Types Of Home Insurance

Home insurance is an essential aspect of protecting your property and ensuring peace of mind. With a wide range of coverage options available, it's crucial to understand the different types of home insurance policies to make an informed decision that best suits your needs. This comprehensive guide will delve into the various home insurance types, providing an in-depth analysis of their features, benefits, and considerations.

Comprehensive Home Insurance

Comprehensive home insurance, also known as all-risk or open-peril coverage, is the most extensive type of home insurance policy. It offers broad protection against a wide range of perils and risks that could potentially affect your home and its contents. This type of insurance is ideal for homeowners who want maximum coverage and peace of mind.

Coverage Details

Comprehensive home insurance typically covers:

- Structure and Buildings: This includes the main residence, any attached structures, and detached buildings like garages or sheds.

- Personal Property: Your belongings, such as furniture, electronics, and clothing, are covered against damage or loss due to insured perils.

- Liability: Provides protection if someone is injured on your property or if your actions cause property damage to others.

- Additional Living Expenses: Covers the costs of temporary accommodation and additional expenses if your home becomes uninhabitable due to an insured event.

- Optional Coverages: Allows for customization, such as coverage for specific valuables like jewelry or artwork, or additional protection for high-risk events like floods or earthquakes.

| Perils Covered | Examples |

|---|---|

| Fire | Structural damage caused by fire. |

| Lightning | Electrical damage due to lightning strikes. |

| Windstorm | Damage from strong winds, including hurricanes. |

| Hail | Damage to roofs and vehicles from hail. |

| Explosion | Structural damage from explosions. |

One of the key advantages of comprehensive home insurance is its open-peril nature, which means it covers all perils except those specifically excluded in the policy. This provides a high level of protection and flexibility.

Named Perils Home Insurance

Named perils home insurance, also known as specified peril or named peril coverage, is a more limited form of home insurance. It covers specific perils or causes of loss that are explicitly listed in the policy.

Coverage Details

Named perils home insurance typically covers a set of common risks, including:

- Fire: Structural damage caused by fire.

- Lightning: Electrical damage due to lightning strikes.

- Windstorm: Damage from strong winds, excluding hurricanes.

- Hail: Damage to roofs and vehicles from hail.

- Explosion: Structural damage from explosions.

- Riots and Civil Commotion: Damage caused by riots or civil unrest.

- Aircraft: Damage caused by aircraft or articles falling from aircraft.

- Vehicles: Damage caused by vehicles not owned or operated by the insured.

It's important to note that named perils home insurance does not cover all possible risks. Perils like theft, vandalism, and water damage are typically excluded, and additional policies or endorsements may be required to cover these risks.

Considerations

Named perils home insurance can be a cost-effective option for homeowners who live in areas with low risk of certain perils or for those on a tight budget. However, it’s crucial to carefully review the policy’s list of covered perils to ensure that your specific needs are met.

Special Form Home Insurance

Special form home insurance, also known as a HO-3 policy, is a widely used type of home insurance that strikes a balance between comprehensive and named perils coverage. It offers broad protection while still providing some flexibility in terms of coverage options.

Coverage Details

Special form home insurance typically covers:

- Dwelling: Protection for the main residence, including attached structures.

- Other Structures: Coverage for detached structures like garages, sheds, or fences.

- Personal Property: Protection for belongings against named perils, including theft, vandalism, and water damage.

- Liability: Covers liability risks if someone is injured on your property or if your actions cause property damage to others.

- Additional Living Expenses: Provides coverage for temporary living expenses if your home becomes uninhabitable due to an insured event.

The named perils covered in a special form policy typically include:

- Fire

- Lightning

- Windstorm

- Hail

- Explosion

- Riots and Civil Commotion

- Aircraft

- Vehicles

- Smoke

- Vandalism

- Theft

- Water Damage (sudden and accidental)

One key benefit of special form home insurance is its named peril coverage for personal property, which offers a broader range of protection compared to named perils policies for the dwelling itself.

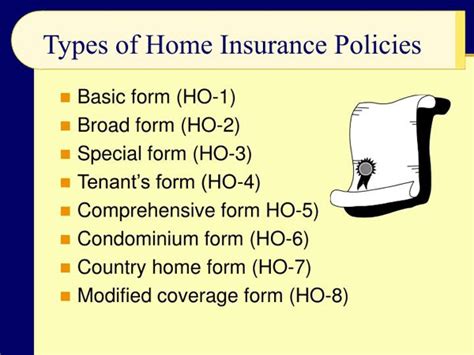

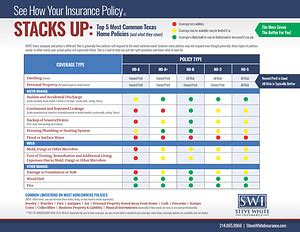

HO-5 and HO-8 Policies

The HO-5 and HO-8 policies are variations of home insurance designed to provide more comprehensive coverage for specific types of homes or situations.

HO-5 Policy (High-Value Homes)

The HO-5 policy, also known as a comprehensive form policy, is tailored for high-value homes or homes with unique features. It offers broader coverage than the standard HO-3 policy, providing open-peril coverage for the dwelling and named peril coverage for personal property.

HO-5 policies are ideal for homeowners who want maximum protection for their valuable homes and belongings. They typically cover a wide range of perils and risks, similar to comprehensive home insurance.

HO-8 Policy (Older Homes)

The HO-8 policy, also known as a modified coverage form, is designed for older homes that may not meet modern building codes. It provides coverage for specific perils and risks, similar to named perils insurance, but with a focus on older homes.

HO-8 policies offer a more affordable option for older homes, as they may not qualify for standard HO-3 policies due to their age or condition. These policies provide coverage for a set of named perils, ensuring protection for older homes that may be more susceptible to certain risks.

Conclusion

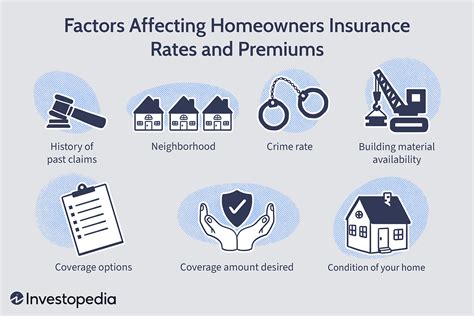

Choosing the right type of home insurance depends on various factors, including the location and age of your home, the value of your belongings, and your specific needs and budget. It’s essential to carefully review the coverage details and exclusions of each policy type to ensure you have the protection you require.

By understanding the different types of home insurance and their features, you can make an informed decision to safeguard your home and its contents. Remember, consulting with insurance professionals and comparing multiple policies can help you find the best coverage for your unique circumstances.

FAQ

What is the difference between comprehensive and named perils home insurance?

+Comprehensive home insurance covers all perils except those specifically excluded, offering broad protection. Named perils insurance covers only the perils listed in the policy, providing more limited coverage.

Is HO-5 insurance better than HO-3 for all homes?

+HO-5 insurance is typically recommended for high-value homes or those with unique features. For standard homes, HO-3 insurance provides a good balance of coverage and cost.

What additional coverages should I consider for my home insurance policy?

+Consider adding coverage for specific risks like floods, earthquakes, or identity theft, depending on your location and personal needs. You may also want to increase your liability coverage limits.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually to ensure it still meets your needs. Life changes, such as renovations or acquiring new valuables, may require adjustments to your coverage.