Annual Home Insurance Cost

Home insurance is a vital aspect of financial planning for homeowners, offering protection against various risks and unexpected events. The cost of home insurance can vary significantly depending on numerous factors, making it a complex topic that often leaves homeowners with many questions. In this comprehensive guide, we delve into the factors influencing annual home insurance costs, providing you with the knowledge to make informed decisions about your home coverage.

Understanding Home Insurance Costs

The annual cost of home insurance, often referred to as the premium, is influenced by a multitude of factors, each contributing to the overall risk profile of your home. These factors can be broadly categorized into three main groups: your home’s characteristics, your personal circumstances, and the insurance company’s assessment of risk.

Factors Influencing Home Insurance Premiums

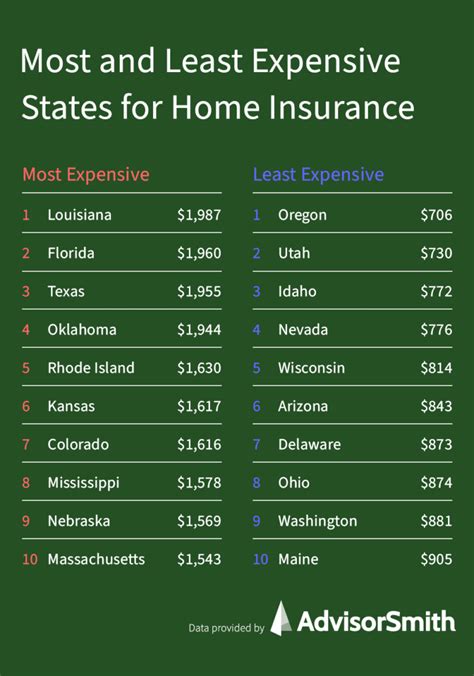

- Home Location and Construction: The physical characteristics of your home play a significant role. Homes in areas prone to natural disasters like hurricanes, tornadoes, or earthquakes typically command higher premiums due to the increased risk of damage. Similarly, homes built with fire-resistant materials or located in areas with good fire protection services may enjoy lower premiums.

- Home Value and Size: The value and size of your home are crucial considerations. Generally, larger homes with higher replacement costs will attract higher premiums. This is because more coverage is required to rebuild or replace the home and its contents in the event of a total loss.

- Age and Condition of the Home: Older homes may pose unique challenges, such as outdated electrical systems or plumbing, which can increase the risk of accidents and thus, the insurance premium. Regular maintenance and updates can help mitigate these risks.

- Personal Circumstances: Your personal financial situation and lifestyle can also impact your insurance premium. For instance, individuals with a strong credit history often receive more favorable rates. Additionally, certain professions or hobbies may be seen as higher risk, leading to increased premiums.

- Insurance Coverage and Deductibles: The level of coverage you choose directly affects your premium. Comprehensive coverage that includes protection against a wide range of perils will typically cost more than basic coverage. Additionally, the choice of deductible - the amount you pay out of pocket before your insurance kicks in - can significantly impact your premium. Higher deductibles usually result in lower premiums.

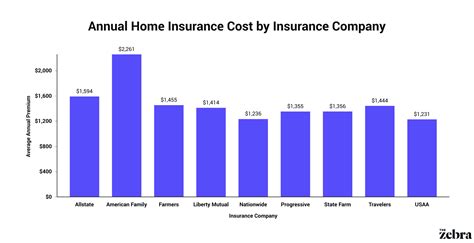

- Insurance Company and Policy Type: Different insurance companies have varying approaches to assessing risk and setting premiums. It’s essential to shop around and compare policies to find the best coverage at the most competitive price. The type of policy you choose, such as a standard home insurance policy or a more specialized one like a high-value home insurance policy, will also affect the cost.

