Cheap Insurance For Business

In the realm of entrepreneurship and business management, one of the key aspects that often demands careful consideration is finding affordable and comprehensive insurance coverage. This is especially crucial for small businesses and startups that are just getting off the ground, as insurance costs can significantly impact their financial health and stability.

The concept of "cheap insurance for business" encompasses a range of strategies and approaches to secure adequate protection without breaking the bank. It involves a nuanced understanding of insurance needs, a strategic approach to coverage, and a keen eye for cost-saving opportunities. This comprehensive guide aims to delve into the world of business insurance, offering insights, tips, and real-world examples to help entrepreneurs navigate the complexities of securing affordable coverage.

Understanding the Essentials of Business Insurance

Business insurance, in its essence, is a protective measure against financial losses that a company might incur due to various unforeseen events. These can range from property damage and liability claims to loss of income and employee-related risks. The importance of insurance in business cannot be overstated, as it provides a safety net that ensures the continuity and long-term viability of an enterprise.

However, the challenge lies in identifying the right type and level of insurance coverage. This is where a comprehensive understanding of one's business operations, potential risks, and legal obligations becomes crucial. Here's a breakdown of some key insurance types that businesses often consider:

- General Liability Insurance: Covers third-party claims for bodily injury, property damage, and personal and advertising injury.

- Professional Liability Insurance (aka Errors and Omissions Insurance): Protects against negligent acts, errors, and omissions in professional services.

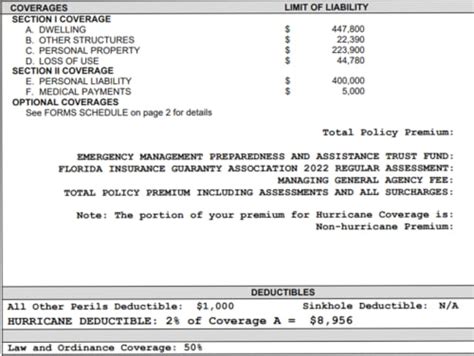

- Property Insurance: Provides coverage for damage or loss to the business's physical assets, such as buildings, inventory, and equipment.

- Business Interruption Insurance: Replaces lost income if a business is forced to close due to a covered peril.

- Workers' Compensation Insurance: Covers medical care and compensation for employees injured or becoming ill due to work-related causes.

Each of these insurance types plays a vital role in protecting different aspects of a business. However, the challenge for many entrepreneurs is to find a balance between adequate coverage and affordability. This is where a strategic approach to insurance procurement becomes essential.

Strategies for Securing Cheap Business Insurance

Finding cheap insurance for a business involves a combination of smart planning, understanding insurance terminology, and a proactive approach to risk management. Here are some effective strategies to achieve this goal:

1. Assess Your Specific Insurance Needs

Every business is unique, and so are its insurance needs. Conduct a thorough risk assessment to identify the specific perils your business is exposed to. This could include evaluating your industry’s common risks, assessing the likelihood of various types of claims, and understanding your legal obligations in terms of insurance coverage.

For instance, a tech startup might prioritize professional liability insurance to protect against claims of errors or omissions in their software, while a retail business might give more weight to property insurance to cover potential losses from theft or fire.

2. Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s crucial to shop around and compare quotes. Online insurance marketplaces can be a great starting point to get a sense of the market rates. However, don’t just focus on the price; also consider the reputation and financial stability of the insurance company, as well as the specific coverage and exclusions in their policies.

Use comparison tools and review websites to evaluate different providers. Reach out to at least three insurance brokers or agencies to get a sense of the range of rates and coverage options available.

3. Bundle Your Insurance Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, you might consider bundling your business property insurance with your commercial auto insurance, or your general liability insurance with professional liability coverage. This not only simplifies your insurance management but can also lead to significant cost savings.

4. Increase Your Deductibles

Increasing your deductibles (the amount you pay out-of-pocket before your insurance kicks in) can lower your insurance premiums. However, this strategy requires careful consideration, as it means you’ll be paying more out of pocket if you do make a claim. It’s a balance between saving on premiums and being able to afford the higher deductible in the event of a claim.

5. Explore Small Business Insurance Programs

Various programs and initiatives are often available to support small businesses in securing affordable insurance. These can include government-backed programs, industry-specific insurance funds, or group insurance programs offered by business associations. Explore these options to see if you’re eligible for any discounts or specialized coverage.

6. Maintain a Strong Risk Management Profile

Insurance companies often reward businesses that demonstrate a strong commitment to risk management. This could involve implementing safety protocols, regular employee training, and adopting measures to mitigate potential risks. A good risk management profile not only reduces the likelihood of claims but can also lead to more favorable insurance rates.

7. Utilize Technology and Online Tools

The insurance industry has seen significant technological advancements, with many providers now offering online platforms for policy management and claims processing. These platforms often provide real-time updates, streamlined processes, and enhanced transparency. Utilize these tools to stay informed, manage your policies efficiently, and even explore options for teleconferencing with your insurance broker or agent.

Case Studies: Real-World Examples of Cheap Business Insurance

To bring these strategies to life, let’s look at some real-world examples of businesses that have successfully secured cheap insurance coverage.

