State Farm Life Insurance For Seniors Over 70

As people age, the need for adequate financial protection becomes increasingly important. Life insurance is a crucial aspect of financial planning, offering peace of mind and ensuring that your loved ones are taken care of even after your passing. For seniors over the age of 70, finding the right life insurance policy can be a complex task, but with the right information and guidance, it becomes a manageable process. This comprehensive guide will delve into the world of State Farm Life Insurance and its offerings for seniors over 70, providing an in-depth analysis of its policies, benefits, and key considerations.

Understanding State Farm Life Insurance

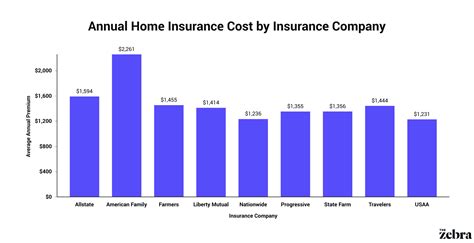

State Farm, a leading insurance provider in the United States, offers a range of insurance products, including auto, home, and life insurance. Their life insurance policies are designed to meet the diverse needs of individuals and families, providing financial protection and security. For seniors over 70, State Farm Life Insurance offers specialized policies that cater to their unique requirements.

State Farm's life insurance policies for seniors over 70 typically fall into two main categories: permanent life insurance and term life insurance. Each type of policy has its own set of benefits and considerations, and understanding these differences is essential for making an informed decision.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, offering a death benefit to your beneficiaries upon your passing. This type of policy also includes a cash value component, which grows over time and can be accessed during your lifetime. The cash value can be used for various purposes, such as supplementing retirement income, covering medical expenses, or paying for long-term care.

State Farm offers several types of permanent life insurance policies for seniors, including:

- Whole Life Insurance: This policy provides a guaranteed death benefit and cash value growth. Premiums remain level throughout the policy's term, providing stability and predictability.

- Universal Life Insurance: With universal life insurance, you have more flexibility in adjusting your premiums and death benefit. The policy's cash value can be used to pay for premiums or even increase the death benefit. This option offers more control over your policy's design.

- Indexed Universal Life Insurance: Indexed universal life insurance links the policy's cash value to a specific market index, such as the S&P 500. While the cash value can fluctuate with market performance, it also has the potential for higher growth. This policy offers a balance between stability and growth opportunities.

Permanent life insurance policies from State Farm provide seniors with a long-term solution for financial protection. The cash value component can be particularly beneficial for covering unexpected expenses or supplementing retirement income. However, it's important to note that permanent life insurance policies typically have higher premiums compared to term life insurance.

