Term Life Insurance Estimate

When it comes to financial planning and securing your loved ones' future, term life insurance is an essential tool. This type of insurance provides coverage for a specified period, often referred to as the "term." It offers a cost-effective way to ensure that your beneficiaries are financially protected in the event of your untimely passing. In this comprehensive guide, we will delve into the world of term life insurance, exploring its intricacies, benefits, and how to estimate the coverage that aligns perfectly with your unique needs.

Understanding Term Life Insurance

Term life insurance is a straightforward and flexible insurance option that offers coverage for a defined period, typically ranging from 10 to 30 years. Unlike permanent life insurance policies, which provide coverage for your entire life, term life insurance is designed to meet specific needs during a particular stage of your life. It is an ideal choice for individuals seeking affordable protection during periods of increased financial responsibility, such as when starting a family, purchasing a home, or paying off debts.

One of the key advantages of term life insurance is its cost-effectiveness. Since it covers a limited period, the premiums are often significantly lower compared to permanent life insurance policies. This makes it an attractive option for those on a budget who still want to ensure their loved ones' financial security. Additionally, term life insurance offers flexibility, allowing individuals to tailor their coverage to their changing needs over time.

How Term Life Insurance Works

Term life insurance operates on a simple premise: you pay a premium for a specified period, and in return, the insurance company promises to pay a designated beneficiary a predetermined sum, known as the death benefit, should you pass away during the policy’s term. The death benefit can be used by your beneficiaries to cover various expenses, including funeral costs, outstanding debts, or to maintain their current standard of living.

The term of the policy can be customized to match your specific needs. For example, if you have young children and want to ensure their financial security until they reach adulthood, you might opt for a 20-year term policy. Alternatively, if you're paying off a mortgage, you might choose a term that aligns with the repayment period to ensure your loved ones can keep the home should you pass away during that time.

| Term Length | Coverage Period |

|---|---|

| 10 Years | Provides coverage for a decade, ideal for short-term financial responsibilities. |

| 20 Years | Offers protection for two decades, suitable for covering children's education or long-term financial goals. |

| 30 Years | Provides the longest term coverage, ensuring protection until retirement or beyond. |

Estimating Your Term Life Insurance Needs

Determining the right amount of term life insurance coverage is a crucial step in financial planning. It involves considering various factors, such as your current and future financial obligations, the financial needs of your beneficiaries, and your personal circumstances.

Assessing Financial Obligations

The first step in estimating your term life insurance needs is to evaluate your current financial obligations. This includes considering your outstanding debts, such as mortgages, car loans, credit card balances, and any other financial commitments. These obligations may impact the amount of coverage you require to ensure your beneficiaries can pay them off in the event of your passing.

For example, if you have a substantial mortgage, you might want to consider a term life insurance policy that covers the remaining balance. This way, your loved ones can continue living in the family home without the burden of a mortgage payment.

Considering Future Financial Goals

Beyond your immediate financial obligations, it’s essential to think about your future financial goals and how they might impact your insurance needs. For instance, if you’re planning to start a family or send your children to college, you’ll want to ensure your policy covers the costs associated with these milestones. Additionally, if you have a business or are an entrepreneur, you may need to factor in business-related expenses and potential losses.

Calculating the Right Coverage Amount

To estimate the appropriate coverage amount, consider the total financial burden your beneficiaries would face if you were to pass away unexpectedly. This includes not only immediate expenses but also long-term financial needs. Some financial advisors suggest calculating your coverage amount based on your annual income, with a common recommendation being 10 to 15 times your annual salary.

For example, if you earn $75,000 per year, a term life insurance policy with a coverage amount of $750,000 to $1,125,000 could provide your loved ones with sufficient financial support to cover living expenses, debts, and future financial goals.

Factors Influencing Term Life Insurance Estimates

When estimating your term life insurance needs, several factors come into play, each impacting the overall cost and coverage of your policy.

