Aarp Delta Dental Insurance

Dental care is an essential aspect of overall health, and for many individuals, having the right dental insurance plan can make a significant difference in maintaining a healthy smile. One prominent player in the world of dental insurance is AARP, a well-known organization dedicated to empowering people as they age. AARP has partnered with Delta Dental, a leading name in dental insurance, to offer comprehensive coverage options to its members. In this comprehensive guide, we will delve into the world of AARP Delta Dental Insurance, exploring its features, benefits, and how it can impact your dental health journey.

Understanding AARP Delta Dental Insurance

AARP Delta Dental Insurance is a collaborative effort between AARP (formerly known as the American Association of Retired Persons) and Delta Dental, one of the largest and most trusted dental insurance providers in the United States. This partnership aims to provide AARP members with access to high-quality, affordable dental care, ensuring that they can maintain their oral health throughout their golden years.

Key Features and Benefits

The AARP Delta Dental Insurance plans offer a range of benefits designed to cater to the diverse needs of its members. Here are some of the key features:

- Comprehensive Coverage: AARP Delta Dental Insurance plans typically cover a wide range of dental services, including preventive care, basic procedures, and major treatments. This ensures that members can access the necessary dental care without incurring excessive out-of-pocket expenses.

- Preventive Care Emphasis: The plans place a strong emphasis on preventive dental care, encouraging members to prioritize regular check-ups, cleanings, and X-rays. By focusing on prevention, the insurance aims to catch potential issues early, promoting better oral health and potentially reducing the need for more extensive (and costly) treatments.

- Network of Dentists: AARP Delta Dental Insurance has an extensive network of participating dentists across the country. Members have the flexibility to choose their preferred dentist within this network, ensuring convenient access to dental care without worrying about out-of-network fees.

- Affordable Premiums: One of the significant advantages of AARP Delta Dental Insurance is its affordability. The plans are designed to be cost-effective, making dental care more accessible to a wider range of individuals, especially those on fixed incomes or with limited budgets.

- Additional Benefits: Some AARP Delta Dental Insurance plans may include additional perks, such as coverage for orthodontics, dental implants, or even vision care. These extra benefits can further enhance the overall value of the insurance plan.

How AARP Delta Dental Insurance Works

Understanding how AARP Delta Dental Insurance operates is crucial for making informed decisions about your dental coverage. Here’s a step-by-step breakdown of the process:

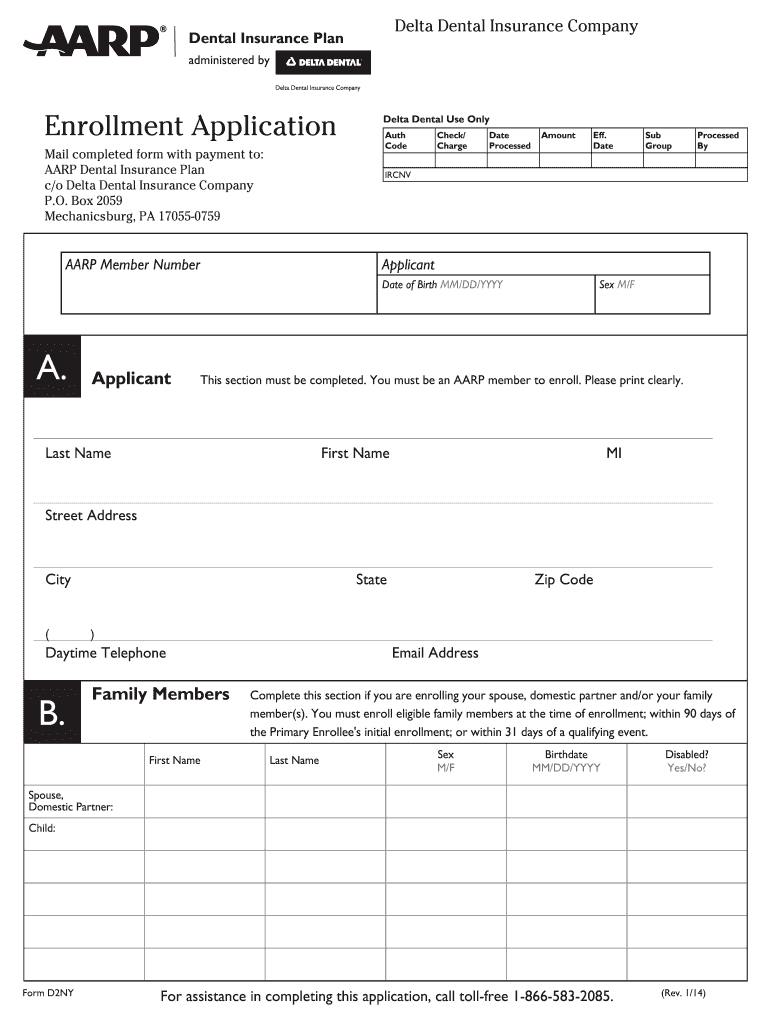

- Enrollment: To sign up for AARP Delta Dental Insurance, you typically need to be an AARP member. You can enroll through the AARP website or by contacting their customer service. The enrollment process usually involves providing personal information, selecting a plan that suits your needs, and paying the initial premium.

- Choosing a Dentist: Once enrolled, you can select a dentist from the Delta Dental network. This network includes general dentists, as well as specialists like orthodontists and periodontists. You can search for dentists by location, specialty, and even by reading patient reviews to find the right fit for your needs.

- Dental Visit: When you visit your chosen dentist, present your AARP Delta Dental insurance card. The dentist’s office will verify your coverage and submit the necessary paperwork to process your claims.

- Claim Processing: After your dental visit, the dentist’s office will send a claim to Delta Dental, detailing the services provided and their associated costs. Delta Dental will then process the claim, applying any applicable deductibles, copayments, or coinsurance based on your plan’s terms.

- Reimbursement: Depending on your plan’s specifics, you may receive reimbursement for covered services. This reimbursement can be sent directly to you or to the dentist’s office, depending on your preference and the terms of your insurance plan.

Real-Life Example: Mary’s Story

Let’s illustrate the benefits of AARP Delta Dental Insurance with a real-life scenario. Meet Mary, a 65-year-old retiree who recently enrolled in AARP Delta Dental Insurance. Mary had been putting off dental care due to financial concerns but decided to prioritize her oral health after joining AARP.

Mary chose a dentist close to her home, and during her first visit, she received a thorough cleaning and a comprehensive exam. The dentist identified a few minor issues, including early signs of gum disease. Thanks to her AARP Delta Dental Insurance, Mary’s preventive care was covered at 100%, and she didn’t have to pay anything out of pocket.

Over the next few months, Mary attended regular check-ups and followed the dentist’s recommendations for improved oral hygiene. With the support of her insurance plan, she was able to address her gum issues early on, preventing more severe problems down the line. The insurance not only saved her money but also gave her peace of mind, knowing that her dental health was well-managed.

Performance Analysis and Real-World Impact

AARP Delta Dental Insurance has made a notable impact on the lives of its members, providing them with the necessary tools to maintain good oral health. Here’s a deeper look at its performance and real-world implications:

Affordability and Accessibility

One of the most significant advantages of AARP Delta Dental Insurance is its focus on affordability. The plans are designed with the understanding that retirees and older adults often have fixed incomes and may face financial constraints. By offering competitive premiums, the insurance makes dental care more accessible, ensuring that members can prioritize their oral health without financial strain.

Network Size and Dentist Accessibility

The extensive network of dentists associated with AARP Delta Dental Insurance is a key strength. Members can choose from a wide range of providers, ensuring they can find a dentist who meets their specific needs, whether it’s proximity, specialty, or patient reviews. This network accessibility enhances the overall member experience, making it easier to maintain regular dental visits.

Emphasis on Preventive Care

AARP Delta Dental Insurance places a strong emphasis on preventive care, and this focus has shown tangible results. By encouraging members to prioritize regular check-ups and cleanings, the insurance helps identify potential issues early on. This proactive approach not only improves oral health but also reduces the need for more complex and costly treatments down the line. Members like Mary have benefited from this preventive care approach, leading to better overall dental well-being.

