Metro Life Insurance

In the ever-evolving landscape of financial services, insurance companies play a pivotal role in securing the future of individuals and businesses alike. Among the myriad of insurance providers, Metro Life Insurance stands out as a prominent player, offering a comprehensive suite of insurance products tailored to meet diverse needs. With a rich history, innovative offerings, and a customer-centric approach, Metro Life Insurance has established itself as a trusted partner for those seeking financial protection and peace of mind.

A Legacy of Financial Security: The Story of Metro Life Insurance

The origins of Metro Life Insurance can be traced back to [founding year], when a group of visionary entrepreneurs recognized the growing need for accessible and reliable insurance solutions. Over the decades, the company has grown exponentially, solidifying its position as a leading provider of life and health insurance, while also expanding into other areas of financial services.

Metro Life Insurance's success story is a testament to its unwavering commitment to innovation and customer satisfaction. The company's leadership has consistently embraced technological advancements, ensuring that its products and services remain relevant and accessible to modern consumers. This forward-thinking approach has enabled Metro Life Insurance to stay ahead of the curve, providing clients with cutting-edge solutions that address their evolving needs.

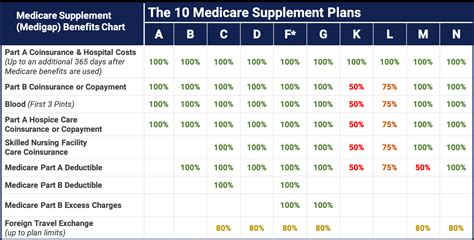

One of the key strengths of Metro Life Insurance lies in its diverse range of insurance products. From traditional life insurance policies that provide financial protection to beneficiaries upon the policyholder's demise, to more contemporary offerings such as critical illness coverage and long-term care insurance, the company offers a comprehensive suite of options to cater to various life stages and circumstances.

The Evolution of Life Insurance: A Metro Life Insurance Perspective

Life insurance, a cornerstone of financial planning, has evolved significantly over the years. Metro Life Insurance has been at the forefront of this evolution, constantly refining its products to align with the changing needs of its customers. Traditional life insurance policies, designed to provide a financial safety net for beneficiaries, remain a core offering. However, Metro Life Insurance has also recognized the importance of adapting to the modern world’s challenges and opportunities.

One notable innovation is the introduction of critical illness coverage. This type of insurance provides financial support to policyholders diagnosed with specific critical illnesses, such as cancer, heart disease, or stroke. By offering this coverage, Metro Life Insurance empowers individuals to focus on their health and recovery without the added stress of financial burdens.

Additionally, the company has expanded its horizons by venturing into long-term care insurance. This type of insurance covers the costs associated with extended care needs, such as assisted living facilities or home healthcare services. With an aging population and the rising costs of healthcare, long-term care insurance has become an increasingly vital component of financial planning. Metro Life Insurance's proactive approach in addressing this need showcases its commitment to staying ahead of the curve and providing comprehensive solutions.

| Insurance Type | Coverage Highlights |

|---|---|

| Life Insurance | Financial protection for beneficiaries, customizable policies, and term or whole life options. |

| Critical Illness Coverage | Financial support for policyholders diagnosed with specified critical illnesses, easing the burden of medical costs. |

| Long-Term Care Insurance | Coverage for extended care needs, including assisted living and home healthcare, providing financial stability during challenging times. |

Moreover, Metro Life Insurance's customer-centric philosophy is evident in its claim settlement process. The company understands that during times of crisis, timely and efficient claim settlements are of utmost importance. Thus, it has streamlined its procedures, ensuring that policyholders receive their benefits promptly and without unnecessary hassle. This commitment to customer satisfaction has earned Metro Life Insurance a reputation for reliability and trustworthiness.

