Everly Life Insurance

Welcome to a comprehensive exploration of Everly Life Insurance, a forward-thinking company revolutionizing the traditional insurance landscape. In this in-depth article, we will delve into the unique features, benefits, and impact of Everly Life Insurance, shedding light on how it is reshaping the industry and empowering individuals to secure their future with confidence.

Unveiling Everly Life Insurance: A New Era in Financial Protection

Everly Life Insurance is a trailblazing force, challenging the status quo and offering a fresh perspective on life insurance. With a focus on innovation, technology, and customer-centricity, Everly has emerged as a leading player in the insurance market, providing comprehensive coverage and peace of mind to individuals and families.

Founded by a team of visionary entrepreneurs and industry experts, Everly Life Insurance has quickly gained recognition for its modern approach to financial protection. By leveraging advanced technologies and a deep understanding of customer needs, Everly has developed a range of innovative insurance products tailored to the evolving demands of today's society.

Key Features and Benefits of Everly Life Insurance

Everly Life Insurance stands out with its unique set of features and benefits, setting it apart from traditional insurance providers. Here’s a closer look at what makes Everly a preferred choice for many:

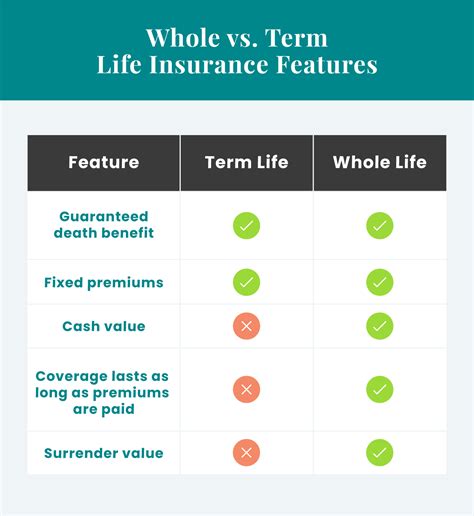

- Customizable Coverage: Everly understands that every individual has unique financial needs and circumstances. Their insurance policies are highly customizable, allowing customers to tailor their coverage to their specific requirements. Whether it's term life insurance, whole life insurance, or a combination of both, Everly offers flexibility to ensure customers receive the protection they need.

- Simplified Application Process: Gone are the days of tedious paperwork and lengthy application processes. Everly Life Insurance has streamlined the application journey, making it quick and convenient. With an intuitive online platform, customers can easily provide their details, select their coverage preferences, and receive a quote within minutes. The entire process is designed to be user-friendly, ensuring a seamless experience.

- Transparent Pricing: Everly believes in transparency and fair pricing. Their insurance policies are priced competitively, offering excellent value for money. Customers can easily understand the cost of their coverage and make informed decisions without hidden fees or surprises. Everly's transparent approach builds trust and empowers customers to take control of their financial future.

- Advanced Underwriting Technology: Everly utilizes cutting-edge underwriting technology to assess risk accurately and efficiently. By leveraging artificial intelligence and data analytics, Everly can provide fast and fair underwriting decisions. This technology enables Everly to offer competitive rates and ensures that customers receive the coverage they deserve without unnecessary delays.

- Digital Policy Management: In today's digital age, Everly recognizes the importance of convenient policy management. Their online platform allows customers to access their policy details, make payments, and update their information with ease. With just a few clicks, customers can stay informed and in control of their insurance coverage, ensuring a hassle-free experience.

- 24/7 Customer Support: Everly understands that insurance needs can arise at any time. That's why they provide dedicated customer support available around the clock. Whether it's answering queries, assisting with policy changes, or providing guidance during times of need, Everly's customer support team is always ready to offer assistance, ensuring customers receive the support they deserve.

Everly’s Impact on the Insurance Industry

Everly Life Insurance has had a significant impact on the insurance industry, driving positive change and setting new standards. Here’s how Everly is shaping the future of financial protection:

- Demystifying Insurance: Everly has played a pivotal role in demystifying the often complex world of insurance. Through their user-friendly platforms and transparent communication, Everly has made insurance more accessible and understandable. By simplifying the insurance journey, Everly empowers individuals to take charge of their financial well-being and make informed decisions.

- Inspiring Innovation: Everly's innovative approach has inspired a wave of innovation across the insurance industry. Traditional providers are now recognizing the importance of technology, customization, and customer-centricity. Everly's success has paved the way for a new era of insurance, where companies are embracing digital transformation and adapting to the evolving needs of their customers.

- Enhancing Customer Experience: Everly's focus on delivering an exceptional customer experience has raised the bar for the entire industry. By prioritizing customer satisfaction and convenience, Everly has set a new standard for insurance providers. Other companies are now investing in enhancing their customer experience, ensuring that clients receive personalized service and support throughout their insurance journey.