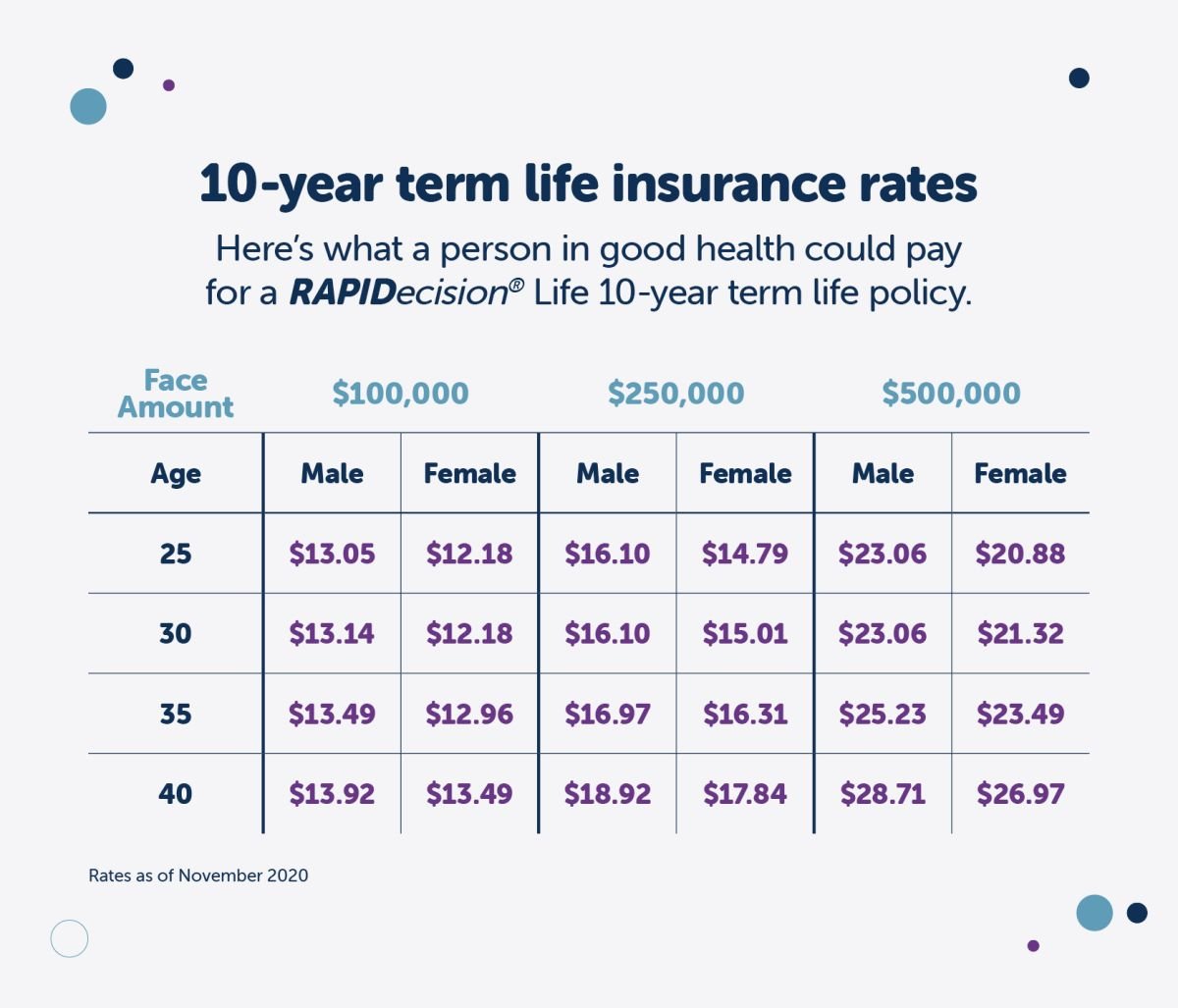

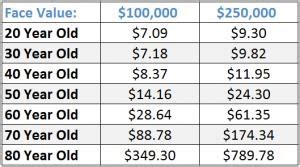

Age and Health

Your age and health are significant determinants of your term life insurance premiums and coverage. Generally, younger individuals are offered lower premiums due to their reduced risk of passing away during the policy term. Additionally, those in good health may qualify for preferred rates, as they are less likely to require insurance payouts.

For instance, a 30-year-old non-smoker in excellent health may qualify for a lower premium than a 45-year-old individual with health complications. This highlights the importance of maintaining a healthy lifestyle to secure the best insurance rates.

Lifestyle and Occupation

Your lifestyle and occupation can also influence your term life insurance estimates. High-risk occupations, such as those in the military or certain dangerous professions, may result in higher premiums or limited coverage options. Similarly, engaging in risky hobbies or activities like skydiving or extreme sports can impact your insurance rates.

It's essential to disclose all relevant information about your lifestyle and occupation when applying for term life insurance to ensure accurate estimates and avoid any potential issues with your policy.

Policy Riders and Add-Ons

Term life insurance policies often come with optional riders or add-ons that can enhance your coverage. These riders can include features like accelerated death benefits for terminal illnesses, waiver of premium for disability, or child riders that provide a small death benefit for your children.

While these riders can add value to your policy, they also increase the overall cost. It's crucial to carefully consider which riders are necessary for your specific circumstances to ensure you're not overpaying for coverage you may not need.