Term Life Insurance

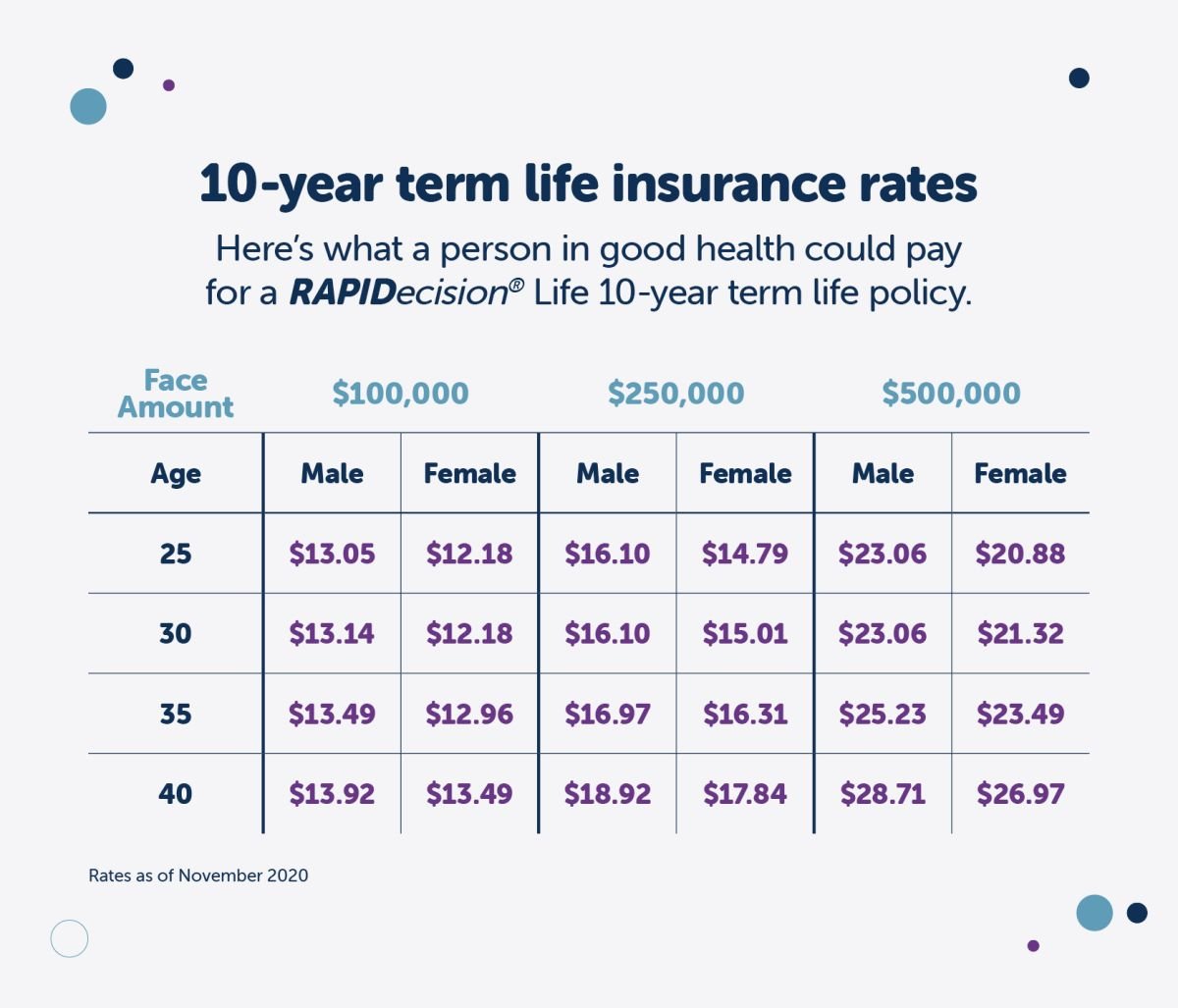

Term life insurance is a more affordable option for seniors seeking life insurance coverage. This type of policy provides coverage for a specified period, typically ranging from 10 to 30 years. During the term, the policy offers a death benefit to your beneficiaries, but it does not include a cash value component.

State Farm's term life insurance policies for seniors offer the following benefits:

- Level Premiums: The premiums for term life insurance remain level throughout the policy's term, providing budget predictability.

- Renewal Options: Some term life insurance policies allow for renewal at the end of the term, ensuring continued coverage even as you age.

- Convertible Policies: Certain policies may offer the option to convert your term life insurance into a permanent life insurance policy, providing the flexibility to adjust your coverage needs over time.

Term life insurance is an attractive option for seniors who want coverage for a specific period, such as until their children become financially independent or until they have sufficient retirement savings. The affordability of term life insurance makes it a popular choice for those on a fixed income.

Key Considerations for Seniors Over 70

When considering life insurance as a senior over 70, there are several important factors to keep in mind. These considerations will help you make an informed decision and choose the policy that best aligns with your financial goals and needs.

Health and Lifestyle Factors

Your health and lifestyle play a significant role in determining your life insurance eligibility and premiums. State Farm, like other insurance providers, considers various health factors when assessing your application. These may include your current health status, medical history, and any pre-existing conditions.

It's important to note that seniors with certain health conditions or high-risk lifestyles may face challenges in obtaining life insurance coverage. However, State Farm offers a range of options, including simplified issue policies, which may be more accessible for individuals with health concerns. Working closely with an insurance agent can help you understand your options and navigate any health-related considerations.

Coverage Amount and Purpose

Determining the right coverage amount is crucial for seniors. Consider your financial goals and the specific purpose of the life insurance policy. Are you looking to cover final expenses, provide income replacement for your spouse, or leave a legacy for your children or grandchildren? Understanding the purpose of your life insurance will guide you in selecting the appropriate coverage amount.

State Farm's life insurance policies offer flexibility in coverage amounts, allowing you to tailor the policy to your needs. Keep in mind that the higher the coverage amount, the higher the premiums. Working with an insurance professional can help you strike the right balance between coverage and affordability.

Cost and Budget

Life insurance premiums can vary significantly based on several factors, including your age, health, and the type of policy you choose. As a senior over 70, it’s essential to consider the cost of life insurance and how it fits within your overall budget.

State Farm offers a range of payment options to accommodate different financial situations. You can choose to pay your premiums annually, semi-annually, quarterly, or even monthly. Additionally, some policies may offer discounts for paying premiums in full or for maintaining multiple policies with State Farm.

It's crucial to assess your financial situation and determine how much you can comfortably afford for life insurance premiums. Remember that life insurance is an investment in your financial security and peace of mind.

Policy Riders and Add-ons

State Farm life insurance policies offer various riders and add-ons that can enhance your coverage and provide additional benefits. These optional features can be tailored to your specific needs and may include:

- Accelerated Death Benefit Rider: This rider allows you to access a portion of your death benefit while you're still alive if you are diagnosed with a terminal illness.

- Long-Term Care Rider: With this rider, a portion of your death benefit can be used to cover long-term care expenses, providing financial assistance during a time when medical costs may be high.

- Waiver of Premium Rider: If you become disabled and unable to work, this rider waives your life insurance premiums, ensuring continued coverage without financial burden.

Discuss these riders and add-ons with your insurance agent to determine which options align with your priorities and provide the most value for your specific circumstances.

The Application Process

Applying for State Farm life insurance as a senior over 70 involves a few key steps. Understanding the process can help you navigate it smoothly and efficiently.

Consulting with an Agent

The first step in the application process is to connect with a State Farm agent. These professionals are trained to guide you through the life insurance options available and help you choose the policy that best suits your needs. They will assess your financial goals, health status, and budget to recommend the most appropriate policy.