- Advancing Underwriting Practices: Everly's utilization of advanced underwriting technology has revolutionized the way risk is assessed. By leveraging data-driven insights and artificial intelligence, Everly has streamlined the underwriting process, making it faster and more accurate. This not only benefits customers by providing swift coverage decisions but also enables insurers to manage risk more effectively.

Real-World Success Stories

Everly Life Insurance has touched the lives of countless individuals, providing them with the financial protection and peace of mind they deserve. Here are a few real-world success stories that highlight the impact of Everly’s insurance offerings:

| Client Name | Coverage Type | Impact |

|---|---|---|

| Sarah Johnson | Term Life Insurance | Sarah, a single mother, secured term life insurance through Everly. The affordable coverage provided her with the reassurance that her children would be financially protected in the event of an unforeseen circumstance. Everly's customizable policy allowed Sarah to choose a coverage amount that aligned with her family's needs. |

| Michael Rodriguez | Whole Life Insurance | Michael, an entrepreneur, opted for whole life insurance from Everly. The policy not only provided him with lifetime coverage but also served as a financial asset. Everly's transparent pricing and excellent customer support made the process seamless, giving Michael the confidence to focus on growing his business. |

| Emily Wilson | Term and Whole Life Combination | Emily, a young professional, chose a combination of term and whole life insurance from Everly. The term life insurance offered her temporary coverage during her career-building years, while the whole life policy provided long-term protection and savings benefits. Everly's simplified application process and digital policy management made it easy for Emily to manage her coverage. |

The Future of Everly Life Insurance

As Everly Life Insurance continues to innovate and adapt to the changing landscape, the future looks bright. Here’s a glimpse into what we can expect from Everly in the coming years:

- Continued Technological Advancements: Everly is committed to staying at the forefront of technology. They will continue to invest in cutting-edge solutions, leveraging artificial intelligence, machine learning, and data analytics to enhance their underwriting processes, improve customer experiences, and offer even more personalized coverage options.

- Expanding Product Offerings: Everly understands the diverse needs of its customers. As they grow, they plan to expand their product portfolio, offering a wider range of insurance solutions. This may include additional life insurance options, as well as exploring new areas such as health insurance, disability insurance, and long-term care coverage.

- Strengthening Partnerships: Everly recognizes the value of collaboration. They aim to forge strong partnerships with other industry leaders, financial institutions, and technology companies. These partnerships will enable Everly to offer an even broader range of services and provide customers with a seamless and integrated financial protection experience.

- Enhancing Customer Education: Everly believes in empowering their customers with knowledge. They will continue to invest in educational resources and initiatives, providing valuable insights and guidance on insurance, financial planning, and wealth management. By educating their customers, Everly aims to help individuals make informed decisions and achieve their long-term financial goals.

Conclusion

Everly Life Insurance has emerged as a game-changer in the insurance industry, offering a fresh and innovative approach to financial protection. With their customizable coverage, streamlined application process, and commitment to customer satisfaction, Everly has positioned itself as a trusted partner for individuals and families. As they continue to lead the way with technological advancements and industry collaborations, Everly is poised to shape a brighter future for financial security.

Whether you're a young professional starting your journey or an established individual seeking comprehensive coverage, Everly Life Insurance provides the tools and support to secure your financial well-being. Embrace the future of insurance with Everly, and take control of your financial future with confidence.

FAQs

What types of life insurance policies does Everly Life Insurance offer?

+Everly Life Insurance offers a range of life insurance policies, including term life insurance, whole life insurance, and a combination of both. Term life insurance provides coverage for a specific period, while whole life insurance offers lifetime coverage and additional savings benefits.

<div class="faq-item">

<div class="faq-question">

<h3>How does Everly's underwriting process work, and how long does it take to receive a decision?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Everly utilizes advanced underwriting technology to assess risk efficiently. Their process involves a thorough evaluation of your health and lifestyle factors. The turnaround time for a decision can vary depending on individual circumstances, but Everly aims to provide swift and fair underwriting decisions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Is Everly Life Insurance affordable, and what factors influence the cost of coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Everly Life Insurance is committed to offering competitive and affordable coverage. The cost of your policy depends on various factors, including your age, health status, coverage amount, and the type of policy you choose. Everly's transparent pricing ensures you understand the cost of your coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my Everly Life Insurance policy to suit my specific needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Everly understands that every individual has unique financial requirements. Their policies are highly customizable, allowing you to choose the coverage type, coverage amount, and any additional riders or benefits that align with your specific needs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I access and manage my Everly Life Insurance policy online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Everly provides a user-friendly online platform where you can access and manage your policy. Simply log in to your account, and you'll have access to your policy details, payment history, and the ability to make updates or changes. The platform is designed for convenience and ease of use.</p>

</div>

</div>

</div>