How Does A Whole Life Insurance Work

Whole life insurance, often referred to as permanent life insurance, is a financial product designed to provide lifelong coverage and build cash value over time. Unlike term life insurance, which offers coverage for a specific period, whole life insurance offers a guaranteed death benefit and a savings component. This makes it a popular choice for those seeking long-term financial protection and asset accumulation.

The unique feature of whole life insurance is its ability to combine protection and investment in one policy. Policyholders pay regular premiums, which are then divided into two parts: one portion goes towards the cost of insurance (COI) to maintain the death benefit, and the other portion is invested to grow the policy's cash value. This cash value acts as a savings account, earning interest and providing various benefits to the policyholder.

Understanding the Components of Whole Life Insurance

To grasp how whole life insurance works, it's essential to understand its key components:

Death Benefit

The death benefit is the amount paid to the beneficiaries upon the insured individual's death. This benefit remains level throughout the policy's term, providing financial security to loved ones. The COI portion of the premium ensures that this benefit remains guaranteed, regardless of the policyholder's age or health status.

Cash Value

The cash value component of whole life insurance is one of its most attractive features. It grows on a tax-deferred basis, meaning the policyholder doesn't pay taxes on the interest earned until the cash value is accessed. This growth is fueled by the investment portion of the premiums, which are typically invested in a conservative portfolio of bonds and other low-risk assets.

| Key Component | Description |

|---|---|

| Cost of Insurance (COI) | The portion of the premium that covers the cost of maintaining the death benefit. |

| Cash Value | A savings account that grows tax-deferred, providing financial flexibility. |

Policyholders can borrow against the cash value or withdraw it tax-free, up to the basis of the policy. This can be especially beneficial for funding retirement, paying for a child's education, or covering unexpected expenses. However, it's important to note that if the cash value is withdrawn or the policy is surrendered, the death benefit may be reduced or eliminated.

The Process of Whole Life Insurance

The process of acquiring and utilizing whole life insurance involves several steps:

Application and Underwriting

To obtain whole life insurance, individuals must first apply. This process typically involves a medical exam and a thorough review of the applicant's health and lifestyle. Underwriters assess the risk associated with insuring the individual, and based on this assessment, the premium is determined.

Premium Payment

Policyholders pay premiums, which can be made on a monthly, quarterly, semi-annual, or annual basis. These premiums are typically fixed, meaning they remain the same throughout the policy's term. However, there are also flexible premium policies that allow for adjustments based on the policyholder's financial situation.

Policy Growth

Over time, the policy's cash value grows. This growth is influenced by the interest rate credited to the policy, which is typically guaranteed by the insurance company. Additionally, the policy may also earn dividends, which are distributed based on the insurance company's financial performance.

Utilizing the Cash Value

Policyholders can access the cash value in several ways:

- Policy Loans: Borrow against the cash value, with the option to repay the loan with interest.

- Withdrawal: Take cash withdrawals, reducing the policy's death benefit and cash value.

- Policy Surrender: Cancel the policy and receive the cash value, minus any surrender charges.

It's important to note that utilizing the cash value in certain ways may have tax implications, and policyholders should consult with a financial advisor to understand the potential impact.

Benefits and Considerations of Whole Life Insurance

Whole life insurance offers several advantages:

- Guaranteed Death Benefit: Provides financial protection for loved ones, regardless of the insured's age or health.

- Cash Value Growth: Allows for tax-deferred savings and potential investment growth.

- Flexibility: Policyholders can borrow against or withdraw cash value to meet financial needs.

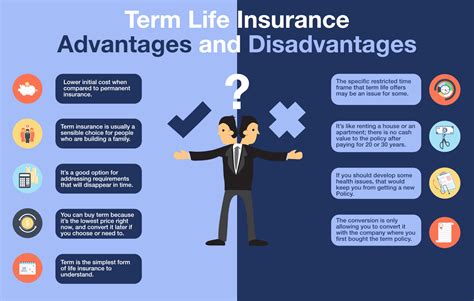

- Lifetime Coverage: Unlike term life insurance, whole life insurance provides coverage for the policyholder's entire life.

However, there are also considerations to keep in mind:

- Higher Premiums: Whole life insurance often has higher premiums compared to term life insurance.

- Complex Structure: Understanding the interplay between the death benefit, cash value, and premiums can be challenging.

- Surrender Charges: Canceling the policy may result in surrender charges, reducing the cash value.

Who Should Consider Whole Life Insurance

Whole life insurance is an attractive option for individuals seeking long-term financial protection and asset accumulation. It's particularly beneficial for those who:

- Want a guaranteed death benefit that remains level throughout their lifetime.

- Are looking for a tax-efficient way to build savings.

- Value the flexibility to access cash value for various financial needs.

- Have a long-term financial plan and can commit to consistent premium payments.

Future Implications and Expert Insights

Whole life insurance remains a staple in the financial planning industry, offering a reliable and flexible way to protect loved ones and build wealth. As economic conditions and tax laws evolve, the appeal of whole life insurance may fluctuate, but its fundamental benefits are expected to remain attractive to those seeking comprehensive financial protection.

Conclusion

Whole life insurance is a complex financial product that offers a unique combination of protection and savings. By understanding its components and the process involved, individuals can make informed decisions about whether whole life insurance aligns with their financial goals and needs. As with any financial decision, it's crucial to consult with professionals and thoroughly review the policy to ensure it meets individual circumstances.

How does the cash value of whole life insurance work?

+The cash value of whole life insurance grows on a tax-deferred basis. It is fueled by the investment portion of the premiums, typically invested in low-risk assets. Policyholders can borrow against or withdraw this cash value, subject to certain conditions and potential tax implications.

Can I change the premium amount for my whole life insurance policy?

+Yes, some whole life insurance policies offer flexible premium payment options. Policyholders can adjust the premium amount based on their financial situation, allowing for greater flexibility in managing their financial commitments.

What happens if I stop paying premiums for my whole life insurance policy?

+If premiums are not paid, the policy may enter a grace period, allowing time for payment. If premiums remain unpaid beyond the grace period, the policy may lapse, resulting in the loss of coverage and any accumulated cash value.