Comparing Term Life Insurance Quotes

Once you have a clear understanding of your term life insurance needs and the factors influencing your estimates, it’s time to compare quotes from different insurance providers. Shopping around for the best rates is essential to ensure you’re getting the most value for your money.

Online Quote Comparison

One of the most convenient ways to compare term life insurance quotes is through online platforms. These websites allow you to enter your personal information and coverage preferences, and then they provide you with a list of quotes from multiple insurance companies. This method saves time and effort, as you can quickly see a range of options and their associated costs.

When using online quote comparison tools, ensure you're providing accurate and detailed information to receive the most precise estimates. Additionally, read the fine print to understand any exclusions or limitations that may apply to the policies you're considering.

Working with an Insurance Broker

Another approach to comparing term life insurance quotes is to work with an insurance broker. Brokers have access to multiple insurance companies and can shop around on your behalf to find the best policy that meets your needs and budget. They can also provide valuable advice and guidance based on their expertise in the industry.

When working with a broker, be transparent about your financial situation, health status, and any specific coverage requirements. This will help them tailor their recommendations to your unique circumstances and ensure you're getting the most suitable policy.

Evaluating Policy Features and Customer Service

When comparing term life insurance quotes, it’s not just about the price. You should also consider the features and benefits of each policy, as well as the reputation and customer service of the insurance company. Look for policies that offer flexibility in terms of coverage periods and the option to convert to permanent life insurance if your needs change in the future.

Additionally, research the insurance company's reputation for timely claim payments and customer satisfaction. You want to ensure that the company you choose has a strong track record of honoring its commitments and providing excellent service when you need it most.

Renewing and Adjusting Your Term Life Insurance

Term life insurance policies typically have a fixed term, and once that term expires, you have a few options for continuing your coverage.

Policy Renewal

Most term life insurance policies offer the option to renew at the end of the term. Renewal typically involves providing updated health and lifestyle information, and your premiums may increase based on your age and any changes in your health status. Renewing your policy can be a straightforward way to maintain coverage without the need for a new medical exam or extensive application process.

Converting to Permanent Life Insurance

If your financial situation and needs change over time, you may want to consider converting your term life insurance policy to a permanent life insurance policy, such as whole life or universal life insurance. Permanent life insurance provides coverage for your entire life and typically includes a cash value component that can be accessed for various financial needs.

The conversion process usually involves a simple application and may require a medical exam, depending on your age and health status. Converting to permanent life insurance can be a strategic move if you want to ensure lifelong coverage and access to additional financial benefits.

Assessing Your Coverage Needs Over Time

As your life circumstances evolve, it’s crucial to periodically reassess your term life insurance coverage to ensure it aligns with your current needs. Major life events, such as marriage, divorce, the birth of a child, or significant changes in your financial status, may warrant adjustments to your policy.

Regularly reviewing your coverage ensures that you're not overinsured or underinsured. It allows you to make informed decisions about your financial protection and make any necessary changes to your policy to reflect your current circumstances.

Conclusion: Securing Your Future with Term Life Insurance

Term life insurance is a powerful tool for securing your loved ones’ financial future during specific stages of your life. By understanding the intricacies of term life insurance, assessing your financial obligations, and comparing quotes from reputable insurance providers, you can make informed decisions about your coverage needs.

Remember, the key to effective term life insurance planning is regular review and adjustment as your life circumstances change. By staying proactive and ensuring your policy aligns with your needs, you can provide peace of mind and financial security for your loved ones, knowing they are protected should the unexpected occur.

What is the average cost of term life insurance?

+

The average cost of term life insurance can vary significantly based on factors like age, health, coverage amount, and policy term. For a healthy 30-year-old non-smoker, a 20-year term policy with 500,000 in coverage might cost around 20 to $30 per month. However, premiums can increase as you age or if you have health issues.

Can I get term life insurance if I have health issues?

+

Yes, individuals with health issues can still obtain term life insurance. However, they may face higher premiums or policy limitations. It’s important to be transparent about your health status when applying for insurance to ensure accurate estimates and avoid any potential issues with your policy.

How often should I review my term life insurance policy?

+

It’s recommended to review your term life insurance policy annually or whenever there are significant changes in your life, such as marriage, birth of a child, or a change in financial status. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

Can I cancel my term life insurance policy?

+

Yes, you can cancel your term life insurance policy at any time. However, it’s important to understand the implications of canceling, as you may lose the coverage and any premiums paid. It’s recommended to carefully consider your financial situation and future needs before making any cancellation decisions.