Best Insurance Auto Rates

When it comes to finding the best auto insurance rates, there are numerous factors to consider. The insurance landscape is complex, and with countless providers offering a wide range of policies, it can be challenging to navigate and identify the most advantageous rates. This article aims to provide an in-depth exploration of the key aspects that influence auto insurance rates, offering valuable insights to help you secure the best deal for your vehicle.

Understanding Auto Insurance Rates

Auto insurance rates are influenced by a multitude of factors, and each insurance provider has its own methodology for calculating these rates. Understanding these factors is crucial for making informed decisions and securing the most competitive prices.

The Role of Risk Assessment

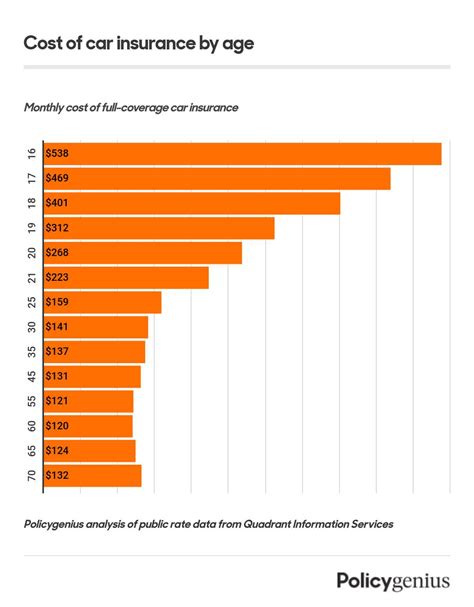

Insurance companies assess the risk associated with insuring a particular vehicle and driver. This risk assessment is a fundamental factor in determining insurance rates. It involves evaluating various aspects such as the driver’s age, driving history, location, and the type of vehicle being insured.

For instance, younger drivers, especially those under 25, are often considered higher-risk due to their lack of experience. This can result in higher insurance premiums. Similarly, drivers with a history of accidents or traffic violations may also face increased rates. The location where the vehicle is primarily driven and stored can also impact rates, as certain areas may have higher incidences of theft or accidents.

Coverage Options and Customization

Auto insurance policies offer a range of coverage options, allowing policyholders to tailor their insurance to their specific needs. This customization can significantly impact the overall rate. Different coverage types include liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Liability coverage, which is typically mandatory, protects policyholders against claims arising from accidents they cause. Collision and comprehensive coverage provide additional protection for the insured vehicle, covering damages from accidents and non-accident-related incidents like theft or natural disasters, respectively. PIP covers medical expenses and lost wages for the policyholder and their passengers, while uninsured/underinsured motorist coverage provides protection in cases where the at-fault driver lacks sufficient insurance.

| Coverage Type | Description |

|---|---|

| Liability | Protects against claims from accidents caused by the policyholder. |

| Collision | Covers damages to the insured vehicle from accidents. |

| Comprehensive | Provides coverage for non-accident-related incidents like theft or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and passengers. |

| Uninsured/Underinsured Motorist Coverage | Protects against financial losses when the at-fault driver lacks sufficient insurance. |

The Impact of Deductibles and Limits

Deductibles and coverage limits are key components of auto insurance policies that can significantly affect rates. A deductible is the amount the policyholder agrees to pay out of pocket before the insurance coverage kicks in. Higher deductibles generally result in lower insurance premiums, as policyholders are assuming more financial responsibility in the event of a claim.

Coverage limits, on the other hand, refer to the maximum amount the insurance company will pay for a covered loss. Higher limits often lead to higher insurance rates, as the insurer is taking on more financial risk. It’s essential to strike a balance between deductibles and limits to ensure adequate coverage without paying excessive premiums.

Comparing Insurance Providers

With numerous insurance providers in the market, comparing rates and coverage options is essential to finding the best deal. While it may seem daunting, several strategies can simplify this process.

Online Comparison Tools

Utilizing online comparison tools can be an efficient way to compare auto insurance rates from multiple providers. These tools allow users to input their information once and receive quotes from several insurers. This approach saves time and effort, providing a quick overview of the available options.

However, it’s important to note that these tools may not always offer the most accurate or up-to-date information. Some providers may have specific criteria or discounts that are not captured by these tools. Therefore, it’s advisable to follow up with individual insurers to verify the quoted rates and explore potential discounts.

Bundling Policies for Discounts

Many insurance providers offer discounts when policyholders bundle multiple insurance policies, such as auto and home insurance. Bundling can lead to significant savings, as insurers often provide a reduced rate for multiple policies. This strategy is particularly beneficial for those who own multiple vehicles or have other insurance needs, such as renters or homeowners insurance.

When considering bundling, it’s essential to compare the overall cost of bundled policies with the cost of separate policies. While bundling may result in discounts, it’s crucial to ensure that the coverage provided is sufficient and meets individual needs.

Discounts and Special Offers

Insurance providers often offer a variety of discounts and special offers to attract new customers and retain existing ones. These discounts can significantly reduce insurance premiums and should be considered when comparing rates.

Common discounts include those for safe driving records, multi-car policies, loyalty (long-term customers), and certain occupations or affiliations. Some insurers may also offer discounts for completing defensive driving courses or installing safety features in vehicles. It’s worthwhile to inquire about these discounts and ensure they are applied to the quoted rates.

