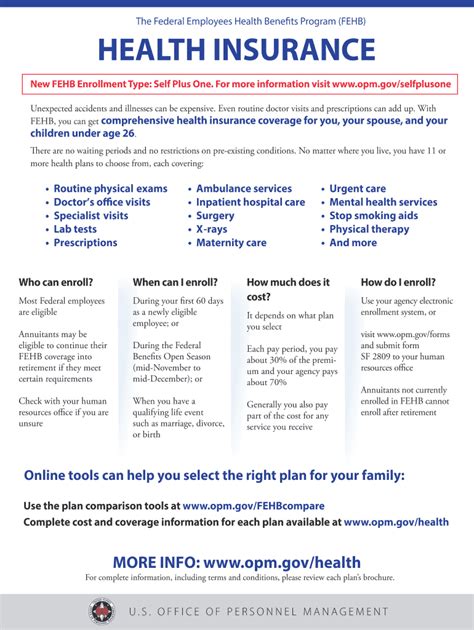

Life and Health Insurance

OPM Insurance’s life and health insurance division offers a holistic approach to protecting individuals and their families. The company provides term life, whole life, and universal life insurance policies, catering to different financial goals and needs. Additionally, OPM Insurance offers health insurance plans, including individual and family medical coverage, as well as dental and vision insurance.

Specialty Insurance

Recognizing the diverse needs of its clients, OPM Insurance has developed a robust specialty insurance division. This division provides coverage for unique risks, including flood insurance, earthquake insurance, and specialty commercial insurance. OPM Insurance’s specialty team works closely with clients to assess their specific needs and develop customized insurance solutions.

Expertise and Innovation: The OPM Advantage

OPM Insurance’s success is built upon a foundation of expertise and a commitment to innovation. The company’s team of industry professionals includes seasoned underwriters, actuaries, and risk management specialists who possess a deep understanding of the insurance landscape.

Underwriting Excellence

OPM Insurance’s underwriting team is renowned for its precision and expertise. These professionals meticulously assess risks, leveraging advanced analytics and industry insights to develop tailored insurance solutions. By thoroughly understanding the unique risks faced by each client, OPM Insurance ensures that its policies provide the necessary coverage while remaining competitively priced.

Technological Advancements

In an era driven by technology, OPM Insurance has embraced digital transformation to enhance its services. The company has invested in cutting-edge technology platforms, streamlining the insurance process and improving overall efficiency. From online policy management and claims submission to real-time risk assessment tools, OPM Insurance leverages technology to provide a seamless and convenient experience for its clients.

Risk Management Leadership

OPM Insurance’s risk management division plays a pivotal role in guiding clients through the complex world of risk assessment and mitigation. The company’s risk management experts provide valuable insights and strategies to help businesses and individuals identify, understand, and manage their risks effectively. Through comprehensive risk assessments, loss control measures, and tailored risk management plans, OPM Insurance empowers its clients to navigate potential threats and protect their assets.

OPM Insurance: A Force for Growth and Stability

OPM Insurance’s impact on the insurance industry extends beyond its comprehensive product offerings and expert services. The company’s commitment to innovation and adaptability has positioned it as a driving force for growth and stability within the market.

Market Leadership and Financial Strength

With a strong financial foundation and a proven track record of success, OPM Insurance has solidified its position as a market leader. The company’s A- (Excellent) rating from AM Best, a leading insurance rating agency, reflects its financial stability and ability to meet its obligations. This rating, coupled with OPM Insurance’s commitment to maintaining a strong balance sheet, provides clients with the confidence that their insurance policies are backed by a financially sound company.

Community Impact and Corporate Social Responsibility

Beyond its business endeavors, OPM Insurance is dedicated to making a positive impact on the communities it serves. The company actively engages in corporate social responsibility initiatives, supporting various charitable causes and promoting sustainability. OPM Insurance’s community involvement includes sponsorships, volunteer programs, and partnerships with local organizations, demonstrating its commitment to giving back and fostering positive change.

Industry Recognition and Awards

OPM Insurance’s excellence and innovation have not gone unnoticed. The company has garnered numerous industry accolades and awards, recognizing its leadership and commitment to customer satisfaction. From industry associations to independent rating agencies, OPM Insurance has consistently been acknowledged for its outstanding performance, customer service, and innovative insurance solutions.

Conclusion: OPM Insurance’s Impact

OPM Insurance has established itself as a trusted partner and leader in the insurance industry. Through its comprehensive insurance solutions, expertise, and commitment to innovation, the company has earned the respect and loyalty of its clients. With a rich history and a forward-thinking approach, OPM Insurance continues to shape the insurance landscape, providing financial protection and peace of mind to individuals, businesses, and communities across the United States.

How can I obtain a quote from OPM Insurance for my specific insurance needs?

+To obtain a quote from OPM Insurance, you can visit their website and utilize their online quoting tool. Alternatively, you can contact their customer service team directly, who will guide you through the process and help you find the right coverage for your needs.

Does OPM Insurance offer customized insurance solutions for businesses?

+Absolutely! OPM Insurance specializes in providing tailored insurance solutions for businesses of all sizes. Their experienced commercial insurance team works closely with businesses to understand their unique risks and develop comprehensive coverage plans.

What sets OPM Insurance apart from other insurance providers in the market?

+OPM Insurance’s dedication to innovation, customer service, and financial stability sets them apart. Their commitment to staying ahead of industry trends and providing personalized insurance solutions ensures they meet the diverse needs of their clients.