1. The Retail Business: Balancing Coverage and Cost

A small retail business owner in a suburban area focused on understanding their specific insurance needs. They recognized that while their business was at risk of property damage (from theft or natural disasters), the likelihood of a customer slipping and falling (which would require general liability insurance) was relatively low. They decided to prioritize property insurance with a higher deductible, and opted for a lower level of general liability coverage. This strategic approach allowed them to secure comprehensive coverage while keeping costs manageable.

2. The Tech Startup: Prioritizing Professional Liability

A tech startup developing innovative software solutions recognized the critical need for professional liability insurance. They understood that even a small error in their software could lead to significant financial losses for their clients. They decided to bundle their professional liability insurance with cyber liability coverage, ensuring protection against both professional errors and cyber-related risks. This strategic decision allowed them to focus on their core business while managing insurance costs effectively.

3. The Manufacturing Business: Emphasizing Risk Management

A manufacturing business specializing in precision machinery invested heavily in risk management. They implemented stringent safety protocols, regular equipment maintenance, and comprehensive employee training programs. As a result, their insurance provider recognized their commitment to risk mitigation and offered them a substantial discount on their general liability and property insurance policies. This case study highlights the power of proactive risk management in securing affordable insurance coverage.

The Future of Cheap Business Insurance

The landscape of business insurance is evolving, driven by technological advancements, changing consumer expectations, and the need for more personalized coverage. As we move forward, several key trends and developments are likely to shape the future of cheap business insurance.

1. Increased Use of Teleconferencing for Insurance Consultations

With the normalization of remote work and digital communication, the use of teleconferencing for insurance consultations is expected to rise. This trend offers several advantages, including convenience, reduced travel costs, and the ability to reach a wider pool of insurance providers. It also facilitates more frequent and timely interactions between businesses and their insurance brokers, allowing for more proactive management of insurance policies.

2. The Rise of Insurtech and Digital Insurance Platforms

Insurtech, or insurance technology, is transforming the industry with innovative solutions. Digital insurance platforms, for instance, are making it easier for businesses to compare policies, manage their coverage, and even purchase insurance online. These platforms often leverage data analytics and machine learning to offer personalized insurance solutions, making it simpler for businesses to find the right coverage at competitive prices.

3. Growing Emphasis on Risk Management and Prevention

As businesses become more aware of the potential risks they face, there’s a growing emphasis on risk management and prevention. This shift in focus is likely to lead to more proactive insurance strategies, where businesses invest in measures to mitigate risks before they occur. This, in turn, can result in more affordable insurance premiums, as insurance providers recognize the reduced likelihood of claims.

4. Expansion of Microinsurance and Group Insurance Programs

Microinsurance and group insurance programs, which offer affordable coverage to small businesses and startups, are expected to expand in the coming years. These programs, often supported by government initiatives or industry associations, provide a vital safety net for businesses that might otherwise struggle to afford comprehensive insurance coverage. The growth of these programs is a positive development, ensuring that more businesses can access the protection they need.

5. Increased Customization and Personalization of Insurance Policies

The future of business insurance is likely to see a greater focus on customization and personalization. With the availability of advanced data analytics and risk assessment tools, insurance providers will be better equipped to offer policies that are tailored to the unique needs and risks of each business. This shift towards personalized insurance solutions will ensure that businesses receive the coverage they truly need, without paying for unnecessary extras.

Conclusion

Securing cheap insurance for a business is a complex but achievable goal. It requires a strategic approach, a thorough understanding of one’s insurance needs, and a proactive attitude towards risk management. By following the strategies outlined in this guide and staying attuned to the evolving landscape of business insurance, entrepreneurs can navigate the challenges of finding affordable coverage and focus on what truly matters: growing their businesses.

What is the average cost of business insurance?

+The average cost of business insurance can vary widely depending on factors such as the type of business, its size, location, and the specific coverage needed. However, as a rough estimate, small businesses often pay between 500 to 1,000 per year for general liability insurance, while larger businesses may pay tens of thousands of dollars for more comprehensive coverage. It’s important to note that these figures are just averages, and actual costs can be significantly higher or lower based on individual circumstances.

Can I get cheap business insurance as a startup with limited funds?

+Absolutely! Startups can often secure affordable insurance coverage by assessing their specific needs, shopping around for quotes, and exploring options like group insurance programs or microinsurance. It’s also important to maintain a strong risk management profile to demonstrate your commitment to minimizing potential claims, which can lead to more favorable insurance rates.

What are some common pitfalls to avoid when seeking cheap business insurance?

+Some common pitfalls to avoid include underestimating your insurance needs, focusing solely on price without considering coverage, and neglecting to regularly review and update your insurance policies. Additionally, it’s crucial to thoroughly read and understand the terms and conditions of any insurance policy before committing, as some policies may have exclusions or limitations that could leave you vulnerable in certain situations.

How can I make sure my business insurance is up-to-date and comprehensive?

+To ensure your business insurance is up-to-date and comprehensive, regularly review your policies and coverage. Conduct periodic risk assessments to identify any new or changing risks your business faces. Stay informed about industry trends and legal requirements that may impact your insurance needs. Additionally, consider working with an insurance broker who can provide expert guidance and help you tailor your insurance coverage to your specific business needs.