The Impact of Technology: Enhancing Customer Experience

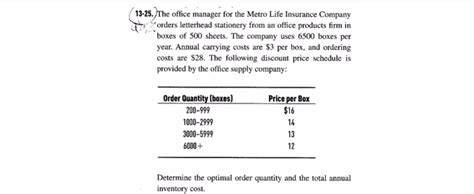

In an era where digital transformation is reshaping industries, Metro Life Insurance has embraced technology as a key enabler. The company has invested significantly in developing a robust digital infrastructure, recognizing that technology can enhance the overall customer experience and streamline operational processes.

One of the standout features of Metro Life Insurance's digital strategy is its user-friendly online platform. Policyholders can access their accounts, manage policies, and make payments with just a few clicks. This convenience not only saves time but also empowers individuals to take control of their financial planning. The platform is designed with simplicity in mind, ensuring that even those less tech-savvy can navigate it effortlessly.

Furthermore, Metro Life Insurance has leveraged technology to improve its underwriting processes. By utilizing advanced analytics and predictive modeling, the company can assess risk more accurately and efficiently. This not only benefits the business by optimizing its risk management strategies but also translates to faster policy approvals for customers, reducing the traditional wait times associated with insurance applications.

The impact of technology extends beyond the customer-facing aspects. Internally, Metro Life Insurance has implemented innovative solutions to optimize its operations. From automating routine tasks to implementing advanced data analytics for strategic decision-making, the company has transformed its back-end processes, resulting in increased efficiency and cost savings. These technological advancements have enabled Metro Life Insurance to focus its resources on enhancing customer service and product innovation.

Digital Innovations: A Competitive Edge

Metro Life Insurance’s embrace of digital transformation has not only improved its operational efficiency but has also given it a competitive edge in the market. The company’s digital initiatives have garnered recognition within the industry, positioning it as a forward-thinking and customer-centric organization.

One notable innovation is the introduction of mobile applications. Metro Life Insurance's mobile apps provide policyholders with convenient access to their insurance information on the go. Customers can view policy details, make payments, and even file claims directly from their smartphones. This level of accessibility and convenience is highly valued by modern consumers who expect seamless digital experiences.

Additionally, Metro Life Insurance has integrated artificial intelligence (AI) and machine learning into its systems. These technologies enhance the company's ability to personalize its offerings, provide tailored recommendations, and offer proactive customer support. By leveraging AI, Metro Life Insurance can anticipate customer needs, address concerns before they escalate, and ultimately, deliver a more satisfying customer experience.

| Digital Innovation | Benefits |

|---|---|

| User-Friendly Online Platform | Convenient policy management, payment options, and accessibility for all users. |

| Advanced Underwriting Technology | Accurate risk assessment, faster policy approvals, and optimized risk management strategies. |

| Mobile Applications | On-the-go policy access, payment options, and claim filing, enhancing customer convenience. |

| Artificial Intelligence Integration | Personalized recommendations, proactive customer support, and enhanced overall satisfaction. |

In conclusion, Metro Life Insurance's journey from its humble beginnings to becoming a leading insurance provider is a testament to its dedication to innovation and customer service. By leveraging technology, the company has not only streamlined its operations but also elevated the customer experience. As the insurance industry continues to evolve, Metro Life Insurance remains poised to lead the way, ensuring that its clients can navigate their financial journeys with confidence and peace of mind.

How does Metro Life Insurance ensure the security of customer data?

+

Metro Life Insurance prioritizes data security and employs robust measures to protect customer information. This includes advanced encryption protocols, regular security audits, and strict access controls. The company stays updated with industry best practices and complies with relevant data protection regulations to ensure the highest level of data security.

What sets Metro Life Insurance apart from its competitors?

+

Metro Life Insurance stands out for its commitment to innovation, customer satisfaction, and a diverse range of insurance products. The company’s focus on technology, including its user-friendly digital platform and advanced underwriting processes, sets it apart. Additionally, its critical illness and long-term care insurance offerings provide comprehensive protection, catering to the evolving needs of modern consumers.

How can I reach Metro Life Insurance’s customer support?

+

Metro Life Insurance offers multiple channels for customer support. You can reach their team through their website’s live chat feature, by calling their toll-free customer service number, or by sending an email to their dedicated support address. The company aims to provide timely and efficient assistance to all inquiries.