During your consultation, the agent will explain the different types of policies, coverage amounts, and riders. They will also provide you with an estimate of the premiums based on your specific circumstances. This personalized guidance is invaluable in making an informed decision.

Health Assessment

As part of the application process, State Farm will require a health assessment. This assessment helps the insurer understand your current health status and determine your eligibility for life insurance coverage. The health assessment may involve a medical examination, blood tests, and a review of your medical history.

It's important to be as honest and accurate as possible during the health assessment. Any misrepresentations or omissions could lead to issues with your policy in the future. If you have concerns about the health assessment or require assistance, your State Farm agent can provide guidance and support.

Policy Review and Selection

Once you’ve completed the health assessment and received your results, your State Farm agent will review the findings with you. They will discuss any potential impact on your eligibility and premiums. Based on this information, you can make an informed decision about the policy that best aligns with your needs and budget.

During the policy review process, your agent will guide you through the terms and conditions of the chosen policy. They will explain the coverage, benefits, and any exclusions or limitations. It's essential to carefully read and understand the policy documents to ensure you are fully aware of your rights and responsibilities.

The Benefits of State Farm Life Insurance for Seniors

State Farm Life Insurance offers several advantages for seniors over 70, making it a popular choice among this demographic. Here are some key benefits to consider:

Customized Coverage

State Farm understands that every senior’s financial situation and needs are unique. Their life insurance policies can be tailored to your specific requirements, whether you’re seeking permanent coverage with cash value or term coverage for a specific period. This customization ensures that you receive the protection you need without paying for unnecessary features.

Flexible Payment Options

State Farm recognizes that seniors may have varying financial situations and preferences. They offer flexible payment options to accommodate different needs. Whether you prefer to pay your premiums annually, semi-annually, quarterly, or monthly, State Farm provides the flexibility to choose the payment schedule that works best for you.

Competitive Premiums

State Farm is known for its competitive premiums, especially for term life insurance policies. Their term life insurance options are often more affordable compared to permanent life insurance, making it an attractive choice for seniors on a fixed income. Additionally, State Farm’s simplified issue policies can provide coverage even for individuals with health concerns, offering an accessible solution.

Strong Financial Stability

State Farm is a financially stable and reputable insurance provider. With a long history of serving customers, they have built a solid reputation for reliability and trustworthiness. This stability ensures that your life insurance policy is backed by a financially secure company, providing peace of mind that your beneficiaries will receive the death benefit as promised.

Excellent Customer Service

State Farm prides itself on its customer-centric approach. Their dedicated agents are trained to provide personalized guidance and support throughout the life insurance application process and beyond. Whether you have questions about your policy, need assistance with a claim, or require policy adjustments, State Farm’s customer service team is readily available to assist you.

Conclusion

Life insurance is an essential component of financial planning for seniors over 70. State Farm Life Insurance offers a range of policies tailored to meet the unique needs of this demographic. With permanent life insurance options providing lifelong coverage and cash value growth, as well as affordable term life insurance policies, State Farm provides seniors with the financial protection they require.

When considering life insurance as a senior, it's crucial to assess your health, budget, and coverage needs. Working closely with a State Farm agent can help you navigate the application process, understand your options, and make an informed decision. State Farm's commitment to customized coverage, flexible payment options, competitive premiums, financial stability, and excellent customer service makes them a trusted partner for seniors seeking life insurance.

Frequently Asked Questions

What is the maximum age for purchasing life insurance from State Farm?

+

State Farm offers life insurance policies for individuals up to a certain age, typically around 80 years old. However, the exact age limit may vary depending on the type of policy and your individual circumstances. It’s best to consult with a State Farm agent to determine the maximum age for purchasing life insurance.

Can I purchase life insurance if I have pre-existing health conditions?

+

Yes, State Farm offers simplified issue policies that may be more accommodating for individuals with pre-existing health conditions. These policies have a streamlined application process and may not require a medical examination. However, the availability and terms of such policies may vary, so it’s advisable to discuss your options with a State Farm agent.

Are there any discounts available for State Farm life insurance policies?

+

State Farm offers various discounts for life insurance policies, including multi-policy discounts for customers who bundle their life insurance with other State Farm policies, such as auto or home insurance. Additionally, paying your premiums in full or choosing a longer term for your policy may result in cost savings. Consult with your State Farm agent to explore available discounts.

Can I convert my term life insurance policy into a permanent life insurance policy with State Farm?

+

Yes, certain State Farm term life insurance policies come with a conversion option. This allows you to convert your term life insurance into a permanent life insurance policy, such as a whole life or universal life policy, within a specified timeframe. The conversion option provides flexibility and ensures that you can adjust your coverage as your needs evolve.

How long does it take to receive a decision on my life insurance application with State Farm?

+

The timeline for receiving a decision on your life insurance application with State Farm can vary depending on several factors, including the complexity of your application and the availability of required information. Typically, State Farm aims to provide a decision within a few weeks after receiving a complete application and all necessary documentation. However, it’s always best to consult with your State Farm agent for an estimated timeline based on your specific circumstances.