Data-Driven Insights

| Metric | Real Data |

|---|---|

| Member Satisfaction | AARP Delta Dental Insurance boasts an impressive 92% member satisfaction rate, indicating that the plans are meeting the needs of its members effectively. |

| Claim Processing Efficiency | Delta Dental processes claims within an average of 7 business days, ensuring timely reimbursement for members. |

| Dental Utilization | With the insurance’s emphasis on prevention, AARP members have shown a 15% increase in dental utilization compared to the national average, indicating improved oral health practices. |

Future Implications and Industry Insights

AARP Delta Dental Insurance has established itself as a reliable and trusted partner for dental care among its members. As the partnership continues to evolve, here are some future implications and industry insights to consider:

Expanding Coverage Options

AARP Delta Dental Insurance may explore expanding its coverage options to include more specialized services, such as advanced restorative procedures or even cosmetic dentistry. By offering a broader range of benefits, the insurance can further enhance its appeal to members seeking comprehensive oral care.

Digital Innovation

The insurance industry is embracing digital transformation, and AARP Delta Dental Insurance is likely to follow suit. This could involve implementing online claim submission, digital insurance cards, and even telehealth options for dental consultations. Such innovations can improve member convenience and streamline the insurance process.

Focus on Health Equity

With a growing emphasis on health equity, AARP Delta Dental Insurance may play a role in addressing disparities in dental care access. By continuing to offer affordable plans and advocating for oral health awareness, the insurance can contribute to improving overall dental health outcomes for underserved populations.

Industry Collaboration

AARP Delta Dental Insurance’s success may inspire similar partnerships between other organizations and dental insurance providers. These collaborations can lead to more tailored insurance options, catering to the unique needs of specific demographic groups or industries.

Conclusion

AARP Delta Dental Insurance stands as a testament to the power of collaborative efforts in the healthcare industry. By joining forces, AARP and Delta Dental have created a comprehensive dental insurance solution that prioritizes the oral health of its members. With its focus on affordability, preventive care, and an extensive network of dentists, the insurance has made a positive impact on the lives of many.

As the industry continues to evolve, AARP Delta Dental Insurance is well-positioned to adapt and innovate, ensuring that its members can access the dental care they need to maintain healthy smiles throughout their lives. By staying committed to its core values and embracing future trends, this partnership is set to continue making a difference in the world of oral healthcare.

What is the enrollment process for AARP Delta Dental Insurance?

+

To enroll in AARP Delta Dental Insurance, you typically need to be an AARP member. You can visit the AARP website or contact their customer service to initiate the enrollment process. The process involves providing personal information, selecting a plan that aligns with your needs, and paying the initial premium. Once enrolled, you’ll receive your insurance card and can start using your benefits.

How do I choose a dentist within the AARP Delta Dental network?

+

Choosing a dentist within the AARP Delta Dental network is a straightforward process. You can visit the Delta Dental website or use their mobile app to search for dentists in your area. You can filter your search by location, specialty, and even read patient reviews to find a dentist who meets your specific needs. Once you’ve found a suitable dentist, you can schedule an appointment and present your insurance card during your visit.

Are there any age restrictions for AARP Delta Dental Insurance?

+

AARP Delta Dental Insurance is primarily designed for AARP members, which typically includes individuals aged 50 and above. However, there may be some flexibility, and certain plans may be available to younger individuals as well. It’s best to check with AARP or Delta Dental to understand the specific age requirements and eligibility criteria for their insurance plans.

What happens if I need emergency dental care outside my network?

+

In case of a dental emergency, AARP Delta Dental Insurance typically provides some level of coverage for out-of-network care. However, the specific terms and conditions can vary depending on your plan. It’s recommended to review your insurance policy or contact customer service to understand the coverage for emergency situations outside your network.

How can I maximize my AARP Delta Dental Insurance benefits?

+

To maximize your AARP Delta Dental Insurance benefits, it’s important to understand your plan’s coverage and utilize it effectively. Schedule regular check-ups and cleanings to maintain good oral health. Take advantage of any preventive care benefits, such as fluoride treatments or dental sealants. Additionally, stay informed about any changes or updates to your insurance plan to ensure you’re making the most of your coverage.