Optimizing Your Insurance Profile

While comparing insurance providers and policies is crucial, optimizing your own insurance profile can also lead to significant savings. There are several strategies you can employ to improve your insurance standing and secure better rates.

Maintaining a Clean Driving Record

A clean driving record is one of the most effective ways to lower auto insurance rates. Insurance companies reward safe drivers with lower premiums, as they pose less risk to the insurer. Avoiding accidents, traffic violations, and maintaining a good driving history can significantly impact your insurance rates over time.

If you have a less-than-perfect driving record, it’s beneficial to focus on improving your driving habits and avoiding further violations. Many insurers offer programs that reward safe driving, such as discounts for accident-free years or discounts for completing safe-driving courses.

Shopping Around Regularly

Insurance rates can fluctuate over time, and what was a competitive rate a year ago may no longer be the best deal. Shopping around regularly, at least once a year, is advisable to ensure you’re still getting the best rates available. This practice also keeps you informed about any new discounts or coverage options that may become available.

When shopping around, it’s important to compare not only rates but also the coverage provided. Sometimes, a slightly higher rate may be justified by better coverage or additional benefits. It’s a delicate balance between cost and value, and regular comparison shopping can help you strike that balance.

Understanding Your Credit Score

Believe it or not, your credit score can impact your auto insurance rates. Many insurance providers use credit-based insurance scores to assess the risk of insuring a particular individual. These scores are calculated based on information in your credit report and are used to predict the likelihood of you filing an insurance claim.

Maintaining a good credit score can lead to lower insurance rates, as it indicates a lower risk to the insurer. If you have a less-than-perfect credit score, taking steps to improve it, such as paying bills on time and reducing debt, can positively impact your insurance rates over time.

The Future of Auto Insurance

The auto insurance industry is constantly evolving, and new technologies and trends are shaping the future of insurance. Understanding these developments can provide valuable insights into potential changes in insurance rates and coverage options.

Telematics and Usage-Based Insurance

Telematics is a technology that allows insurance providers to monitor a vehicle’s usage and driving behavior. This data is then used to calculate insurance rates based on actual driving habits rather than general assumptions. Usage-based insurance, also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD), is a growing trend that offers policyholders the opportunity to lower their insurance premiums by demonstrating safe driving habits.

Telematics devices, often installed in vehicles or connected to smartphones, track various factors such as mileage, acceleration, braking, and time of day. Policyholders who drive fewer miles, exhibit safer driving habits, or drive during less risky times may be eligible for lower insurance rates. This technology provides a more accurate assessment of risk and can lead to significant savings for responsible drivers.

The Rise of Electric Vehicles

The increasing popularity of electric vehicles (EVs) is another trend that is shaping the future of auto insurance. EVs present unique considerations for insurance providers, as they differ from traditional internal combustion engine vehicles in several ways. For instance, EVs often have lower maintenance costs and are generally considered safer, which can lead to reduced insurance rates.

However, EVs also have higher purchase prices and specialized repair needs, which can increase insurance costs. As the EV market continues to grow, insurance providers are developing specific policies and coverage options to cater to the unique needs of EV owners. This includes specialized coverage for battery replacement or repair, as well as roadside assistance tailored for EVs.

Autonomous Vehicles and Insurance

The advent of autonomous or self-driving vehicles is another significant trend that will impact the auto insurance industry. As these vehicles become more prevalent, the nature of insurance coverage will need to adapt. Autonomous vehicles have the potential to significantly reduce the number of accidents, as human error is often a major factor in collisions.

With reduced accident risks, insurance rates for autonomous vehicles could potentially be lower. However, there are also new risks and complexities associated with these vehicles, such as the potential for cyber attacks or software failures. Insurance providers will need to develop innovative coverage options to address these unique risks and provide adequate protection for autonomous vehicle owners.

Conclusion

Securing the best auto insurance rates involves a combination of understanding the factors that influence rates, comparing providers and policies, and optimizing your insurance profile. By staying informed about the latest trends and technologies in the insurance industry, you can make more informed decisions and potentially save on your insurance premiums.

Remember, auto insurance is a complex landscape, and what works best for one person may not be the ideal solution for another. It’s essential to tailor your insurance coverage to your specific needs and circumstances. Regularly reviewing and adjusting your insurance policy can help ensure you’re always getting the best value for your money.

How often should I compare auto insurance rates?

+It’s advisable to compare auto insurance rates at least once a year. This allows you to stay updated on any changes in rates or coverage options and ensure you’re still getting the best deal. However, if your circumstances change, such as buying a new vehicle or moving to a new location, it’s worthwhile to compare rates more frequently.

Can I negotiate auto insurance rates with providers?

+While auto insurance rates are primarily based on standardized calculations, there may be room for negotiation, especially if you’re a loyal customer or have a good relationship with your insurance provider. It’s worth inquiring about potential discounts or asking for a review of your policy to ensure you’re receiving the best rates available.

What factors should I consider when choosing an auto insurance provider?

+When choosing an auto insurance provider, consider factors such as the range of coverage options, customer service reputation, financial stability, and any additional benefits or perks offered. It’s also essential to ensure the provider is licensed and reputable. Reading reviews and comparing quotes from multiple providers can help you make an informed decision.