Real-World Example: Annual Home Insurance Cost Variations

To illustrate the impact of these factors, let’s consider two hypothetical homeowners, Sarah and David.

| Factor | Sarah's Home | David's Home |

|---|---|---|

| Location | Suburban area with low crime and minimal natural disaster risk | Coastal region prone to hurricanes |

| Home Value | $300,000 | $500,000 |

| Age of Home | 10 years old | 30 years old |

| Deductible | $1,000 | $2,000 |

| Coverage Type | Standard Home Insurance | High-Value Home Insurance |

Given these factors, Sarah's annual home insurance premium might be around $1,200, while David's, due to the higher risk factors, could be closer to $2,500. This example demonstrates how different circumstances can lead to significantly different insurance costs.

Strategies to Reduce Annual Home Insurance Costs

While the cost of home insurance is largely influenced by factors beyond your control, there are several strategies you can employ to potentially reduce your annual premium and save money.

Enhancing Your Home’s Safety

One of the most effective ways to reduce your home insurance premium is by making your home safer and less susceptible to damage. This can involve a range of improvements, such as:

- Home Security Upgrades: Installing a monitored security system, reinforced doors, and high-quality locks can deter burglars and reduce the risk of theft. Many insurance companies offer discounts for such safety measures.

- Fire Safety Improvements: Upgrading your home’s fire safety features, including installing smoke detectors, fire extinguishers, and a sprinkler system, can significantly lower your fire risk. These improvements often lead to insurance discounts.

- Weatherproofing Your Home: Taking steps to protect your home against natural disasters can be beneficial. For example, installing storm shutters or impact-resistant windows can reduce the risk of damage from hurricanes or severe storms.

Optimizing Your Insurance Policy

There are several strategies you can employ to optimize your insurance policy and potentially reduce your annual premium, including:

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. This can lead to significant savings.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly reviewing your policy ensures that you’re not paying for coverage you no longer need and helps you identify any gaps in your coverage.

- Increase Your Deductible: While this strategy involves paying more out of pocket in the event of a claim, it can lead to a substantial reduction in your annual premium. However, it’s important to choose a deductible amount that you’re comfortable paying.

Shopping Around for the Best Deal

Comparing quotes from multiple insurance companies is a crucial step in finding the best deal for your home insurance. Each insurer assesses risk differently, and their rates can vary significantly. By shopping around, you can find the insurer that offers the best coverage at the most competitive price.

The Future of Home Insurance Costs

The home insurance landscape is constantly evolving, and several factors are likely to shape the future cost of home insurance.

Climate Change and Natural Disasters

As climate change continues to impact weather patterns, the frequency and severity of natural disasters are likely to increase. This could lead to higher insurance premiums, especially in areas prone to these events. Insurance companies will need to adapt their risk assessment models to account for these changing conditions.

Advancements in Technology

Technological advancements are expected to play a significant role in shaping the future of home insurance. For instance, the use of smart home devices and sensors can provide real-time data on home conditions, potentially allowing insurance companies to offer more personalized and accurate coverage. Additionally, blockchain technology and artificial intelligence could streamline insurance processes, reducing costs and improving efficiency.

Changing Consumer Behavior

As consumer awareness and preferences evolve, so too will the home insurance market. The growing demand for sustainable and environmentally friendly products and services may lead to new insurance offerings focused on these values. Additionally, the increasing popularity of shared economy models, such as Airbnb, could impact insurance needs and costs.

Conclusion

Understanding the factors that influence home insurance costs is the first step towards making informed decisions about your home coverage. By considering your home’s characteristics, personal circumstances, and insurance company policies, you can find the right balance of coverage and cost. Additionally, implementing strategies to reduce your premium, such as enhancing your home’s safety and optimizing your insurance policy, can help you save money without compromising on protection.

How do I find the best home insurance rate for my needs?

+To find the best home insurance rate, compare quotes from multiple insurers. Consider your specific needs and ensure the policy covers those adequately. Don’t forget to ask about discounts for safety features or bundling policies.

What factors can I control to lower my home insurance costs?

+You can take steps to enhance your home’s safety, such as installing security systems or fire safety measures. Additionally, reviewing and optimizing your coverage regularly can help lower costs.

How do natural disasters impact home insurance costs?

+Natural disasters can increase insurance costs, especially in areas prone to such events. Insurance companies factor in the risk of potential damage, which can lead to higher premiums.